Solutions for navigating market volatility amid U.S. tariff changes

Recent changes in U.S. tariffs have introduced new dynamics to the global market landscape, presenting both challenges and opportunities for investors. Understanding these developments is essential for making informed investment decisions. Marc Franklin, our Deputy Head of Multi-Asset Solutions, Asia, and Senior Portfolio Manager provided his view.

Quick thoughts on US reciprocal tariffs

The US President Donald Trump announced reciprocal tariff details on 2 April, 2025, which has introduced volatility to the financial markets. Alex Grassino, Global Chief Economist, along with the Multi-Asset Solutions Team (MAST), Macroeconomic Strategy Team, share their latest views.

Policy Normalisation in Japan: how high will the BoJ go?

The Bank of Japan has continued to raise interest rates in an effort to "normalize" monetary policy, presenting potential opportunities for discerning investors.

Solutions for navigating market volatility amid U.S. tariff changes

Recent changes in U.S. tariffs have introduced new dynamics to the global market landscape, presenting both challenges and opportunities for investors. Understanding these developments is essential for making informed investment decisions. Marc Franklin, our Deputy Head of Multi-Asset Solutions, Asia, and Senior Portfolio Manager provided his view.

Quick thoughts on US reciprocal tariffs

The US President Donald Trump announced reciprocal tariff details on 2 April, 2025, which has introduced volatility to the financial markets. Alex Grassino, Global Chief Economist, along with the Multi-Asset Solutions Team (MAST), Macroeconomic Strategy Team, share their latest views.

Policy Normalisation in Japan: how high will the BoJ go?

The Bank of Japan has continued to raise interest rates in an effort to "normalize" monetary policy, presenting potential opportunities for discerning investors.

12 March 2025

Kai Kong Chay, Senior Portfolio Manager, Greater China Equities

Wenlin Li, Senior Portfolio Manager, Greater China Equities

As we progress through 2025, Greater China equities have demonstrated strong performance, particularly Hong Kong equities, which have been supported by southbound inflows. In addition to the recent breakthroughs in AI and humanoid robot development, we observe other positive catalysts that further support the region’s market.

Greater China equities showed resilience year-to-date in 2025, with the Hang Seng Index rising by 22.1%, the Hang Seng China Enterprises Index (HSCEI) gaining 23.3%, and the MSCI China Index increasing by 20.8%. (see table below)1.

2025 year-to-date performance of Greater China equity indices1

| Indices | Total returns in USD (%) |

| Hang Seng TECH Index | +35.82 |

| Hang Seng China Enterprises Index | +23.33 |

| Hang Seng Index | +22.21 |

| MSCI China Index | +20.83 |

| MSCI Zhong Hua Index | +19.48 |

| Shanghai Stock Exchange Composite Index | +2.02 |

Besides the DeepSeek AI breakthrough (which prompts acceleration of AI adoption in mainland China) and humanoid robot development, there are other positive catalysts as we move into the rest of 2025.

(1) Positive policy signals

On 24 February, Mr Wu Qing, Chairman of the China Securities Regulatory Commission (CSRC), published an article in the Journal of New Industrialization highlighting mainland China’s development priorities, particularly in fostering technologically innovative high-end manufacturing and new-industry companies.

(2) Positive messages from China’s National People's Congress (NPC) meeting

The key messages from work report from China’s NPC meeting are largely in-line with our view. The targets span across various areas, which are holistic and help navigate macro uncertainties and boost domestic growth. Domestic demand is key for 2025.

