Important Notes:

9 August 2024

Our flagship Global Multi-asset Diversified Income approach is globally unconstrained and uses traditional and non-traditional income sources to harvest income. With a multi-asset portfolio, investors can gain access to a wider range of income-generating assets, as well as greater depth and diversification within and across asset classes.

The approach is aimed at capturing multiple income sources as well as diverse factor biases that may present in the market. The portfolio returns are not dominated by one factor (i.e. growth) but rather seeks to take advantage of market and factor breadth. Recent broadening of market breadth, year to date, has benefited the portfolio as sectors such as Consumer Discretionary, Communication Services, Industrials and Healthcare have also started to perform beyond just Tech.

Furthermore, allocations in Emerging Market Debt, a partial recovery in Asia credit as well as select Preferred securities have also added value to the portfolio.

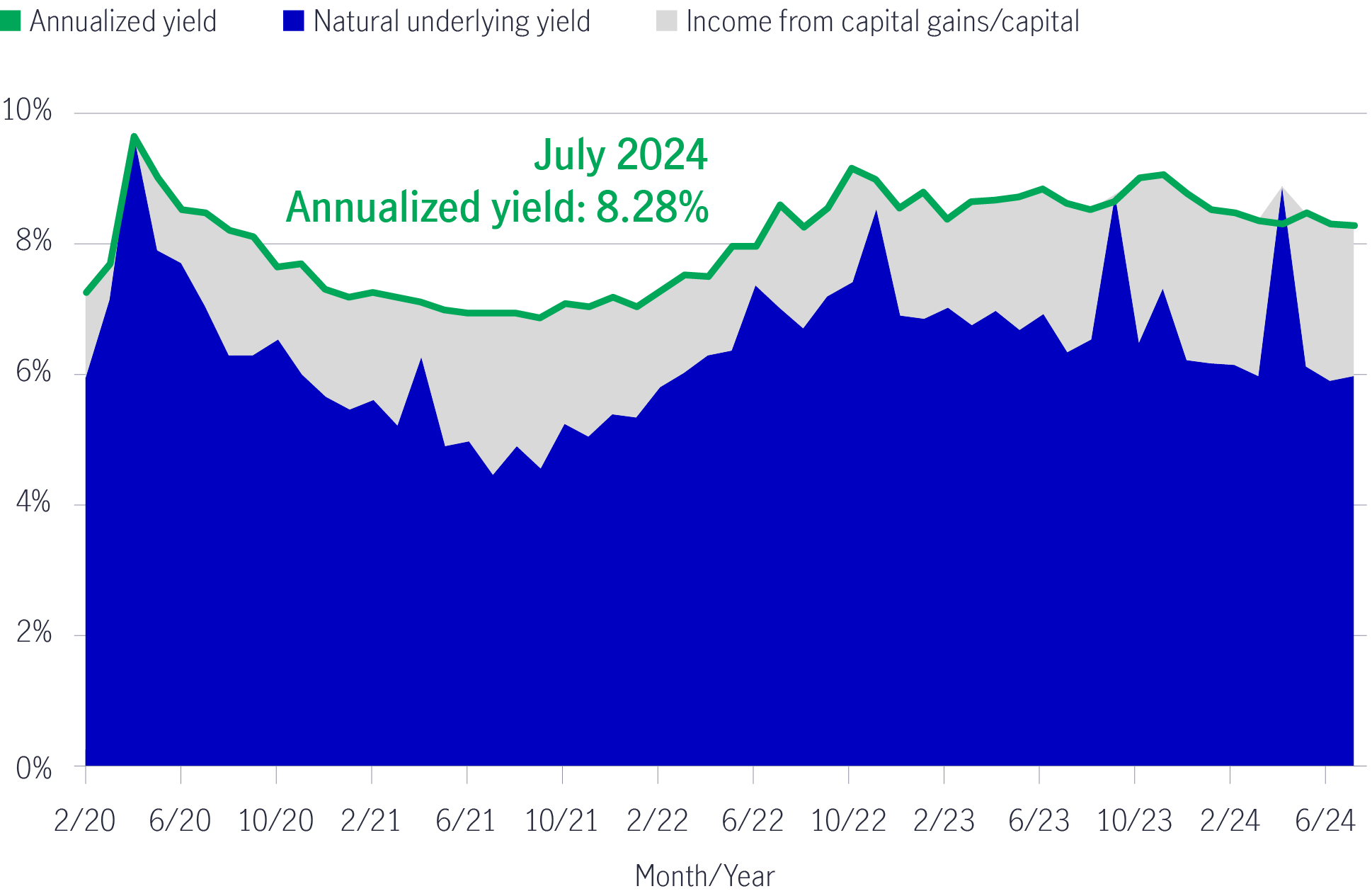

As an income-oriented portfolio, a significant portion of the strategy’s payout is generated from underlying natural yields (Chart 1), with less reliance on capital appreciation. The approximate natural underlying yield generation has captured rising global yields and volatility over the past year:

Chart 1: Natural underlying yield as a major source of income1

Within the options writing segment of the portfolio, persistent regular implementation helps to enhance premium capture, particularly on equity index or ETF level options, whilst opportunistic option writing on High Yield ETFs has been used at times, tactically, to further add to the income generation of the portfolio.

A key differentiating feature of the portfolio is option writing. Beyond just call writing, Implementing put writing can be a notable income enhancer given the put premium capture by the portfolio during rising markets.

We believe the tooling embedded within the Global Multi-Asset Diversified Income approach allows for thoughtful portfolio management to achieve a pure income outcome and a better income solution for our clients.

For a sustainable long-term income strategy, we strive to achieve higher natural yields (the cash generated from invested income sources) that are closer to or even equal to the distribution payout target to minimise the need to rely on drawing from capital gains or principal capital. Hence, our global multi-asset diversified income approach is not reliant on the continued growth of equity or fixed-income markets. We will remain focused on generating higher, sustainable natural yields from a range of assets with lower correlations and expected relatively lower volatilities (Chart 2) than strategies that are more reliant on asset appreciation.

