30 August 2024

Murray Collis, Chief Investment Officer, Fixed Income (Asia ex-Japan)

Chris Lam, Portfolio Manager, Asia Fixed Income

Billy Wu, Portfolio Manager, Asia Fixed Income

Asian credit showed accelerating momentum in the first half of 2024. Strong technical factors, such as tight supply, coupled with robust economic growth and additional policy stimulus in China, lifted the asset class. In this investment note, Murray Collis and the Pan-Asian Fixed Income team explain how three themes should continue to support Asian credit in the second half of the year, presenting attractive opportunities for investors, particularly in the high-yield segment.

For 1H 2024, Asian credit posted solid gains despite uncertainty around US Treasury yields and market-related events such as regional elections. With attractive all-in yields on offer, investors keenly added Asian credit exposure to lock in favourable income opportunities, which underpinned a broad tightening of credit spreads across the region.

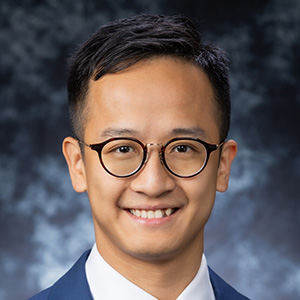

Asian high yield (HY) particularly stood out, rising 11.83% year-to-date1, significantly outperforming other fixed-income markets (see Chart 12) amid notably improved market sentiment after the Chinese government released a raft of supportive programmes.

Chart 1: Asian HY outperforming significantly year-to-date2

Source: Bloomberg, as of 31 July 2024. Index rebased to 100.

Targeted assistance for the property sector, coupled with more accommodative monetary policy and consumption-related stimulus, propelled returns. Greater stability in frontier markets also contributed, as these countries emerged from credit distress with support from the International Monetary Fund (IMF) and external creditors on debt restructuring.

Meanwhile, Asian investment grade (IG) continued to demonstrate its ongoing resilience, gaining 3.84%3 over the same period due to tighter credit spreads and a strong technical catalyst in the form of limited bond supply.

For the remainder of 2024, we believe Asian credit is well placed to continue navigating an uncertain macro landscape due to three compelling themes:

1) Resilient fundamentals and lower default rates

2) Positive structural changes in the investment universe leading to more diverse market opportunities.

3) Superior risk-adjusted returns for the asset class versus global peers.

Asian credit has proven resilient over the past few years despite experiencing numerous notable challenges, including the impact of the COVID-shock and the China property sector crisis. Although these events characterised 2022 and 2023, we believe the credit cycle in the region has bottomed and now presents attractive opportunities for investors.

Strong regional economic fundamentals will support the asset class’s momentum moving forward. The growth stories in India and Indonesia, catalysed by shifting global supply chains and increasing manufacturing onshoring, are compelling and should drive regional dynamics and potential credit upgrades despite lingering economic concerns in China.

Indeed, India posted the fastest growth rate of the world’s largest economies in 2023 at 7.7%. Looking forward, although Asia’s economic growth is forecast to moderate slightly to 4.3% in 2025, the region remains the growth standout compared to other major regions. Importantly, Asia still contributes around 60% of global GDP and remains the world’s most dynamic economic region.

