9 October 2024

Kai-Kong Chay, Senior Portfolio Manager, Greater China Equities

In the wake of clear and coordinated policy announcements, investors swiftly reappraised their views of the China equity market, which rallied sharply in the final week of September and early October. Kai-Kong Chay, Senior Portfolio Manager, Greater China Equities, and the Greater China Equities Team analyze the latest round of stimulus measures and explain why it warrants more than short-term tactical attention. The team also highlights a case study of Chinese companies that are ‘going-global’ to showcase this important juncture in the country’s corporate development.

Since late September, there’s been a raft of coordinated policy announcements with supportive measures for China’s economy on multiple fronts. These include a basket of rate and ratio cuts, supportive measures for the property market, stock market liquidity support, fiscal stimulus, and shoring up the banks’ capital positions1.

We believe this concerted, multi-pronged approach is powerful and holistic as it empowers individuals, corporates, banks, and non-bank financial institutions to engage and participate in economic activities. Compared to the previous round of concerted measures announced in July, this round of monetary easing and fiscal stimulus spans different areas, such as the property market, consumption, and financials, which should boost investors’ confidence in China’s economy.

The latest round of monetary easing spans policy rates, the reserve required ratio (RRR) and mortgage rates:

To further facilitate access to funding, an RMB 500 billion asset swap facility will be set up by the PBOC for non-bank financial (mutual funds, insurers, and brokers) to borrow directly from the PBOC with their quality collateral2. In addition, there will be an RMB 300 billion re-lending program for corporate buybacks, which could help to extend the pace of stock repurchases.

On 8 October, the National Development and Reform Commission (NDRC) laid out incremental policies to step up fiscal measures, including (1) speed up special purpose bond issuance to local government to support growth, (2) encourage private capital to participate in major infrastructure projects including railways, energy, water conservancy, etc., (3) formation of new list of key private investment nationwide, and (4) support for private capital to issue infrastructure REITs. NDRC stated that it would front-load RMB100 billion (US$14.1 billion) from the 2025 central budget, meanwhile, priority will be given to supporting key urban renewal projects.

As the NDRC focuses to on plans expand domestic demand, promote consumption, digest the stock of housing and support the property and capital markets, the NDRC said that the economy will achieve the target of about 5% growth for the year.

