25 November 2021

Environmental and social issues often command the most attention in conversations related to environmental, social, and governance (ESG) investing, leaving the G out of the spotlight. However, corporate governance practices determine a company’s approach to building stakeholder value, including how it seeks to mitigate risks and pursue opportunities related to the E and S factors.

G stands for governance, which essentially means the policies and practices—and ultimately the values—that guide how a corporation is operated and governed. Despite being a core component of ESG, corporate governance is often overlooked, and poor governance practices can create fertile conditions for corporate malfeasance.

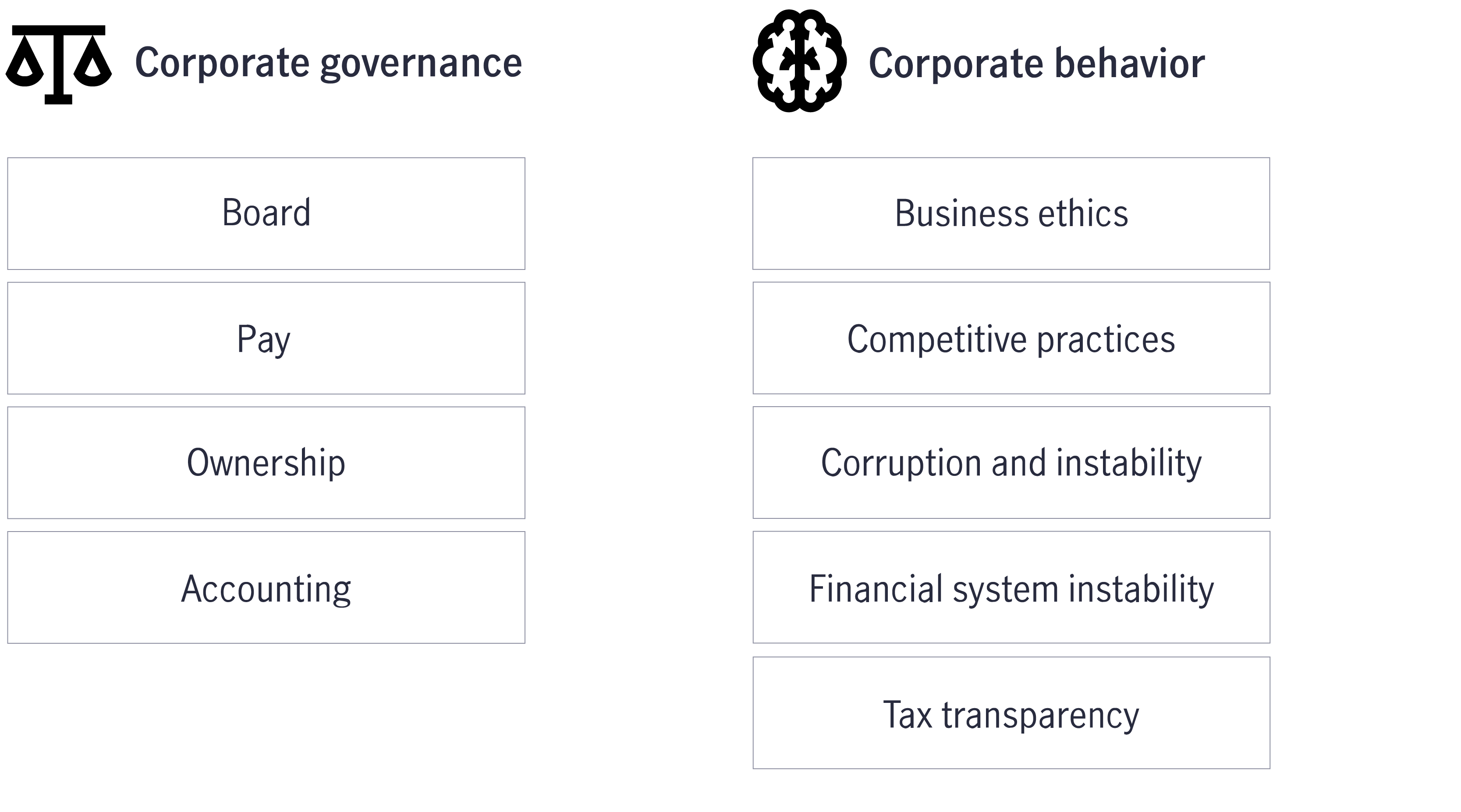

Governance may be understood as having two key components: corporate governance and corporate behavior. The governance piece involves the makeup of a company’s board, ownership, and management teams as well as its accounting, auditing, and corporate disclosure practices. Good governance goes beyond seeking diversity on the board in terms of gender, race, and background. It also involves ensuring that there is a good mix of people who are independent board members from outside the company and can provide a fresh perspective and real oversight, mixed with insiders who are more knowledgeable about the company. Through their oversight roles, independent directors and audit committees can also serve as gatekeepers and potentially reduce the risk of fraudulent accounting practices.

Under the corporate behavior umbrella, there’s the company’s business ethics, transparency, and regulatory compliance as well as the presence of any anticompetitive practices, corruption, or instability.

Good governance can:

Recent headlines about corporate governance among oil and gas majors and the growing attention paid to sustainability and ESG factors in general mean that publicly traded companies will continue to face pressure to expand their objectives beyond profits and shareholder interests and embrace a broader set of goals and stakeholders. Just as firms have the incentive to make products and services that people want to buy, they’re equally incented to approach governance and corporate practices generally in ways that make customers and clients comfortable doing business with them.

1 A case for modern governance: The high cost of governance deficits,” Diligent Institute, 5/21/19.

2 2018 Deloitte Millennial Survey,” Deloitte, 2018.

Dollar cost averaging: An easier way to withstand volatile markets

If investors wish to reduce volatility and benefit from long-term growth when the markets move up and down, the passive strategy of dollar cost averaging may be a feasible choice.

Risk Diversification

There is no free lunch. But Risk Diversification comes close in investing. A diversified portfolio was shown to optimize returns with lower volatility in the long run.

Better income – Aim for higher, not the highest

If we focus too much on chasing the highest yield and upfront yield generation, we could suffer from early capital depletion and miss the total return opportunity towards the later stages of the investment journey.

Dollar cost averaging: An easier way to withstand volatile markets

If investors wish to reduce volatility and benefit from long-term growth when the markets move up and down, the passive strategy of dollar cost averaging may be a feasible choice.

Risk Diversification

There is no free lunch. But Risk Diversification comes close in investing. A diversified portfolio was shown to optimize returns with lower volatility in the long run.

Better income – Aim for higher, not the highest

If we focus too much on chasing the highest yield and upfront yield generation, we could suffer from early capital depletion and miss the total return opportunity towards the later stages of the investment journey.