27 March 2023

2022 was an exceptionally volatile year for financial markets. With equities and bonds falling in tandem, major MPF fund categories inevitably saw their returns land in the red1. Shrinking retirement portfolios could trigger plenty of questions from employees. Let’s debunk some common investment myths and discuss ways to navigate market volatility.

2022 was an extraordinary year for financial markets. As the pandemic unfolded, inflation in the US, UK, and Japan hit highs not seen in more than 40 years, while in the eurozone, price rises were at a 23-year peak,2 prompting European, US and UK central banks to hike rates aggressively. Not only did this undermine the conventional complementary effect of equities and bonds in investment markets – by simultaneously investing in both types of assets, gains in one could potentially offset partial losses in the other – but equities, bonds and major foreign currencies (versus the US dollar) all recorded negative returns for the first time in almost half a century.3

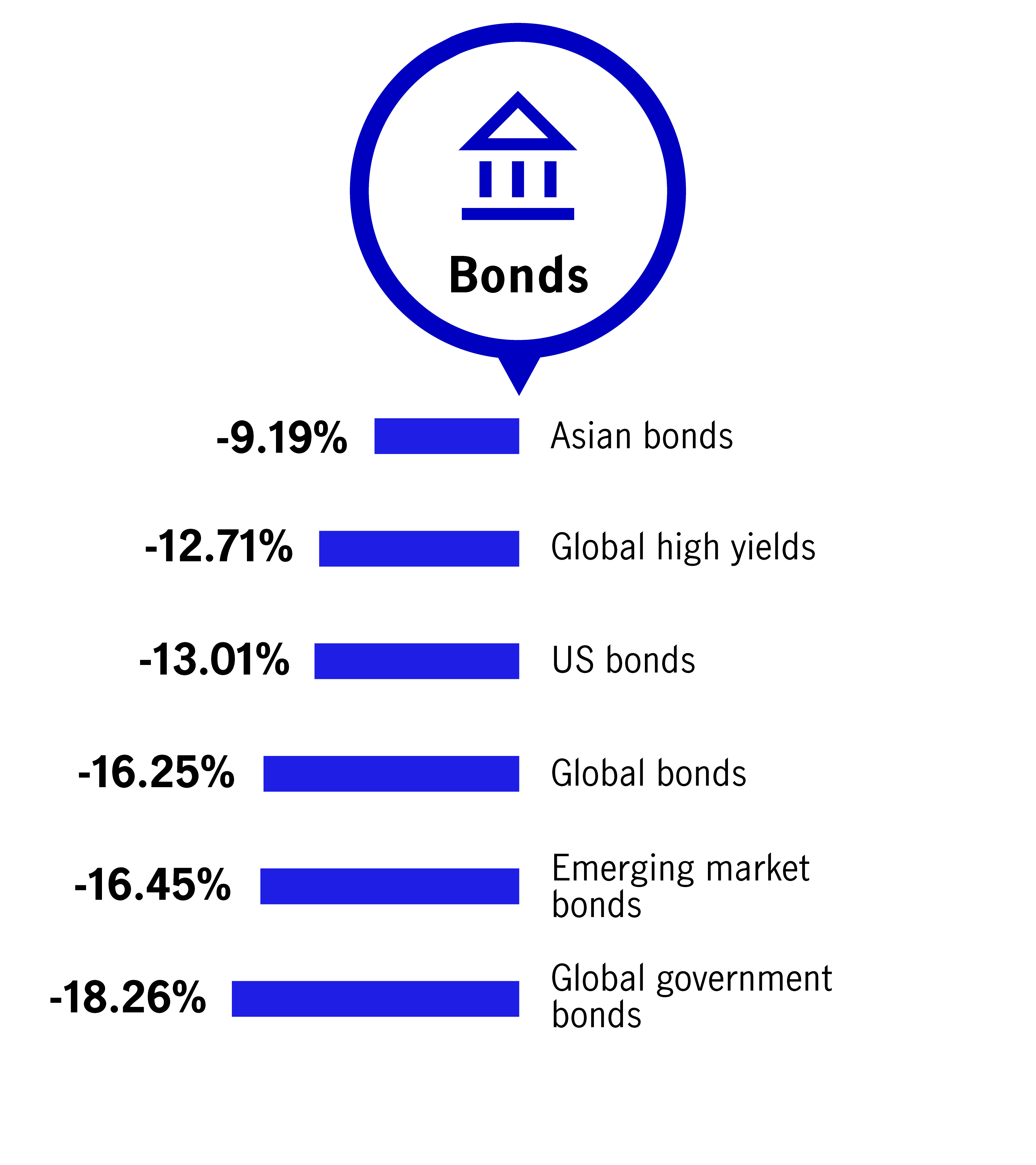

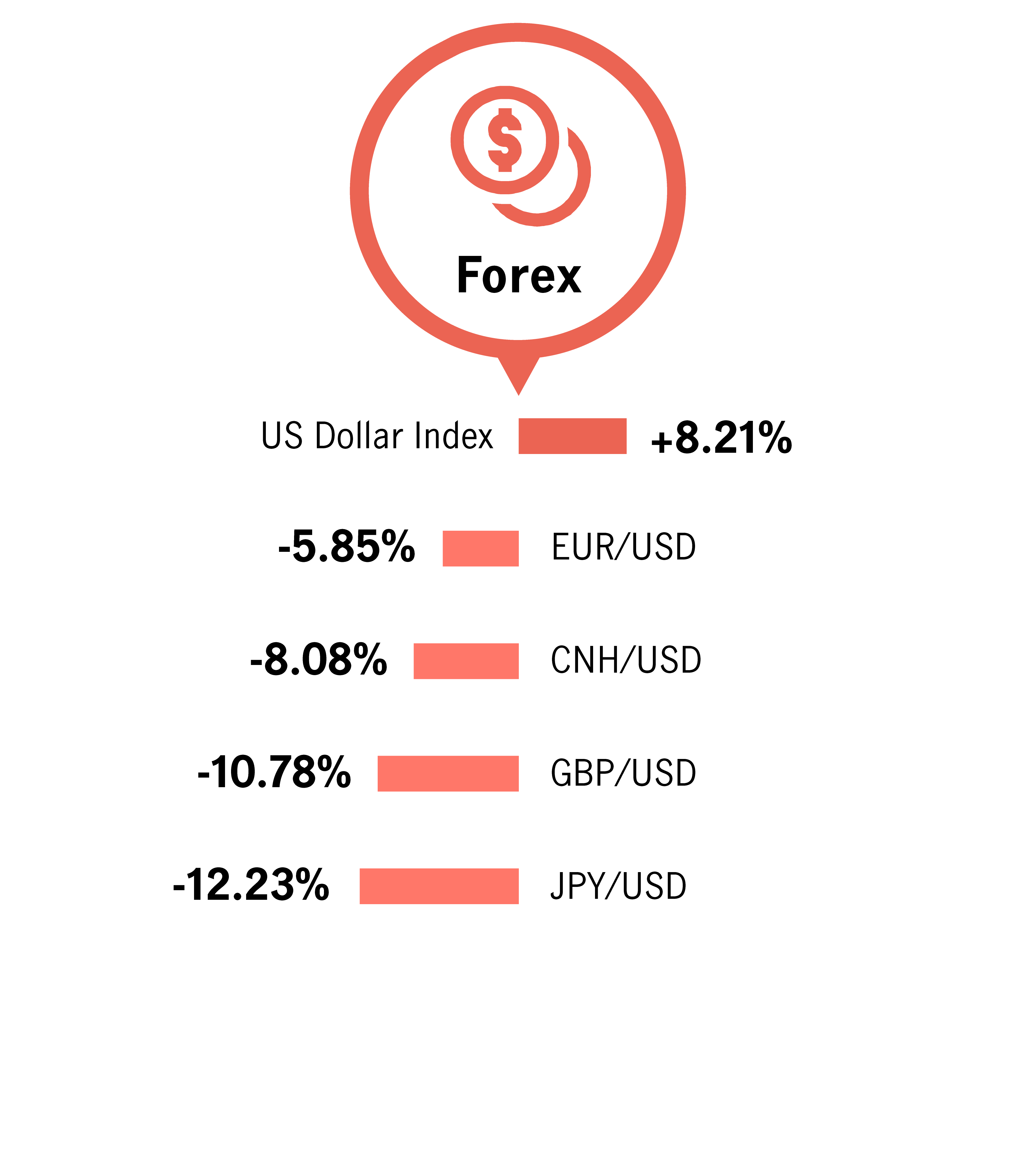

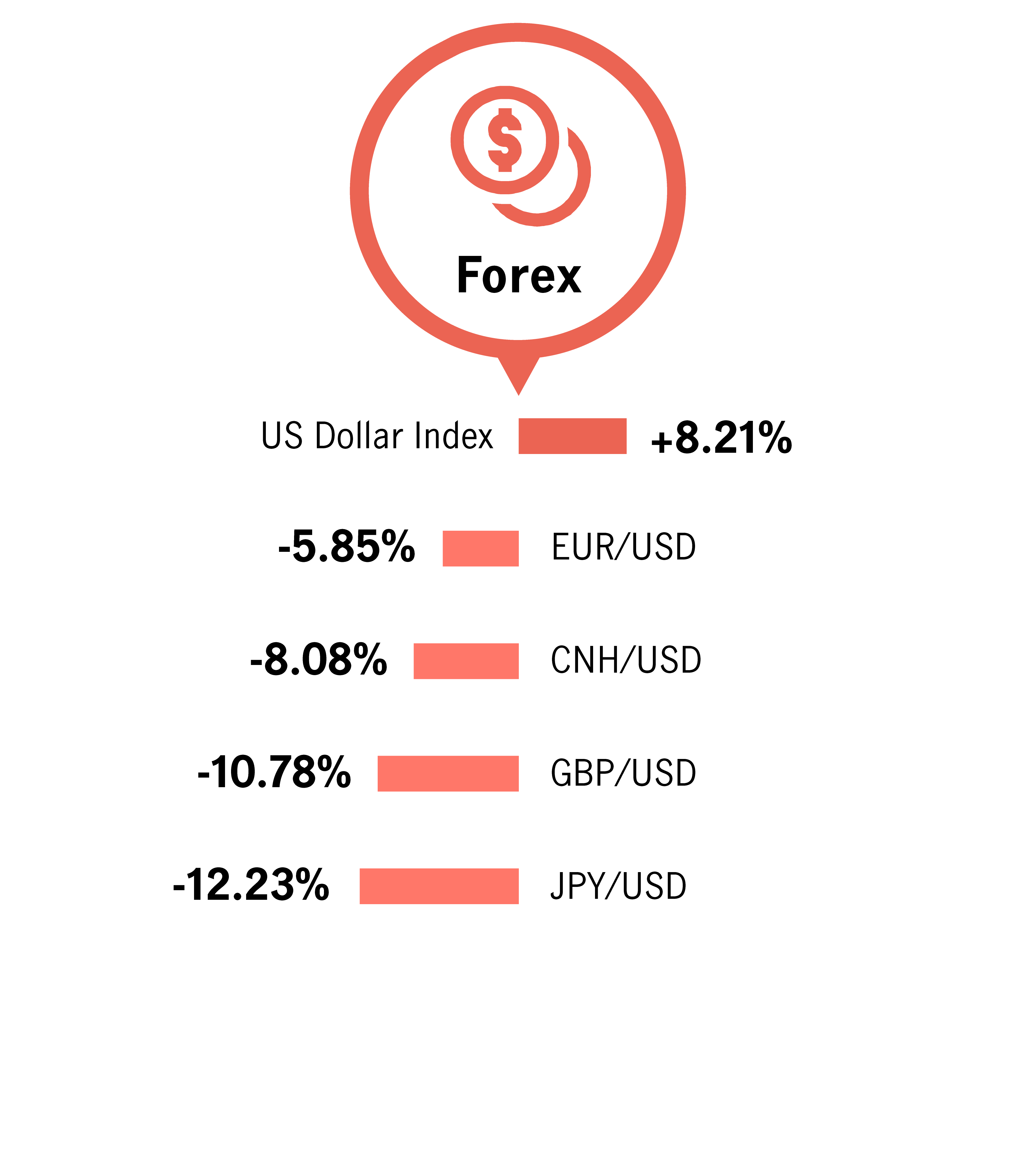