Key targets and priorities announced in NPC meeting2

| Areas | Details |

| Monetary and fiscal policy | • Budget deficit ratio set at around 4% of GDP • RMB 500 billion of new special sovereign bonds for big banks • RMB 4.4 trillion of new special local government bonds in 2025 • RMB 1.3 trillion of ultra-long special sovereign bonds • May cut required reserve ratio (RRR) and interest rates when time is appropriate • To coordinate reforms of fiscal and tax systems |

| Economy | • China vows to make domestic demand the main economic driver in 2025 • Gross domestic product (GDP) growth target at around 5% • CPI growth target at ~2% • Target urban unemployment rate of about 5.5% in 2025 • To carry out special initiatives to boost consumption • To maintain basic stability of the RMB • Plans 7.2% increase in 2025 defense spending |

| Property | • Give local governments more autonomy in acquiring homes • To expand scope of affordable housing relending |

| Technology | • To increase funding to bio-manufacturing and quantum technology • To develop a system of open-source models for AI & 6G technology • To support extensive application of large-scale AI models |

| Energy and agriculture | • Target -3% energy use per unit of GDP for 2025 • To develop intelligent new energy cars |

| Health Care | • To refine policy for centralized medicine procurement • China subsidy for resident medical care to be raised by RMB30 per person • To support and encourage private investment • To support cross-border e-commerce, boost logistics system • To improve policies on volume-based drug procurement |

(3) Recovery pace of mainland China’s property market

Some positive data points include:

