Important Notes:

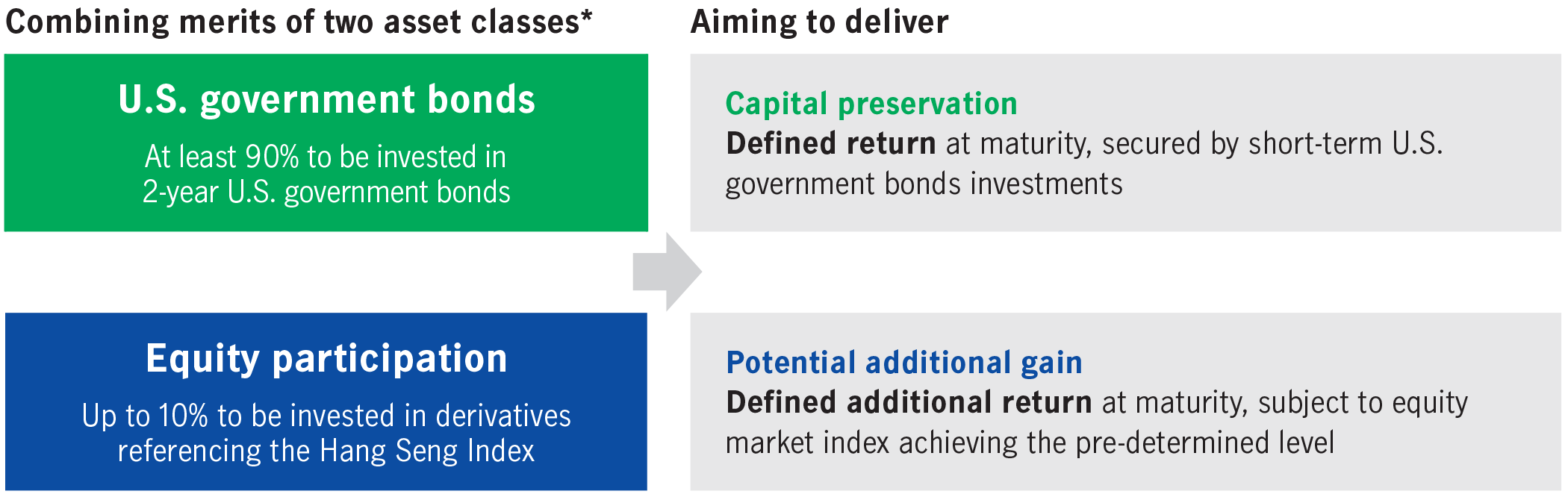

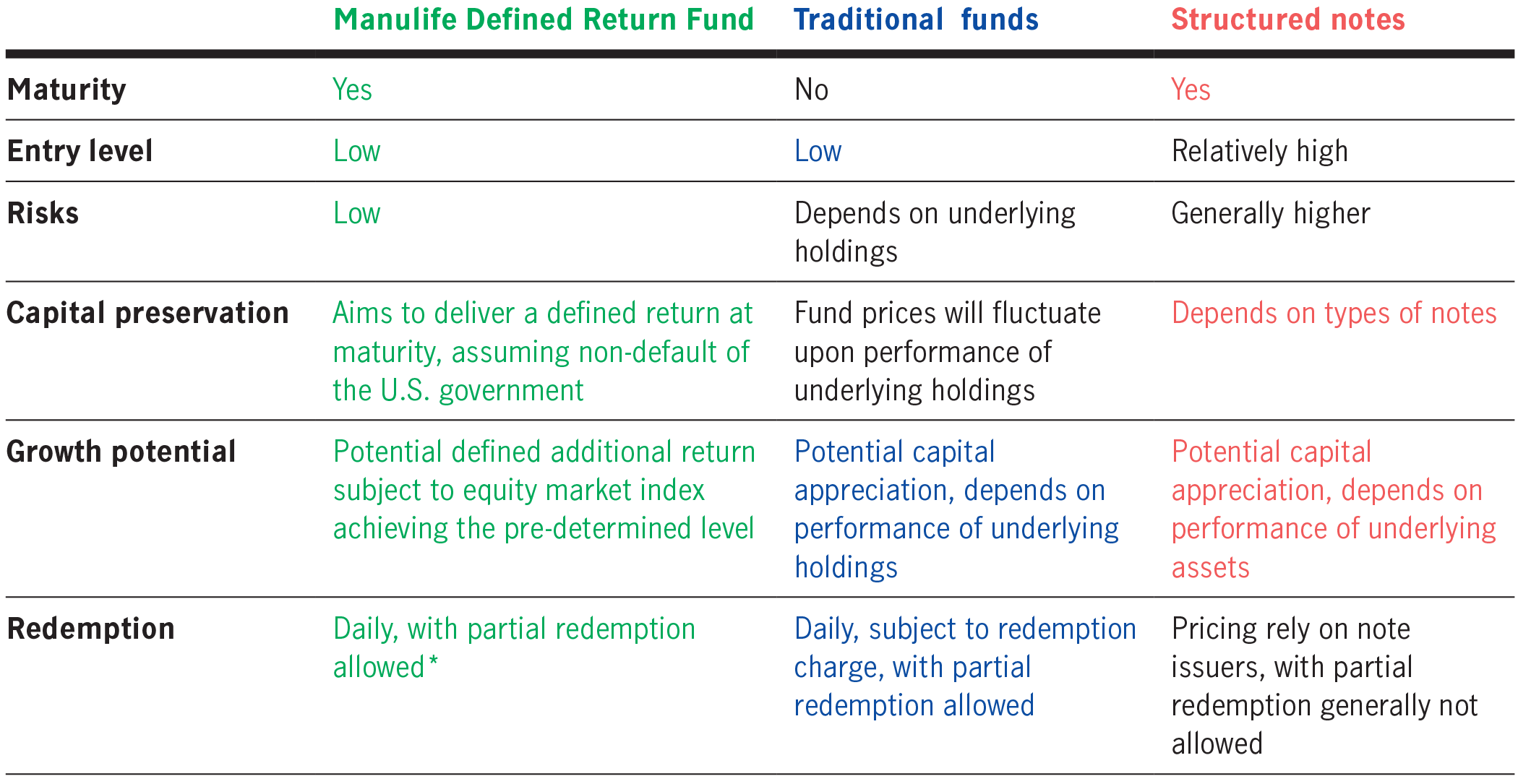

In today’s dynamic and ever-changing investment world, investors are seeking an investment strategy to participate in the potential upside of the equity market while minimizing risks. By combining the merits of U.S. government bonds and Hong Kong equities, Manulife Defined Return Fund aims to provide total return comprising of (i) investors’ initial investment money after the subscription fee deduction ("initial investment") and (ii) potential additional gain of initial investment over an investment period of around 2 years.

*For illustrative purpose only. The Fund will adopt a buy and hold strategy with active risk monitoring. Over the fixed investment period, the value of the Fund’s assets may fluctuate due to market movements and consequently, the resulting asset allocation between primary and residual investments may vary and may not be exactly reflective of the Fund’s intended asset allocation as disclosed in the offering document.

*For illustrative purpose only. The Fund will adopt a buy and hold strategy with active risk monitoring. Over the fixed investment period, the value of the Fund’s assets may fluctuate due to market movements and consequently, the resulting asset allocation between primary and residual investments may vary and may not be exactly reflective of the Fund’s intended asset allocation as disclosed in the offering document.

