8 April 2025

The latest development in tariff-centric trading policies has been on the market’s radar, with a recent retaliatory announcement by China that imposed a 34% levy on all US-imported goods. The situation has sparked risk aversion and a notable correction in global equity markets. In this note, we examine the measures more deeply and assess their impact on Greater China equities.

Despite the US reciprocal tariff rates on mainland China and Taiwan, which are higher than the market expected, we believe mainland China has multiple options for further action. For instance, on 4 April 2025, it announced a 34% retaliatory tariff on all goods imported from the US1.

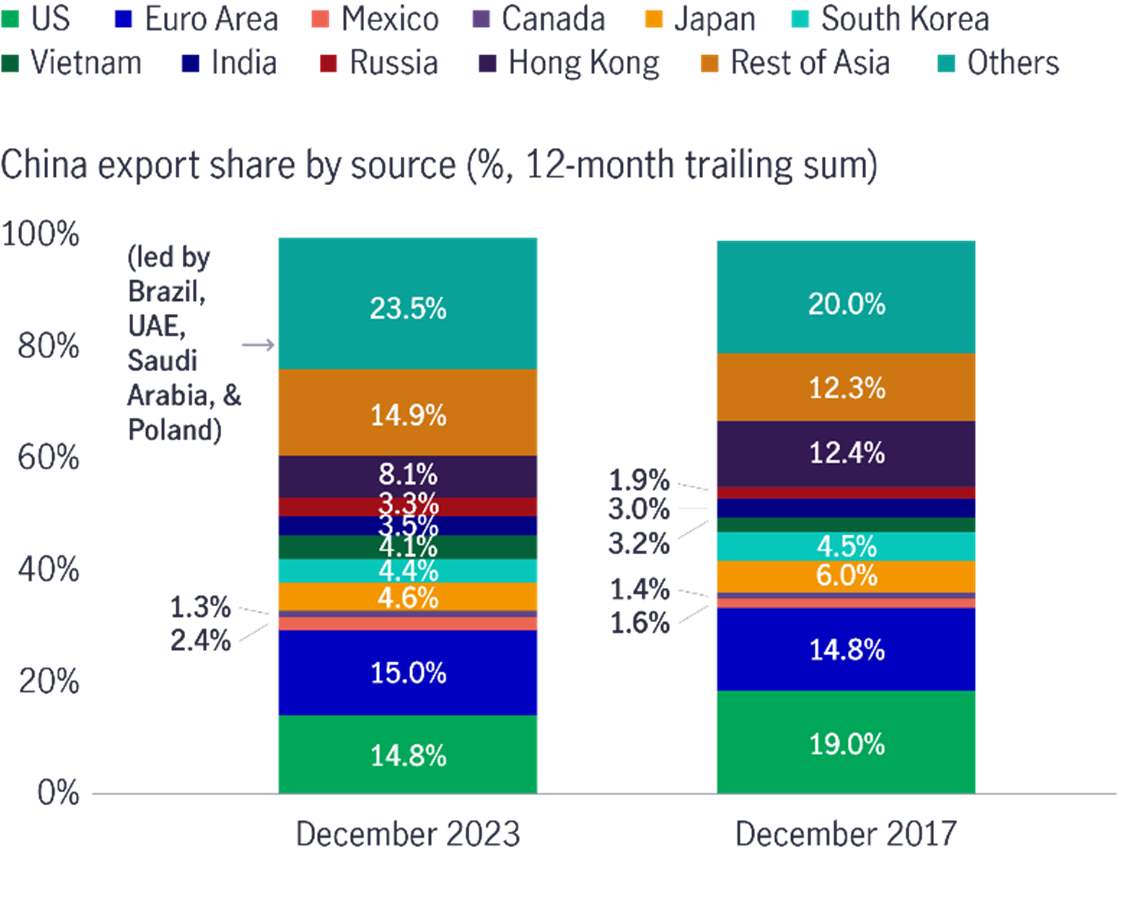

Tariffs are not new. Over the past years, mainland China’s exports to the US have declined while its exports to the rest of the world have increased. Hence, mainland China’s dependency on direct channels has been reduced. For example, mainland China’s exports to the US as a percentage of its export share was 19% in 2017. As of 2023, this had fallen to 14.8% (see Chart 1).

