27 October 2021

US bank portfolio management team

U.S. bank stocks fell dramatically in early 2020 as investors feared that economic lockdowns would severely weaken banks’ loan portfolios as COVID-19 spread across the globe. The potential for losses on a scale of those that banks sustained in the global financial crisis led investors to flee the market segment. Yet 18 months later, bank equities have proven resilient. In this commentary, we explore how U.S. banks prepared to weather the economic tail risk of a pandemic and discuss why we maintain a favorable view of the segment amid prospective signs of continued strength for banks.

In the early months of COVID-19, banks built significant loan loss reserves to protect against pandemic-related losses. These reserves have proved more than adequate, in our view, and actual losses have been limited due to fiscal support as well as banks’ abilities to work with borrowers suffering business interruptions.

While we’re still working our way through another wave of COVID-19 cases driven by the Delta variant, it appears the U.S. economy has maintained its footing through the uptick in cases. From our discussions with bank management teams, we believe the Delta surge isn’t likely to lead to meaningfully higher loan losses. In fact, we think a multistage bank recovery is already under way, as signaled by recent strength in quarterly earnings.

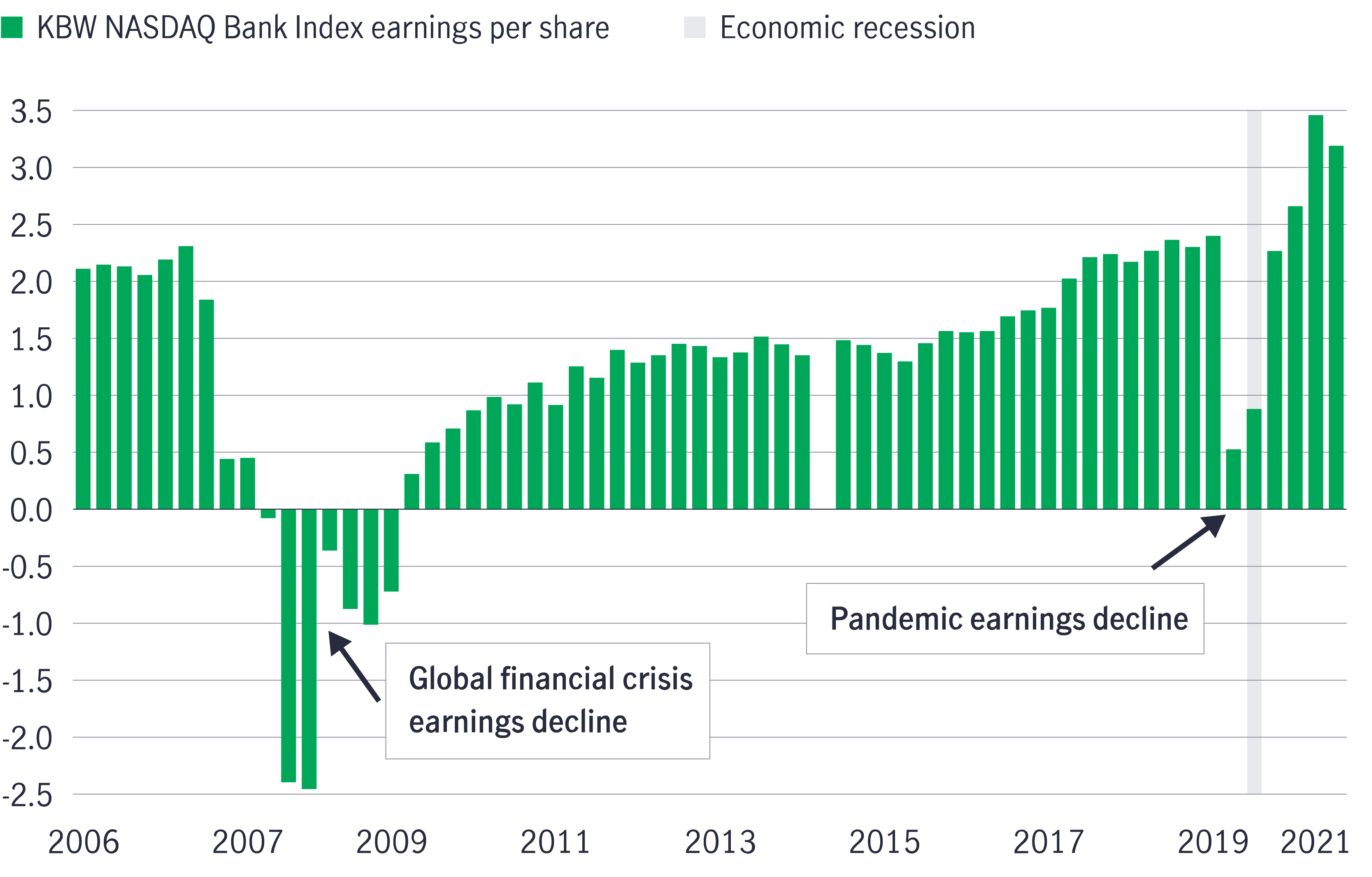

As the market realized that credit losses would be contained earlier this year, the first part of the recovery took hold. We call this the credit rebound. Banks’ earnings recovered from depressed levels in 2020, as they no longer needed to set aside outsized provisions for loan losses.

U.S. bank earnings came roaring back from pandemic lows

KBW NASDAQ Bank Index quarterly earnings per share, Q1 2006 to Q2 2021 ($)

Source: Bloomberg, as of June 30, 2021. The KBW NASDAQ Bank Index tracks the performance of leading banks and thrifts that are publicly traded in the United States. It is not possible to invest directly in an index. Earnings per share (EPS) is a measure of how much profit a company has generated calculated by dividing the company's net income by its total number of outstanding shares.

Meanwhile, as U.S. regulators became comfortable with the safety of bank balance sheets during the pandemic, banks were permitted to increase capital returns to shareholders through the resumption of share buybacks. In addition, temporary restrictions on banks’ dividend payments were lifted.

