26 May 2021

US bank portfolio management team

With each passing quarter since the pandemic began to disrupt the economy in early 2020 and the outlook for U.S. banks was upended, the industry has managed to successfully retrench and position itself to help lead the economy’s broader recovery. Nearly all publicly traded U.S. banks have released first-quarter results as of this writing, and the industry as a whole continues to exceed our expectations. Based on our analysis, here are nine salient points about the current state of banks and the implications for equity investors.

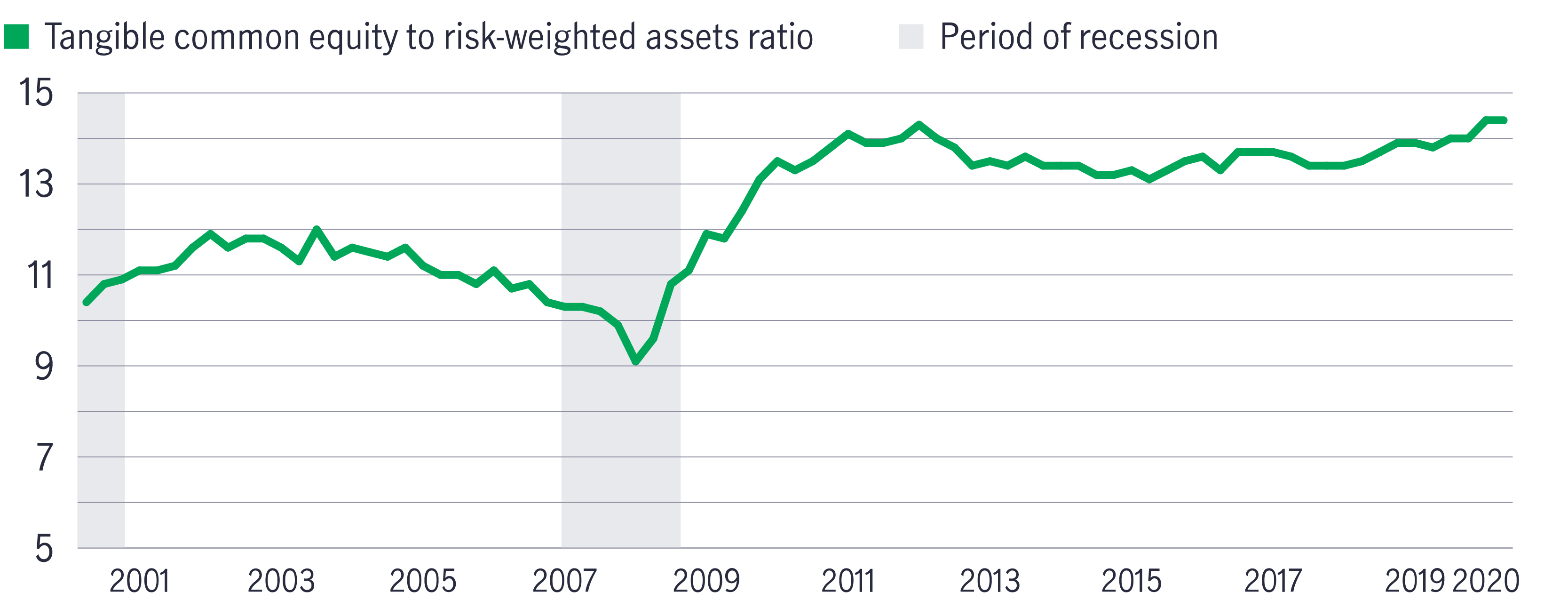

U.S. banks' capital levels have surged since a 2009 low

U.S. banks' ratio (%) of tangible common equity to risk-weighted assets, 2001–2020

Source: Federal Deposit Insurance Corp., January 2021. A tangible common equity to risk-weighted assets ratio is used to assess the potential for future bank financial stress based on commonly measured capital ratios.

U.S. banks appear to us to be fundamentally strong, with historically high levels of capital and liquidity. As the economy has reopened, credit fundamentals have been materially better than had been expected a year earlier. Strong results from regulators’ latest round of stress tests to assess major banks’ abilities to weather further economic shocks triggered a further loosening of restrictions related to share buybacks. We view these developments as a testament to the industry’s capital strength and improved underwriting. In addition, we believe that the most recent stimulus package that Congress approved in March should further support the economy and reduce credit costs. As these trends persist, we expect U.S. bank earnings to accelerate throughout 2021.

1 “KBW Bank Earnings Wrap-Up 1Q21, v. 2: Banks Continue to Deliver EPS Beats on Mostly Favorable Credit Trends,” Keefe, Bruyette & Woods, April 23, 2021.

2 Earnings per share (EPS) is a measure of how much profit a company has generated calculated by dividing the company's net income by its total number of outstanding shares.

3 U.S. Federal Reserve press release, March 25, 2021.

Q&A: The role of Asia-Pacific bonds in an investor’s portfolio

We look at Asian dollar bonds from a broader perspective and their role in downside protection.

Understanding the preferred securities market

Preferred securities occupy a unique niche in financial markets, blending elements of both debt and equity. In this Q&A, we explore the different types of preferred securities and delve into why their versatile nature makes them an attractive option across a wide range of market environments.

Beyond the hyperbole: three macro takeaways from the 2024 US elections

What investors and policy watchers should take away from the 2024 election results depends, in part, on time horizon.

Q&A: The role of Asia-Pacific bonds in an investor’s portfolio

We look at Asian dollar bonds from a broader perspective and their role in downside protection.

Understanding the preferred securities market

Preferred securities occupy a unique niche in financial markets, blending elements of both debt and equity. In this Q&A, we explore the different types of preferred securities and delve into why their versatile nature makes them an attractive option across a wide range of market environments.

Beyond the hyperbole: three macro takeaways from the 2024 US elections

What investors and policy watchers should take away from the 2024 election results depends, in part, on time horizon.