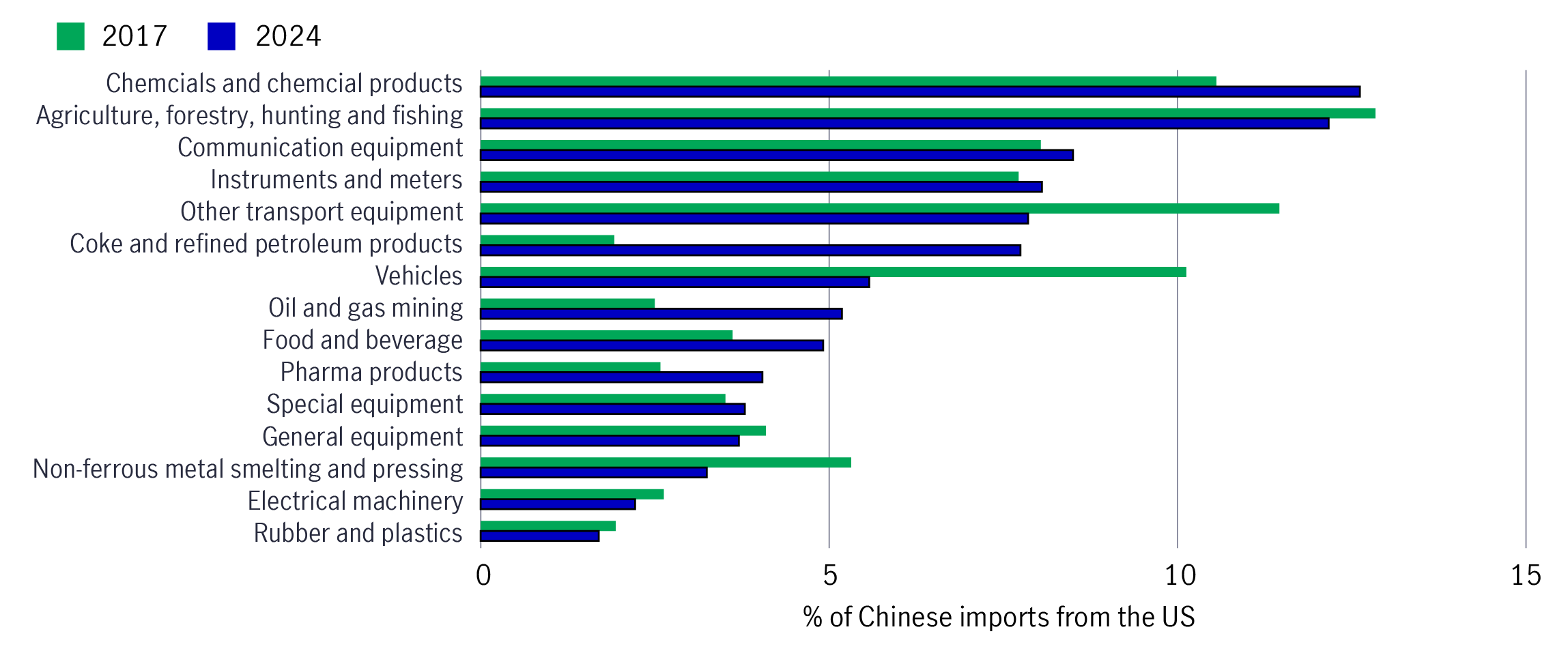

Having that said, mainland China still imports chemical, agricultural, forestry and communication equipment (top categories) from the US (see Chart 3), which, in turn, faces mainland China’s retaliatory tariffs.