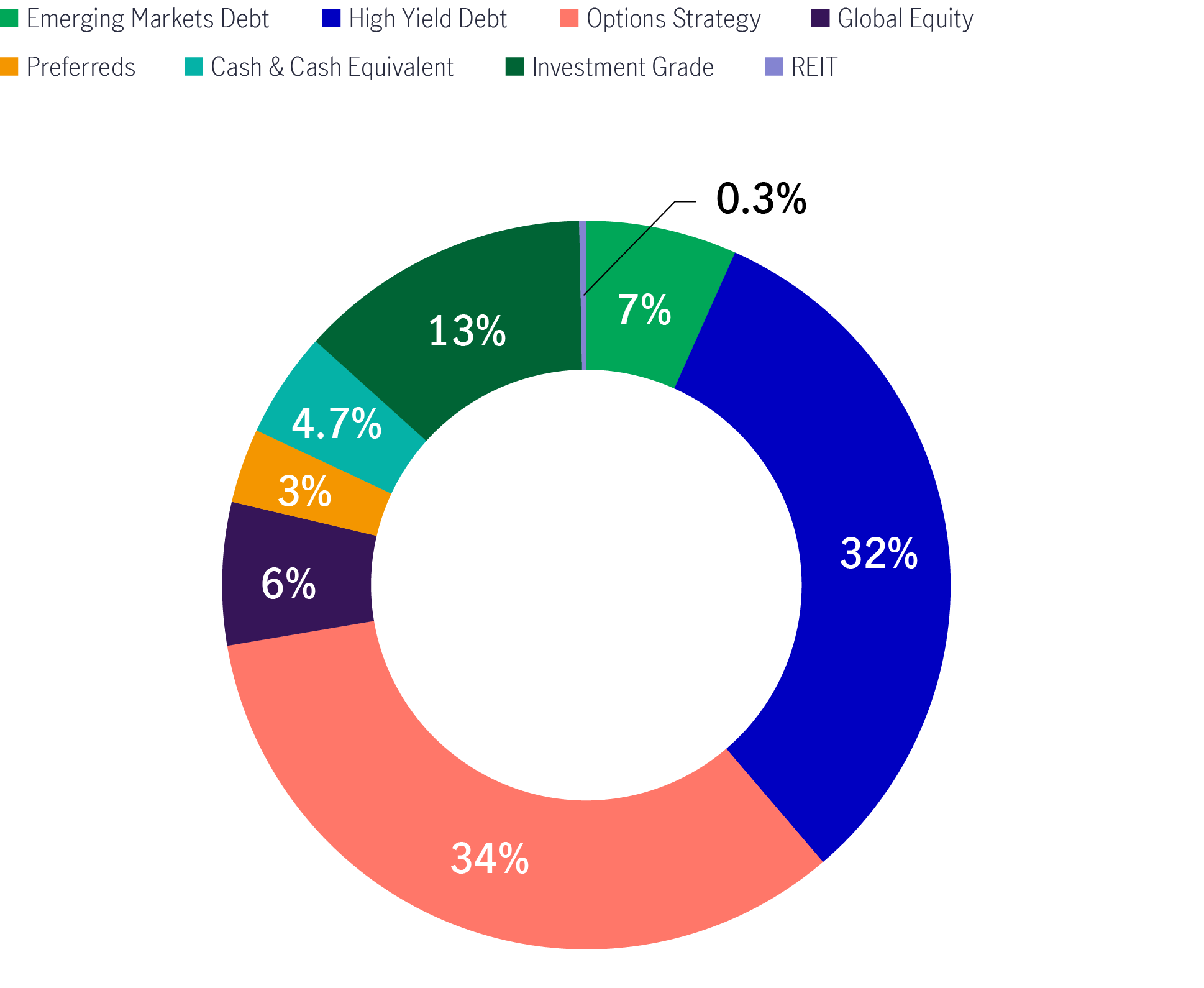

Chart 2: GMADI’s natural underlying yields breakdown2

Contribution to Income by asset class (as of 30 June 2024)

