25 August 2021

Hui Min Ng, Portfolio Manager, Equities

Derrick Yee, Client Portfolio Manager, Asia Equities

Asia-Pacific Real Estate Investment Trusts (AP-REITs) have become increasingly popular with investors, and deservedly so. AP-REITs can offer a unique, diversified opportunity set across real-estate segments: from established Grade-A office space located in the region’s bustling cities to cutting-edge logistical facilities and the growing number of data centres that power cloud applications. This article is the first in a series of three that will provide a comprehensive introduction to this emerging asset class.

To begin with, we will examine the basic structure and benefits of holding REITs, benefits of portfolio inclusion, the fundamentals of AP-REITs, including the main sub-sectors, and their historical performance. We will then move onto to an in-depth exploration of how AP-REITs perform in different market environments (second article), focusing on movements in interest rates and inflation. Finally, we will look at how the asset class is positioned to perform in 2021 and beyond (third article).

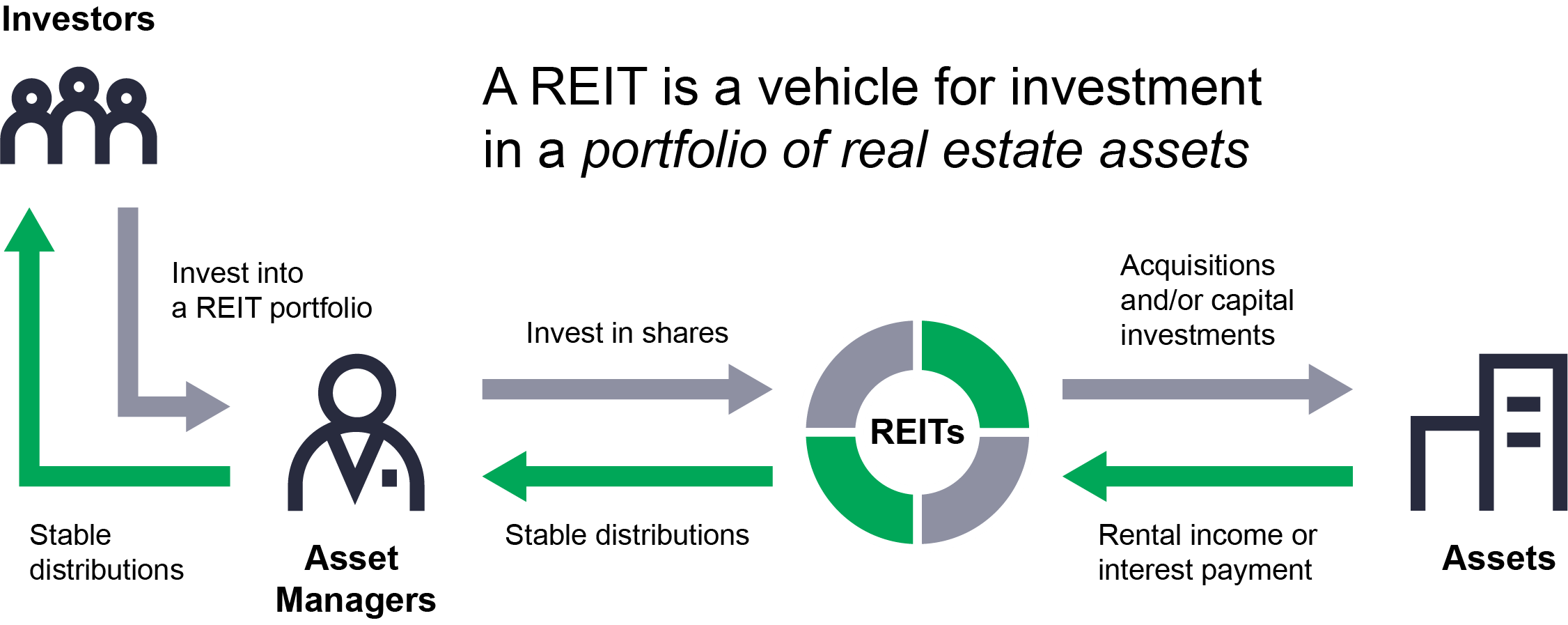

Investors should be aware of AP-REITs’ unique holding structure. Although this section will speak generally of the structure and benefits of REITs, they are also applicable to AP-REITs.