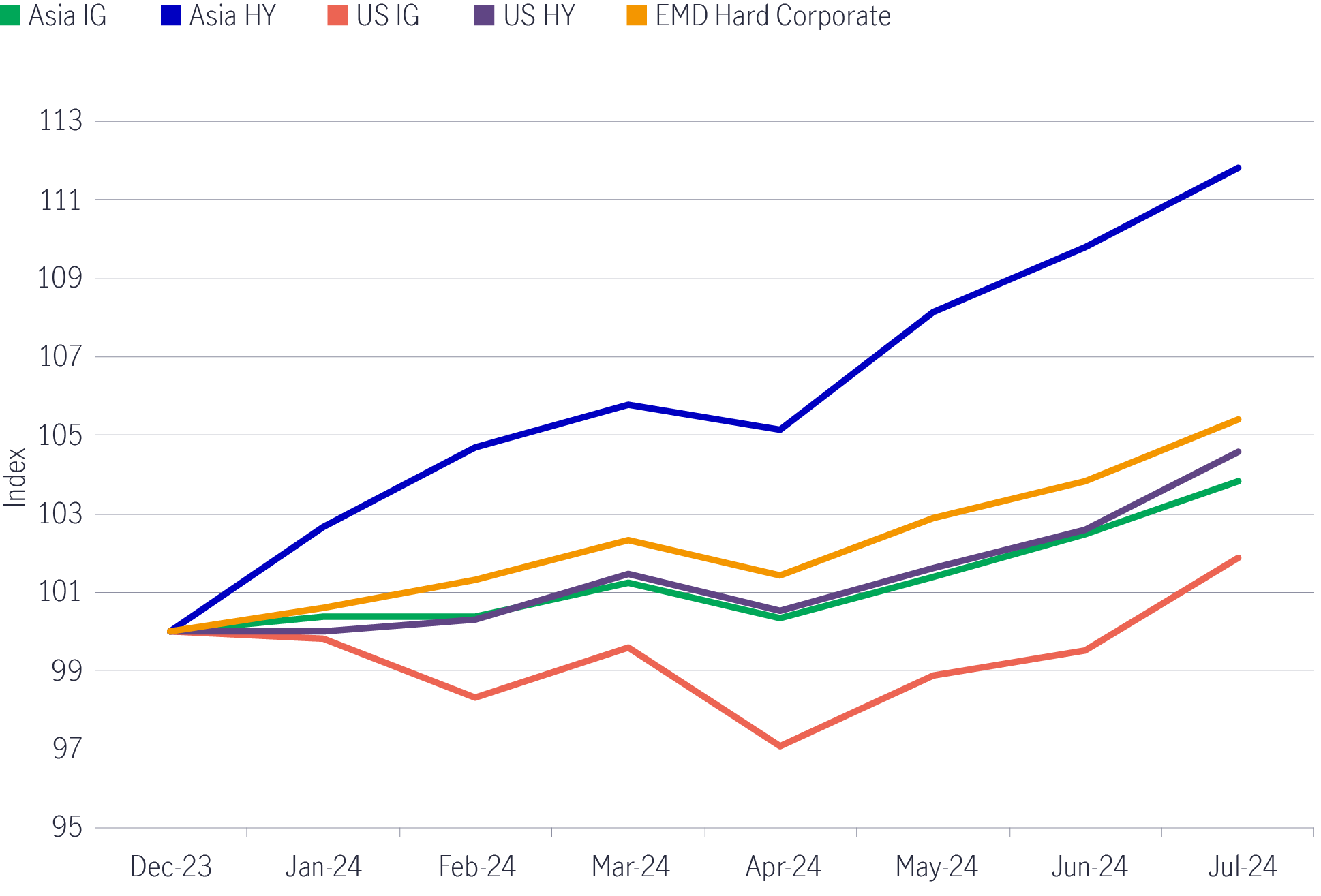

Additionally, we expect historically elevated default rates to continue trending lower. The surge in defaults and downgrades in the past several years was largely concentrated in China’s property sector and the local government funding vehicles segment, while the rest of the region experienced meaningfully lower levels of distress (see Chart 24).

Chart 2: Asia’s HY default rate has declined from its peak4

Source: BofA Global Research, ICE.

Finally, frontier economies in the region have also stabilised somewhat after being in distressed territory. We are cautiously constructive on these markets as they gradually return to growth; however, the path to normalisation remains bumpy.

Sri Lanka is expected to emerge from sovereign default in the near term on the back of IMF support and agreements struck with creditors to restructure its external debt in July. While the economic situation, supported by a rebound in tourism, has notably improved, uncertainty remains as presidential elections approach in September and difficult structural reforms to keep the IMF programme on track are on the political agenda.

Meanwhile, the newly elected government in Pakistan is implementing structural reforms to address fiscal challenges and secure further support from the IMF and other bilateral lenders. However, volatility may still arise from political challenges and external shocks that could hinder reform progress and delay the IMF programme.

