10 January 2025

Joseph H. Bozoyan, Portfolio Manager

Preferred securities occupy a unique niche in financial markets, blending elements of both debt and equity. In this article, we explore the different types of preferred securities and delve into why their versatile nature makes them an attractive option across a wide range of market environments.

Preferred securities are a type of hybrid security often issued by big, stable companies such as banks, utilities, and real estate investment trusts (REITs). These investments combine features of both stocks and bonds, making them an attractive choice for investors looking for a mix of income and growth potential.

There are several distinct types of preferred securities, each with its own characteristics. They sit between bonds and common stocks in a company’s capital structure, with each having their own place and level of priority when it comes to payments and claims.

Chart 1: The preferred securities market is versatile and diverse

Source: Manulife Investment Management, 2025.

The diverse nature of preferred securities makes them a versatile investment option, offering unique features that can perform well in various economic conditions. This flexibility allows investors to find opportunity within preferreds, regardless of the market environment.

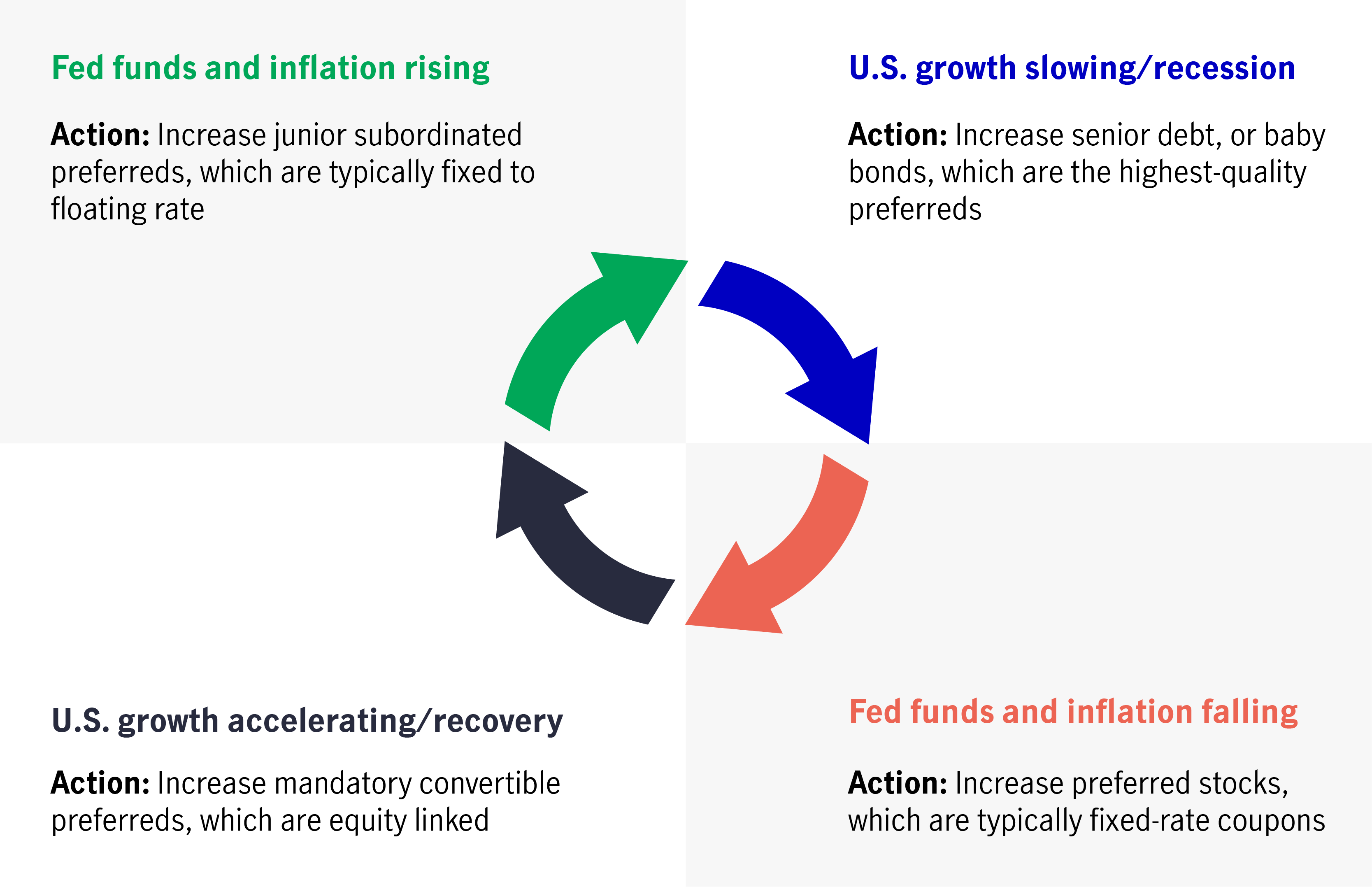

Chart 2: Preferred securities have the potential to do well in a range of market environments

Source:Manulife Investment Management, 2025.