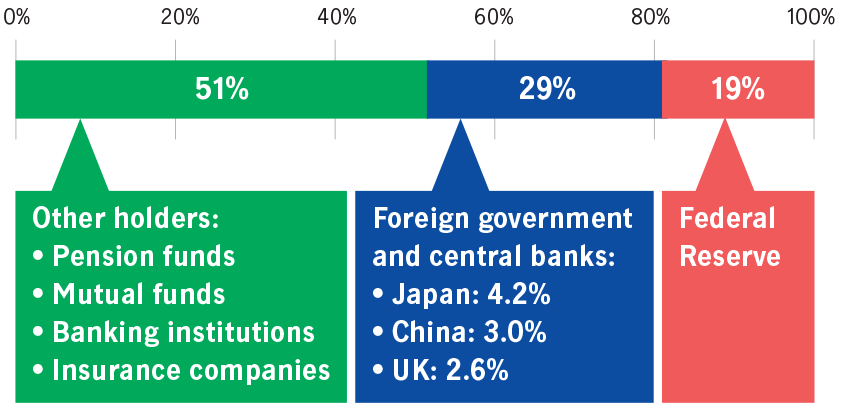

Holder breakdown of U.S. government bonds market1

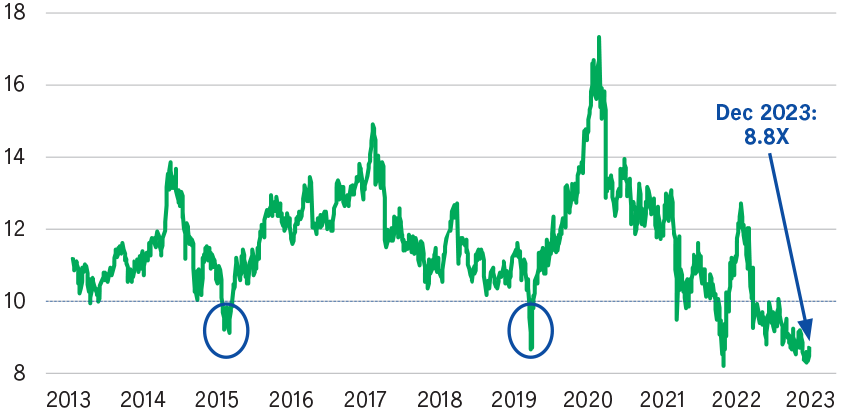

Estimated P/E ratio of Hang Seng Index (times)2

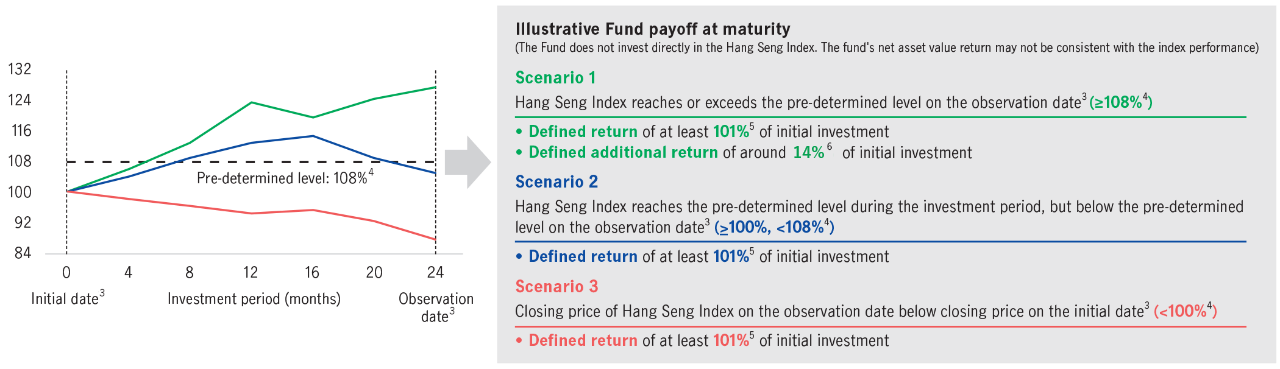

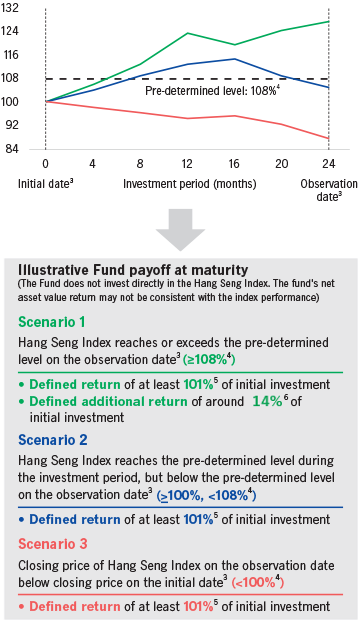

The Fund aims to provide a defined return plus additional gain potential over an investment period of around 2 years. Under the best-case scenario, if the Hang Seng Index reaches or exceeds the pre-determined level on the observation date3, the Fund aims to deliver:

Otherwise, the Fund aims to deliver a defined return at maturity, even if the Hang Seng Index records negative price return.

For illustration purpose only.

For illustration purpose only.

For illustration purpose only.

*Subject to up to 1% redemption charge before the maturity date

| Fund name | Manulife Advanced Fund SPC – Defined Return Segregated Portfolio I |

| Investment objective | The Fund’s primary investment objective is to provide total return by investing primarily in a portfolio of fixed income securities in the United States (“US”) over an investment period of approximately two years from the Inception Date up to the Maturity Date. The Fund is designed to, on a best efforts basis, return Shareholders’ initial investment through its primary investments – plus any gains realized through both its primary and residual investments – on the Maturity Date. |

| Initial offer period | February 19, 2024 – March 8, 2024 (no subscription after IPO period) |

| Inception date | March 11, 2024 |

| Maturity date7 | On or around March 31, 2026 (around 2 years) |

| Reference index | Hang Seng Index |

| Pre-determined level8 | 108% |

| Defined return9 | 101% |

| Indicative defined additional return10 | Around 14% |

| Base currency | USD |

| Available share classes | AA (USD) ISIN code: KYG5800M5689 |

| Initial subscription fee11 | Currently up to 5% of the NAV per Share |

| Dealing frequency | Daily redemption |

| Redemption charge11 | 1.00% |

| Management fee11 | Currently 0.60% p.a. |

27+ years

investment experience of lead manager

640+

investment experts across asset classes12

USD 149.7 billion

in AUM of multi-asset solutions13

Unless otherwise stated, all information sources are from Manulife Investment Management, as of December 31, 2023. Projections or other forward-looking statements regarding future events, targets, management discipline or other explanations are only current as of the data indicated. There is no assurance that such events will occur, and if they were to occur, the result may be significantly different than that shown here. Investment involves risk. Investors should not make investment decisions based on this material alone and should read the offering document for details, including the risk factors, charges and features of the product. This material has not been reviewed by the Securities and Futures Commission. Issued by Manulife Investment Management (Hong Kong) Limited.

3456412