Trusts are mandated to pay out a certain percentage of their operating income to investors in the form of dividends1. When investing in a REIT portfolio, investors are purchasing a portfolio of real estate assets through equity shares (see Chart 1). REITs use the capital for acquisitions and management of properties; they aim at paying out the proceeds of received rental income to investors in a stable dividend stream.

With that in mind, there are numerous benefits for investors to hold AP-REITs; many investors hold them for the potential source of income, which include:

Although the first AP-REIT (ex-Japan) was listed in Australia in 1971, the concept is still relatively new to the region. Singapore has since emerged as the leading REITs hub2, while lesser-developed markets in Southeast Asia have gained notable momentum over the past five years.

The relative novelty of the asset class, coupled with a diverse range of opportunities, is proving particularly attractive in our view to investors. Indeed, the expanding REIT universe gives investors exposure not only to real estate in more developed economies, such as Australia and Singapore, but also emerging markets, like India and the Philippines, with the latter launching its first REIT in in 20203). Indonesia is also currently working on changes to REIT laws that should allow for listings.

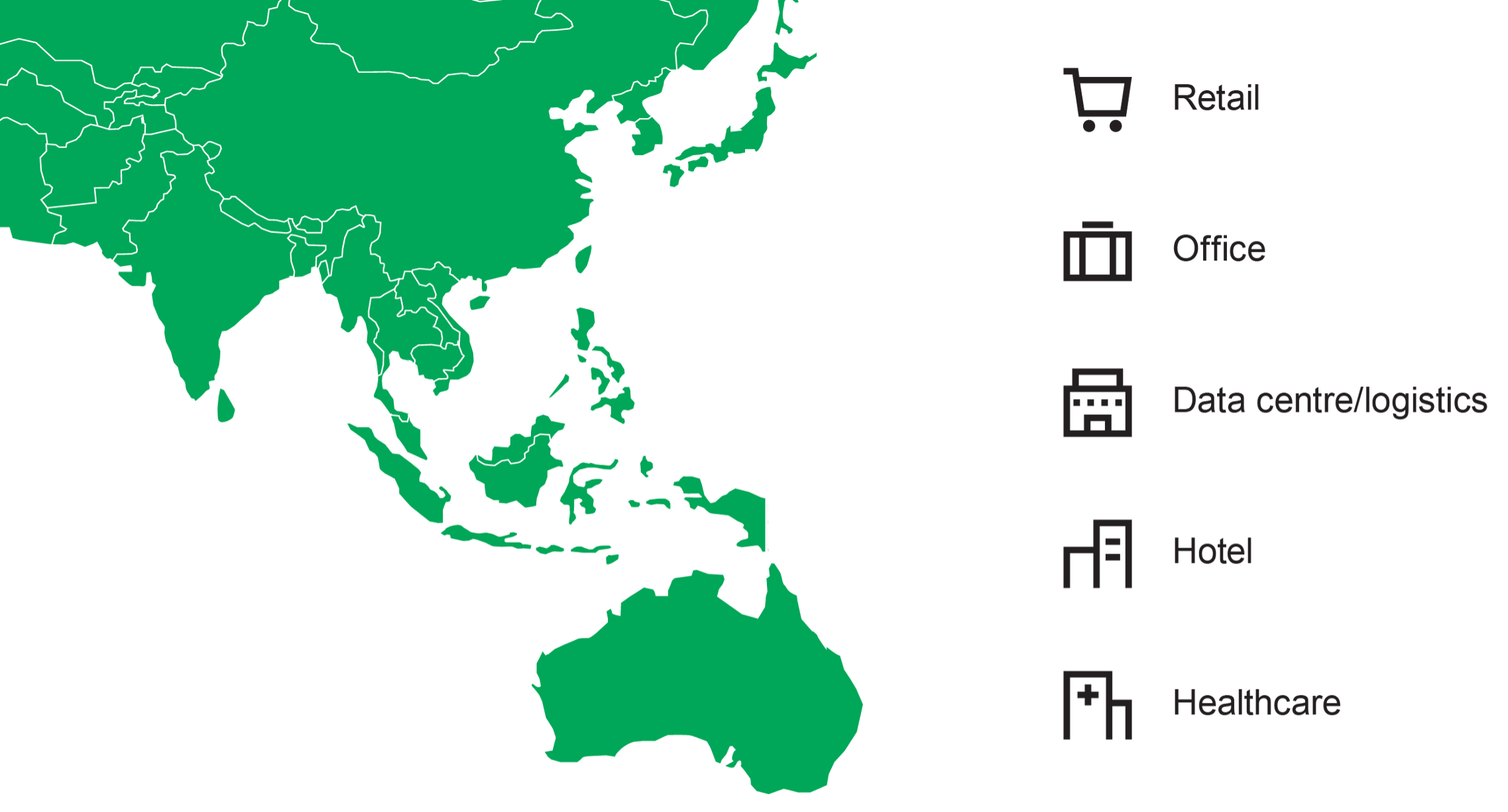

The diversity extends to real-estate segments that include established and newer industries. Office and retail REITs represent traditional real-estate plays around the region. Meanwhile, industrial REITs (incorporating data centres and logistics) and healthcare REITs reflect exciting innovations in the asset class. To add value, REIT management teams from these sub sectors would renovate properties and reorganise tenant contracts to generate continuous rental income.

Chart 2: Diversified sector exposure of Asia-Pacific REITs

Apart from the traditional retail malls, offices, industrial parks and hotels, AP-REITs also encompass new industries like data and logistics warehouses. We believe the emergence of e-commerce and cloud computing would benefit these new industries.