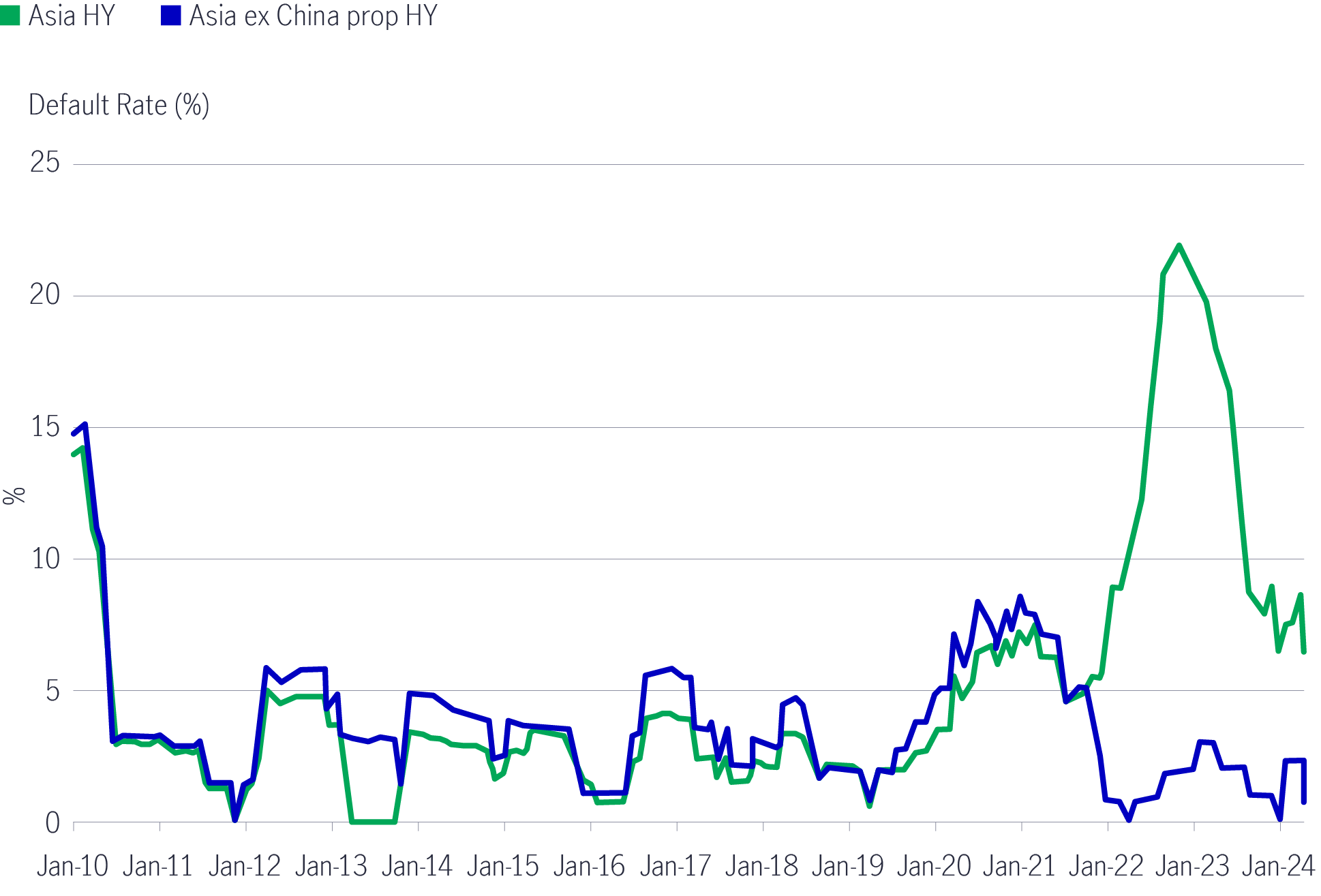

Asia’s credit universe has experienced significant structural change over the past two years. While still the largest country weight represented, China’s overall weight in the J.P. Morgan Asia Credit Index has now been reduced to around 34% due to limited supply from China and overall net redemptions by issuers over the past 2-3 years.

While the country is still expected to play a key role moving forward, other regional economies such as India, Indonesia, and South Korea should contribute to a more diverse credit market (see Chart 35).

Chart 3: Asia’s credit universe is evolving5

Source: J.P. Morgan.

Furthermore, Japan and Australia, traditionally the territory of developed markets, have risen in importance among Asian investors, particularly with the introduction of the J.P. Morgan Asia Credit Asia-Pacific Index in 2023. These credits provide a different economic profile than others in the region, leading to enhanced diversification opportunities.

