Important Notes:

19 December 2024

In 2024, we have witnessed major developed market central banks, including the US Federal Reserve (Fed), starting their easing cycles. Given the resilient performance of the US economy, we expect the Fed to reduce the federal funds rate at a measured pace, which translates into a fairly higher-for-longer rate environment. We therefore believe that multi-asset income solutions like the Manulife Global Multi-Asset Diversified Income Fund (GMADI - the Fund) will remain relevant and attractive for investors as yields remain high, offering the opportunity to capture an abundance of elevated yields in the market. The flexibility of allocating between traditional (fixed income) and non-traditional (option writing) income sources helps navigate potential rate and growth outlook uncertainties while maintaining relatively stable yield generation.

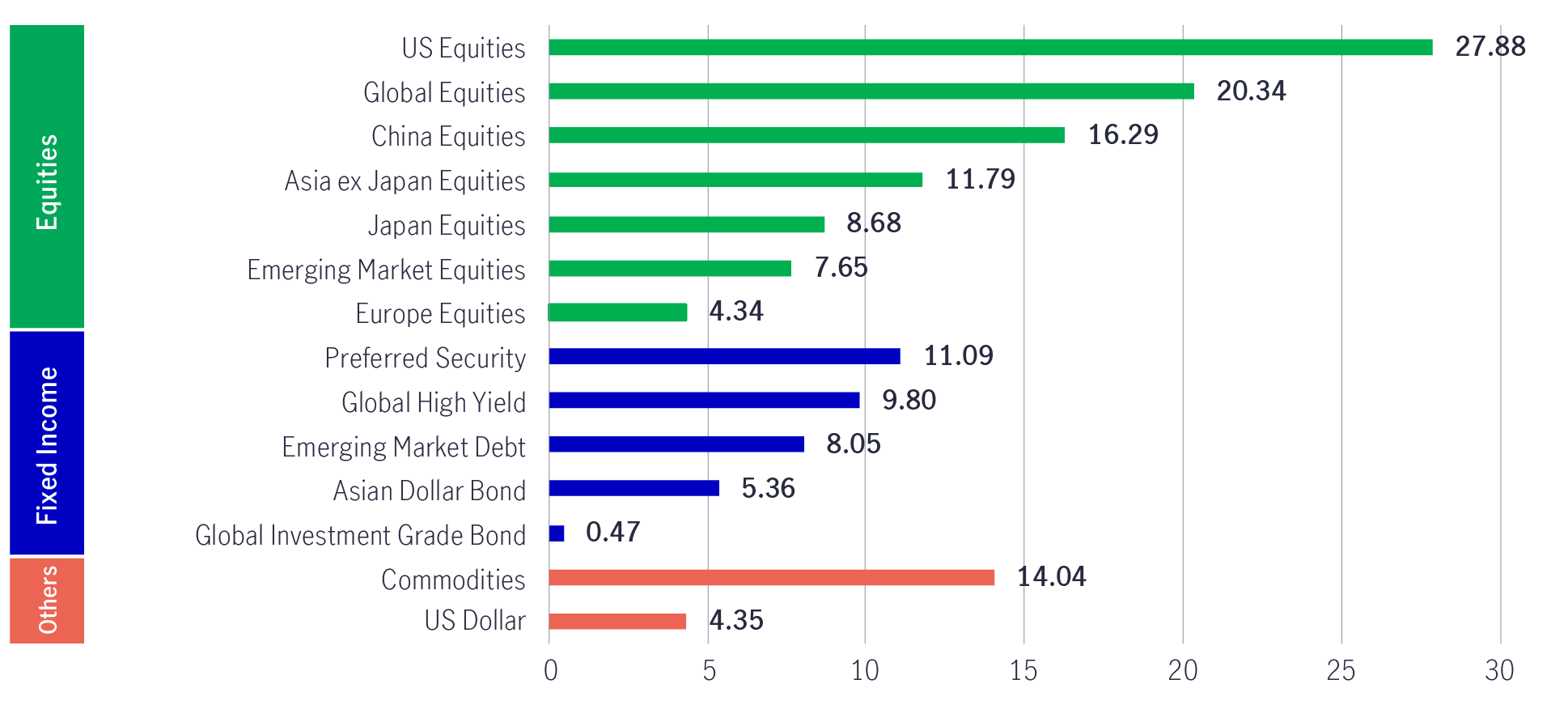

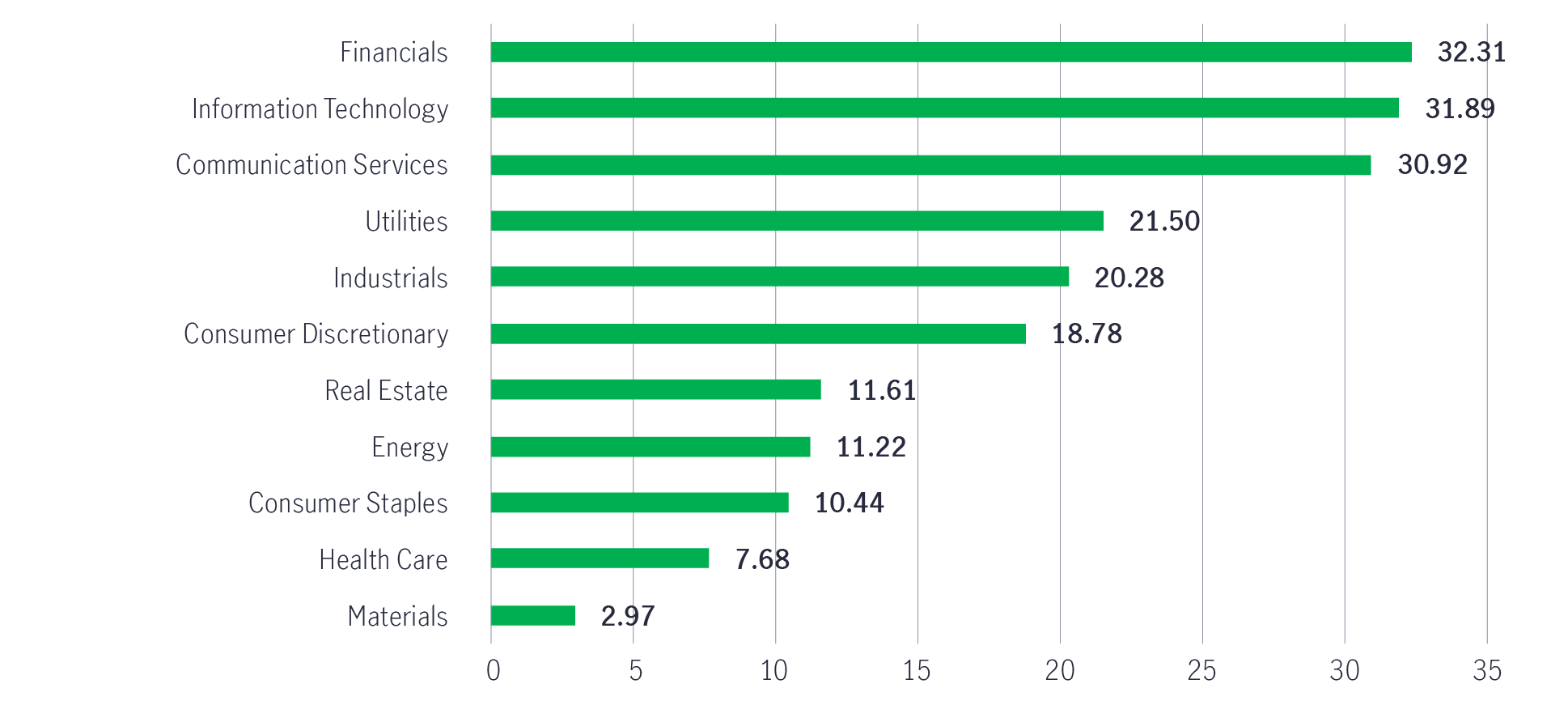

Let’s review the market performance of major asset classes so far this year:

Chart 1: 2024 year-to-date major asset classes cumulative performance (%)1

Chart 2: 2024 year-to-date global equity sector cumulative performance (%)1

GMADI’s income profile was 7.5% at launch in 2019 when rates were zero, whilst US Fed fund rates have risen as much as 525 basis points (now up 450 basis points from zero rates)2, GMADI payout is now approximately 8%3 and has de-risked its portfolio profile since then. We don’t see any significant impact on the distribution yield amid a US rate cutting cycle, and we expect the payout to remain competitive and high single digit into the foreseeable 2025.

