Important Notes:

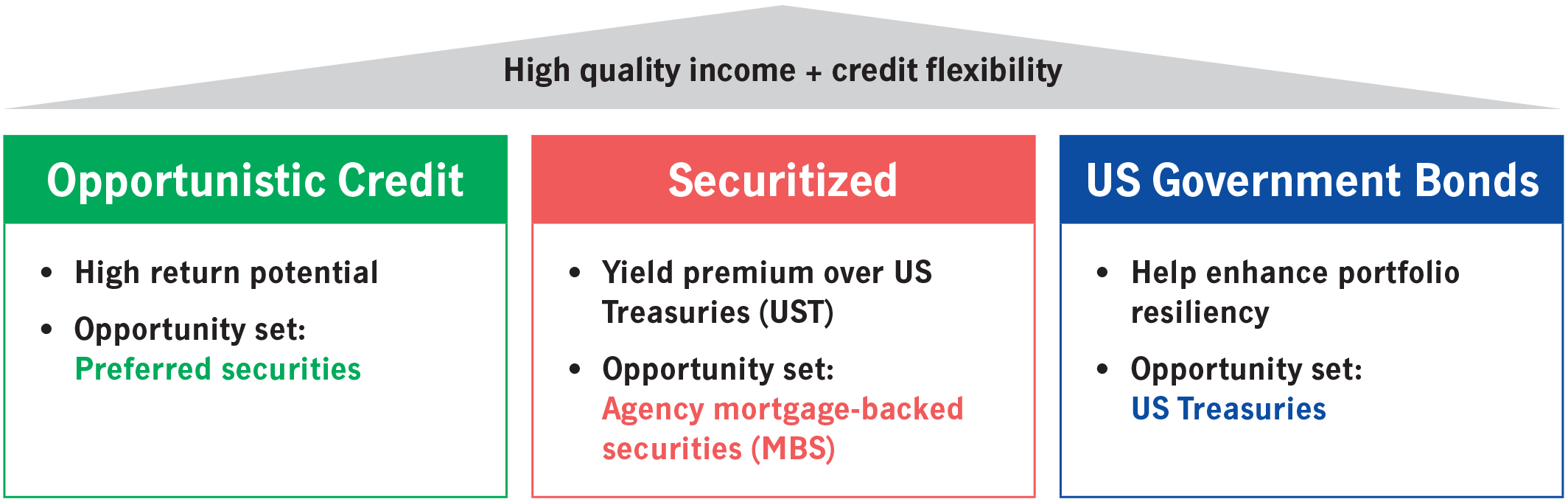

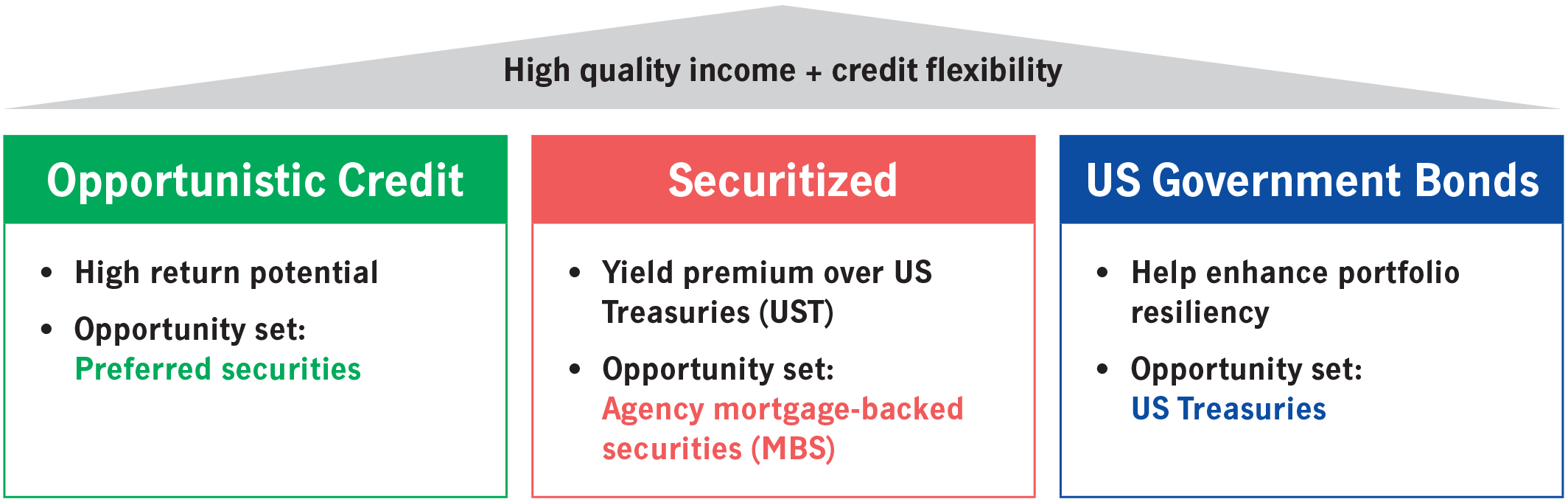

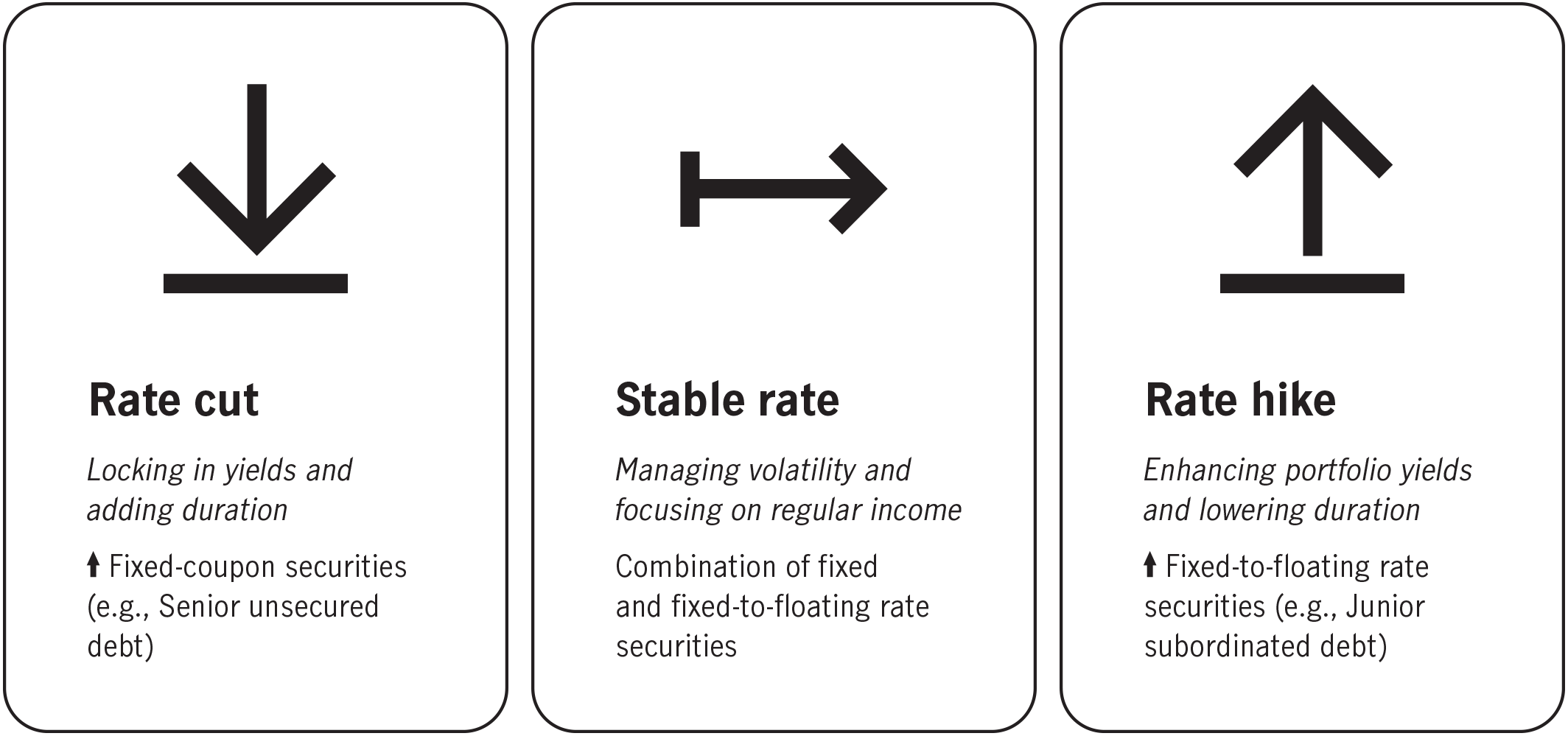

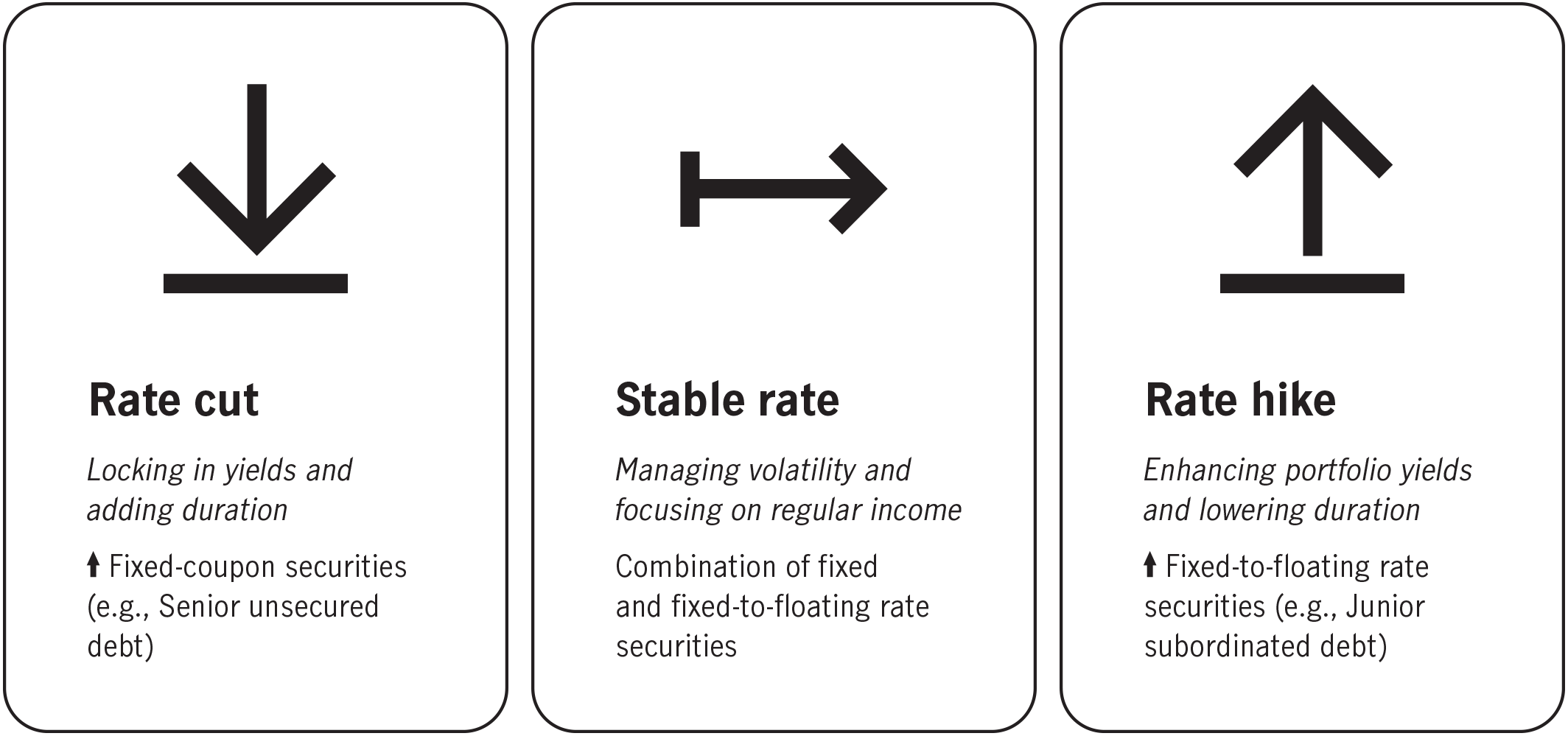

