16 October, 2020

The recent announcement by FTSE Russell to include China government bonds (CGBs) in its flagship index has deepened investor interest in the asset class. While the structural theme of index inclusion should drive foreign inflows over the medium term, investors should also be aware of other positive short-term drivers. We analyse the impact of FTSE Russell’s inclusion on CGBs and look at the constructive cyclical factors supporting the relative attractiveness of China’s bond market.

On 24 September 2020, FTSE Russell announced that China RMB-denominated government bonds (CGBs) are scheduled to be included in the firm’s flagship World Global Bond Index (WGBI) from October 2021. This is pending final confirmation of the date in March 20211. Their addition will be phased in over a 12-month period.

CGBs had originally been placed on the firm’s WGBI inclusion watch list in September 2018 but were ultimately rejected in 2019, as the country’s bond market did not meet the selection criteria. However, in making its most recent decision, FTSE Russell cited key progress in numerous areas, including improvements to secondary-market bond liquidity, enhancements in the foreign-exchange market structure, and the development of global settlement and custody processes2.

CGBs are already included in several large global bond indices, such as the JP Morgan and Bloomberg Barclays suites3; their inclusion in the FTSE Russell WGBI is arguably more significant due to the large amount of passive investor flows expected from the decision.

While FTSE Russell will not release the implementation details of the inclusion process until March 2021, there are estimates that CGBs will make up around 5.7% of the WGBI upon full inclusion4. Based on an estimated US$2.5 trillion (from both passive and active funds) that tracks the WGBI, it is predicted that inclusion in this index could lead to around US$140 billion entering China’s government bond market over time5. Over the seven months to end July 2020, China’s onshore bond market had attracted RMB$474 billion of foreign inflows, representing a year-on-year increase of 61%6.

Over the full year, foreign inflows into China bonds are seemingly on track to be between RMB800 billion and RMB1 trillion. This figure could potentially rise to RMB1 and RMB1.2 trillion in 2021. While foreign ownership of CGBs is currently around 8.5% of the total market, it could increase to something approaching 20% by the end of 20227.

Foreign ownership of the overall China bond market could grow from the current 2.6% to almost 4%8.

Clearly, the index inclusion theme, including the latest FTSE WGBI announcement, has been important in drawing investor interest into China bonds. This momentum is likely to continue over the medium term, as investors progressively re-allocate from other bond markets into China bonds. As this structural theme plays out, the increased demand for China bonds should be supportive for the asset class.

In reaching their decision to include CGBs in the WGBI, FTSE Russell has acknowledged the progress made in improving the market infrastructure for Chinese bonds, which has helped facilitate easier market participation by international investors.

One recently announced improvement is that regulators have extended trading hours in the China Interbank Bond Market (CIBM) to 8 p.m. (1200 GMT) to facilitate greater access for Europe-based investors. Looking ahead, we expect the Chinese authorities will continue to make further enhancements to facilitate access for international investors, which will further broaden the appeal of the country's bonds.

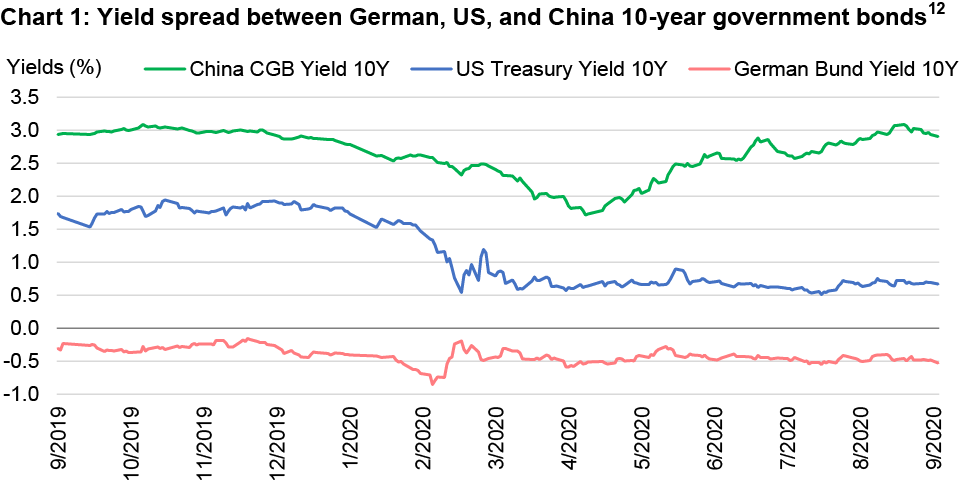

China bonds are also attractive relative to other bond markets from a nominal and real-yield perspective. The CGB 10-year is currently yielding around 3.1% in nominal terms and 0.74% in real terms9. In response to the Covid-19 crisis, global central banks have been cutting interest rates aggressively, with the US Federal Reserve effectively reducing its official rates to zero per cent and have further signalled to the market their intention to keep interest rates low over the next two-to-three years. This has resulted in 10-year US Treasuries now yielding around 0.67%10. Consequently, the current spread between 10-year CGBs and 10-year US Treasuries is around 2.4%, making China bonds attractive on a relative basis11.