Critically, the Fund’s distribution yield is well above inflation, so investors are not eroding their purchasing power. Additionally, the yield itself is not unrealistically high, meaning that distributions do not have to rely on persistently paying out of capital.

We expect the Fed to cut rates at a measured pace, and therefore, rates will remain fairly higher for longer – we believe investors can continue to be paid well through yield capture in such an environment and income strategies will remain attractive into 2025. In an unlikely situation where the Fed cuts rates aggressively, we think the demand for yield will increase (similar to the low interest rate environment a few years ago).

Fixed income securities are the Fund’s key income sources, contributing 48% of its natural underlying yield (30% from global developed markets high yield bonds, 5% from emerging market debt, 10% from investment grade bonds, and 3% from preferred securities)4.

High yield bonds historically delivered strong returns during Fed easing periods (except during the Global Financial Crisis). At present we see markets pricing in a US soft landing scenario, which has translated to narrowing spreads across most of fixed income, with even tighter spreads in the high yield space. It is crucial to emphasise the importance of flexibility and selecting the most appropriate securities within a capital structure to generate significant income, preserve capital, and limit permanent capital losses due to defaults.

In 2025, High Yield corporate bonds may continue to offer competitive income generation, though we are concerned that valuations are stretched and do not prefer the riskiest segment of the market (CCCs grades and below) which see disproportionate defaults. However more recently we have made additions into the CCC space given expectations of moderating default rates. Meanwhile, we continue to shift our preference toward high-quality investment-grade credits, and we see the appeal in select floating-rate fixed income over select high-yield bonds.

We believe there are appealing income opportunities within credit and spread sectors, with the potential for spread compression and limited risk of permanent capital impairment. The preferred asset class is considered attractive to fairly valued, and well-positioned for more restrictive financial conditions.

Similarly, we see opportunities in emerging market credit as valuations more adequately reflect corporate conditions, but given the challenging global growth outlook, we are very selective. We are warming up to Asia credits given a more positive outlook on broader EM Debt.

We believe default risks are subsiding as growth remains stable and potential US new administration policy favours corporates further. Potential measures targeting China may lead to volatility across Chinese asset classes, however the Fund has limited China fixed income exposure currently, favouring broader Asia fixed income ideas.

GMADI has a globally diversified set of exposures which are expected to offer diversified coupon and dividend opportunities via fixed income, alongside option writing which has consistently been a core driver of income (currently accounting for 38% of the Fund’s natural underlying yield4)– which we also expect to remain so under the US new administration.

The Fund has active equity security selection with the potential to generate alpha. The team prefers not to write options on single securities but rather look towards index level option writing that allow us to reflect our active asset allocation views, by selling away index upside through call writing, but retaining the individual security upside return generation. Furthermore, by adopting a complementing put writing strategy, we can generate a profile that is more defensive than owning the outright equities (without a put writing overlay). If markets fall, we lose on the equity returns but this is offset by the premiums retained on the call side, offsetting downside on other parts of the portfolio. If markets rise, the portfolio benefits from equity upside participation whilst a percentage of the equities that have a covered call writing structure attached won’t generate all the traditional upside but will receive income in the form of premiums from selling those covered calls, and at the same time, the Fund is able to capture and retain premiums on the put side.

Persistent option writing within the portfolio is expected to continue on a solid footing as a tool to generate sustainable premiums and enhance yield for the portfolio. As volatility rises, the portfolio is able to capture elevated volatility as it is reflected in option pricing which the fund sells. Option writing offers the flexibility to add more potential income capture or reduce potential income capture instead for returns. If markets are bullish, GMADI can reduce the call writing or increase put writing – and vice versa in an expected bear market.

The portfolio is consistent in writing 30 Delta country and index calls and 50 Delta puts, with tactical decision making around this—including frequency, strike levels, and coverage—depending on market views and volatility expectations.

We see options writing to continue to add value to the Fund via premium generation through index-level and/or country-level option writing which can be tactically adjusted to navigate market risk.

Overall, the equities within the portfolio maintained sector diversification, with overweight exposure towards consumer discretionary and healthcare, and energy to a small margin - well positioned to capture a broader market return. The Fund has underweights in technology and financials to mitigate sector-driven volatility5.