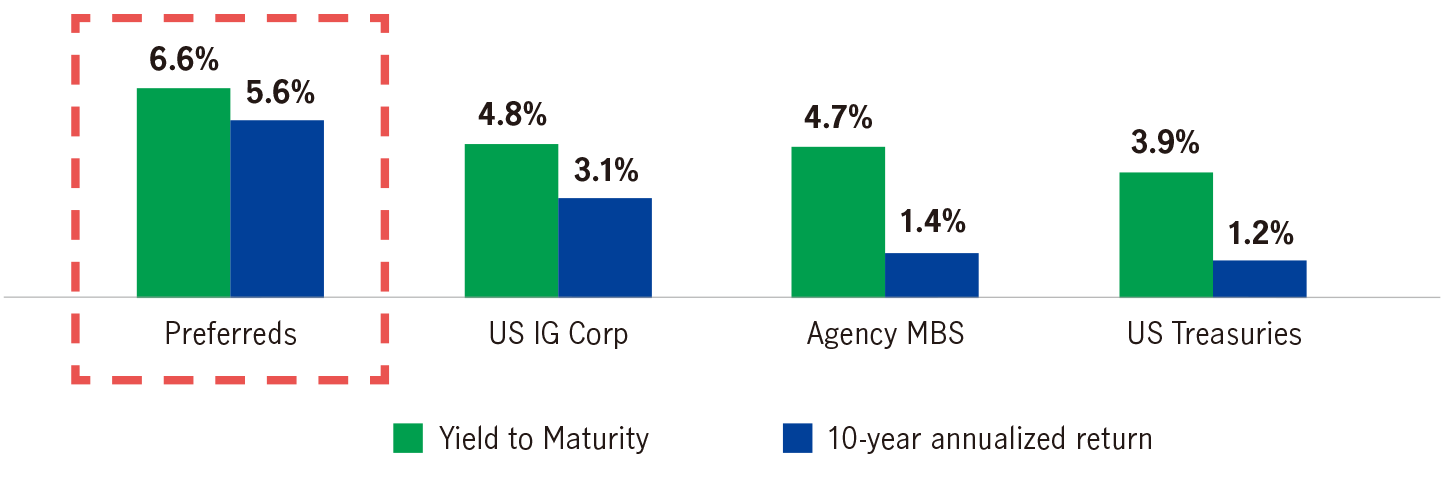

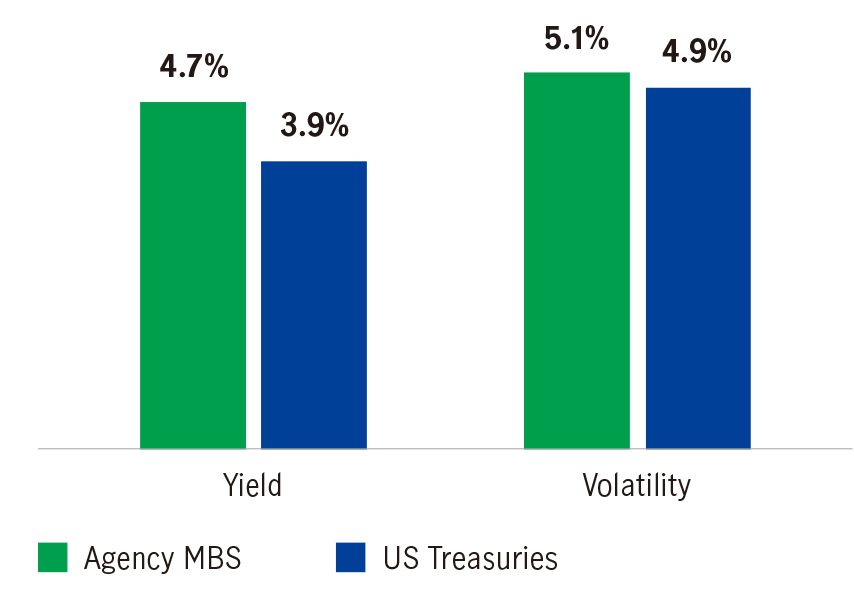

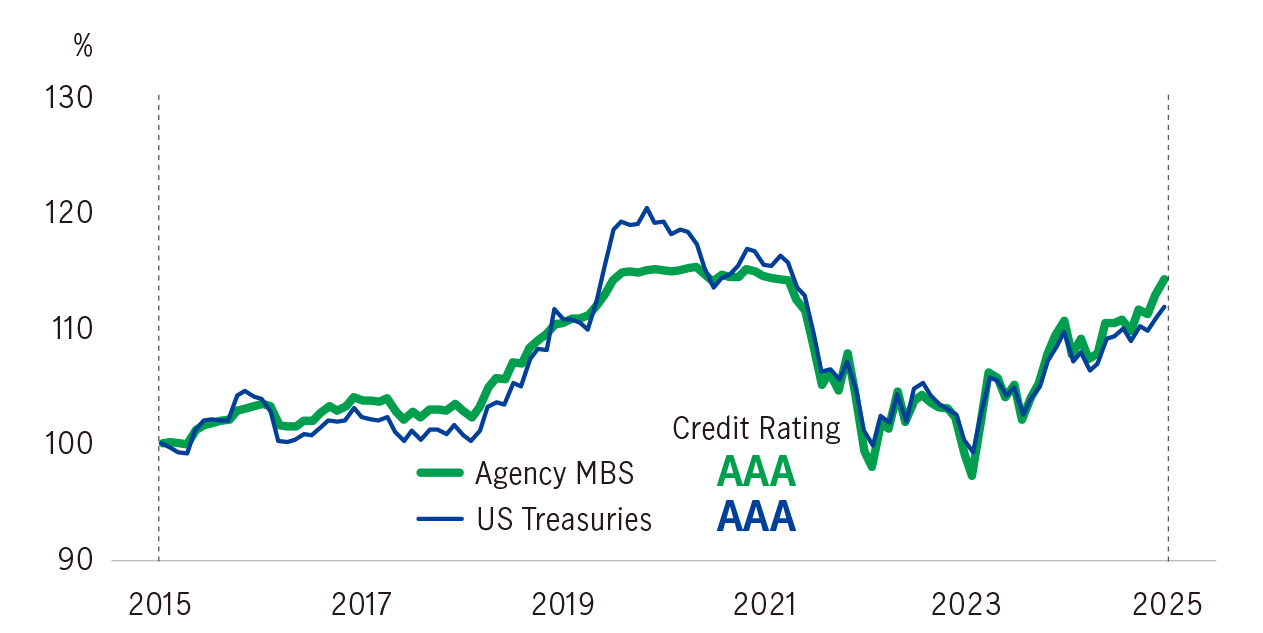

Combining Opportunistic Credit, Securitized, and US Government allocations, our High-quality Fixed income solution aims to provide a high, sustainable income opportunity with low volatility. Instead of tilting to a specific fixed income asset which is subject to credit risks (e.g. high yield bonds) or interest rate risks (e.g. treasuries), our unconstrained approach invests across bond sectors, credit qualities and capital structures with the aim to deliver a smoothed investment journey across market cycles.