Chart 1: China’s export share by source

Source: MS Research

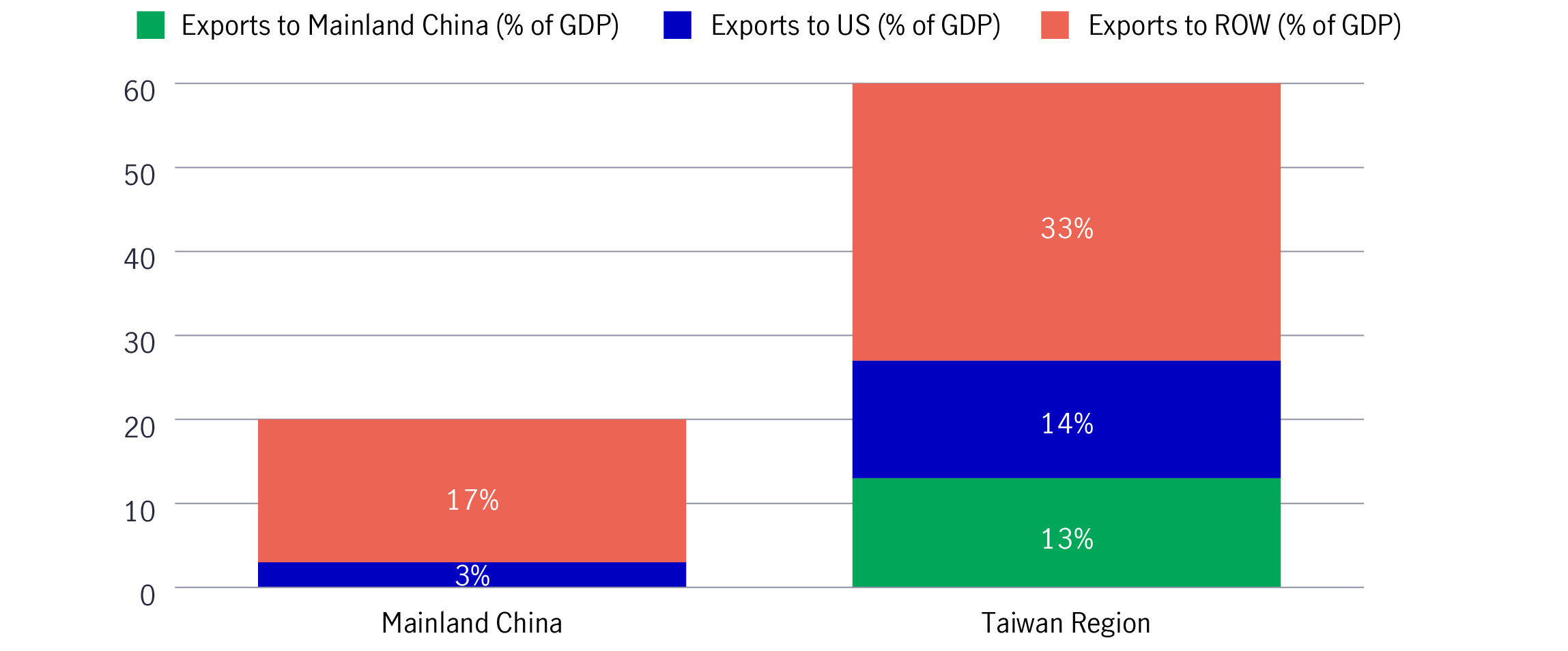

Chart 2: Goods exports to GDP (% of GDP, 12-month trailing sum)

Source: MS research

Chart 3: Top 15 Chinese imports from the US by sector (2024)

Source: GS research, April 2025

Mainland China is also ready to counter external uncertainties. During the Two Sessions plenary meetings in March 2025, it was highlighted that “the central budget has preserved sufficient policy tools and spaces to counteract domestic and external uncertainties.” Accelerated measures, such as a RMB 3 trillion increase in the government bond net issuance quota, were announced in the 2025 budget. See our previous note here.

