22 January 2025

Alex Grassino, Global Chief Economist

Dominique Lapointe, CFA, Global Macro Strategist, Multi-Asset Solutions Team

Erica Camilleri, CFA, Senior Global Macro Analyst, Multi-Asset Solutions Team

Hugo Bélanger, Senior Global Macro Analyst, Multi-Asset Solutions Team

2025 is shaping up to be a year of transition. With that in mind, we explore five key forces that we believe will drive the global economy and markets this year. Return to this page periodically for additional timely insight and resources to help guide you through 2025.

For illustrative purpose only

At a high level, global growth sits at the intersection of easier monetary policy and rising trade protectionism.

We enter 2025 with a reasonably sanguine outlook for U.S. economic growth, albeit with potential risks to the downside. Our broad view remains that while some downward pressure on growth is eventually possible due to a relatively high interest-rate environment, the U.S. Federal Reserve's (Fed’s) easier monetary policy stance since September 2024 should mitigate that risk somewhat, likely allowing current trends in the economy to persist for the foreseeable future.

At this stage, we believe these dynamics should express themselves as a cooling but still healthy U.S. labor market and continued momentum in the consumer space. We wouldn’t expect any new fiscal policies enacted by the new president’s administration to have much impact on the domestic economy until the second half of 2025 and into 2026. However, we could conceivably see more immediate shocks to the economy from global trade activity, including any U.S.-imposed tariffs on key trading partners.

As of this writing, growth profiles in most of the world’s other developed markets (DMs)—Canada, Europe, and the United Kingdom—appear to be more subdued than in the United States, with the lagged effects of tighter monetary policy and slowing global trade (especially with China) weighing on these countries and likely to keep doing so. We believe 2025 is likely to be marked by counterbalancing factors: The economic support provided by easier monetary policy may be dampened to some degree by the downside risks around more protectionist trade policies, particularly in the United States.

For its part, Japan is on a different trajectory than other DMs, as its firmer inflation of late and slightly better economic growth prospects could allow the central bank to continue normalizing monetary policy in the months ahead. That being said, we’d expect any material escalation in global trade tensions to affect Japan’s economy as well.

We would refer you to the emerging markets (EMs) section of the global macroeconomic outlook for more detail on these countries, but generally speaking, our recurring theme for 2025 would be one of relative winners and losers. From our standpoint, EM economies that are either more domestically focused or more closely aligned with the United States look to be in the strongest positions going forward.

Change in GDP growth estimates since 1 September 2024

Source: Macrobond, Manulife Investment Management.

Entering 2025, it appears that most global central banks would like to move monetary policy toward their respective neutral interest rates (i.e., the rate at which policy is neither stimulative nor restrictive to the nation’s economy). However, we expect the first half of the year to pose obstacles that may prevent a predictable, straightforward path to neutrality.

Following the November 2024 U.S. elections, U.S. Federal Reserve (Fed) Chair Jerome Powell emphatically stated that the Fed will remain model- and data-dependent, and that the Federal Open Market Committee (FOMC) members “don’t guess, don’t speculate, don’t assume” when it comes to potential policy impacts of new political leadership.

Since then, however, a lot more hesitancy has seeped into the Fed’s rhetoric, with two key factors likely to emerge as complicating the central bank’s policy-rate path and potentially triggering bouts of market volatility in 2025:

Tighter global monetary policy has likely played some role in dampening economic growth in Canada, parts of Europe, and the United Kingdom, all of which have recently experienced cooling domestic demand. The problem is that even amid weaker growth in these developed markets (DMs), higher-than-desired inflation is still constraining central banks’ ability to ease policy (i.e., cut rates). Moreover, a potentially shallower Fed easing trajectory could force many central banks to decide where they want to fall on the trade-off between growth and a weaker currency.

Japan remains a clear exception among DMs, as it attempts to bring its policy rate up to neutral against a backdrop of potentially slower global trade.

In emerging markets (EMs), the extent to which central banks are able to ease monetary policy could be dictated by their levels of exposure to global trade, and by how much they might have to adjust their plans to relative U.S. dollar strength.

Most, but not all, DM central bank policy rates are likely to come down in 2025

Source: Fed, BoC, ECB, BOJ, BoE, RBA, Riksbanken, Macrobond, Manulife Investment Management, as of 9 December 2024.

The global political backdrop of 2024, including pivotal elections in the United States and the United Kingdom, brought forward a hotly debated topic for the year ahead: Will mounting public debt drive government bond yields higher in 2025?