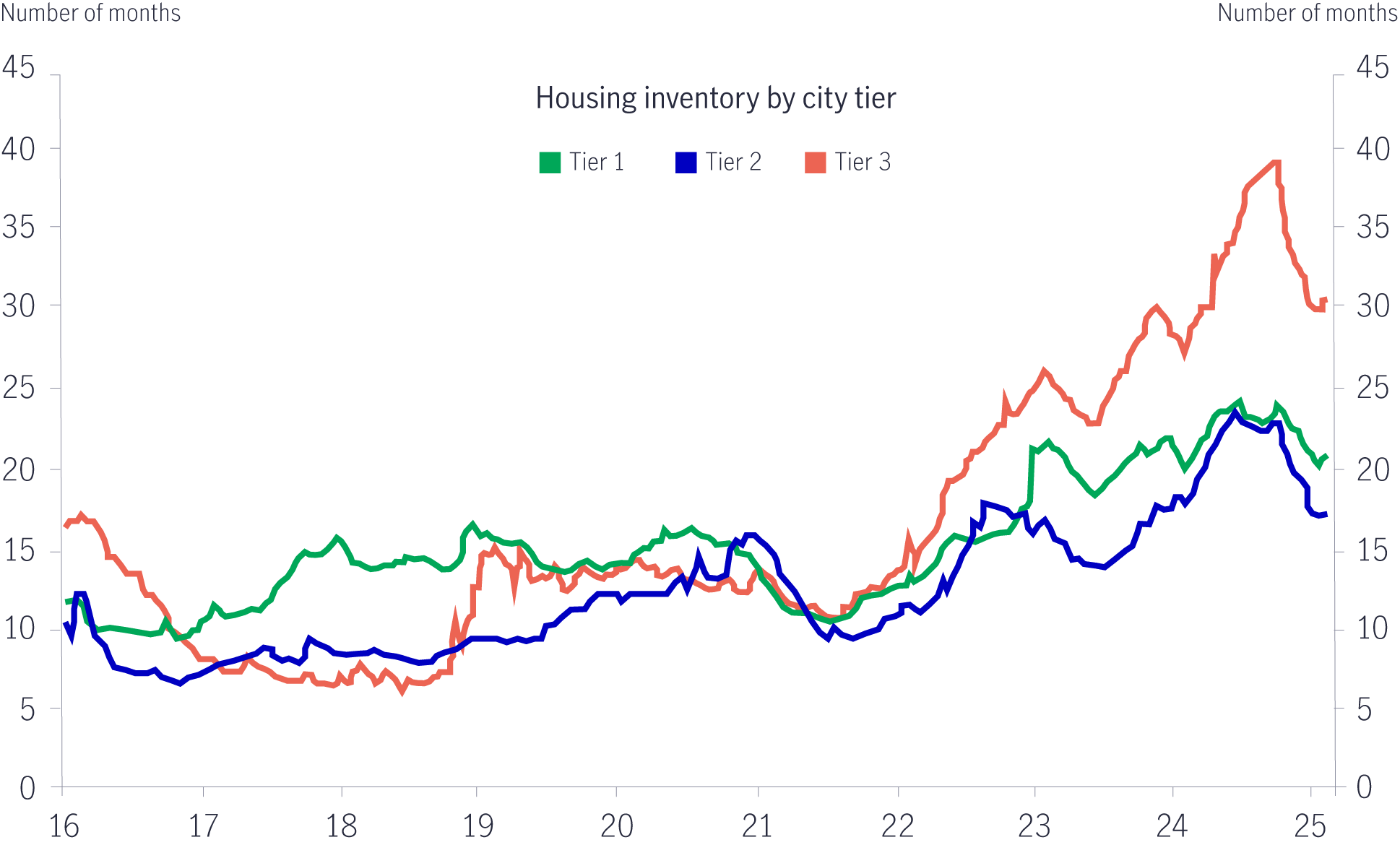

Housing inventory ratios fell significantly in recent months, driven by improving sales3

(4) Additional support for the mainland China banking sector

During the China NPC meeting, China announced RMB 500 billion of new special sovereign bonds for banks, which lends support to banks as well as a broad range of sectors, including consumer, property and industrials.