More recently, the team have trimmed back some of the smaller exposures as well as exited a handful of equity names post some disappointing sales results. Select semi-conductor names were exited whilst some of the relatively lower market cap names were more levered than preferred and therefore warranted an exit. The portfolio previously had close to 100 equity names which has now been trimmed to around 85 high conviction names with the proceeds added to existing names5.

At a time when we’re seeing peak-level US equity valuations, continued uncertainty in the geopolitical environment, and wider dispersion in markets, there is value in taking a more cautious approach. Going into 2025, we continue to focus on quality across equity assets.

Within the United States, there is an opportunity for healthcare, consumer discretionary and financials, and we still feel the large-cap growth story has some legs. Japan is enjoying improving fundamentals and reasonable valuations, and it stands to benefit from positive corporate governance reforms. Outside of Japan, Asia-Pacific is well-positioned as a defensive play within a slower growth, manufacturing-led world.

Overall, we expect the market to experience some volatility into 2025, particularly as investors reprice interest rate and potentially inflation expectations. We maintain that there are downside risks to the economy given tighter credit conditions, but hopeful these will be alleviated into 2025. Tactical positioning will be more prevalent again as we continue into 2025, to be able to nimbly add and de-risk portfolios as well as add to yield opportunities as they arise.

1 Source: Bloomberg, FactSet, data as of 30 November, 2024. Performance is in USD and total return. Equities indices represented by MSCI indices. Preferred securities = ICE BofAML US All Cap Securities index; Emerging Market Debt = JPM EMBI. Asian Dollar Bond represented by Markit iboxx index. Global high yield bond = Bloomberg Global High Yield total return index unhedge. Global Investment grade bond represented by FTSE indices. Commodities = TR CRB Index. US dollar = US dollar index. Past performance is not indicative of future performance.

2 US Federal Reserve, as of 10 December 2024.

3 Source: Manulife Investment Management. For the period ended 29 November 2024, the annualised yield of the Fund’s AA (USD) MDIST (G) class was 8.07%. Dividend rate and dividend are not guaranteed. Dividends may be paid out of capital. Refer to important note 2. Please note that a positive distribution yield does not imply a positive return. Annualised yield = [(1+distribution per unit/ex dividend NAV)^distribution frequency]–1, the annualised dividend yield is calculated based on the latest relevant dividend distribution with dividend reinvested, and may be higher or lower than the actual annual dividend yield. Fund inception date: 25 April 2019.

4 Manulife Investment Management, data as of 30 November, 2024.

5 As of 30 November, 2024. Information about the portfolio holdings is historical and is not indication of the future composition. Diversification or asset allocation does not guarantee a profit nor protect against loss in any market.

Asian Fixed Income: Are we at a turning point?

This outlook analyses the near-term tailwinds propelling returns in Asian fixed income, as well as the structural fundamentals and shifting geopolitical trends that could support the asset class over the long-term.

Midyear 2025 global macro outlook: what’s changed and what hasn’t

More forceful-than-expected government policy decisions, particularly by the United States, have swiftly overtaken some of our early 2025 views. Global trade issues and deglobalization have indeed come to the fore, with knock-on effects for many trade-sensitive emerging markets. Elsewhere, capital markets the world over are contending with a big wave of government debt supply, which is driving global bond yields higher.

Greater China Equities: 2H 2025 Outlook

The latest Greater China Equities Outlook highlights how our investment team navigates global uncertainties and invests through the lens of our investment framework via the “4A” positioning: Acceleration, Abroad, Advancement, and Automation.

Asian Fixed Income: Are we at a turning point?

This outlook analyses the near-term tailwinds propelling returns in Asian fixed income, as well as the structural fundamentals and shifting geopolitical trends that could support the asset class over the long-term.

Midyear 2025 global macro outlook: what’s changed and what hasn’t

More forceful-than-expected government policy decisions, particularly by the United States, have swiftly overtaken some of our early 2025 views. Global trade issues and deglobalization have indeed come to the fore, with knock-on effects for many trade-sensitive emerging markets. Elsewhere, capital markets the world over are contending with a big wave of government debt supply, which is driving global bond yields higher.

Greater China Equities: 2H 2025 Outlook

The latest Greater China Equities Outlook highlights how our investment team navigates global uncertainties and invests through the lens of our investment framework via the “4A” positioning: Acceleration, Abroad, Advancement, and Automation.