Important Notes:

In today’s dynamic and ever-changing investment world, Asian investors seek solutions to achieve higher, stable income with growth potential, while minimizing risks. It’s time to unlock Asia’s resilience, income potential and long-term growth opportunities with a diversified and differentiated approach.

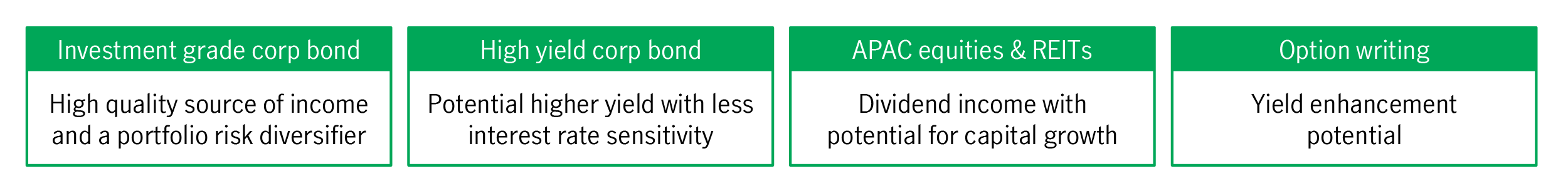

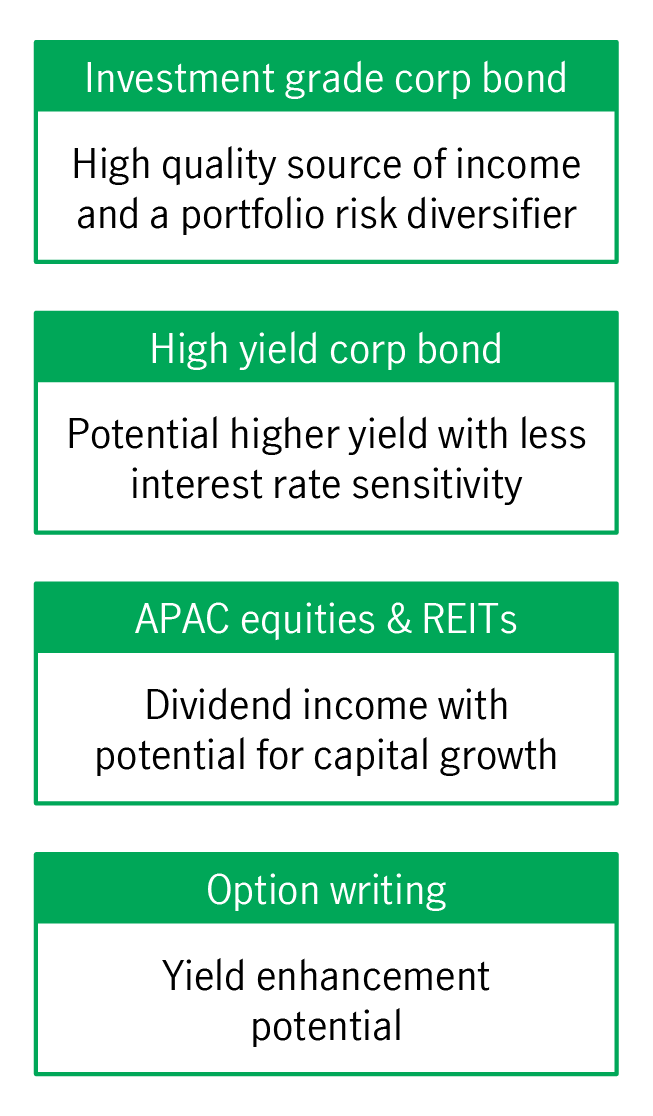

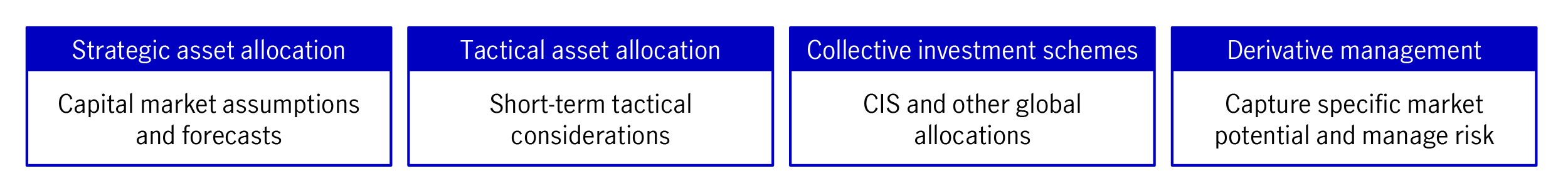

