18 June 2024

Rana Gupta, Senior Portfolio Manager

Koushik Pal, Senior Director, Indian Equities

In early June, Indian Prime Minister Narendra Modi’s Bharatiya Janata Party (BJP) unexpectedly failed to secure a majority of seats in the country’s election. As a result, the BJP will be more dependent on members of the incumbent National Democratic Alliance (NDA) to govern as a coalition over the next five years. Although growth in India has been robust, there has been clear outperformance of capital over labour, profits over wages, investment over consumptions, urban over rural. This surprising electoral result has led many investors to wonder what is next for India, particularly whether there will be policy continuity, whether same trends will continue, or Government will shift to welfare measures and what this means for its high-flying equity market. In this investment note, Rana Gupta, Senior Portfolio Manager, and Koushik Pal, Senior Director, Indian Equities, analyse the implications of the recent pivotal election and lay out a roadmap for how it may affect India’s economic development and investment opportunities through the ‘5Ds’ framework.

In the recent Indian national election, the BJP-led NDA alliance was re-elected with a majority for a third consecutive term (NDA 3.0), with Narendra Modi as Prime Minister.

A key surprise in the election was the loss of the BJP’s simple majority. The BJP, which leads the NDA alliance, won 240 seats, a loss of 63 from its 2019 tally, and was well short of the Indian Parliament’s simple majority of 272 seats. The results surprised the market: exit polls released on 1 June predicted an average of 360 seats for the NDA alliance, with all exit polls pointing to the BJP achieving a comfortable majority on its own.

In the last two elections of 2014 (NDA 1.0) and 2019 (NDA 2.0), the BJP crossed the simple majority mark on its own and coalition partners had far less bargaining power.

While this is the first time Prime Minister Modi will need to actively work with his coalition partners, India has had a long history of coalition governments. Since 1989, regional parties have risen in prominence given India’s culturally and linguistically diverse landscape, and coalition governments have been the norm. That trend paused in 2014 and 2019 as the BJP won majorities on its own.

However, in 2024, the coalition government has made a comeback. In such a governing structure, smaller parties often have political leverage, requiring a consultative approach to policymaking.

After a brief correction following the results, Indian markets re-captured the highs made after the exit polls. The NDA 3.0 government was sworn in on 8 June, soon after the election results. Although the number of ministers is higher than before (72 compared to 58 in 2019) to accommodate alliance partners, markets expected policy continuity with key ministers in areas like home affairs, finance, external affairs, defence, roads, and rail remaining unchanged. Our views on the implications of the elections for markets are slightly more nuanced and addressed next.