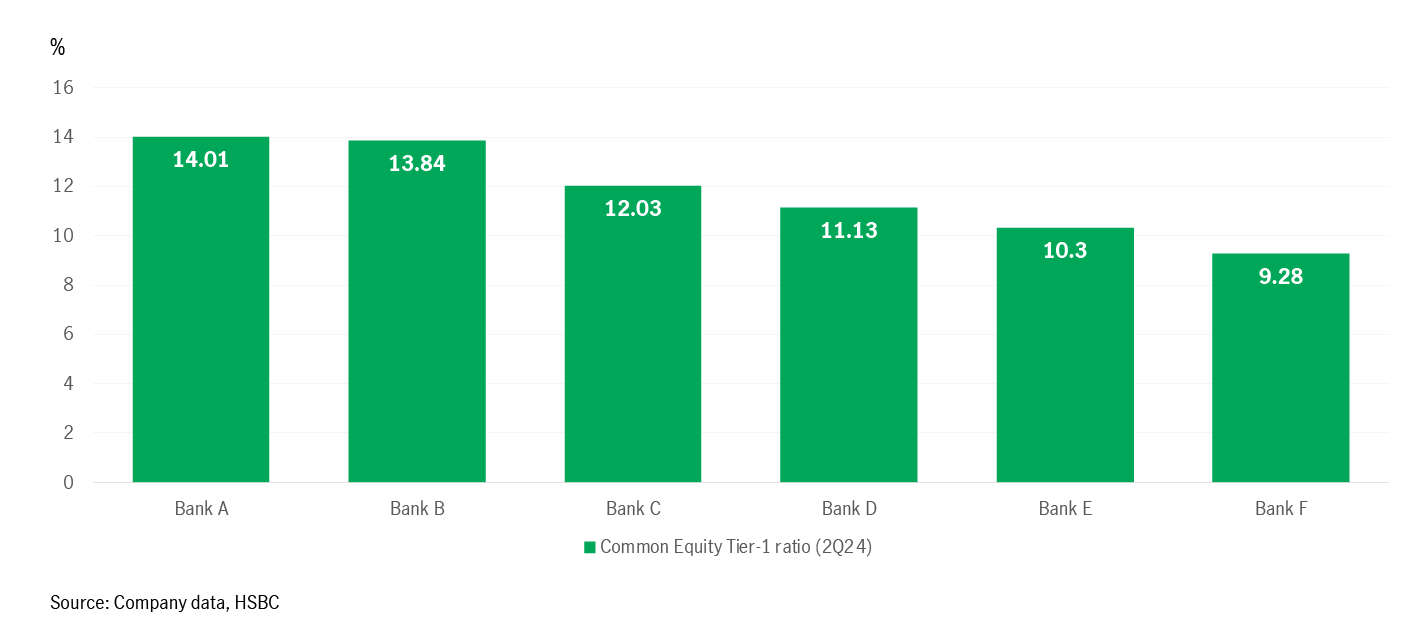

The National Financial Regulatory Administration is aiming for a phased strengthening of the core Tier-1 ratios of the six major state-owned banks in China. We view this as a significant move, as it is the first time this has happened since 2008.

Chinese banks were well capitalised with solid core Tier-1 capital adequacy ratios before the announcement. However, the earnings of Chinese banks in 1H 2024 suffered due to weaker-than-expected loan growth. Hence, the announcement to inject fresh capital into the large state-owned banks is clearly positive for the China banking sector.

Chart 1: Common Equity Tier-1 ratios for six state-owned banks

Since 2022, diverging China-US monetary policies have constrained China’s policymakers’ ability to pursue a more aggressive easing policy. With the beginning of the U.S. rate cut cycle in September, China has more room to conduct comprehensive monetary easing to improve the system’s overall liquidity and trigger immediate spillover impacts on the physical economy. Lower effective lending rates and deposit costs are positive for Chinese banks, while a lower RRR could provide the banking system with longer-term liquidity (estimated to be RMB 1 trillion).

By lowering existing mortgage rates and allowing existing mortgage payers to refinance their existing home loans based on a lower rate, an estimated RMB 150 billion in interest savings3 could be released back to mortgage payers, increasing their discretionary spending power.