Major equity and bond indices worldwide saw double-digit losses in 2022 (see illustration below)– at one point, they retreated by more than 20% from their yearly highs2 – and both equities and bonds entered bear-market territory. At the same time, developed and emerging-market currencies depreciated against the US dollar, leaving the US dollar and major commodities as the only gainers.

Against this backdrop, major types of MPF funds declined, with the annualised net return of equity funds falling by 19.3% in 2022, mixed-asset funds retreated by 17.4%, while lower-risk funds, such as bond funds and guaranteed funds, also closed in the red (-13.1% and -5.3%, respectively). Conservative funds were the best-performing category, with a net annualised return of 0.4%.4

Major asset class returns 20225

More years, better living

They say that 60 is the new 50, so if you are nearing the next chapter of life, why not make the most out of your golden years by embracing new experiences, pursuing passions and enjoying life to the fullest?

Harness lower-risk funds to navigate uncertainty and volatility

Market uncertainties are accelerating recently, this article will discuss how employees navigate the turbulent conditions by making good use of lower-risk fund

Your retirement withdrawal strategy—four tips for managing inflation

When it is time to enjoy what you’ve always dreamed of doing, the retirement planning doesn’t end there. It’s important to regularly review your withdrawal strategy and make adjustments as needed to keep changing economic conditions from throwing you off track. Consider the four tips to help keep inflation from depleting your retirement savings sooner than you expected.

When markets turn volatile, some investors quickly divest their holdings to book profits or cut losses. However, before making any investment decision, it is important to make thorough considerations and not get swept along by market sentiment. Why?

The point of time when scheme members start investing in the MPF, investment styles (lump-sum voluntary contributions or fixed monthly contributions), investment objectives, duration, asset classes held, and the amount of members’ MPF contributions differ. When and under what circumstances should holdings be sold, and should these holdings be sold partially or in full? It is difficult to provide one-size-fits-all answers to these questions.

If you have decided to sell, why not ask yourself these four questions first:

1. Am I selling because of personal factors or changes in short-term market sentiment?

2. Can I “cash out” after selling?

Under MPF legislation, scheme members may only withdraw their MPF derived from mandatory contributions and tax-deductible voluntary contributions (TVC) upon reaching age 65.6 Therefore, the proceeds of all the desired “take profits” or “cut losses” actions relating to these two contributions (made before age 65) cannot be cashed out. These actions are regarded as switching funds: from the sold fund(s) to other constituent fund(s).

3. Has the investment outlook for the asset class I plan to sell changed?

Short-term fluctuations in asset prices may arise because of changes in market sentiment and are not necessarily linked to the longer-term investment outlook. But if that outlook deteriorates, investors could consider adjusting their portfolio’s asset allocation, even if market conditions appear calm at that specific point in time. On the other hand, if the outlook remains unchanged, or even when an asset class benefits from positive catalysts (e.g., opportunities arising from the launch of supportive policies for specific sectors), scheme members may reconsider the timing of the sale.

4. Is the adjusted portfolio deviating from my original objectives? Are the expected returns still achievable?

Excluding personal factors, it is common to sell during market downturns and switch to funds with lower potential risk or volatility – especially when markets are expected to retreat further.