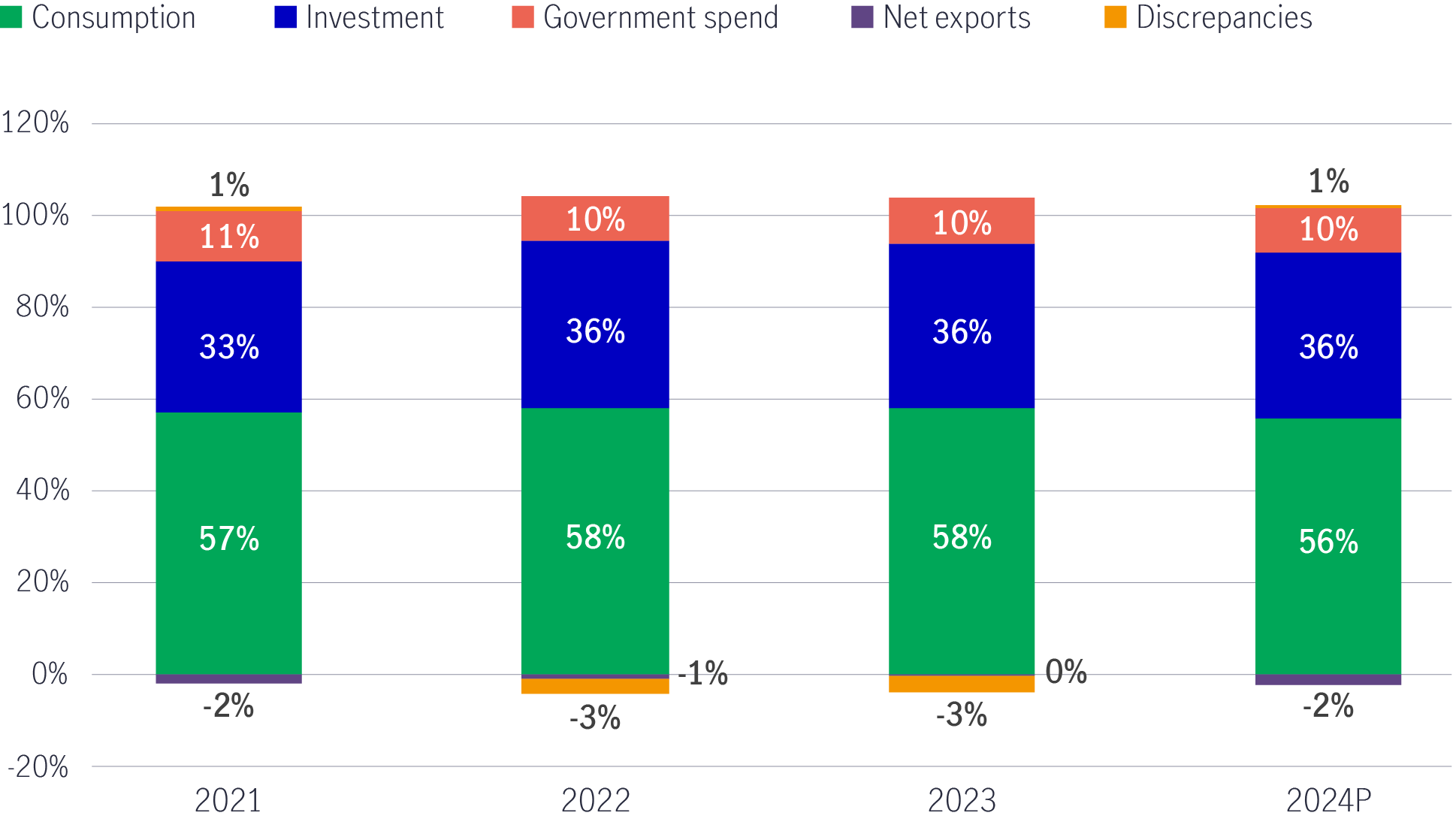

We note that the BJP’s weaker-than-expected performance was in key states that are poorer, rural, more agricultural, and often have a labour force that lacks skills to help them become gainfully employed. The 2024 election occurred in the context of NDA 2.0, which was the pursuit of fiscal consolidation and growth through public infrastructure spending and incentives to encourage corporate capital expenditure. This resulted in investment-led growth and fixed capital formation.

However, consumption has underperformed since the pandemic amid a lack of government support. It did not materially improve (particularly at the lower end) from 2021 to 2024. In our view, this K-shaped recovery since 2021 might have impacted the electoral outcomes in certain states.

We believe NDA 3.0 will continue with policy objectives such as maintaining fiscal discipline, moderating inflation, and promoting private capital expenditure. A greater spending focus could return to areas like healthcare, affordable housing and workforce skilling, increasing long-term employability. We believe this will be the key to boosting consumption. To be clear: We do not expect NDA 3.0 to embrace populism but, instead, increase investment in labour force to complement its policies on capital stock creation during NDA 2.0.

While the government’s economic policy direction becomes more apparent after the Union Budget is presented in the next month, we will attempt to provide more details on: 1) The economic backdrop and; 2) Potential steps to watch going forward. Lastly, we provide an update on incremental changes to our 5D themes.

To understand the overall economic policy setup of the two successive BJP majority NDA governments, we have put their agendas into two separate buckets:

1) Policy priorities that have driven overall economic policymaking.

2) Fiscal priorities that have driven how the government manages revenue and expenditure.

Chart 1: India’s gross fiscal deficit, 2021-2025(P)

Source: Ministry of Finance.