Indeed, expansionist fiscal policies and large budget deficits in many regions already have many investors questioning the sustainability of public debt levels, which could lead, over time, to an increase in the so-called term premium for government bonds. In other words, following a nearly 40-year decline, the compensation asked to extend the duration of a long-term loan to the government might start rising again. Here are three elements to watch in 2025:

1 Large deficits are here to stay. Structurally large budget deficits, from the 2008 global financial crisis to pandemic-related stimulus, have led to massive public debt accumulation worldwide. Without sufficient revenue measures to offset the additional spending, global government debt has nearly doubled from $51 trillion in 2010 to $97 trillion in 2023. Citing other priorities like employment security and the cost of living, evidence shows that the public’s appetite for austerity, or fiscal restraint, has waned, leaving governments with little desire to rein in their deficits.

2 Higher interest rates aren’t helping. In the pre-COVID-19 era, governments could often refinance their existing public debt by issuing new bonds at the prevailing lower interest rates, helping to limit the cost of servicing their debt loads. This probably won’t be possible going forward, as we believe global interest rates will ultimately settle higher than in prior decades, implying that debt will have to be refinanced at higher rates, increasing public debt charges.

3 Who will buy the debt? It’s difficult to envision what types of investors would be able and willing to absorb excess public debt. With U.S. Treasuries, for example, foreign investors’ share of total debt in circulation has declined since 2009. And the Fed is unlikely to purchase Treasuries in the absence of a liquidity crisis or a severe recession. More price-sensitive buyers (e.g., households and commercial banks) could pick up the slack, but they might require a higher term premium to continue bankrolling government spending. On the plus side, higher U.S. government bond yields could make the asset class more attractive to investors relative to corporate bonds and equities.

Will the term premium move significantly higher in 2025?

Source: New York Fed, Macrobond, U.S. Treasury, U.S. Federal Reserve, IMF, Manulife Investment Management, as of 19 December 2024. New York Fed ACM Model estimate.

Global manufacturing and trade cycles are crucial to our 2025 macroeconomic outlook, as much of the inherent cyclicality in GDP growth, sales trends, and corporate earnings is linked to these dynamics.

Our indicators show that global trade and manufacturing activity peaked in the third quarter of 2024, with continued weakening likely in the months ahead. Softer global trade would suggest more modest economic growth in the first half of 2025, as reduced demand for goods could prompt firms to cut inventories and production, dampening labor market conditions and consumer confidence. However, this scenario could be tempered by the potentially positive effects of easier monetary policy and stronger fiscal support in China.

Following the 2024 U.S. elections, the new presidential administration’s plans to take a more protectionist approach to trade policy add another layer of uncertainty to the global trade picture. For example, President Trump’s proposed tariffs on imports from key trading partners like China, Mexico, and Canada could severely hamper global trade activity. While the likelihood of some U.S.-imposed tariffs appears high, quantifying their impact on global trade next year and beyond is difficult without further details.