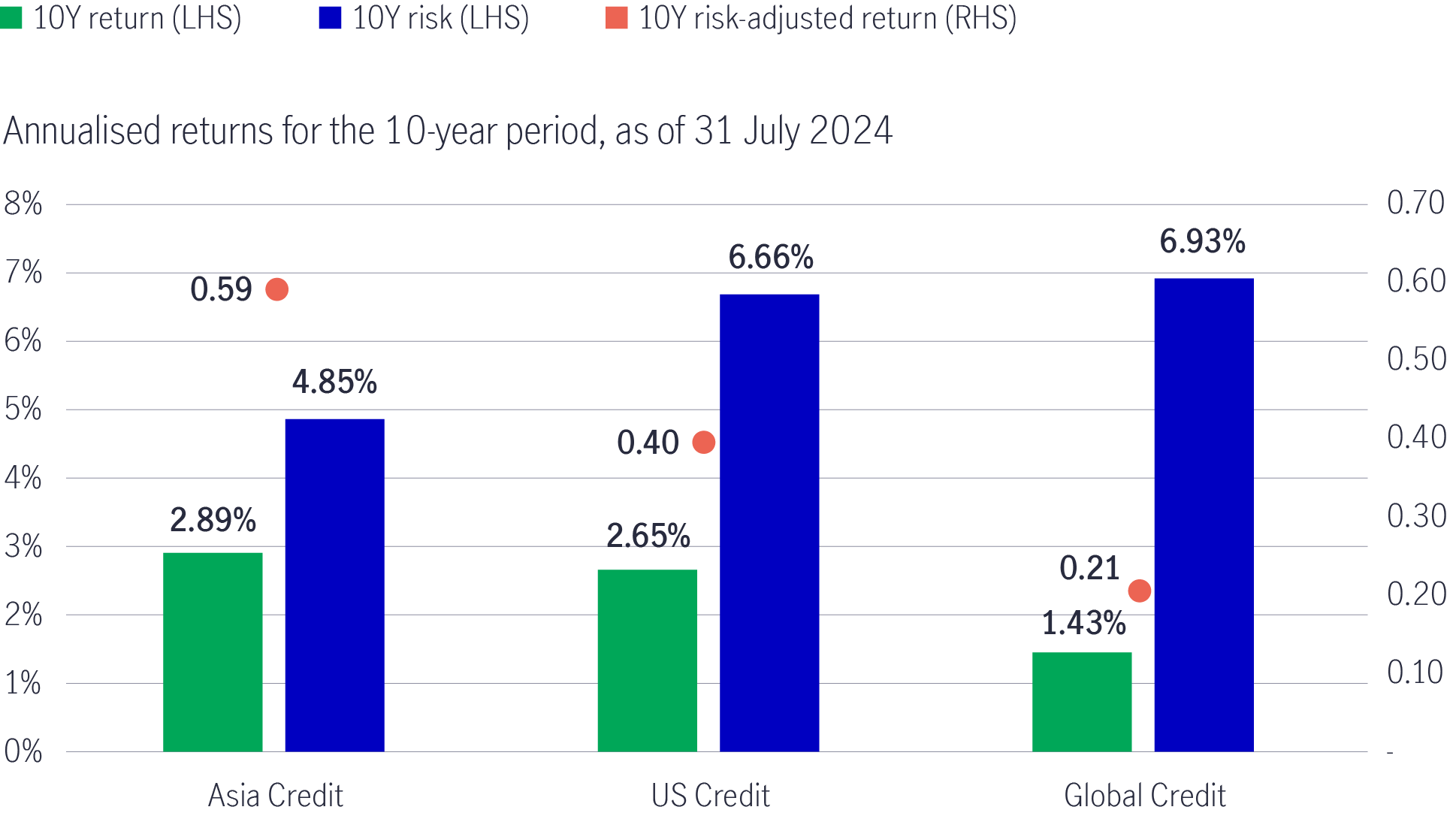

Asia has emerged from the volatility seen in the past few years with its fundamental long-term investment thesis intact. The region’s credit market continues to offer superior risk-adjusted returns compared to other global credit markets (see Chart 46), making the asset class attractive.