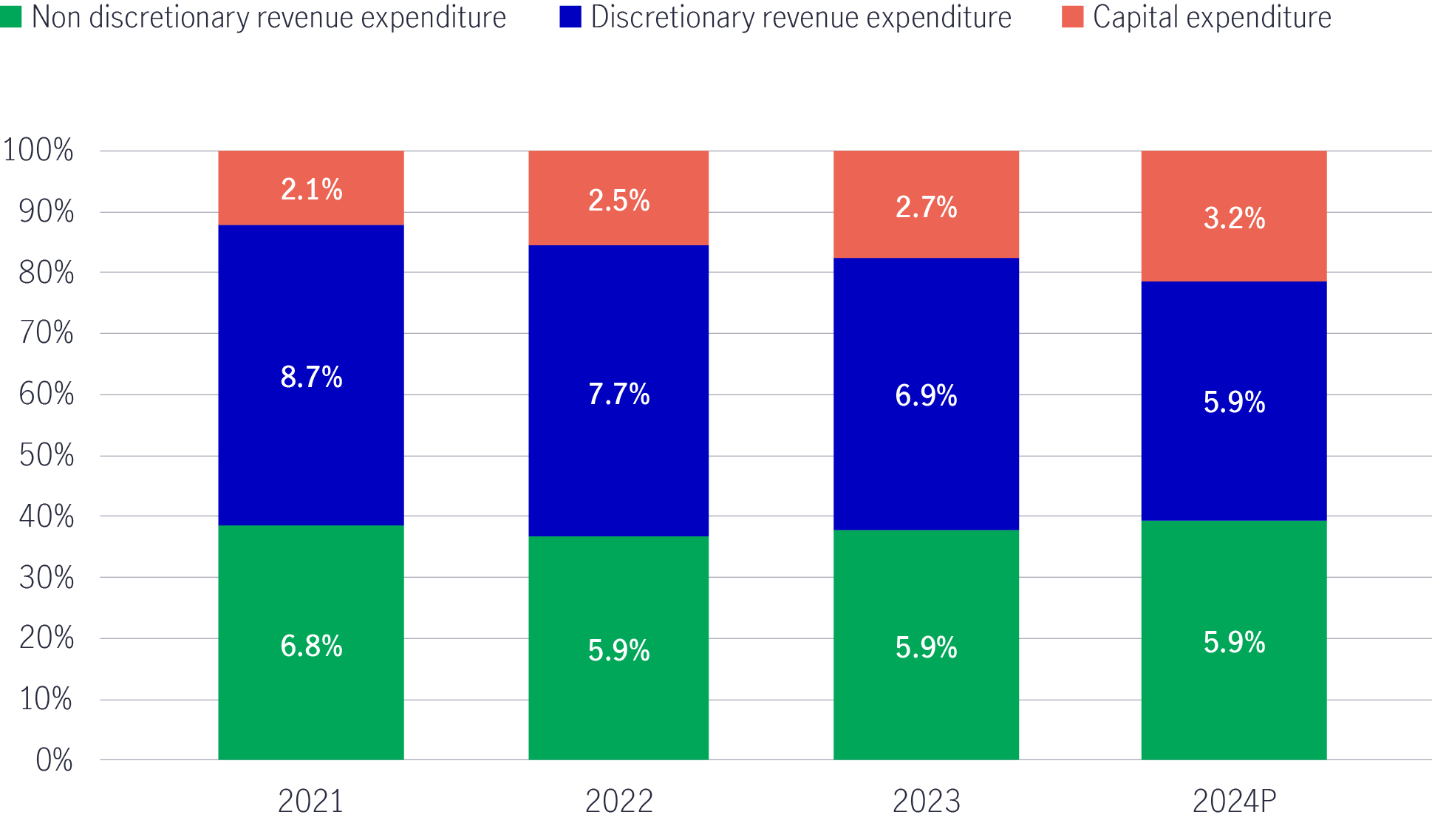

Chart 2: Government expenditure: Rising capex at the expense of lower discretionary revenue expenditure, 2021-2024(P)

Source: Ministry of Finance, Kotak estimates.