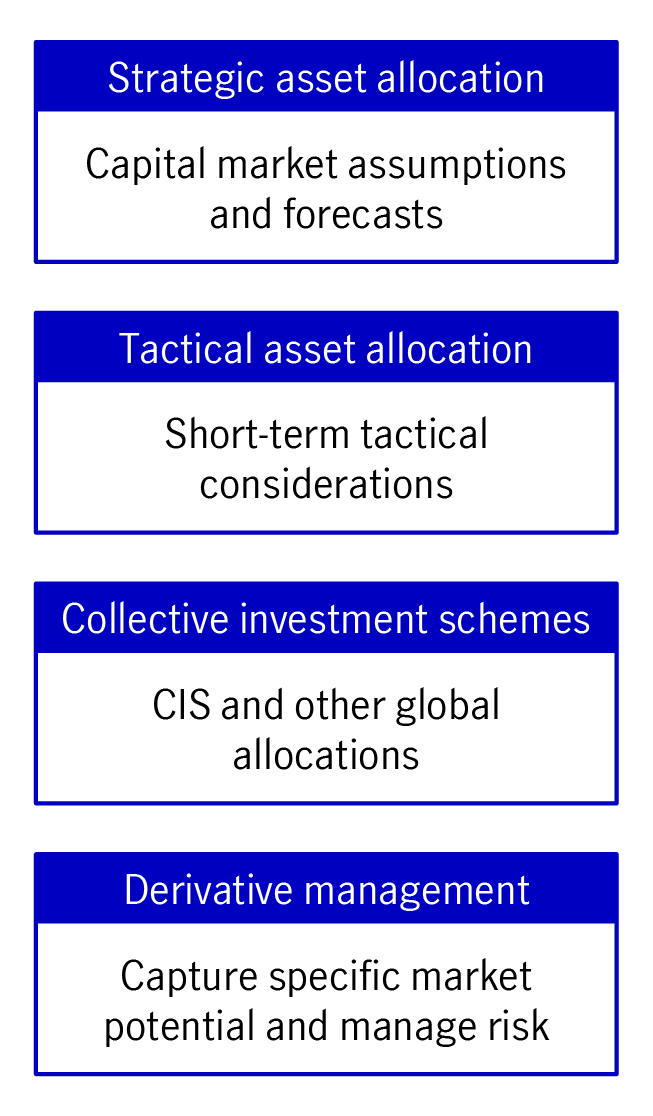

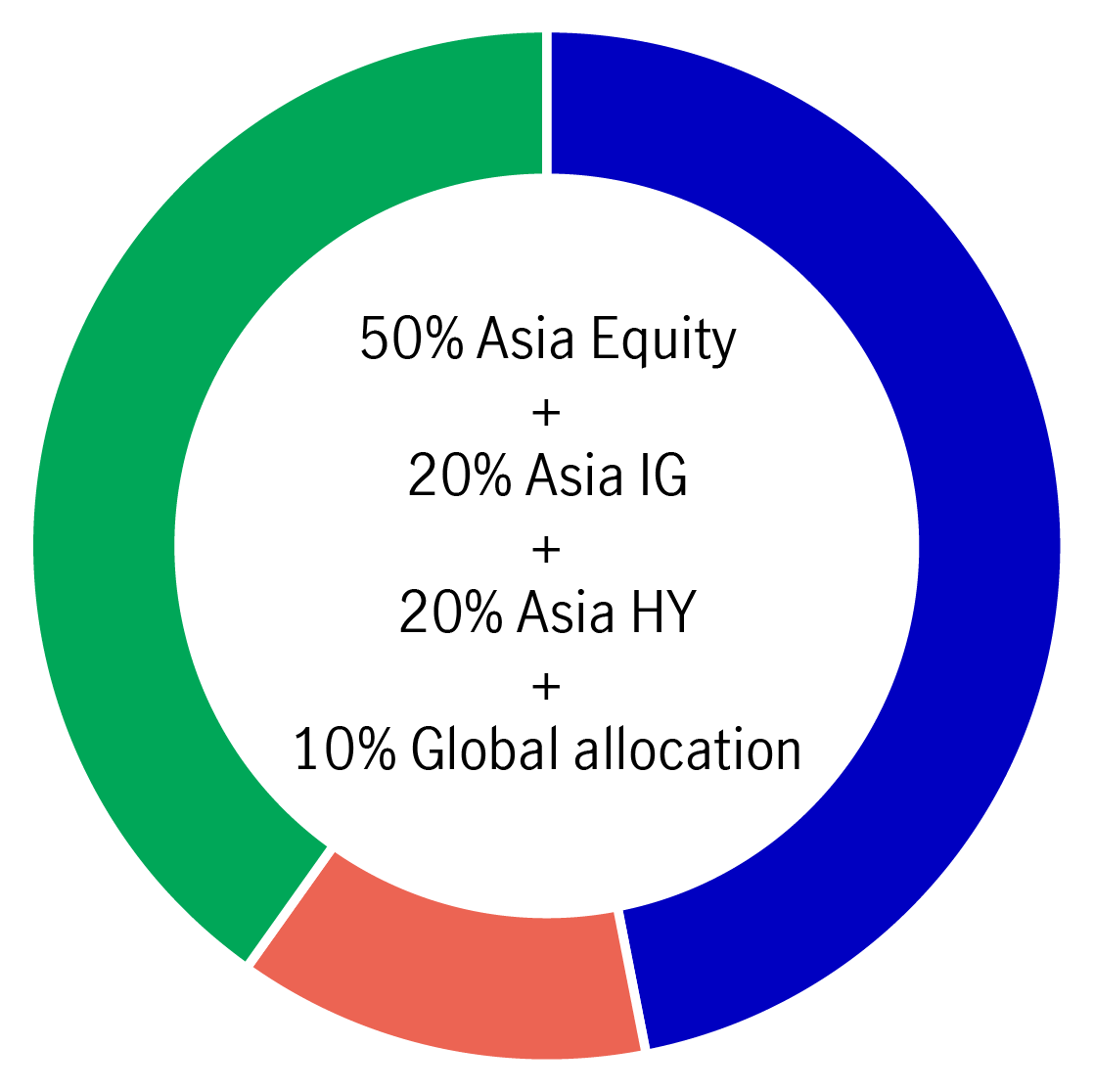

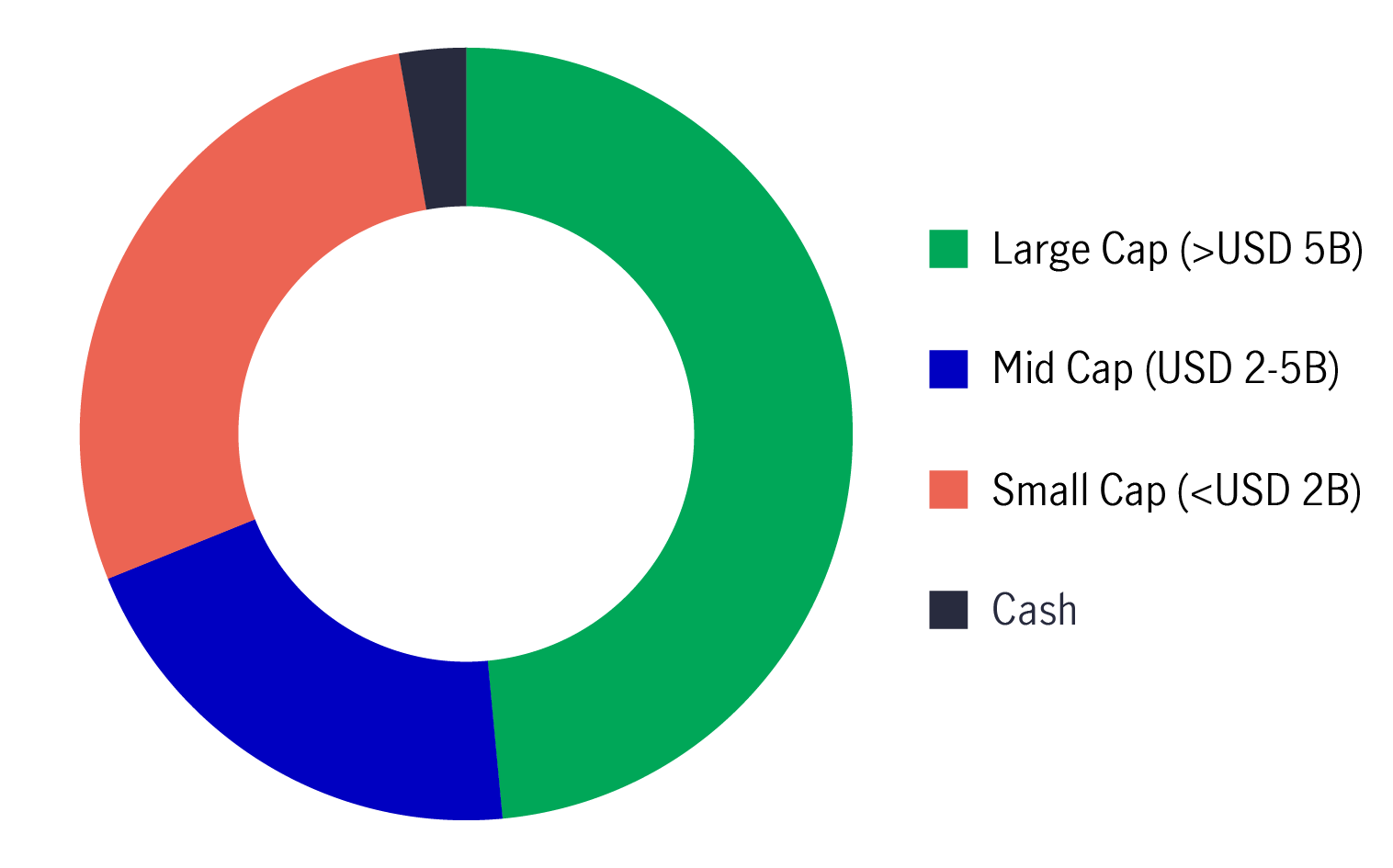

Combining Asia investment grade, Asian high yield, yield focused Asian equities with discretionary global allocations, the strategy aims to achieve a competitive, stable income potential, whilst managing market downside risk through derivative implementation. The strategy aims to provide:

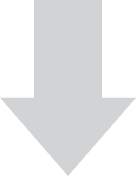

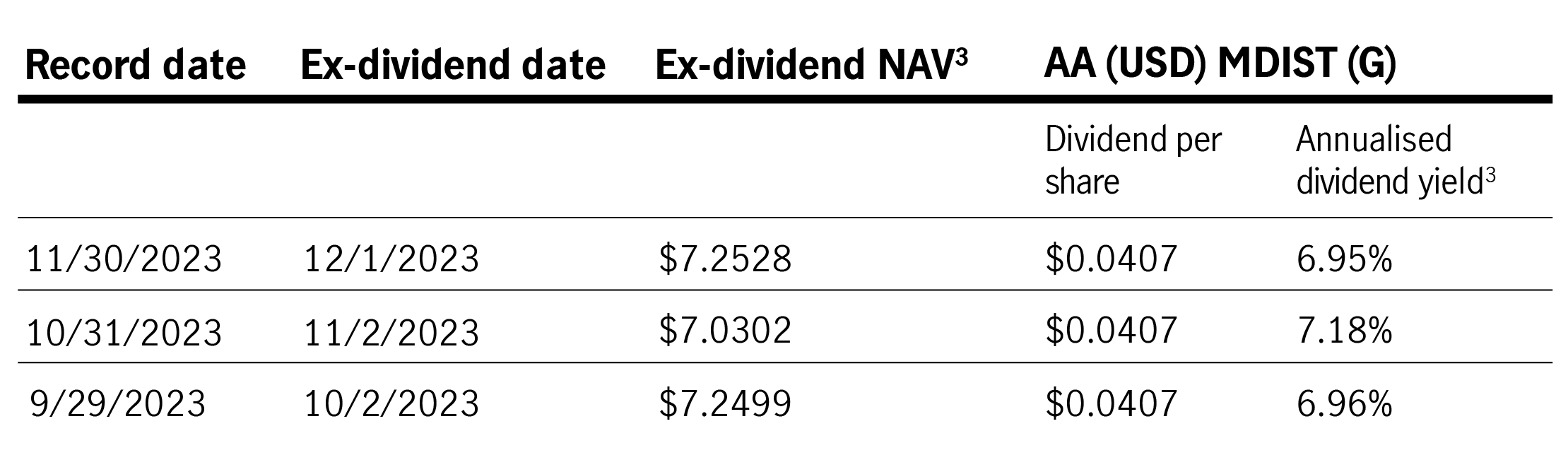

The strategy implements a flexible and dynamic approach, aiming for high, stable income potential from three sources: bond coupons, equity dividends, and enhanced income potential via option writing. The strategy’s distribution is predominantly generated from the underlying natural yield, with less reliance on capital appreciation. The natural underlying portfolio yield has been kept healthy, at around 6% on average since inception versus the average distribution yield of AA (USD) MDIST (G) at 6.2%2.