After switching, low-risk funds will account for a greater proportion of a portfolio, which means potential volatility and returns will be lower. For younger scheme members far from retirement age, overly defensive allocations may be incompatible with their investment objectives. This makes achieving higher capital gains and the desired returns by retirement harder.

Many articles summarised investment market performance in 2022, which listed the declines seen in different asset classes and the average losses endured by investors. However, the market returns featured in these articles refer to the gains and losses of individual asset classes in 2022, not investors’ individual returns. As such, the data does not reflect investors’ actual horizon, assets held, investment cost, asset allocation and other factors that calculate the overall return of their portfolios.7

Therefore, these reported losses do not reflect personal financial losses. And investors should avoid making make premature decisions based on such data.

In times of turmoil, if investors want to reduce volatility or lower their investment costs, as well as take advantage of long-term growth potential, the automatically executed dollar-cost averaging strategy may be a feasible choice. And this is precisely the strategy employed by MPF!

What does it mean? It involves regularly investing a fixed-dollar amount in a specific investment – regardless of fluctuations in the market price. As a result, scheme members buy more units when prices are low and fewer units when prices are high.

What are the benefits? It is often difficult to choose the best time to invest. The three major advantages of dollar cost averaging include the following:

1. Scheme members regularly invest fixed sums based on pre-set orders, regardless of market conditions. We believe it is a potentially beneficial strategy for those who are overly concerned about market volatility and miss investment opportunities, possess a lower risk appetite, do not have time to follow the relevant asset prices closely or have limited funds (contributions).

2. When there are unanticipated market movements (notable rises or falls), inexperienced investors could make irrational decisions, such as buying high due to a fear of missing out on market rallies or selling low to avoid further losses because of falling markets. However, dollar cost averaging helps alleviate the potential negative effects of irrational “active trading” on investment returns.

3. When markets are volatile, it is possible to accumulate more units at lower prices. This could result in a lower average investment cost than with a lump-sum approach during the entire investment period, which helps diversify risk. If the underlying asset prices stabilise or even trend upwards during times of uncertainty, investors may earn positive returns at the end of the period and may even outperform lump-sum investing.

A retirement portfolio often holds different assets and changes in value depending on the performance of individual assets and the strategy adopted.

While both equities and bonds recorded losses in 2022, the extent of equity losses across different regions (e.g., emerging markets, Europe, Japan, or the US) or bonds with different ratings (highly rated government bonds, investment-grade corporate bonds) varied greatly. If the assets held in 2022 recorded the largest/larger losses, the year-on-year percentage decrease in their value – compared to 2021 – will inevitably be greater.

At the start of 2023, some equities and bond markets once rebounded, albeit at a different pace. If assets with smaller gains (or even losses) account for a high proportion of portfolio holdings, overall returns may be lower than markets.

When structuring a portfolio, some scheme members may not have strong views of their investments. They either take guidance from family members and friends or replicate their portfolios entirely. As a result, they may opt for a single or overly concentrated strategy, focusing on one to two asset classes. Unfortunately, if their market predictions are incorrect and they choose the worst-performing asset as their sole holding, the percentage decrease in value would be significant because they do not have exposure to better-performing assets that could offset the losses.

Everyone has different risk tolerances, investment objectives and horizons. To better manage risk, diversification may be an effective way.

What does it mean? Diversification means combining different asset classes in one portfolio based on individual investment objectives and risk tolerance. Every asset class has its own risk and reward characteristics; they perform differently depending on the point in the economic cycle. Investing in a single asset may be insufficient to meet a scheme member’s investment objectives while possibly bearing the risk of over-concentration.

What are the benefits? By diversification, each asset will only form a part (but not the whole) of an investment portfolio. The variability of each asset class will matter less, while the overall portfolio volatility will be reduced to manage risk better.