We believe that further fiscal policies will follow, plus mainland China has room to ease monetary policies further, as highlighted during the Two Sessions.

Moreover, mainland China’s announcement on 30 March 2025 that it would allocate RMB 520 billion to shore up the capital of four domestic banks, including China Construction Bank, Bank of China, Bank of Communications and Postal Savings Bank, is positive, enabling them to provide further loan growth to support corporates and small and medium-sized enterprises (SMEs).

Over the year to date, mainland China’s technology related sectors, ranging from AI and robotics to hardware, software and autonomous driving, rallied. This came amid DeepSeek’s breakthrough, optimism surrounding mainland China’s AI and technology acceleration, as well as localisation trends as many companies embrace AI/inference. Overall, mainland China continues to advance on the home-grown technologies front, which is encouraging.

Consumption remains an essential driver of mainland China’s economy. Trade-in policies for consumer goods (e.g., electronics, home appliances, and communication equipment) have boosted domestic consumption since the fourth quarter of 2024 and into 2025. Mainland China may also provide more holistic stimulus to boost consumption (e.g., increasing incomes and wealth by supporting employment as well as raising pensions and elderly/childcare benefits).

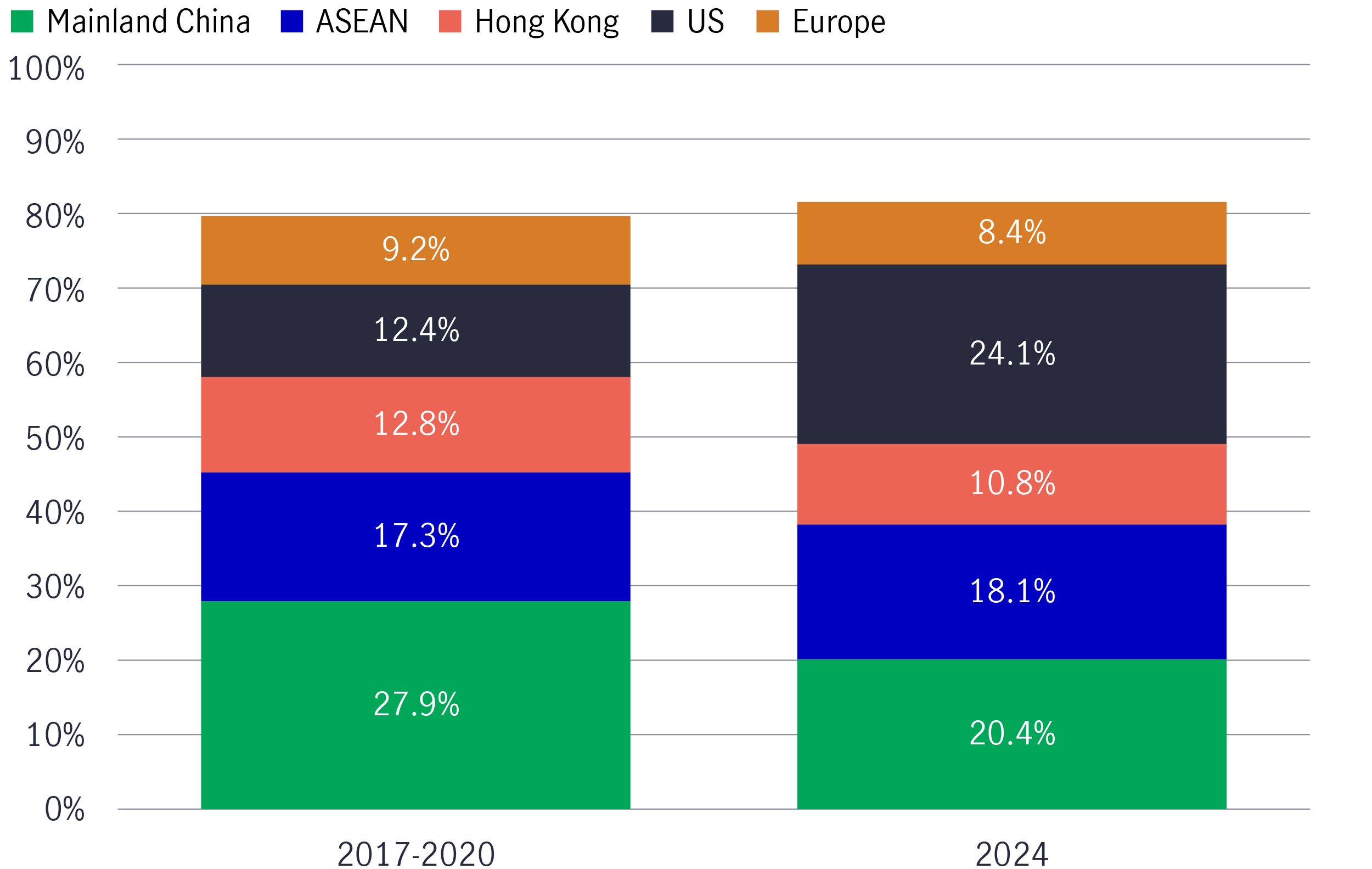

Taiwan region’s export exposure to the US increased by around 24.1% in 2024 – almost double that seen in the period 2017-2020 (see chart 4). By product type, information, communication, video/audio products, and electronic components remained the top categories. However, for now, semiconductors have been exempted from the reciprocal tariff list, which should be positive. Over the medium term, we still favour leading foundry companies.

Chart 4: Taiwan region: export to top five destinations (% share to total exports)