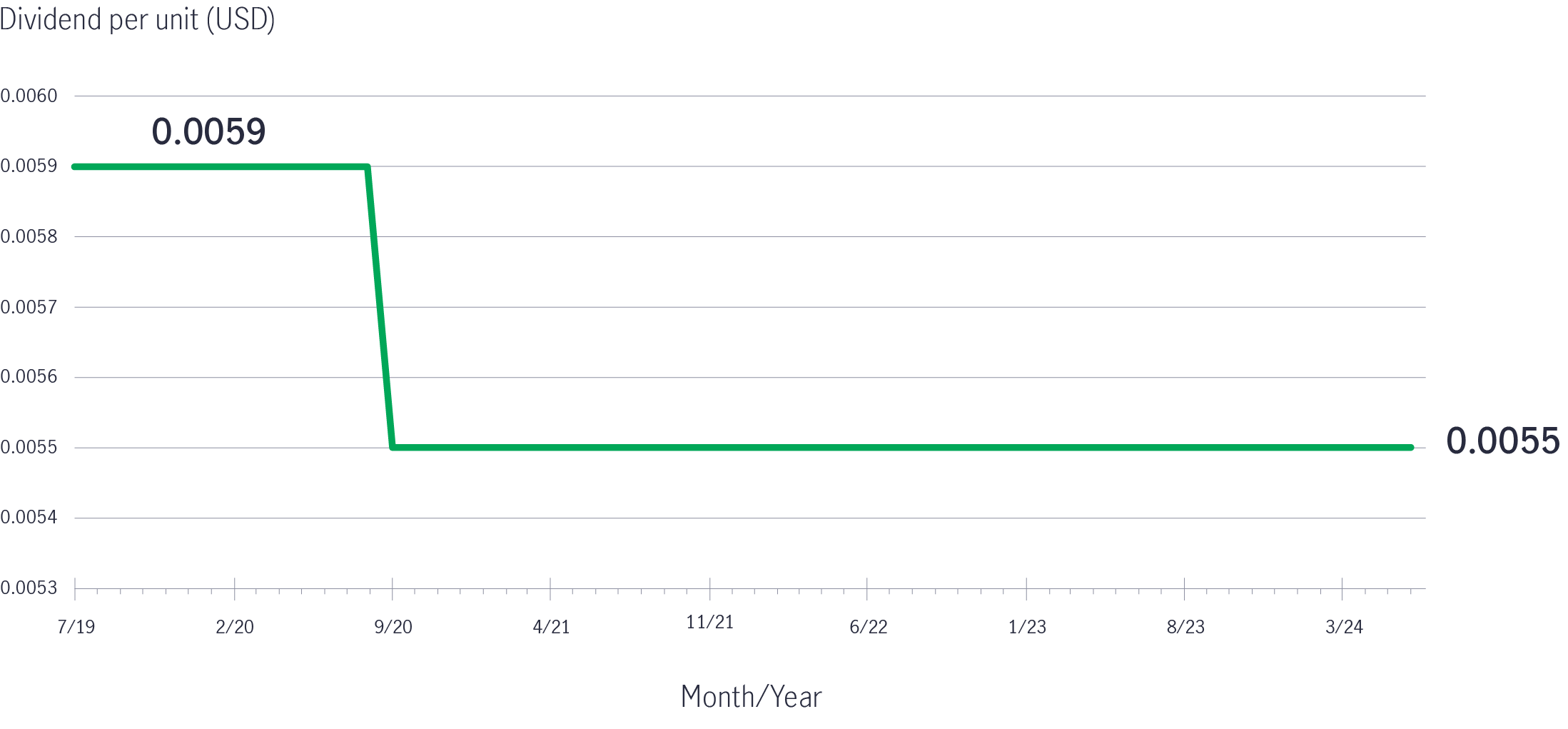

While distribution yields have fluctuated (subject to NAV movements), the absolute dividend amounts of GMADI payments have been relatively stable since launch, regardless of the market situation. The dividend was 0.0059 USD per unit in the first distribution (July 2019), and this was maintained at the same level until August 2020. In September 2020, the dividend was revised to 0.0055 USD per unit until now (Chart 3).

It should be noted that GMADI has made relatively high income distributions during a zero-rate period. Therefore, we are confident that a high income distribution should be maintained. Our view is for rates to remain high, albeit lower than current levels over the next 12 months, validating our conviction that a higher for longer rate environment can benefit income seeking strategies such as GMADI.

Chart 3: Relatively stable dividend payment of GMADI3

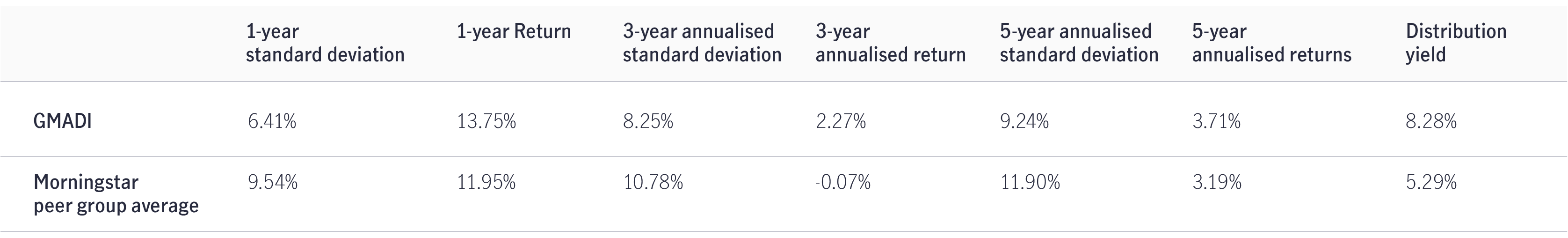

We believe GMADI remains well placed to capture attractive yields across traditional and non-traditional income sources whilst maintaining a competitive payout of at least 8% (since June 2022) with a volatility profile of around 8% (3-year annualised)3.

Comparing with Morningstar peer category average, GMADI offered a higher distribution yield; demonstrated lower standard deviation and higher returns over the past 1-year, 3-year and 5-year periods (Chart 4).

Chart 4: Volatility, return and yield profile versus peers (1-year, 3-year, 5-year)4

We believe the search for income will continue and remain an attractive segment for investors. Yields are now higher for income investors to capture a higher income versus prior years whilst segments within the global fixed income space are offering varying levels of spread opportunities, despite some of the historical tights seen more recently. Equities are also highlighting broader depth in terms of returns rather than market returns being dominated by tech and a growth factor historically.