Chart 3: Factor share in real GDP, 2021-2024 (P)

Source: Ministry of Finance, Kotak estimates.

Looking ahead, we need to underline the distinction between the new government’s two pillars of economic management, i.e., policy and expenditure priorities.

The government’s core economic agenda of growing manufacturing and driving growth through investments will remain unchanged. These objectives align with the government’s long-term vision of growing domestic manufacturing, thus reducing net exports and increasing energy independence through a green transition. We also believe the foundation for private capital investment in the aforementioned areas has already been laid.

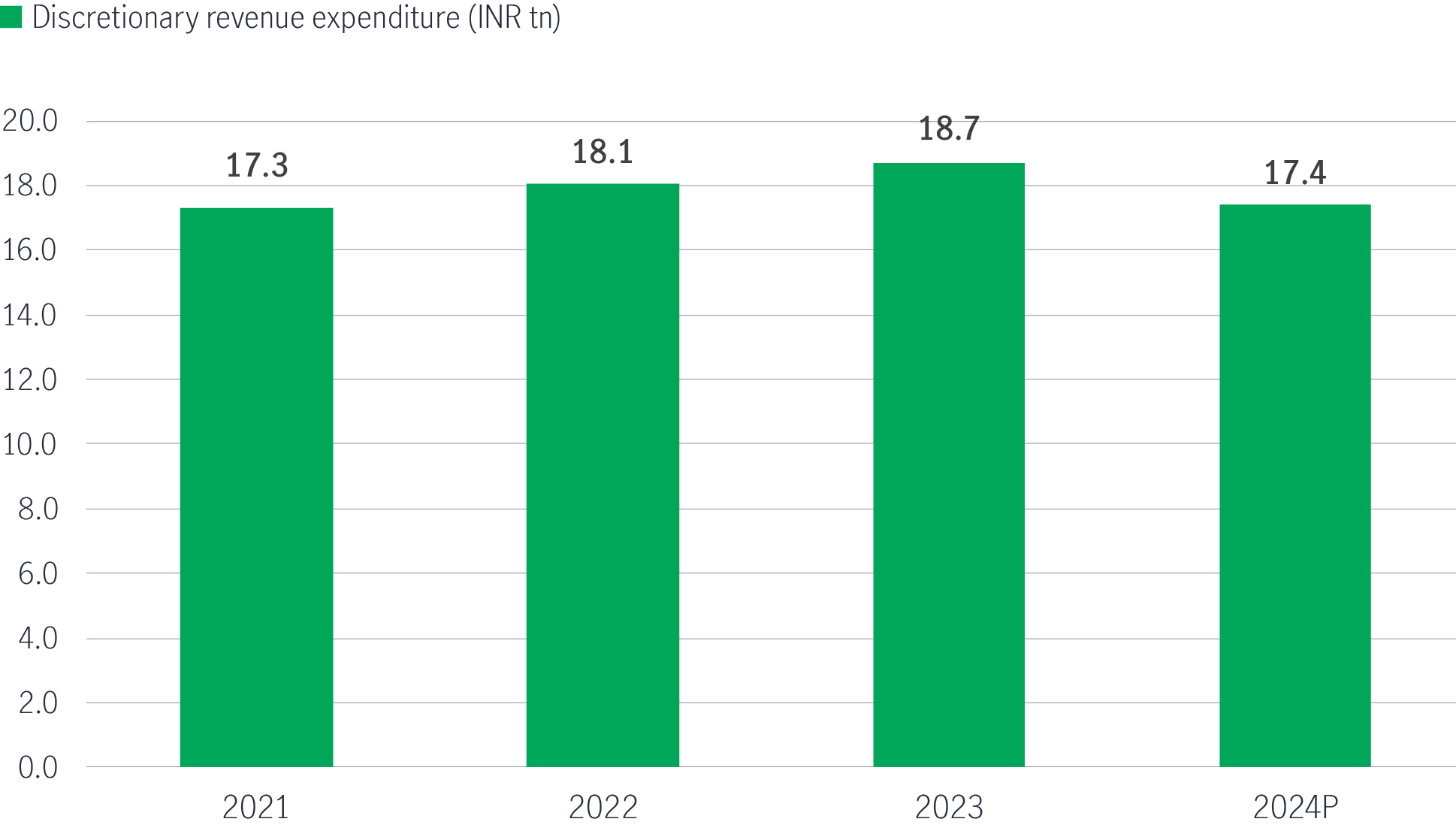

However, the government may reprioritise how it manages discretionary revenue expenditure, which has remained essentially flat over the last three years in absolute terms (see Chart 4).

