29 September 2021

Just as relationships take time to blossom, you need patience for investments to grow in value. To reap a potentially considerable return, it’s vital to start investing as soon as possible, allowing time to work its magic over the wealth-accumulation process. This is known as the compounding effect.

The compounding effect works in the same way as a time deposit with lump sum deposit and withdrawal. The potential returns you accrue are not withdrawn on each maturity date, but instead, they’re rolled over with the principal, creating a new sum for the next investment period. Since the principal is continuously expanding, your future returns may be larger than the previous round, which creates the wealth-accumulation effect. The longer the investment time frame, the greater the compounding effect, and, consequently, the bigger the rollover amount.

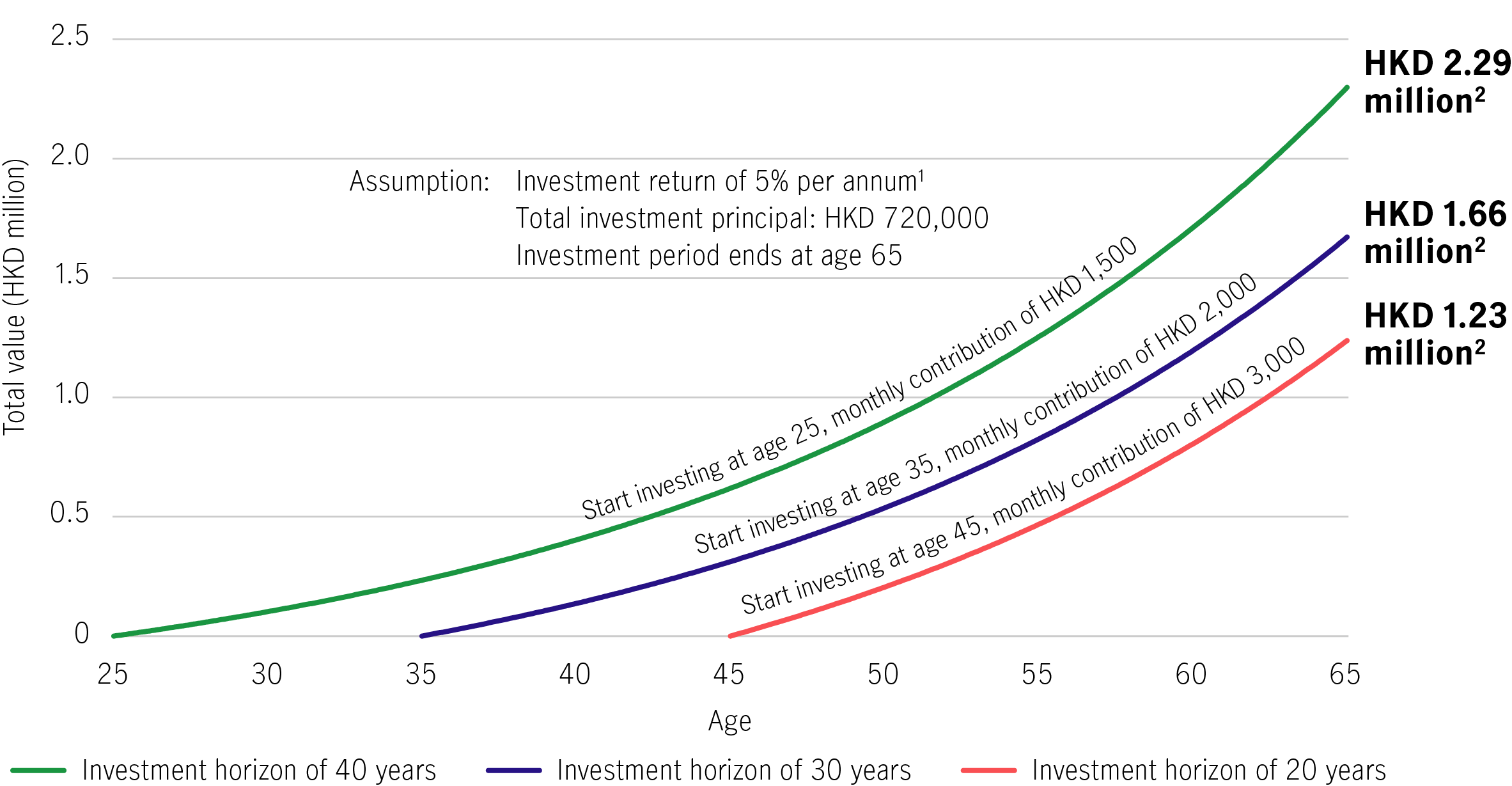

Let’s say a person starts investing at age 25, contributing HKD 1,500 every month for 40 years. Assuming an expected return rate of 5% per annum1, with monthly compounding the principal and interest will amount to approximately HKD 2.29 million2 when the investor reaches 65. This cumulative return is more than 2.1 times greater than the total principal amount (HKD 720,000) over the entire period.

If the person waits until the age of 45 before they start investing, the investment period is reduced in half to 20 years. Even when monthly investments are doubled to HKD 3,000 (the total investment principal remains the same, i.e., HKD 720,000), the total value at the end of the period will only be around HKD 1.23 million2, equivalent to about 70% of the cumulative return. Compared with an investment horizon of 40 years, the accumulated profit is over HKD 1 million less!

Therefore, time is a highly effective catalyst for wealth creation. But, remember, it also slips away by the second and cannot be stored for future use. If you have not started to save or invest, then you are losing time and missing out on a precious opportunity to accumulate wealth.

The sooner you invest, the greater the compounding effect

Past performance is not an indicative of future performance. For illustrative purpose only.

1. Source: Mandatory Provident Fund Schemes Authority (MPFA), 8 February 2021. The annualized return was 4.8% since the inception of the MPF System in 2000.

2. Source: Investor and Financial Education Council (IFEC) “How much will I get in the future?” calculator, July 2021. Total values are rounded to the nearest ten thousand dollars.

More years, better living

They say that 60 is the new 50, so if you are nearing the next chapter of life, why not make the most out of your golden years by embracing new experiences, pursuing passions and enjoying life to the fullest?

Harness lower-risk funds to navigate uncertainty and volatility

Market uncertainties are accelerating recently, this article will discuss how employees navigate the turbulent conditions by making good use of lower-risk fund

Your retirement withdrawal strategy—four tips for managing inflation

When it is time to enjoy what you’ve always dreamed of doing, the retirement planning doesn’t end there. It’s important to regularly review your withdrawal strategy and make adjustments as needed to keep changing economic conditions from throwing you off track. Consider the four tips to help keep inflation from depleting your retirement savings sooner than you expected.

More years, better living

They say that 60 is the new 50, so if you are nearing the next chapter of life, why not make the most out of your golden years by embracing new experiences, pursuing passions and enjoying life to the fullest?

Harness lower-risk funds to navigate uncertainty and volatility

Market uncertainties are accelerating recently, this article will discuss how employees navigate the turbulent conditions by making good use of lower-risk fund

Your retirement withdrawal strategy—four tips for managing inflation

When it is time to enjoy what you’ve always dreamed of doing, the retirement planning doesn’t end there. It’s important to regularly review your withdrawal strategy and make adjustments as needed to keep changing economic conditions from throwing you off track. Consider the four tips to help keep inflation from depleting your retirement savings sooner than you expected.