Uncertainty remains in terms of the Fed, global growth and stickier than expected inflation whilst some single only asset classes are experiencing rich valuations. We believe a broad diversified high-income approach that can tap into a diverse set of income sources, whilst navigating the changing macro regimes, will serve investors well over the course of 2024.

Read more:

Better income – Aim for higher, not the highest

Better income – Preferred securities

1 Source: Manulife Investment Management, as of 1 July 2024. Distribution yield applies only to AA (USD) MDIST (G) Share class. Dividend rate is not guaranteed. Dividends may be paid out of capital. Refer to important note 2. Please note that a positive distribution yield does not imply a positive return. Past performance is not indicative of future performance. Annualised yield = [(1+distribution per unit/ex dividend NAV)^distribution frequency]–1, the annualised dividend yield is calculated based on the latest relevant dividend distribution with dividend reinvested, and may be higher or lower than the actual annual dividend yield. Diversification or asset allocation does not guarantee a profit nor protect against loss in any market.

2 Source: Manulife Investment Management, Barclays Point. As of 30 June 2024. Performance breakdown and yield breakdown by asset class are as of total portfolio return and yield. Due to rounding, the total may not be equal to 100%. The above yield does not represent the distribution yield of the Fund and are not an accurate reflection of the actual return that an investor will receive in all cases. A positive distribution yield does not imply a positive return.

3 Source: Manulife Investment Management, as of 30 June 2024, Dividend data refers only to Class AA (USD) MDIST(G). The dividend is not guaranteed. Dividends may be paid out of capital. Refer to important note 2. Investors should not make any investment decision solely based on information contained in the chart above. You should read the relevant offering document (including the key facts statement) of the fund for further details including the risk factors.

4 Source: Manulife Investment management and Morningstar, as of 30 June 2024. Morningstar peer group: EAA OE USD Flexible Allocation. Returns in US dollars. Past performance is not indicative of future performance. Please note that a positive distribution yield does not imply a positive return. Investors should not make any investment decision solely based on information above.

3733733

The case for liquid real assets in a shifting inflation regime

For over a decade, global investors operated under the assumption that inflation would remain subdued, anchored below 2% - a belief reinforced by central bank credibility and structural disinflationary forces like globalisation and technological deflation. However, the post-pandemic world has ushered in a new regime of structurally higher inflation risks, with evolving policy responses that make liquid real assets increasingly attractive.

Greater China Equities: Perspective for Q4 2025

Heading into the final quarter of the year, we remain constructive, supported by the US Federal Reserve interest rate cutting cycle, Mainland’s demand-side stimulus, strategic priorities outlined in the 15th Five-Year Plan, continued recovery in corporate earnings and robust fund inflows.

Q&A: Potential market impact of a US government shutdown

The US Senate failed to pass a last-minute funding deal, triggering the first federal government shutdown in nearly seven years starting from 1 October. Our Multi-Asset Solutions Team shares insights on how markets have responded during past shutdowns, and how investors can position themselves amid the uncertainty.

The case for liquid real assets in a shifting inflation regime

For over a decade, global investors operated under the assumption that inflation would remain subdued, anchored below 2% - a belief reinforced by central bank credibility and structural disinflationary forces like globalisation and technological deflation. However, the post-pandemic world has ushered in a new regime of structurally higher inflation risks, with evolving policy responses that make liquid real assets increasingly attractive.

Greater China Equities: Perspective for Q4 2025

Heading into the final quarter of the year, we remain constructive, supported by the US Federal Reserve interest rate cutting cycle, Mainland’s demand-side stimulus, strategic priorities outlined in the 15th Five-Year Plan, continued recovery in corporate earnings and robust fund inflows.

Q&A: Potential market impact of a US government shutdown

The US Senate failed to pass a last-minute funding deal, triggering the first federal government shutdown in nearly seven years starting from 1 October. Our Multi-Asset Solutions Team shares insights on how markets have responded during past shutdowns, and how investors can position themselves amid the uncertainty.