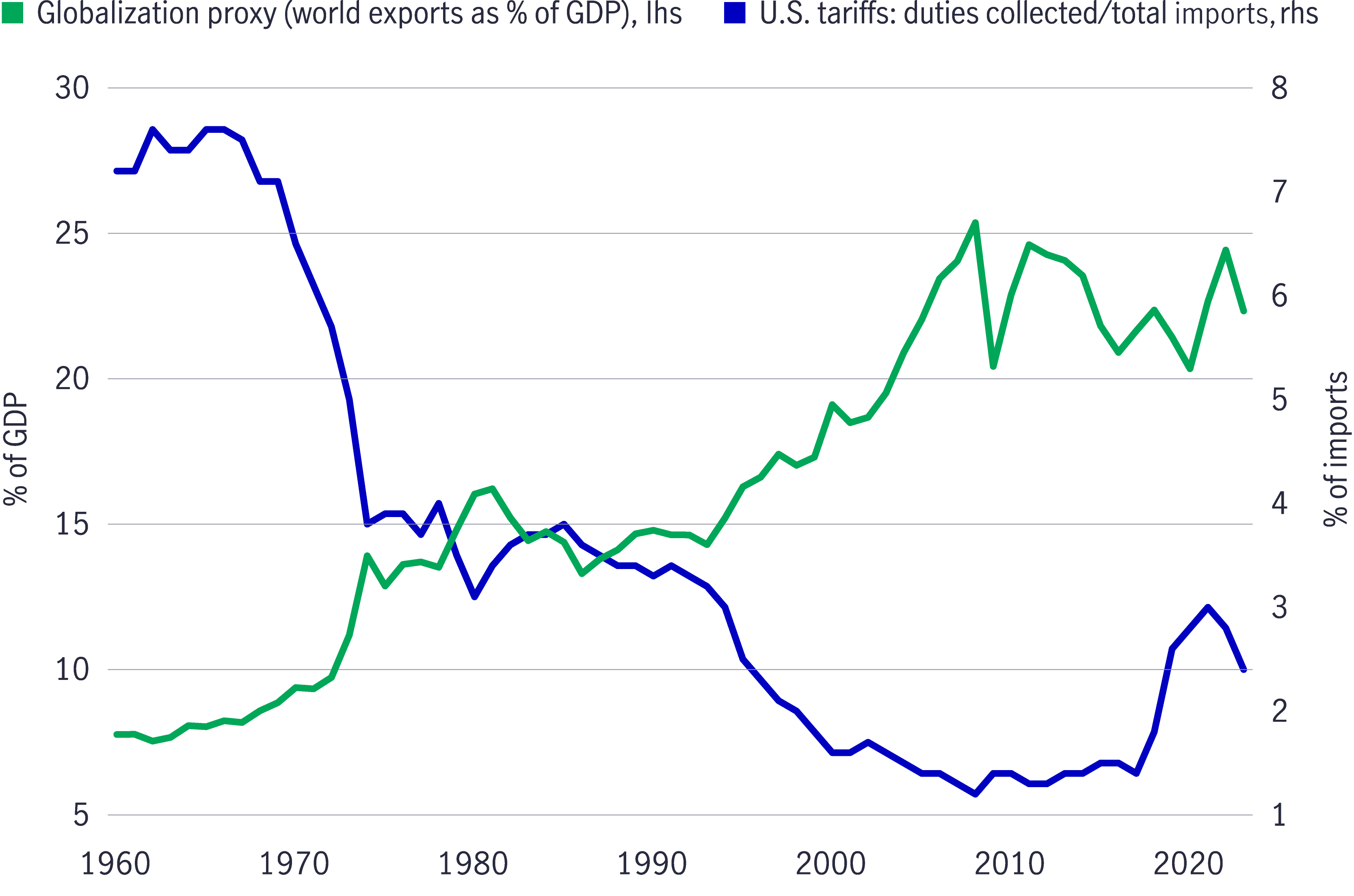

In any case, the imminent change in U.S. political leadership reinforces our conviction in the structural view that the era of hyper-globalization is probably behind us, altering a nearly 40-year global phenomenon that spurred cross-border trade and capital flows among nations, as well as persistent deflationary pressures.

To be clear, we don’t see globalization reversing anytime soon. Rather than a collapse of the current trade ecosystem, we expect a generally slower global trade impulse in 2025, with implications for our longer-term growth and inflation forecasts. We believe supply-side shocks and constraints—from trade policies, climate-related events, the low-carbon transition, and geopolitical conflicts—could increasingly influence the global economy, putting upward pressure on both the level and volatility of inflation.

This type of supply-driven inflation could require different monetary policy responses from global central banks than the more demand-driven inflation of the recent past.

U.S. tariffs look poised to rise, and global trade to slow, in 2025

Source: IMF, World Bank, USITC, Macrobond, Manulife Investment Management, as of 12 November 2024.

Emerging markets may face headwinds in 2025, but China could be a potential bright spot.

This macro backdrop could prove challenging for many EMs, but it may also present investment opportunities within specific markets. EM countries that rely heavily on global trade and have limited room for monetary and fiscal easing are likely to lag, whereas domestically focused economies that are more closely aligned with U.S. policy should fare relatively well.

Manageable inflation and weak growth may lead to further EM rate cuts

Source: Macrobond, Manulife Investment Management, as of 12 November 2024. The Consumer Price Index (CPI) tracks the average change of prices over time by urban consumers for a market basket of goods and services. It is not possible to invest directly in an index.

2025 Outlook Series: Global Healthcare Equities

The Global Healthcare team maintains a sense of measured optimism for the performance of healthcare equities given the underlying key subsector strength in 2025.

2025 Outlook Series: Global Semiconductors

From an investment perspective, we believe a diverse, global portfolio of high conviction, quality companies in these target industries offers an attractive, long-term risk-return profile underpinned by robust fundamentals, significant tailwinds, structural demand growth and earnings visibility.

2025 Outlook Series: Asia Fixed Income

As rate paths shift and market volatility is expected to increase across global rates, credit, and currency markets, we explain why the sub-asset classes within the Asian fixed income space (Asia high yield, Asia investment grade, and Asia local currency) could provide shelter with opportunities.

2025 Outlook Series: Global Healthcare Equities

The Global Healthcare team maintains a sense of measured optimism for the performance of healthcare equities given the underlying key subsector strength in 2025.

2025 Outlook Series: Global Semiconductors

From an investment perspective, we believe a diverse, global portfolio of high conviction, quality companies in these target industries offers an attractive, long-term risk-return profile underpinned by robust fundamentals, significant tailwinds, structural demand growth and earnings visibility.

2025 Outlook Series: Asia Fixed Income

As rate paths shift and market volatility is expected to increase across global rates, credit, and currency markets, we explain why the sub-asset classes within the Asian fixed income space (Asia high yield, Asia investment grade, and Asia local currency) could provide shelter with opportunities.