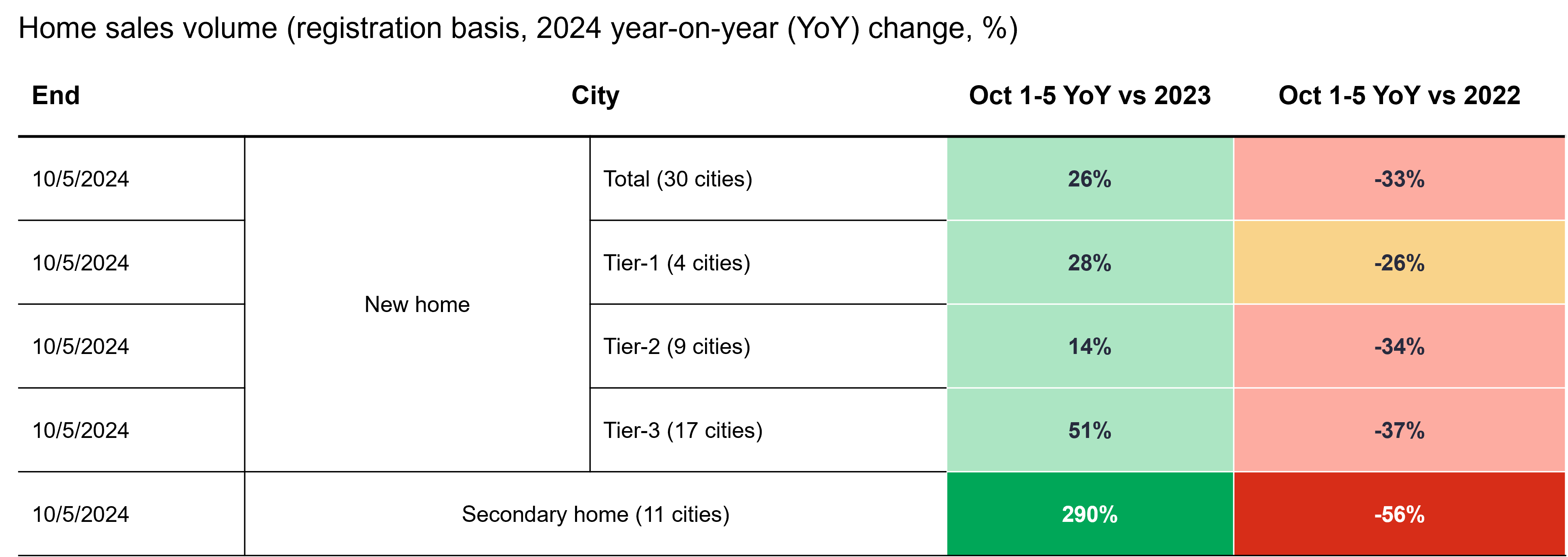

In stimulating the demand for property, a cut in mortgage rates and the down-payment ratio helps improve home affordability and encourage potential buyers to enter the property market, which is critical to reigniting property market transaction volumes.

Shortly after the policy announcement on 24 September, immediate positive action was seen on the ground. During the Golden Week holiday, cities that offered home purchase discounts recorded at least a 50% increase in project viewings, according to the Ministry of Housing and Urban-Rural Development.

Chart 2: Home sales during the Golden Week holiday (1 October to 5 October 2024)

Source: Wind, as of 5 October 2024.