Another attractive aspect of the China bond market is its historically low correlation with other global bond markets. Currently, the correlation for CGBs versus global aggregate bonds is around 0.29, bringing diversification benefits for investors13.

We believe that the People’s Bank of China (PBoC) will likely maintain a stable interest rate environment over the next six months, focusing on targeted easing and money market operations to ensure there is sufficient liquidity to support growth in the real economy. At the same time, they want to underline that financial risks are also being adequately addressed. For currency, we expect the RMB to trade close to its current range of between 6.8 – 7.0 against the US dollar into year-end.

The FTSE announcement of the inclusion of CGBs in the WGBI is an important and expected development that should see a further and gradual expansion in demand for this asset class from international investors – particularly as authorities continue with their initiatives to improve market access. In our view, China bonds also stand out in the current market cycle, relative to other global bond markets, due to their high nominal and positive real yields and diversification opportunities.

1 FTSE Russell, 24 September 2020. In March 2021, FTSE Russell advisory committees and some index users will give final affirmation of the inclusion date and implementation timeline based on whether recently announced reforms have made the anticipated practical improvements to the market structure.

2 FTSE Russell, 24 September 2020.

3 In January 2019, Bloomberg Barclays announced that Chinese RMB-denominated government and policy bank debt would be added to the Bloomberg Barclays Global Aggregate Index starting in April 2019. In September 2019, JP Morgan stated that Chinese government bonds would be included in its Government Bond Index Emerging Markets (GBI-EM) suite starting in February 2020.

4 Goldman Sachs, 19 September 2020.

5 Goldman Sachs,19 September 2020 based on estimated US$2.5 trillion assets under management (AUM) tracking the FTSE WGBI index.

6 Standard Chartered, as of 31 August 2020.

7 Standard Chartered, as of 31 August 2020.

8 Standard Chartered, as of 31 August 2020.

9 Bloomberg, as of 21 September 2020.

10 Bloomberg, as of 21 September 2020.

11 Bloomberg, as of 21 September 2020.

12 Bloomberg, as of 21 September 2020.

13 Based on 10 years from 30 September 2010 to 30 September 2020. Aggregate bonds are represented by Bloomberg Barclays Global Aggregate Total Return index; China government bonds are represented by ICE BofA China Government Index.

The case for liquid real assets in a shifting inflation regime

For over a decade, global investors operated under the assumption that inflation would remain subdued, anchored below 2% - a belief reinforced by central bank credibility and structural disinflationary forces like globalisation and technological deflation. However, the post-pandemic world has ushered in a new regime of structurally higher inflation risks, with evolving policy responses that make liquid real assets increasingly attractive.

Greater China Equities: Perspective for Q4 2025

Heading into the final quarter of the year, we remain constructive, supported by the US Federal Reserve interest rate cutting cycle, Mainland’s demand-side stimulus, strategic priorities outlined in the 15th Five-Year Plan, continued recovery in corporate earnings and robust fund inflows.

Q&A: Potential market impact of a US government shutdown

The US Senate failed to pass a last-minute funding deal, triggering the first federal government shutdown in nearly seven years starting from 1 October. Our Multi-Asset Solutions Team shares insights on how markets have responded during past shutdowns, and how investors can position themselves amid the uncertainty.

The case for liquid real assets in a shifting inflation regime

For over a decade, global investors operated under the assumption that inflation would remain subdued, anchored below 2% - a belief reinforced by central bank credibility and structural disinflationary forces like globalisation and technological deflation. However, the post-pandemic world has ushered in a new regime of structurally higher inflation risks, with evolving policy responses that make liquid real assets increasingly attractive.

Greater China Equities: Perspective for Q4 2025

Heading into the final quarter of the year, we remain constructive, supported by the US Federal Reserve interest rate cutting cycle, Mainland’s demand-side stimulus, strategic priorities outlined in the 15th Five-Year Plan, continued recovery in corporate earnings and robust fund inflows.

Q&A: Potential market impact of a US government shutdown

The US Senate failed to pass a last-minute funding deal, triggering the first federal government shutdown in nearly seven years starting from 1 October. Our Multi-Asset Solutions Team shares insights on how markets have responded during past shutdowns, and how investors can position themselves amid the uncertainty.