Chart 4: Global credit comparison of risk-adjusted returns6

Source: Bloomberg, Manulife Investment Management Analysis.

Currently, Asian IG and HY bonds also offer a decent spread pickup compared with US and global credit, which should provide a buffer against expected US rate volatility.

From an income perspective, both Asian IG and HY credit, which are yielding above 5% and 10%, respectively, are expected to remain attractive for investors, especially as short-end rates are expected to decline later this year should the US Federal Reserve follow through with rate cuts in September as per the market’s expectations.

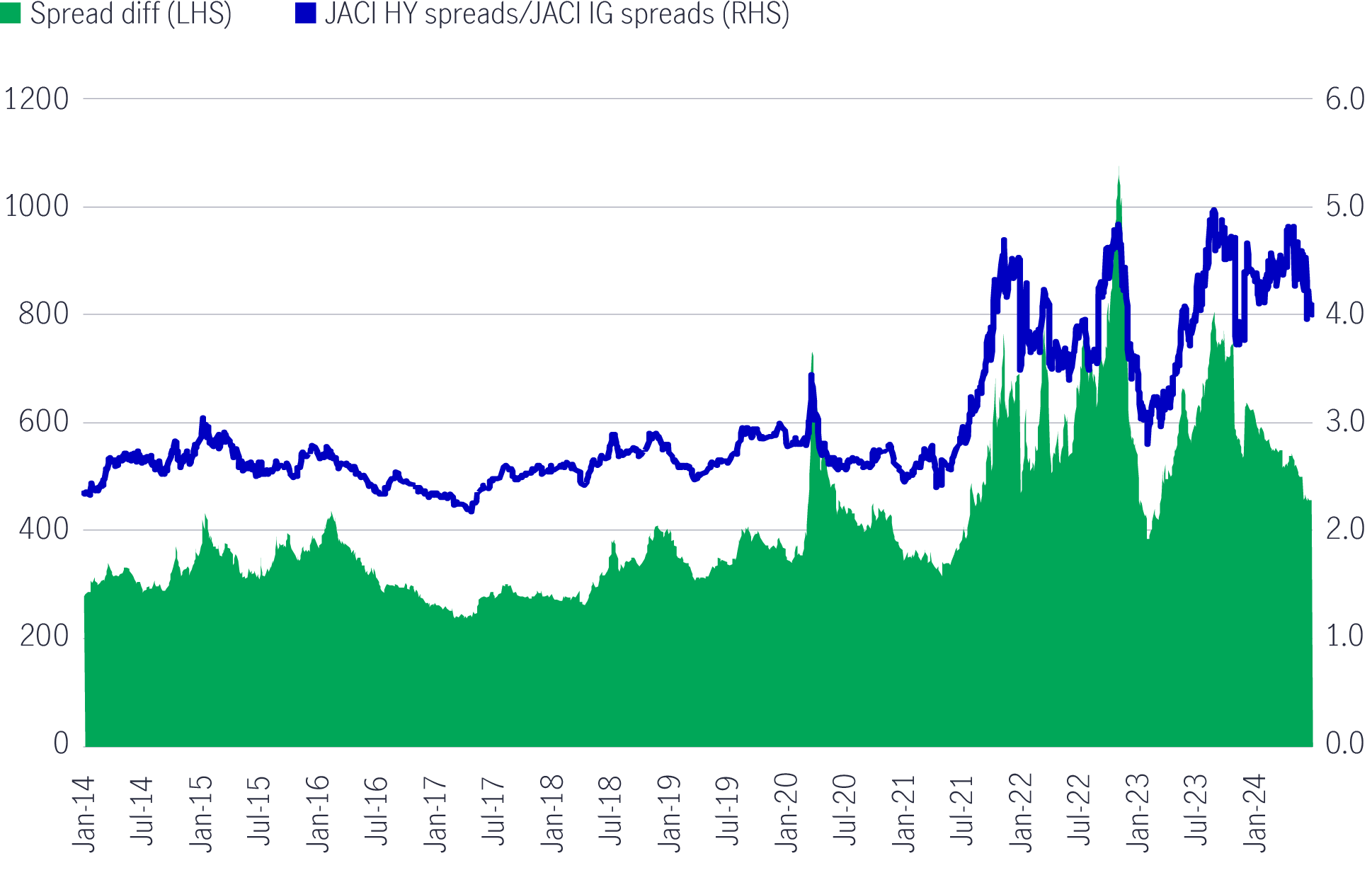

If we consider these segments from a potential total return perspective, we currently prefer HY over IG due to current valuations for HY looking more attractive compared with historical levels (see Chart 57).