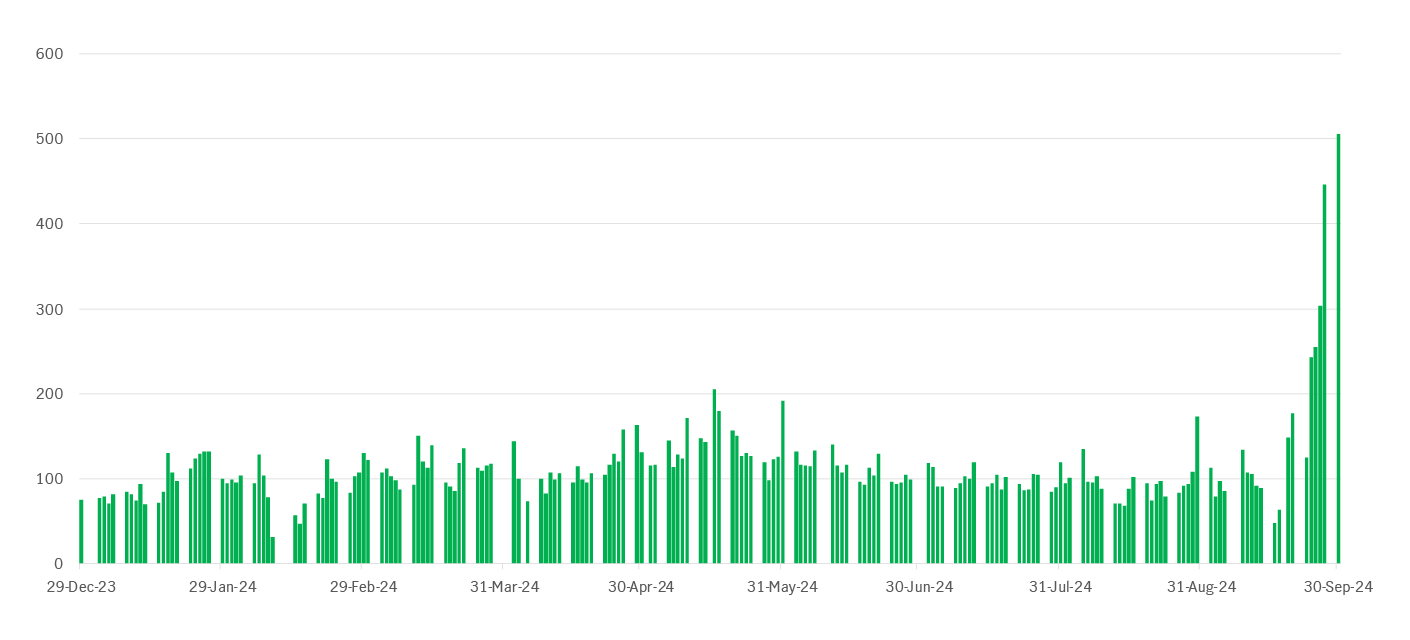

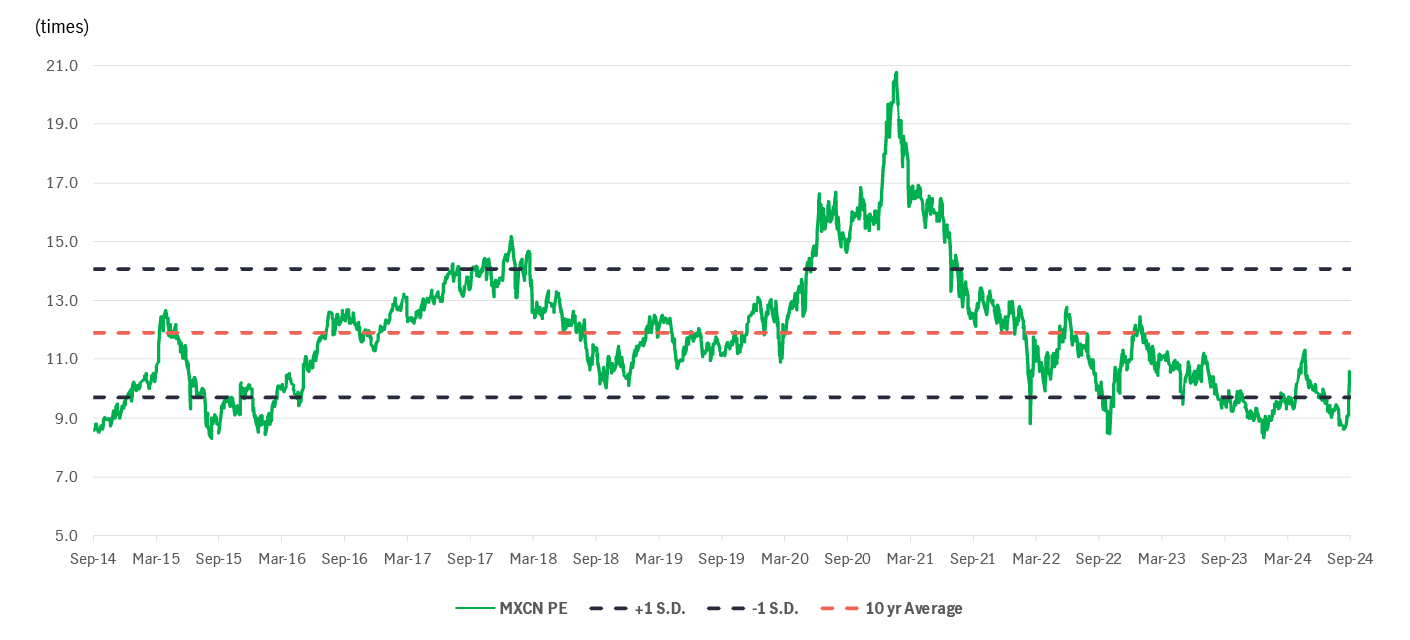

Shortly after the policy announcements in late September, transaction activity and volume for the Hong Kong equity markets picked up across the board (Chart 3), and daily turnover recorded a historical high. Valuations also improved but were still below historical averages (offshore: Charts 4, onshore: Chart 5). In the near term, potential catalysts include the following:

1) More monetary policy easing is expected: The PBOC has already indicated its intention to lower RRR by another 50 basis points, which indicates China’s determination to stimulate the economy and support the property sector.

2) Potential fiscal policy announcements: NDRC laid out plans to step up fiscal measures and announced incremental policies, which include speeding up special purpose bond issuance to local governments to support regional economic growth. supporting urban renewal projects, encourage private capital to participate in infrastructure projects, as well as supporting more eligible private capital projects including issuing infrastructure REITs.

3) Property: More relaxation in home purchase restrictions, continued policy support for urbanisation and an implementation facility for housing de-stocking will also be supportive.

4) Consumption: China has announced 20 key steps to boost service consumption in August. Potential government step-up funding support for consumer goods trade-in and equipment upgrade programs should drive further recovery for the consumer sector over the next few months.

Chart 3: Stock market turnover in Hong Kong reached historical high (billion, HK dollar)

Source: HKEX, Bloomberg, as of 30 September 2024.

Chart 4: MSCI China Index trades at 11 times (12-month price-to-earnings ratio)

Source: Bloomberg, as of 30 September 2024.

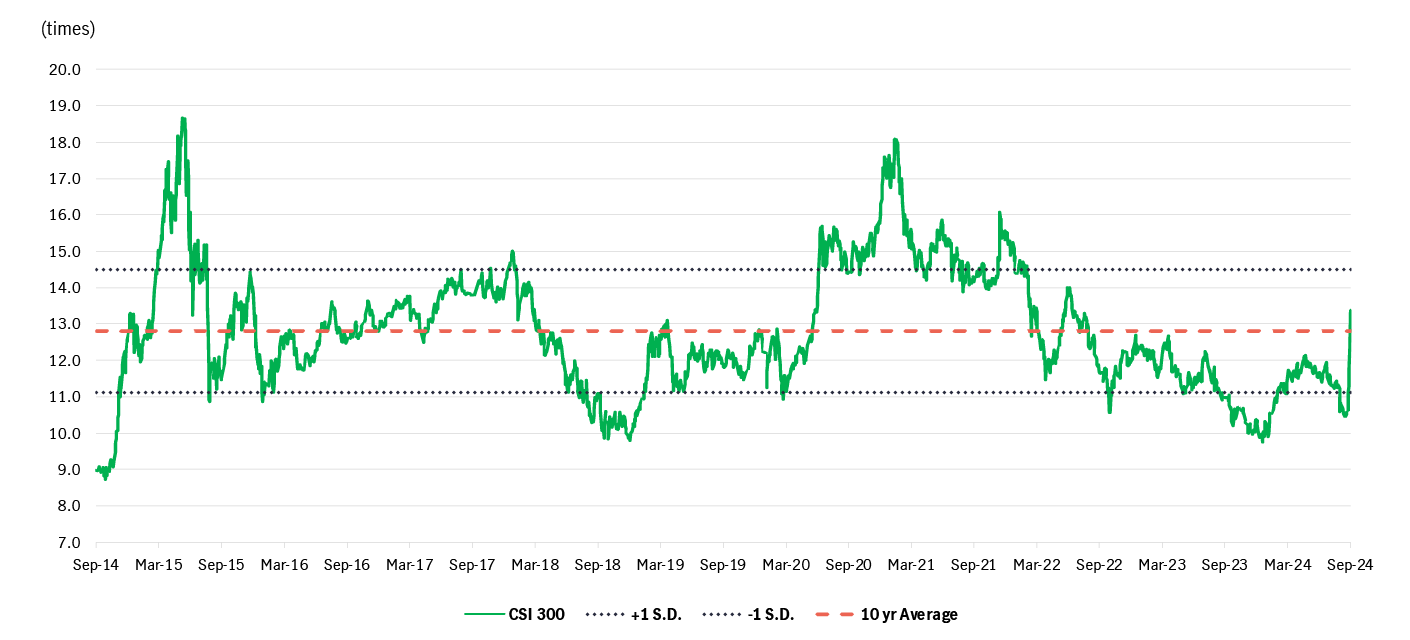

Chart 5: CSI 300 index valuation is recovering

Source: Bloomberg, as of 30 September 2024.

Going into the fourth quarter of 2024, we view these sectors favourably:

In conclusion, we believe mainland China/Hong Kong equity markets are at an important juncture that deserves investors’ attention:

1) The kick-starting of the U.S. rate-cutting cycle is positive for mainland China/Hong Kong equity markets and interest-rate-sensitive sectors.

2) First-half 2024 earning upward revisions seen for MSCI China sectors.

3) China corporates are valuing up, with nearly 600 companies announcing interim dividends this year (the highest ever).

4) We see gradual improvements in China’s property sector, coupled with China’s stimulus measures.

5) We think Chinese companies have competitive ‘go-global’ strategies that will enable them to gain market share overseas despite headwinds.

China’s EV market has grown strongly domestically, with penetration in China exceeding 50%4. However, exports to foreign markets have become an emerging driver in the past few years. In 2023, China’s export passenger vehicles increased by 62% year on year in 2023, of which 27% were EVs5.