While their credit prospects improved this year, banks have faced headwinds on the revenue front, driven by the lower level of absolute interest rates and muted loan demand. We think these trends should reverse as we move into 2022 and the economy continues to normalize.

Throughout the pandemic, banks have seen a surge in deposits driven by customers displaying cautionary behavior. In addition, many Americans deposited proceeds from government stimulus payments. Likewise, banks have been cautious in investing the deposit inflow into securities; therefore, cash levels on bank balance sheets have surged. Meanwhile, loan demand has been muted as borrowers flush with government transfers have had a limited appetite to borrow. On top of this, supply chain interruptions have driven down inventory levels throughout the economy, which has pressured commercial loan utilization rates.

As the economic rebound gains momentum and government stimulus programs wind down, we expect loan demand to accelerate. Management teams at many banks have recently said that internal loan pipelines have rebounded to prepandemic levels. Additionally, we expect that an inventory restocking will occur as supply chains normalize over the next year, benefiting loan demand.

A notable example of this is at automobile dealerships, where inventory levels have recently plunged. This inventory is likely to rebound as production of new vehicles begins to normalize in 2022.

U.S. vehicle inventories have fallen sharply amid the pandemic

Monthly domestic automobile inventories, August 2011–August 2021

Source: U.S. Federal Reserve Bank of St. Louis, U.S. Bureau of Economic Analysis, October 2021.

In addition, we think that the infrastructure legislation that the Biden administration is now trying to push through Congress is likely to drive loan demand for years to come as contractors and suppliers will need to invest to support their capital needs.

Two other factors are important for investors to note. We believe that a potential uptick in lending would drive net interest income higher, fueling the revenue rebound, while a more normalized interest-rate environment would provide an additional catalyst.

At its September 2021 meeting, the U.S. Federal Reserve indicated that it’s likely to begin tapering its bond-buying stimulus activity in the months ahead. We believe such a move would benefit banks, as they could invest some of their excess cash into loans and securities generating higher interest rates.