Chart 5: Asian HY at historically attractive levels versus IG7

Source: Bloomberg, as of 30 June 2024.

HY spreads have notably tightened since the Chinese government released supportive measures for the property sector in October 2023. However, the spread pickup over IG remained at roughly 500 basis points as of the end of June, which is still historically high8.

Specifically, in HY, offshore bonds of China's property sector have posted a significant rebound year-to-date after the government moves to stabilise the sector. Lower defaults and a much smaller weight of the property sector in the HY universe should see the sector be much less of a drag on returns moving forward. Further stimulus measures should also be supportive of other non-property-related sectors in China’s HY segment.

In addition, there is value in selected perpetual bonds in Asia, which are poised to benefit from a US rate-cut cycle and issuers’ strong access to alternative funding in local markets. We see the potential for fixed-for-life perpetual bonds to rally as it becomes more economical for issuers to call back their perpetual bonds, while their lower cash prices and high current yields offer some downside protection for investors.

Looking forward, several positive catalysts exist for upside: credit improvement stories, such as a potential sovereign credit upgrade in India and frontier markets. Favourable technical factors with a manageable new bond supply pipeline should also serve as a favourable tailwind for the asset class.

The three core themes discussed, including Asia’s resilient fundamentals and lower default rates, positive structural developments, and attractive risk-adjusted returns for Asian credit, should continue to help drive returns for the asset class in 2H 2024.

HY is particularly attractive as valuations remain compelling with a high potential for solid returns over the next 6-12 months due to favourable market technical dynamics and further expected declines to default rates. IG is also well positioned to offer investors stable income and remain resilient due to the region’s economic strength.

Finally, the expansion of the investment universe to traditionally developed markets offers new possibilities for diversification and portfolio construction. These catalysts are not only attractive to Asian investors but also to many global funds who have been waiting on the sidelines for a sustained recovery in the asset class to materialise.

1 Source: Bloomberg. JACINCTR as of 31 July 2024.

2 Source: Bloomberg, as of 31 July 2024. Index rebased to 100.

3 Source: Bloomberg. JACIICTR as of 31 July 2024.

4 Source: BofA Global Research, ICE.

5 Source: J.P. Morgan.

6 Source: Bloomberg, Manulife Investment Management Analysis.

7 Source: Bloomberg, as of 30 June 2024.

8 Source: J.P. Morgan.

2026 Outlook Series: Greater China Equities

Greater China equity markets registered a strong equity rally in 2025 to date, driven by technology breakthroughs, demand for localisation, go-global demand, and upward earnings growth revisions. We reiterate a positive view on Greater China equity markets going into 2026 as we believe Mainland and Taiwan are well-positioned to drive high-quality growth to the next level.

2026 Global Macroeconomic Outlook: clearer picture, better growth

Our 2026 macro outlook highlights key themes across global economies and commodities, what we'll be watching closely in the new year, and portfolio takeaways for investors to consider.

Asian Fixed Income: Are we at a turning point?

This outlook analyses the near-term tailwinds propelling returns in Asian fixed income, as well as the structural fundamentals and shifting geopolitical trends that could support the asset class over the long-term.

2026 Outlook Series: Greater China Equities

Greater China equity markets registered a strong equity rally in 2025 to date, driven by technology breakthroughs, demand for localisation, go-global demand, and upward earnings growth revisions. We reiterate a positive view on Greater China equity markets going into 2026 as we believe Mainland and Taiwan are well-positioned to drive high-quality growth to the next level.

2026 Global Macroeconomic Outlook: clearer picture, better growth

Our 2026 macro outlook highlights key themes across global economies and commodities, what we'll be watching closely in the new year, and portfolio takeaways for investors to consider.

Asian Fixed Income: Are we at a turning point?

This outlook analyses the near-term tailwinds propelling returns in Asian fixed income, as well as the structural fundamentals and shifting geopolitical trends that could support the asset class over the long-term.