For illustration only

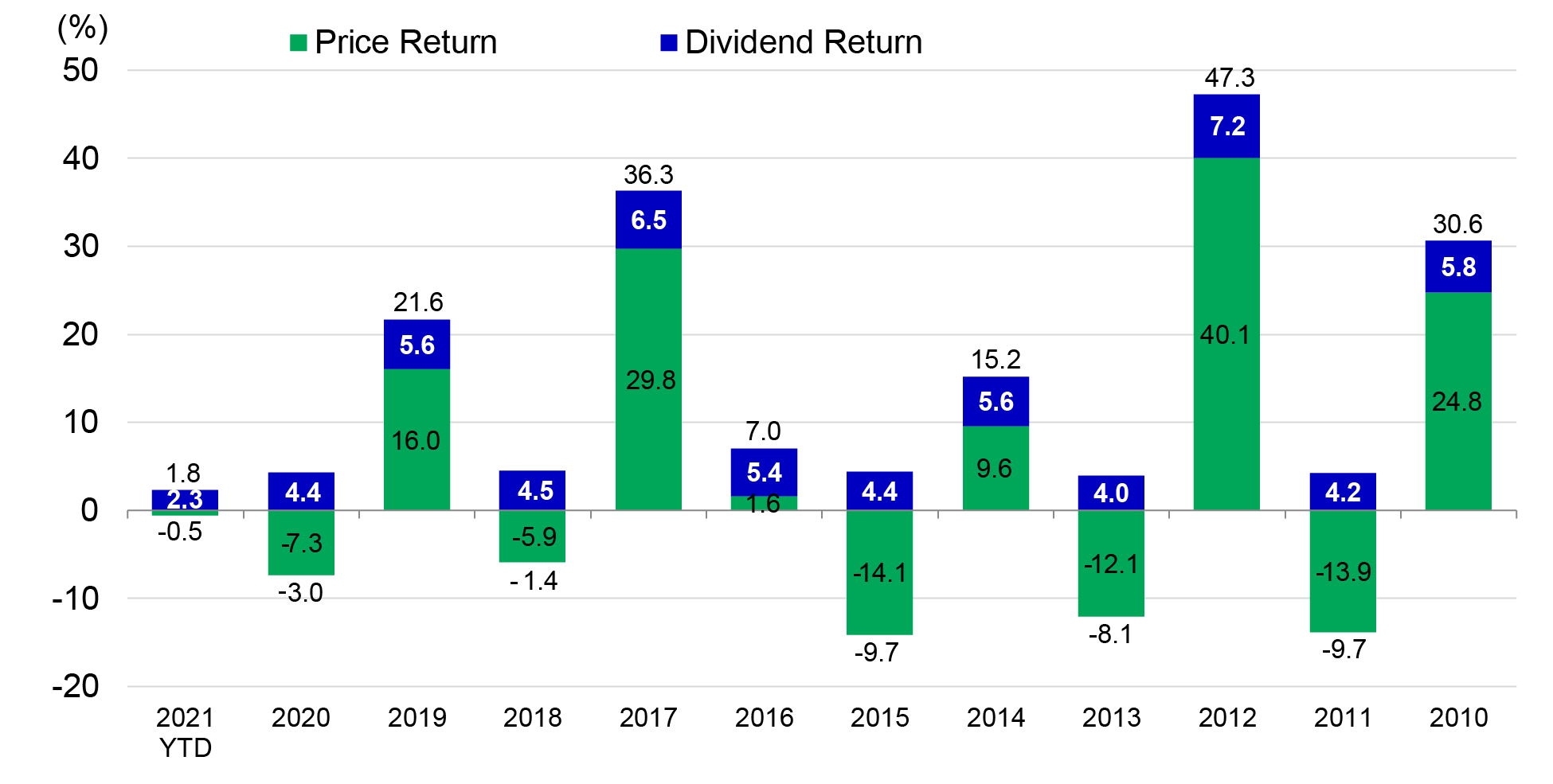

Despite the tumultuous performance of global equity markets over the past decade, AP-REITs have posted a positive total return on a cumulative basis from 2009 (as of 31 December) to 2021 (as of 30 June)4. Dividend payouts are the main reason: although the prices of AP-REITs have experienced volatility along with the broader market, the income element of the security has provided a cushion for investors. This defensive nature is a key reason why investors are interested in the asset class. In the next article, we will explore in more the elements contained in this chart, looking at how changes in inflation and interest rates impact AP-REITs.

Chart 3: Annual total returns of Asia ex Japan REITs (2010 – YTD 2021)

Source: Bloomberg as of 30 June 2021. Asia ex Japan REITs are represented by FTSE EPRA/NAREIT Asia ex Japan REITs Index (capped). Performance in US dollar.

1 The percentage of statutory payout varies by jurisdiction, but generally accounts for a significant portion of the trust’s earnings.

2 Bloomberg, 22 February 2020.

3 1st REIT listing shows PHL market ready to resume business | Philippine News Agency (pna.gov.ph), 13 August 2020.

4 Bloomberg, as of 30 June 2021. Asia ex-Japan REITs = FTSE/EPRA Nareit Asia ex Japan index (capped); For illustrative purposes only. Past performance is not an indication of future results.

Policy Normalisation in Japan: how high will the BoJ go?

The Bank of Japan has continued to raise interest rates in an effort to "normalize" monetary policy, presenting potential opportunities for discerning investors.

Here come the tariffs: why it’s too soon to draw conclusions

The recent announcement of U.S. tariffs on key global trading partners grabbed plenty of headlines but until we get more details, it's hard to assess the global economic implications.

Q&A: The role of Asia-Pacific bonds in an investor’s portfolio

We look at Asian dollar bonds from a broader perspective and their role in downside protection.

Policy Normalisation in Japan: how high will the BoJ go?

The Bank of Japan has continued to raise interest rates in an effort to "normalize" monetary policy, presenting potential opportunities for discerning investors.

Here come the tariffs: why it’s too soon to draw conclusions

The recent announcement of U.S. tariffs on key global trading partners grabbed plenty of headlines but until we get more details, it's hard to assess the global economic implications.

Q&A: The role of Asia-Pacific bonds in an investor’s portfolio

We look at Asian dollar bonds from a broader perspective and their role in downside protection.