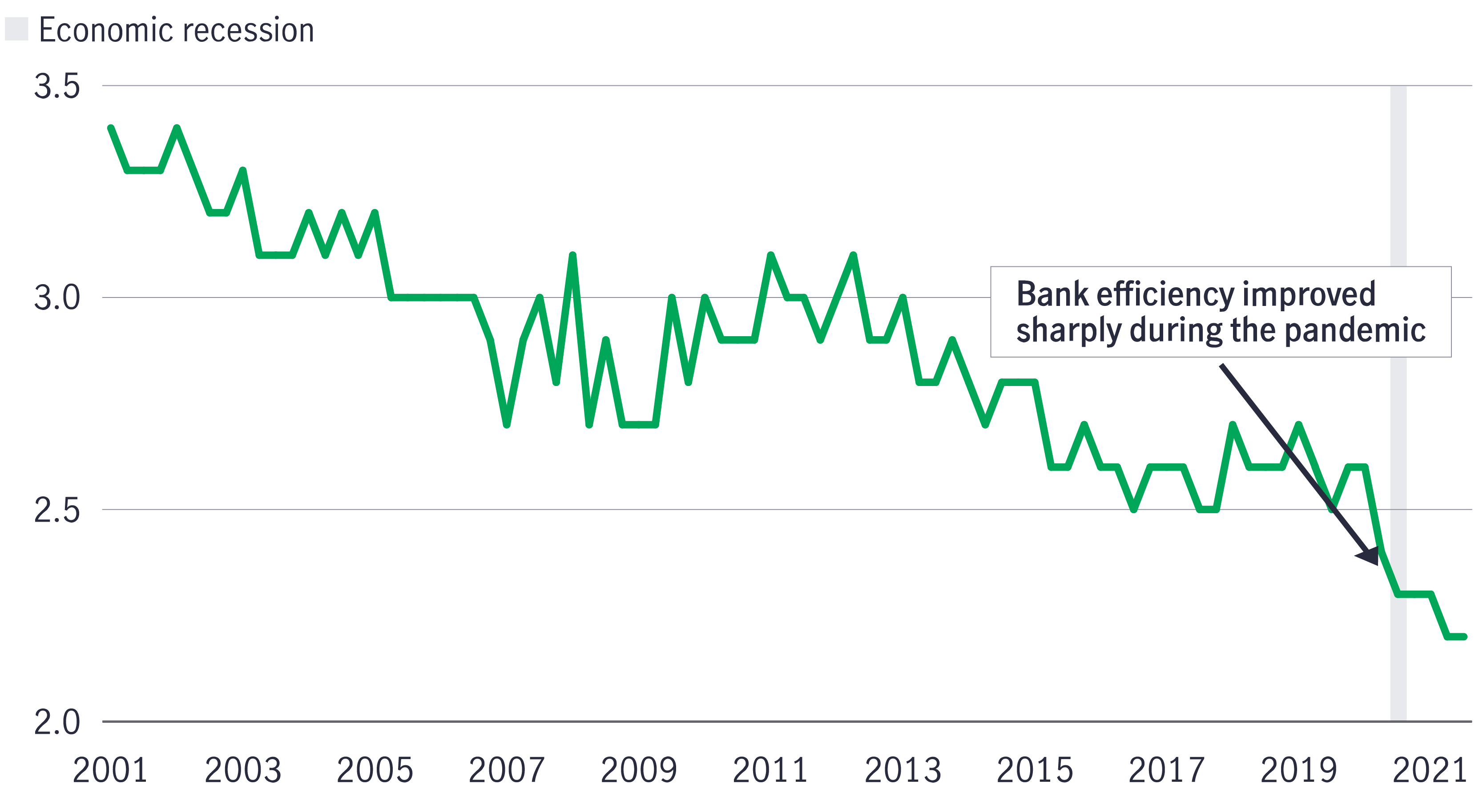

Following the credit and revenue rebounds, we believe the final stage of the banking sector’s recovery will be driven by efficiency improvement. Banks have improved their operational efficiency over the past two decades, and we believe this trend is likely to persist—and even accelerate—as we continue to move past the pandemic.

U.S. banks: two decades of efficiency gains have kept a lid on noninterest expenses

U.S. banks' quarterly total noninterest expenses as a percentage of total assets, Q1 2001–Q2 2021

Source: Federal Deposit Insurance Corp., as of July 2021.