For illustrative purposes only.

| Fund name | Manulife Global Fund – USD Income Fund |

Investment objective and strategy |

The Fund aims to achieve income generation by investing at least 70% of its net assets in fixed income securities and fixed income related securities denominated in U.S. Dollar of issuers globally. The Fund will seek to maintain an average credit rating of investment grade. |

Investment manager |

Manulife Investment Management (US) LLC |

Inception date |

January 29, 2007 |

Base currency |

USD |

Fund size |

USD 131 million |

Benchmark |

Bloomberg US Aggregate Bond TR USD Index |

Available Share classes |

AA (USD) (LU0278409817) AA (USD) Acc (LU2089985878) AA (USD) Inc (LU1079480403) AA (USD) MDIST (G) (LU2208648639) R (USD) MDIST (G) (LU2699159948) AA (HKD) (LU1077378633) AA (HKD) Inc (LU1077379011) AA (HKD) MDIST (G) (LU2208648803) R (HKD) MDIST (G) (LU2699160011) |

Initial subscription fee |

Currently up to 5% of the NAV per Share |

Switching charge |

Up to 1% of the NAV of the Shares being switched |

Management fee |

Currently 1.00% p.a.* |

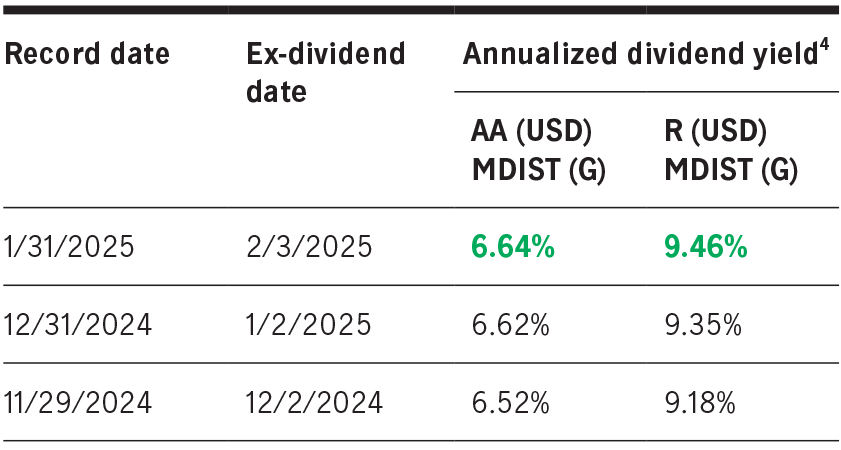

Distribution policy |

Aims to distribute dividends monthly |

*As of September 30, 2025

We are the global wealth and asset management segment of Manulife Financial Corporate, we draw on more than 150 years of financial stewardship to partner our clients globally.

24+ years

Average investment experience of portfolio management team

150+

investment experts in global fixed income team5

USD 209.7 billion

in AUM of fixed income assets6

Unless otherwise stated, all information sources are from Manulife Investment Management, as of September 30, 2025. Projections or other forward-looking statements regarding future events, targets, management discipline or other explanations are only current as of the data indicated. There is no assurance that such events will occur, and if they were to occur, the result may be significantly different than that shown here. Investment involves risk. Investors should not make investment decisions based on this material alone and should read the offering document for details, including the risk factors, charges and features of the product. This material has not been reviewed by the Securities and Futures Commission. Issued by Manulife Investment Management (Hong Kong) Limited.

4984231