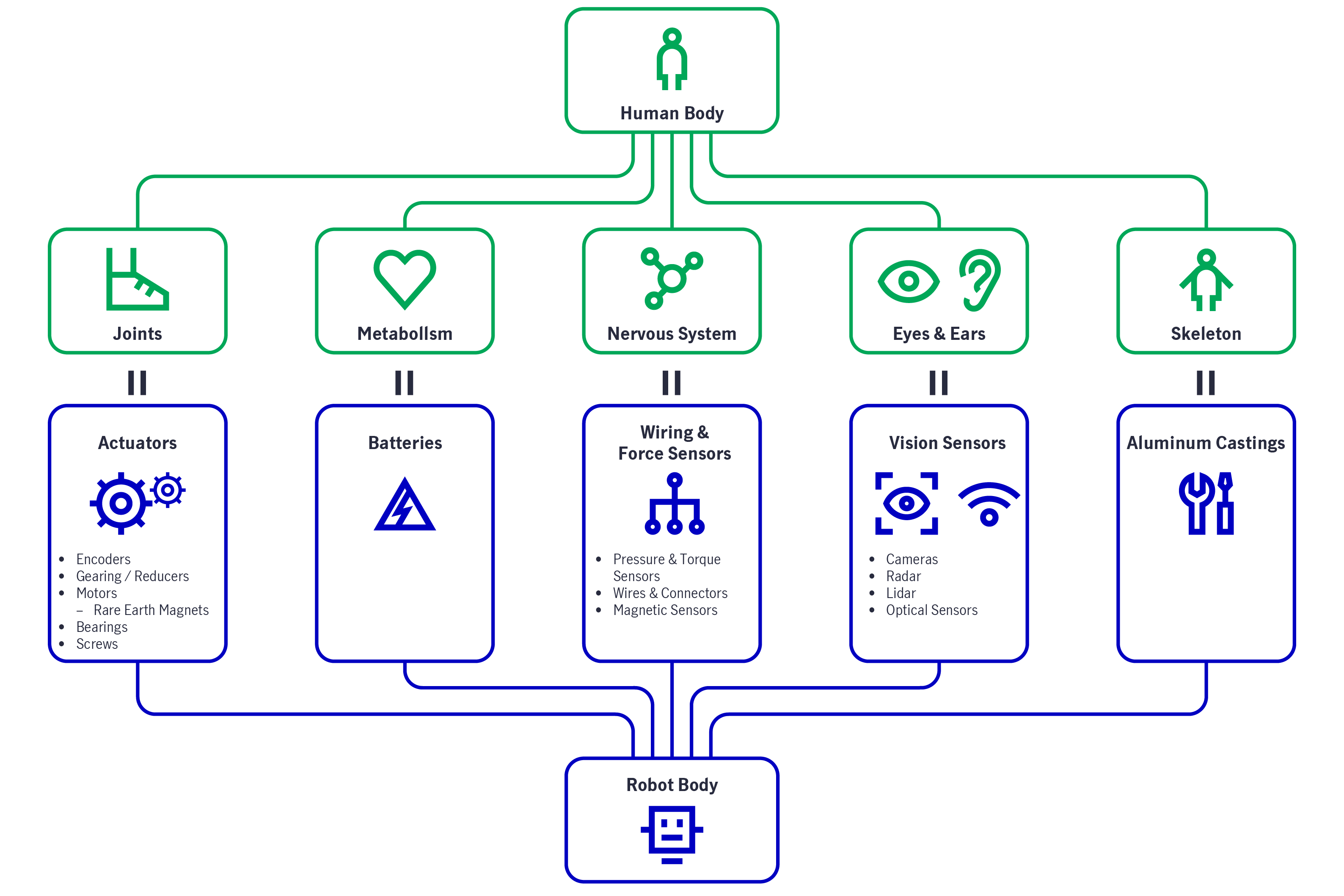

Dissecting the humanoid body4

The recent development and encouraging technological breakthrough are positive drivers for Greater China equity markets in 2025. We continue to favour technology, media, and telecommunications (TMT) and platform companies (with AI adoption acceleration, advanced manufacturing companies with go-global strategies, edge AI beneficiaries (e.g. AI smartphones and AI PCs), as well as the robotic supply chain.