Source: Taiwan Ministry of Finance, MS research

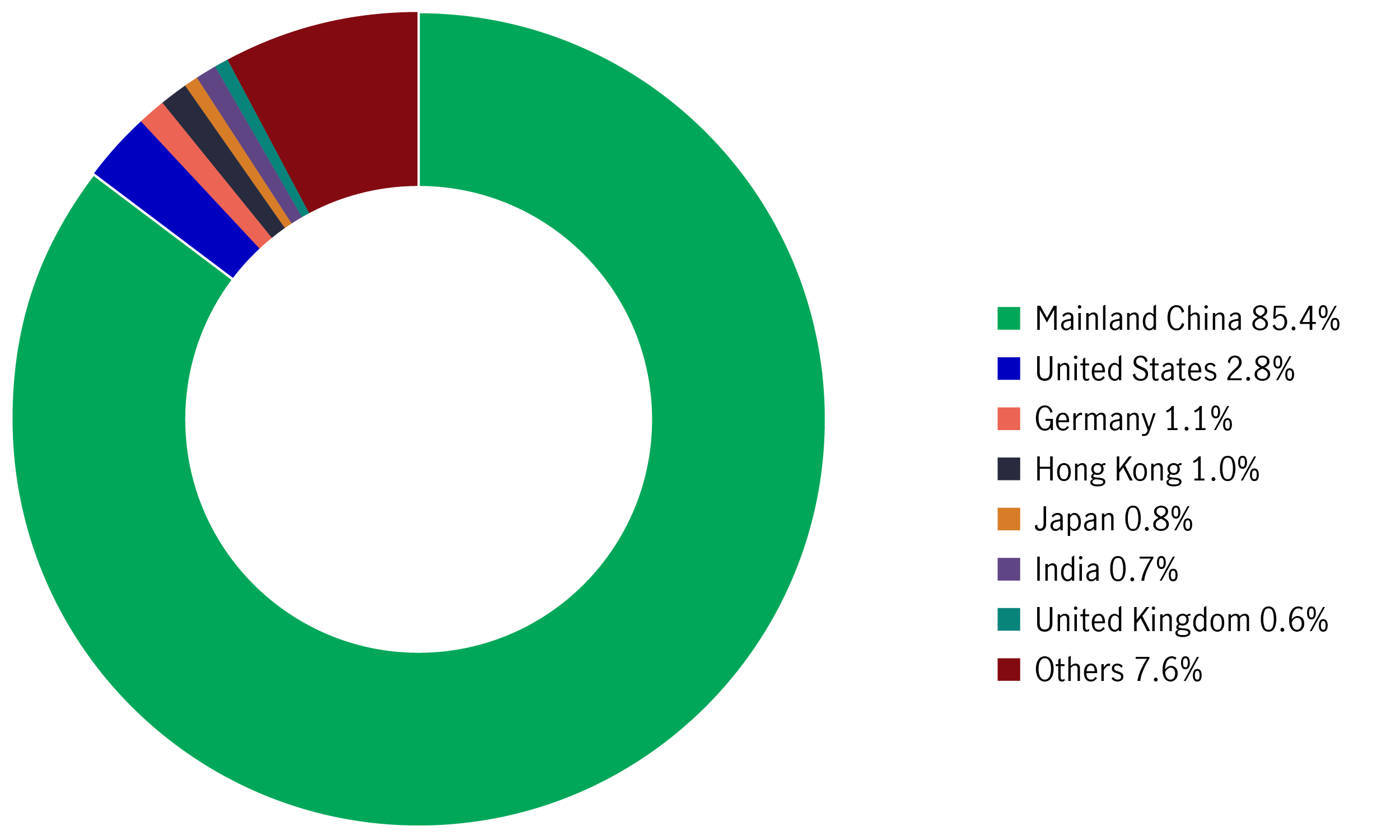

MSCI China Index only has <3% of revenue exposure to the US, which is low (see Chart 5).

Our Greater China equity strategies are defensively positioned as the investment team has recently taken partial profits on mainland China technology, media and telecommunications names as well as Taiwan IT and hardware companies. At the same time, it has added exposure to domestic-oriented areas, such as mainland China software, consumption, and healthcare names.

However, over the medium-to-long term, we continue to advanced manufacturing leaders, beneficiaries of the AI and robotics supply chain, and domestic niche consumption leaders. Mainland China continues to accelerate its technological self sufficiency with notable breakthroughs that continue to take leadership strides.

Chart 5: MSCI China last 12 months revenue breakdown by markets

Source: MS research, March 2025

1 China Ministry of Commerce, 4 April 2025.

Solutions for navigating market volatility amid U.S. tariff changes

Recent changes in U.S. tariffs have introduced new dynamics to the global market landscape, presenting both challenges and opportunities for investors. Understanding these developments is essential for making informed investment decisions. Marc Franklin, our Deputy Head of Multi-Asset Solutions, Asia, and Senior Portfolio Manager provided his view.

Quick thoughts on US reciprocal tariffs

The US President Donald Trump announced reciprocal tariff details on 2 April, 2025, which has introduced volatility to the financial markets. Alex Grassino, Global Chief Economist, along with the Multi-Asset Solutions Team (MAST), Macroeconomic Strategy Team, share their latest views.

2025 Outlook Series: Global Healthcare Equities

The Global Healthcare team maintains a sense of measured optimism for the performance of healthcare equities given the underlying key subsector strength in 2025.

Solutions for navigating market volatility amid U.S. tariff changes

Recent changes in U.S. tariffs have introduced new dynamics to the global market landscape, presenting both challenges and opportunities for investors. Understanding these developments is essential for making informed investment decisions. Marc Franklin, our Deputy Head of Multi-Asset Solutions, Asia, and Senior Portfolio Manager provided his view.

Quick thoughts on US reciprocal tariffs

The US President Donald Trump announced reciprocal tariff details on 2 April, 2025, which has introduced volatility to the financial markets. Alex Grassino, Global Chief Economist, along with the Multi-Asset Solutions Team (MAST), Macroeconomic Strategy Team, share their latest views.

2025 Outlook Series: Global Healthcare Equities

The Global Healthcare team maintains a sense of measured optimism for the performance of healthcare equities given the underlying key subsector strength in 2025.