During the pandemic, banks’ advanced technology adoption accelerated significantly. With branch lobbies closed for extended periods, customers who previously made in-person visits were directed to mobile delivery methods, accelerating digital adoption. Additionally, with the government’s rapid roll out of the Paycheck Protection Program, many banks used new technologies to fast-track commercial loan origination. Finally, banks continue to invest in back-office technologies, such as robotic process automation, to streamline workflows. We think this will continue, and it’s likely that banks will seek to cut more costs and close more branches in the years ahead.

Aside from technological advancements, another driver of efficiency improvement for the industry has been the long-term trend of consolidation. Following a pause during the height of the pandemic, merger and acquisition (M&A) activity has surged. In fact, through the first eight months of 2021, we’ve already seen 18 bank deals in excess of $500 million in value each. According to S&P Capital IQ, this is the highest number of deals of this value since 1998, when 24 such deals were announced.1

In many of these deals, the acquiring bank can often eliminate upward of 30% of the acquired institution’s cost base, in our experience; these significant operating efficiencies typically drive earnings accretion for the acquirer. With nearly 5,000 banks remaining in the United States,2 we see a long runway for M&A to continue—and to continue creating compelling investment opportunities.

We believe that continued economic recovery from the pandemic downturn clearly will support banks’ fundamentals and earnings going forward. For investors, the banking sector still provides an attractive opportunity as bank shares remain discounted relative to historical averages and to the broader indexes, in our view.

Bank stocks were trading at 1.28x their book value as of September 30, 2021, a meaningful discount to their long-term average of 1.61x dating to the mid-1990s.3 We’d note that despite the significant pandemic headwinds in 2020, the industry remained profitable overall that year and grew book value. Book value growth accelerated in the first half of 2021 as well, on the back of lower provisioning requirements, and we think this is likely to extend into 2022.

Moreover, on a relative basis, banks recently traded at about 63% of the forward price-to-earnings ratio of the broader market.4 Additionally, we believe there is upside potential to earnings estimates if the economy continues to improve given the revenue rebound through higher loan growth and higher rates in the years ahead. Taken together, these trends bode well for the prospects of bank shares.

1 “Wave of large-scale US bank M&A reaches highest level in 23 years,” S&P Capital IQ, September 27, 2021.

2 Federal Deposit Insurance Corp., as of June 30, 2021.

3 FactSet, as of September 30, 2021, for the SNL U.S. Bank Index relative to its average dating to December 31, 1994. The SNL U.S. Bank Index tracks all major exchange banks in SNL’s coverage universe. It is not possible to invest directly in an index.

4 FactSet, as of September 30, 2021. The 63% figure represents a forward price-to-earnings ratio of 12.58x for the S&P Composite 1500 Banks Index and 20.12x for S&P 500 Index. The S&P Composite 1500 Banks Index tracks the performance of publicly traded large- and mid-cap banking companies in the United States. The S&P 500 Index tracks the performance of 500 of the largest publicly traded companies in the United States. It is not possible to invest directly in an index.

Q&A: The role of Asia-Pacific bonds in an investor’s portfolio

We look at Asian dollar bonds from a broader perspective and their role in downside protection.

Understanding the preferred securities market

Preferred securities occupy a unique niche in financial markets, blending elements of both debt and equity. In this Q&A, we explore the different types of preferred securities and delve into why their versatile nature makes them an attractive option across a wide range of market environments.

Beyond the hyperbole: three macro takeaways from the 2024 US elections

What investors and policy watchers should take away from the 2024 election results depends, in part, on time horizon.

Q&A: The role of Asia-Pacific bonds in an investor’s portfolio

We look at Asian dollar bonds from a broader perspective and their role in downside protection.

Understanding the preferred securities market

Preferred securities occupy a unique niche in financial markets, blending elements of both debt and equity. In this Q&A, we explore the different types of preferred securities and delve into why their versatile nature makes them an attractive option across a wide range of market environments.

Beyond the hyperbole: three macro takeaways from the 2024 US elections

What investors and policy watchers should take away from the 2024 election results depends, in part, on time horizon.