What are the effects? Diversification does not guarantee positive returns within a certain period. However, even if the portfolio invests in the worst-performing asset, the overall investment returns will exceed that asset class.8

1 Mandatory Provident Fund Schemes Statistical Digest Quarterly Report December 2022 – published by the Mandatory Provident Fund Schemes Authority (MPFA). Data as of 31 December 2022. Past performance is not indicative of future performance.

2 Bloomberg, February 2023.

3 Hong Kong Monetary Authority, 30 January 2023.

4 Mandatory Provident Fund Schemes Statistical Digest Quarterly Report December 2022 – published by the Mandatory Provident Fund Schemes Authority (MPFA). Data as of 31 December 2022. Return figures are net of fees and charges. Returns of different types of constituent funds were calculated by way of time-weighted method. This time-weighted method takes into account the unit price and asset size of each constituent fund at different points in time. Unlike the internal rate of return (IRR) method, it does not capture the impact of the contributions into and benefits withdrawn from the constituent funds. The annualised net return was calculated by raising the monthly return to the power of 12. Past performance is not indicative of future performance.

5 Data source: Bloomberg, Manulife Investment Management, data as of 31 December 2022. Equities and bond returns are the total returns in US dollar of the following indices: European equities are represented by MSCI Europe Index; Japan equities are represented by MSCI Japan Index; Asia Pacific ex-Japan equities are represented by MSCI Asia Pacific ex-Japan Index; World equities are represented by MSCI World Index; US equities are represented by S&P 500 Index; Emerging market equities are represented by MSCI Emerging Markets Index; Greater China equities are represented by MSCI Golden Dragon Index; Asian bonds are represented by 50% JPMorgan Asia Credit Index + 50% Markit iBoxx Asian Local Bond Index; Global high yield bonds are represented by Bloomberg Global High Yield Corporate Bond Index; US bonds are represented by Bloomberg Barclays US Aggregate Index; Global bonds are represented by Bloomberg Barclays Global Aggregate Index; Emerging market bonds are represented by JPMorgan EMBI Global Core Index; World government bonds are represented by FTSE world government bond index. US dollar index measures of weighted average performance of US dollar against six other foreign currencies including euro, Japanese yen, British pound, Canadian dollar, Swedish krona and Swiss franc. Bulk commodities are represented by Refinitiv/CoreCommodity CRB index. Past performance is not indicative of future performance.

6 There are specific circumstances where scheme members may withdraw their MPF before reaching age 65. Benefits of Special voluntary contributions (SVC) can be withdrawn or transferred anytime. Source: Mandatory Provident Fund Schemes Authority (MPFA).

7 As investors are still holding their assets, the overall return mentioned above refers to the booking gains or losses as of a certain cut-off date, but not the actual (realised) returns/losses.

8 Assuming an investment portfolio consists of two or more asset classes, and there is only one asset class to be the worst performer.

When markets turn volatile, some investors quickly divest their holdings to book profits or cut losses. However, before making any investment decision, it is important to make thorough considerations and not get swept along by market sentiment. Why?

The point of time when scheme members start investing in the MPF, investment styles (lump-sum voluntary contributions or fixed monthly contributions), investment objectives, duration, asset classes held, and the value of members’ MPF contributions differ. When and under what circumstances should holdings be sold, and should these holdings be sold partially or in full? It is difficult to provide one-size-fits-all answers to these questions.

If you have decided to sell, why not ask yourself these four questions first:

1. Am I selling because of personal factors or changes in short-term market sentiment?

2. Can I “cash out” after selling?

Under MPF legislation, scheme members may only withdraw their MPF derived from mandatory contributions and tax-deductible voluntary contributions (TVC) upon reaching age 656. Therefore, the proceeds of all the desired “take profits” or “cut losses” actions relating to these two contributions (made before age 65) cannot be cashed out. These actions are regarded as switching funds: from the sold fund(s) to other constituent fund(s).