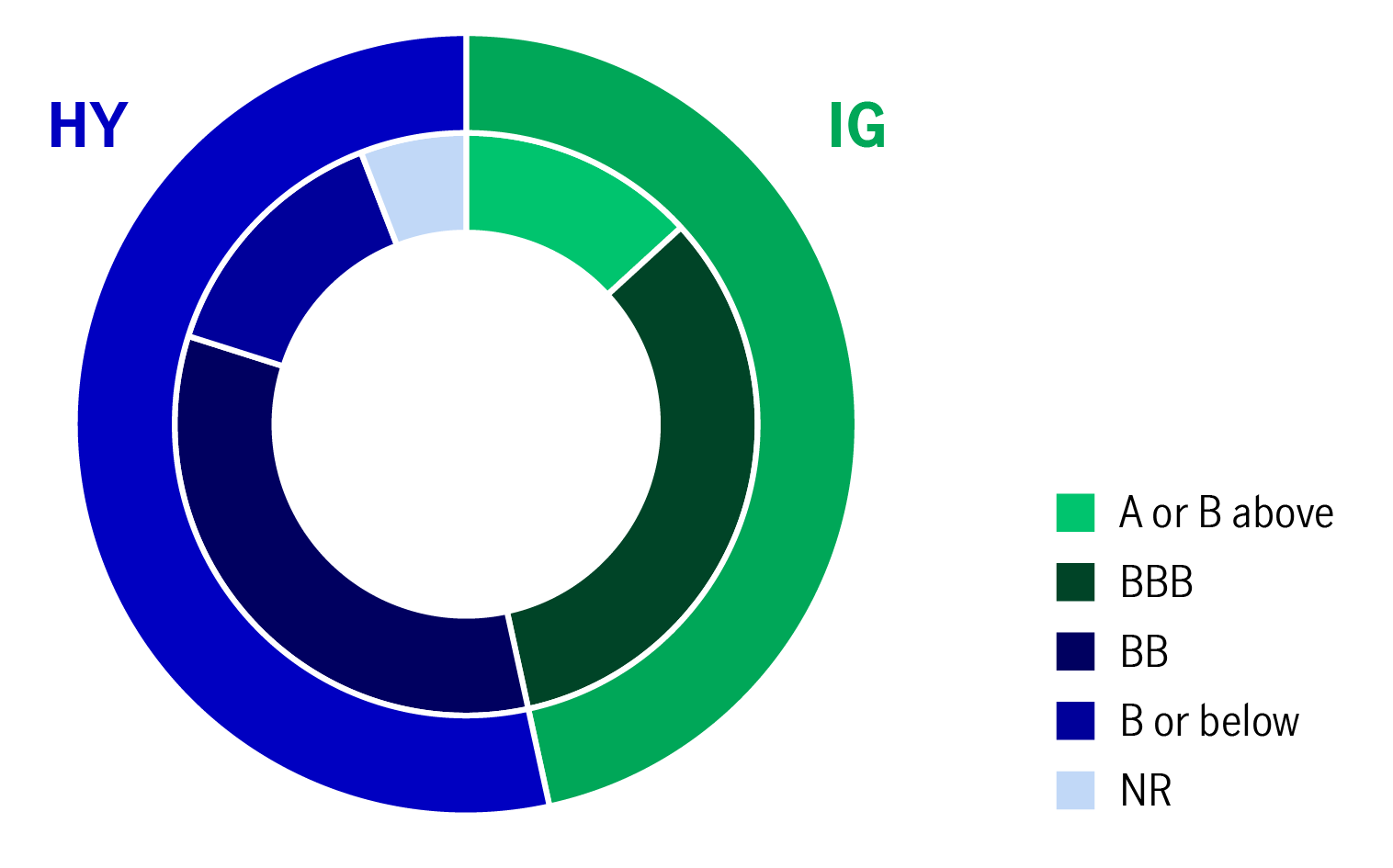

Fixed income

Aims to provide relatively stable income as well as diversification benefits.

Equities

Seek attractive income opportunities as well as risk adjusted return potential.

Discretionary global allocation/option writing

Flexibility to capture opportunities outside of Asia, enhance income potential and manage risks.

Dividend schedule

(The distribution yield is not guaranteed. Distribution may be paid out of capital. Refer to Important Note 2.)

| Fund name | Manulife Global Fund – Asia Dynamic Income Fund |

Objective and investment strategy |

The Fund aims to achieve income generation by investing primarily in a diversified portfolio of equity, equity-related, fixed income and fixed incomerelated securities of companies and/or governments in Asia. |

Launch date |

July 2, 2021 |

Base currency |

USD |

Available share classes |

AA Acc USD (LU2327854464) |

Initial subscription fee |

Currently up to 5% of the NAV per share |

Switching charge |

Up to 1% of the NAV of the shares being switched |

Management fee |

Currently 1.50%* |

Distribution policy |

Aims to distribute dividends monthly |

*Such fees may be increased up to a specified permitted maximum by giving affected shareholders at least three months prior notice, and distributor for its services. The Directors reserve the right to charge up to 6% of the NAV per share.

We are the global wealth and asset management segment of Manulife Financial Corporate, we draw on more than 150 years of financial stewardship to partner our clients globally.

25+ years

investment experience of lead manager

625+

investment experts across asset classes4

USD 145 billion

in AUM of multi-asset solutions5

3202021