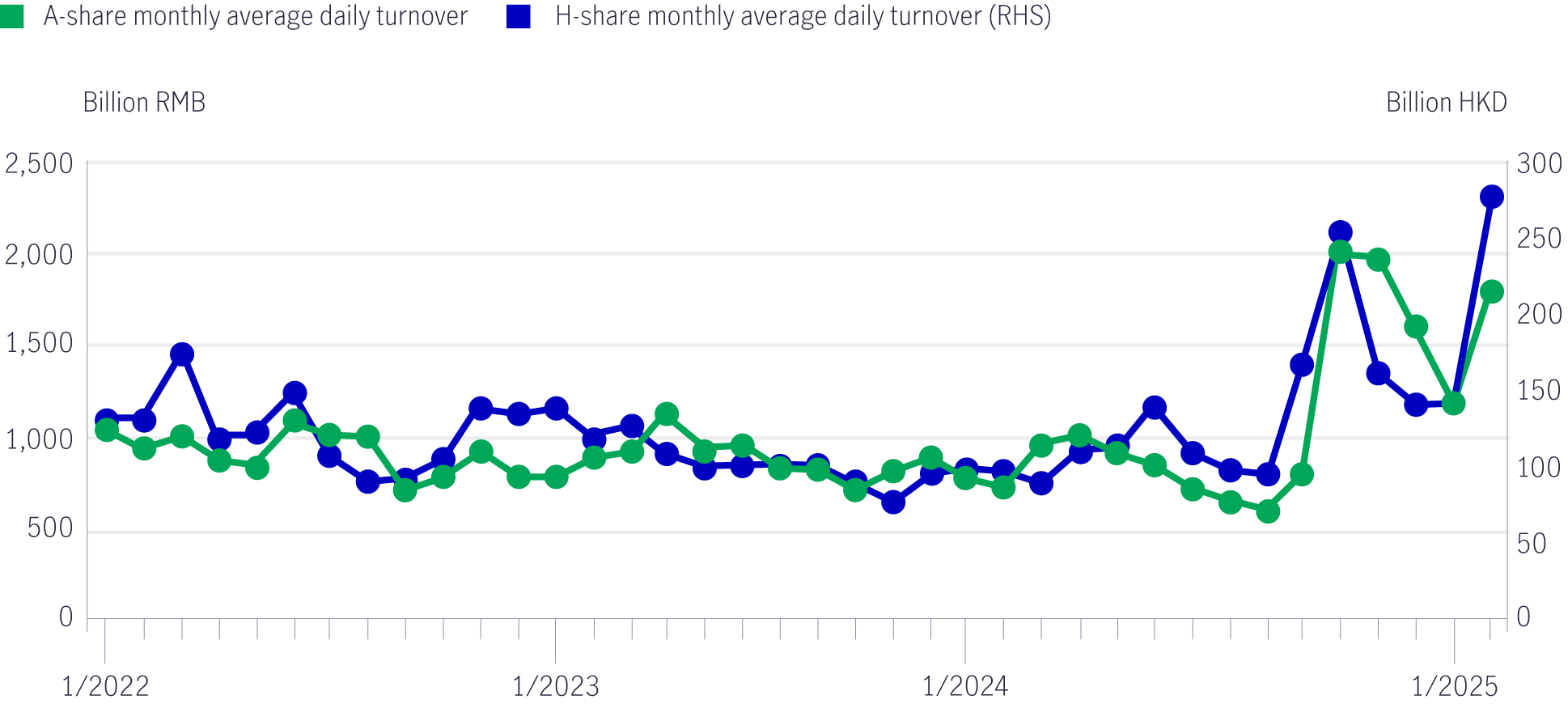

• Mainland China’s southbound flows remain strong.

Turnover in both A-share and H-share markets accelerated in January and February 2025

Source: Wind, Hong Kong Stock Exchange, HSBC GR, as of 26 February 2025. February 2025 data is up to 24 February 2025.

We see positive catalysts which further support the Greater China equity markets. These include supportive policies aimed at addressing the capital-raising needs of innovative high-end manufacturing and new-industry companies, a series of domestic growth measures announced during the NPC meeting, a recovering mainland property market, and potential additional recapitalization in the mainland banking sector. As we anticipate more innovation in the humanoid robot industry and faster development in autonomous driving, we continue to favour technology, media, and telecommunications (TMT) and platform companies, advanced manufacturing companies with go-global strategies, edge AI beneficiaries, as well as the robotic supply chain.

1 Bloomberg, data as of 6 March 2025. Total returns in USD. Past performance is not indicative of future performance.

2 NPC meeting, 5 March 2025.

3 Source: GS research, 11 February 2025.

4 Morgan Stanley Research.

Solutions for navigating market volatility amid U.S. tariff changes

Recent changes in U.S. tariffs have introduced new dynamics to the global market landscape, presenting both challenges and opportunities for investors. Understanding these developments is essential for making informed investment decisions. Marc Franklin, our Deputy Head of Multi-Asset Solutions, Asia, and Senior Portfolio Manager provided his view.

Quick thoughts on US reciprocal tariffs

The US President Donald Trump announced reciprocal tariff details on 2 April, 2025, which has introduced volatility to the financial markets. Alex Grassino, Global Chief Economist, along with the Multi-Asset Solutions Team (MAST), Macroeconomic Strategy Team, share their latest views.

2025 Outlook Series: Global Healthcare Equities

The Global Healthcare team maintains a sense of measured optimism for the performance of healthcare equities given the underlying key subsector strength in 2025.

Solutions for navigating market volatility amid U.S. tariff changes

Recent changes in U.S. tariffs have introduced new dynamics to the global market landscape, presenting both challenges and opportunities for investors. Understanding these developments is essential for making informed investment decisions. Marc Franklin, our Deputy Head of Multi-Asset Solutions, Asia, and Senior Portfolio Manager provided his view.

Quick thoughts on US reciprocal tariffs

The US President Donald Trump announced reciprocal tariff details on 2 April, 2025, which has introduced volatility to the financial markets. Alex Grassino, Global Chief Economist, along with the Multi-Asset Solutions Team (MAST), Macroeconomic Strategy Team, share their latest views.

Policy Normalisation in Japan: how high will the BoJ go?

The Bank of Japan has continued to raise interest rates in an effort to "normalize" monetary policy, presenting potential opportunities for discerning investors.