3. Has the investment outlook for the asset class I plan to sell changed?

Short-term fluctuations in asset prices may arise because of changes in market sentiment and are not necessarily linked to the longer-term investment outlook. But if that outlook deteriorates, investors could consider adjusting their portfolio’s asset allocation, even if market conditions appear calm at that specific point in time. On the other hand, if the outlook remains unchanged, or even when an asset class benefits from positive catalysts (e.g., opportunities arising from the launch of supportive policies for specific sectors), scheme members may reconsider the timing of the sale.

4. Is the adjusted portfolio deviating from my original objectives? Are the expected returns still achievable?

Excluding personal factors, it is common to sell during market downturns and switch to funds with lower potential risk or volatility – especially when markets are expected to retreat further.

After switching, low-risk funds will account for a greater proportion of a portfolio, which means potential volatility and returns will be lower. For younger scheme members far from retirement age, overly defensive allocations may be incompatible with their investment objectives. This makes achieving higher capital gains and the desired returns by retirement harder.

Many articles summarised investment market performance in 2022, which listed the declines seen in different asset classes and the average losses endured by investors. However, the market returns featured in these articles refer to the gains and losses of individual asset classes in 2022, not investors’ individual returns. As such, the data does not reflect investors’ actual horizon, assets held, investment cost, asset allocation and other factors that calculate the overall return of their portfolios.7

Therefore, these reported losses do not reflect personal financial losses. And investors should avoid making make premature decisions based on such data.

In times of turmoil, if investors want to reduce volatility or lower their investment costs, as well as take advantage of long-term growth potential, the automatically executed dollar-cost averaging strategy may be a feasible choice. And this is precisely the strategy employed by MPF!

What does it mean? It involves regularly investing a fixed-dollar amount in a specific investment – regardless of fluctuations in the market price. As a result, scheme members buy more units when prices are low and fewer units when prices are high.

What are the benefits? It is often difficult to choose the best time to invest. The three major advantages of dollar cost averaging include the following:

1. Scheme members regularly invest fixed sums based on pre-set orders, regardless of market conditions. Therefore, it is a potentially beneficial strategy for those who are overly concerned about market volatility and miss investment opportunities, possess a lower risk appetite, do not have time to follow the relevant asset prices closely or have limited funds (contributions).

2. When there are unanticipated market movements (notable rises or falls), inexperienced investors could make irrational decisions, such as buying high due to a fear of missing out on market rallies or selling low to avoid further losses because of falling markets. However, dollar cost averaging helps alleviate the potential negative effects of irrational “active trading” on investment returns.

3. When markets are volatile, it is possible to accumulate more units at lower prices. This could result in a lower average investment cost than with a lump-sum approach during the entire investment period, which helps diversify risk. If the underlying asset prices stabilise or even trend upwards during times of uncertainty, investors may earn positive returns at the end of the period and may even outperform lump-sum investing.

A retirement portfolio often holds different assets and changes in value depending on the performance of individual assets and the strategy adopted.

While both equities and bonds recorded losses in 2022, the extent of equity losses across different regions (e.g., emerging markets, Europe, Japan, or the US) or bonds with different ratings (highly rated government bonds, investment-grade corporate bonds) varied greatly.

If the assets held in 2022 recorded the largest/larger losses, the year-on-year decline in their value – compared to 2021 – will inevitably be greater.

At the start of 2023, some equities and bond markets once rebounded, albeit at a different pace. If assets with smaller gains (or even losses) account for a high proportion of portfolio holdings, overall returns may be lower than markets.

When structuring a portfolio, some scheme members may not have strong views of their investments. They either take guidance from family members and friends or replicate their portfolios entirely. As a result, they may opt for a single or overly concentrated strategy, focusing on one-to-two asset classes. Unfortunately, if their market predictions are incorrect and they choose the worst-performing asset as their sole holding, the decline in value would be significant because they do not have exposure to better-performing assets that could offset the losses.

Everyone has different risk tolerances, investment objectives and horizons. To better manage risk, diversification may be an effective way.