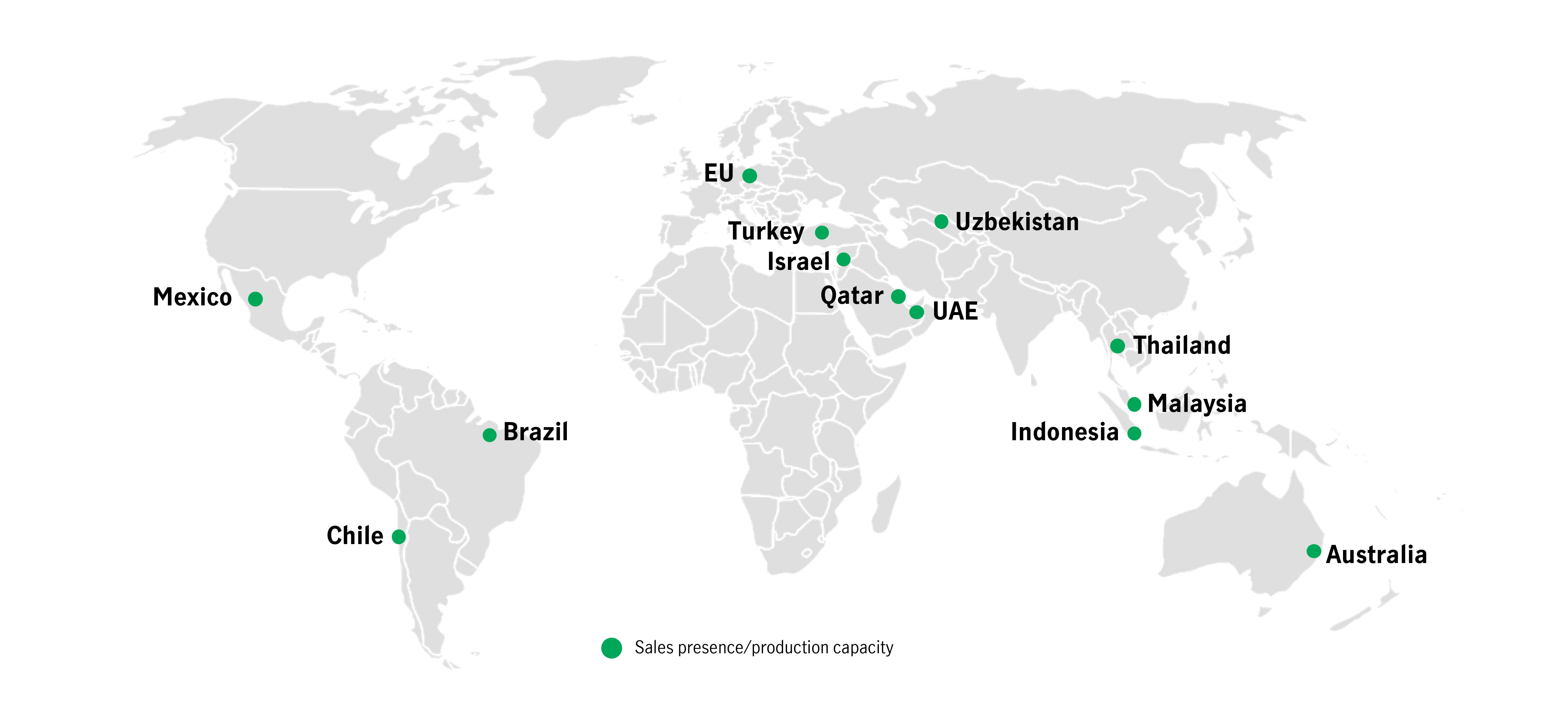

Despite EU tariffs, China’s leading players are pursuing a ‘Go-Global’ strategy via factory localization in overseas markets.

The key to long-term success is localising production, which Chinese companies have successfully adopted. This is helping them establish brand equity and distribution networks overseas.

Chinese auto manufacturers also bring their upstream and downstream suppliers (“value chain benefit”) as they go global (Chart 6).

Chart 6: A leading Chinese auto company with a strong global footprint

Source: Customized chart based on a Chinese auto company’s global network. For illustrative purpose only.

1 China's central bank unveils most aggressive stimulus since pandemic | Reuters; China's central bank cuts RRR by 50 basis points to strengthen market confidence - Global Times.

3 Manulife Investment Management estimates, as of 8 October 2024.

4 2024年8月份全国乘用车市场分析-中国汽车流通协会 (cada.cn)

5 China Passenger Car Association (CPCA) report - January 2024 - MarkLines Automotive Industry Portal

Quick comments on Moody's cut US credit rating

On May 16, credit rating agency Moody's Ratings downgraded the United States' credit rating from Aaa to Aa1. Alex Grassino, Global Chief Economist, together with the Multi-Asset Solutions Team (MAST), Macroeconomic Strategy Team, share their latest views.

Riding the wave: building resilience amid volatility

On the back of escalating tariffs between the United States and other parts of the world, markets have dropped significantly as economic growth concerns have risen and investor sentiment and consumer confidence have destabilized, with some markets tiptoeing precariously on the precipice of bear market territory as of this writing.

Macro meets markets: 5 investable themes to watch

The intersection between the macro backdrop and the market setting investors must navigate has perhaps never been more apparent than it is today. The five themes discussed below highlight this critical intersection.

Quick comments on Moody's cut US credit rating

On May 16, credit rating agency Moody's Ratings downgraded the United States' credit rating from Aaa to Aa1. Alex Grassino, Global Chief Economist, together with the Multi-Asset Solutions Team (MAST), Macroeconomic Strategy Team, share their latest views.

Riding the wave: building resilience amid volatility

On the back of escalating tariffs between the United States and other parts of the world, markets have dropped significantly as economic growth concerns have risen and investor sentiment and consumer confidence have destabilized, with some markets tiptoeing precariously on the precipice of bear market territory as of this writing.

Macro meets markets: 5 investable themes to watch

The intersection between the macro backdrop and the market setting investors must navigate has perhaps never been more apparent than it is today. The five themes discussed below highlight this critical intersection.