Chart 4: Discretionary revenue expenditure has stagnated, 2021-2024(P)

Source: Ministry of Finance, Kotak estimates.

We may see the government allocate more resources towards the long-term development of labour in rural areas by providing more resources to healthcare, skills development and housing during upcoming budget in July. We believe it can do this without deviating from its fiscal consolidation targets, as the government now has significant resources including, but not limited to, strong tax collection and significantly higher-than-expected dividend income from Reserve Bank of India.

In our view, NDA 3.0 realises that the response to lower-than-expected electoral outcomes need not be populism, which could erode the macro policy and fiscal framework built over the past 10 years. At the same time, the consumption question needs to be addressed for sustained and balanced long-term growth.

As discussed above, the solution runs through the labour market. The key to boosting employment is not just capital investment leading to higher growth but also complementing this progress by making labour more available and employable.

While the consensus expects the current focus on capital expenditure over consumption to continue, we think policymakers will address the consumption question by increasing expenditure to increase the availability and employability of the labour market. This will complement its earlier policies of creating fixed-asset investments and promoting sustainable, well-balanced growth in a populous democracy like India.

In the following section, we will discuss the incremental changes to our previously introduced 5Ds framework: Digitisation, Deglobalisation, Decarbonisation, Demography and Deficit Reduction to reflect our current view on the economic policy priorities of NDA 3.0.

We expect that our 5D themes, which identify key investment themes in Indian equities, will remain relevant. The possible changes discussed above will present new opportunities that we aim to capitalise on, as well as some potential risks to watch out for. We discuss these briefly below:

We remain constructive on India’s economic growth, corporate earnings growth, growing domestic equity savings, and Indian equities.

However, we also need to be mindful, and will be carefully watching the following risk factors over the near-term:

In conclusion, we believe some reprioritization of expenditure to improve the employability and availability of labour during NDA 3.0 will compliment the NDA 2.0 policy of capital stock creation. We don’t think the government will resort to blatant populism, which can impact overall stability.

Overall, we think that with 7% real GDP growth, India will remain one of the fastest-growing major emerging markets. This should also support early to mid-teens earnings growth. With its large US $3.9 trillion economy, a market capitalisation of US $4.8 trillion, healthy earning growth, robust corporate balance sheets, and an ROE of more than 15%, the potential for its equity market to create long-term wealth remains healthy. These factors, along with rising domestic savings being deployed in equities, should continue to support India’s premium multiple among emerging markets. Within that supportive framework, we expect that themes linked to our updated ‘5D’ framework should continue to perform.

Policy Normalisation in Japan: how high will the BoJ go?

The Bank of Japan has continued to raise interest rates in an effort to "normalize" monetary policy, presenting potential opportunities for discerning investors.

Here come the tariffs: why it’s too soon to draw conclusions

The recent announcement of U.S. tariffs on key global trading partners grabbed plenty of headlines but until we get more details, it's hard to assess the global economic implications.

Q&A: The role of Asia-Pacific bonds in an investor’s portfolio

We look at Asian dollar bonds from a broader perspective and their role in downside protection.

Policy Normalisation in Japan: how high will the BoJ go?

The Bank of Japan has continued to raise interest rates in an effort to "normalize" monetary policy, presenting potential opportunities for discerning investors.

Here come the tariffs: why it’s too soon to draw conclusions

The recent announcement of U.S. tariffs on key global trading partners grabbed plenty of headlines but until we get more details, it's hard to assess the global economic implications.

Q&A: The role of Asia-Pacific bonds in an investor’s portfolio

We look at Asian dollar bonds from a broader perspective and their role in downside protection.