What does it mean? Diversification means combining different asset classes in one portfolio based on individual investment objectives and risk tolerance. Every asset class has risk- and-reward characteristics; they perform differently depending on the point in the economic cycle. Investing in a single asset is typically insufficient to meet a scheme member’s investment objectives while bearing the risk of over-concentration.

What are the benefits? By diversification, each asset will only form a part (but not the whole) of an investment portfolio. The variability of each asset class will matter less, while the overall portfolio volatility will be reduced to manage risk better.

What are the effects? Diversification does not guarantee positive returns within a certain period. However, even if the portfolio invests in the worst-performing asset, the overall investment returns will still exceed that asset class.8

1 Mandatory Provident Fund Scheme Statistical Digest Quarterly Report December 2022 – published by the Mandatory Provident Fund Schemes Authority (MPFA). Data as of 31 December 2022. Past performance is not indicative of future performance.

2 Bloomberg, February 2023.

3 Hong Kong Monetary Authority, 30 January 2023.

4 Mandatory Provident Fund Scheme Statistical Digest Quarterly Report December 2022 – published by the Mandatory Provident Fund Schemes Authority (MPFA). Data as of 31 December 2022. Return figures are net of fees and charges. Returns of different types of constituent funds were calculated by way of time-weighted method. This time-weighted method takes into account the unit price and asset size of each constituent fund at different points in time. Unlike the internal rate of return (IRR) method, it does not capture the impact of the contributions into and benefits withdrawn from the constituent funds. The annualised net return was calculated by raising the monthly return to the power of 12. Past performance is not indicative of future performance.

5 Data source: Bloomberg, Manulife Investment Management, data as of 31 December 2022. Equities and bond returns are the total returns in US dollar of the following indices: European equities are represented by MSCI Europe Index; Japan equities are represented by MSCI Japan Index; Asia Pacific ex-Japan equities are represented by MSCI Asia Pacific ex-Japan Index; World equities are represented by MSCI World Index; US equities are represented by S&P 500 Index; Emerging market equities are represented by MSCI Emerging Markets Index; Greater China equities are represented by MSCI Golden Dragon Index; Asian bonds are represented by 50% JPMorgan Asia Credit Index + 50% Markit iBoxx Asian Local Bond Index; Global high yield bonds are represented by Bloomberg Global High Yield Corporate Bond Index; US bonds are represented by Bloomberg Barclays US Aggregate Index; Global bonds are represented by Bloomberg Barclays Global Aggregate Index; Emerging market bonds are represented by JPMorgan EMBI Global Core Index; World government bonds are represented by FTSE world government bond index. US dollar index measures of weighted average performance of US dollar against six other foreign currencies including euro, Japanese yen, British pound, Canadian dollar, Swedish krona and Swiss franc. Bulk commodities are represented by Refinitiv/CoreCommodity CRB index. Past performance is not indicative of future performance.

6 There are specific circumstances where scheme members may withdraw their MPF before reaching age 65. Benefits of Special voluntary contributions (SVC) can be withdrawn or transferred anytime. Source: Mandatory Provident Fund Schemes Authority (MPFA).

7 As investors are still holding their assets, the overall return mentioned above refers to the booking gains or losses as of a certain cut-off date, but not the actual (realised) returns/losses.

8 Assuming an investment portfolio consists of two or more asset classes, and there is only one asset class to be the worst performer.

More years, better living

They say that 60 is the new 50, so if you are nearing the next chapter of life, why not make the most out of your golden years by embracing new experiences, pursuing passions and enjoying life to the fullest?

Harness lower-risk funds to navigate uncertainty and volatility

Market uncertainties are accelerating recently, this article will discuss how employees navigate the turbulent conditions by making good use of lower-risk fund

Your retirement withdrawal strategy—four tips for managing inflation

When it is time to enjoy what you’ve always dreamed of doing, the retirement planning doesn’t end there. It’s important to regularly review your withdrawal strategy and make adjustments as needed to keep changing economic conditions from throwing you off track. Consider the four tips to help keep inflation from depleting your retirement savings sooner than you expected.