One feature that can vary among each type of preferred security is their coupon structure. Some preferreds have a fixed rate, meaning they pay a set dividend or interest rate for the life of the security. Others have a floating rate, where the dividend or interest adjusts periodically based on a benchmark interest rate. There are also fixed-to-floating-rate preferreds, which start with a fixed rate for an initial period and then switch to a floating rate based on a specified benchmark.

In a scenario in which inflation is dropping and the federal funds rate is expected to decline, investing in preferred stocks with fixed rate coupons can be beneficial. These fixed rate preferred stocks usually offer higher yields compared with common stocks and many fixed-income securities. As interest rates go down, these fixed rate yields become even more attractive, helping investors avoid reinvestment risk and lock in higher yields for a set period.

In addition, the prices of existing fixed rate preferred stocks tend to rise as interest rates fall due to the inverse relationship between yield and the price of fixed rate securities. This potential for price appreciation, combined with a compelling level of income, makes fixed rate preferred stock an attractive option when interest rates are falling.

When interest rates are rising, junior subordinated debt, which typically has a fixed to floating-rate structure, can be an area of opportunity within preferreds. After the fixed rate period ends, coupon payments will adjust upward with rising rates, giving investors a higher income level. This flexibility can make fixed to floating-rate preferreds, such as junior subordinated debt, an attractive choice when interest rates are likely to increase.

Investors might also benefit from adjusting their preferreds allocation based on the current economic outlook. By strategically shifting their investments within the preferreds market, they can focus on equity-linked preferreds during economic expansions to capture growth and lean toward more bond-like preferreds during downturns for stability and reliable income.

Mandatory convertible preferreds, or mandys, are a type of preferred stock that automatically converts into common stock at a predetermined date. This feature makes mandys an attractive option during periods of strong economic growth, allowing investors to benefit from the potential increase in the issuing company’s stock price.

In periods in which economic growth is likely to slow down or contract, investors might consider tilting toward baby bonds. Baby bonds hold a higher priority in the capital structure compared with other preferred securities, reducing their likelihood of default even in challenging market conditions.

Solutions for navigating market volatility amid U.S. tariff changes

Recent changes in U.S. tariffs have introduced new dynamics to the global market landscape, presenting both challenges and opportunities for investors. Understanding these developments is essential for making informed investment decisions. Marc Franklin, our Deputy Head of Multi-Asset Solutions, Asia, and Senior Portfolio Manager provided his view.

Quick thoughts on US reciprocal tariffs

The US President Donald Trump announced reciprocal tariff details on 2 April, 2025, which has introduced volatility to the financial markets. Alex Grassino, Global Chief Economist, along with the Multi-Asset Solutions Team (MAST), Macroeconomic Strategy Team, share their latest views.

Takeaways from China’s NPC Meeting & upcoming drivers for Greater China equity market

In addition to the recent breakthroughs in AI and humanoid robot development, we observe other positive catalysts that further support the region’s market.

Solutions for navigating market volatility amid U.S. tariff changes

Recent changes in U.S. tariffs have introduced new dynamics to the global market landscape, presenting both challenges and opportunities for investors. Understanding these developments is essential for making informed investment decisions. Marc Franklin, our Deputy Head of Multi-Asset Solutions, Asia, and Senior Portfolio Manager provided his view.

Quick thoughts on US reciprocal tariffs

The US President Donald Trump announced reciprocal tariff details on 2 April, 2025, which has introduced volatility to the financial markets. Alex Grassino, Global Chief Economist, along with the Multi-Asset Solutions Team (MAST), Macroeconomic Strategy Team, share their latest views.

Takeaways from China’s NPC Meeting & upcoming drivers for Greater China equity market

In addition to the recent breakthroughs in AI and humanoid robot development, we observe other positive catalysts that further support the region’s market.