26 June 2023

Christopher M. Chapman, CFA, Senior Portfolio Manager, Head of Global Multi-Sector Fixed Income

This sharp repricing in bond markets has had profound implications for fixed-income investors, especially for those who extended their risk budgets outside of historical ranges. Christopher M. Chapman, CFA, Senior Portfolio Manager, Head of Global Multi-Sector Fixed Income, believes now is an opportune time for investors to recalibrate their portfolio risk and their future expectations, considering both the current market environment and the next phase looming just over the horizon.

In the summer of 2007, as the extent of the global financial crisis was only just beginning to reveal itself, the yield on 10-year U.S. Treasuries slipped below the 5% threshold. In the sixteen years since then, 5% remains a level yet to be reached again. Quite to the contrary, yields on the 10-year hit an all-time low of just 0.52% in August 2020 and spent nearly all of that inauspicious year trading below 1%.1

Then, in the span of just 16 months, everything changed. Inflation jumped from less than 2% in the United States to 9%—a 40-year high.2 The U.S. Federal Reserve (Fed) had no choice but to respond with a series of rate increases, and the investment landscape was suddenly upended to become the one we face today, characterized by stubbornly high inflation, restrictive monetary policy, and potentially overvalued asset prices.

The silver lining for fixed-income investors, though, is that yield has finally returned to the bond markets. For instance, to date in 2023, yields on the 10-year U.S. Treasury have generally traded in the 3.5% to 4.0% range, which is twice the level from early last year. Meanwhile, the three-month T-bill has experienced an even more pronounced jump, from 0.08% at the start of 2022 to 5.10% at the end of April 2023.3 Income in 2023 is no longer quite so elusive.

Back to the aughts: yields are now at levels not seen since before the global financial crisis

Source: Bloomberg, as of 30 April 2023. It is not possible to invest directly in an index. Yield to worst is the lowest potential yield calculated by taking into account an issue’s optionality, such as prepayments or calls.

We’d be remiss to not acknowledge that income isn’t the only reason investors hold bonds. Reducing overall portfolio risk, especially relative to equity allocations, has always been one of the chief functions of fixed income. On that score, it’s been a particularly challenging period for investors.

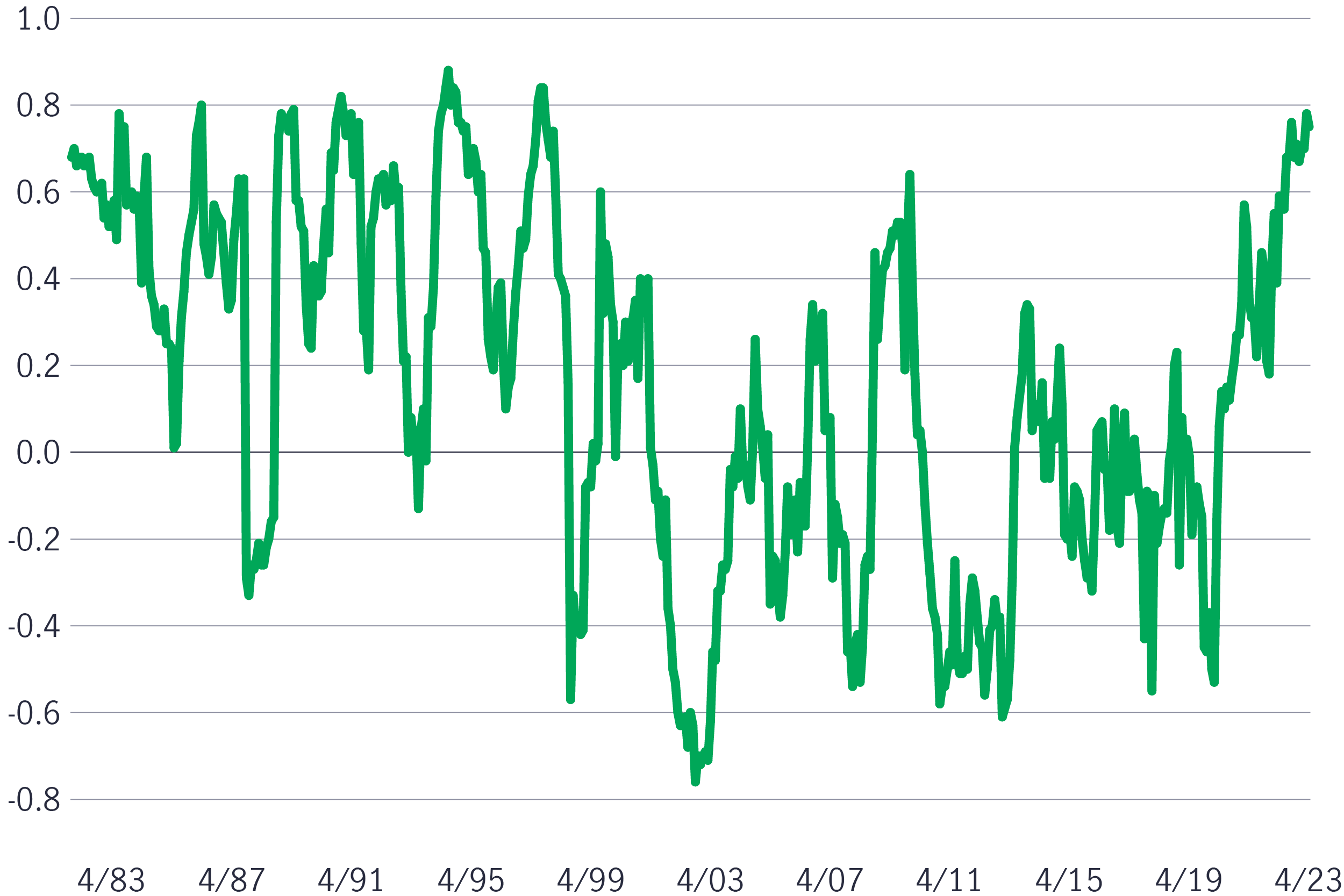

While the one-year correlation of the Bloomberg U.S. Aggregate Bond Index versus the S&P 500 Index has historically been highly volatile, we see that it tends to coalesce in a range from –0.2 to 0.2; for the decade prior to 2022 (2012–2021), the average was essentially zero, coming in at –0.02. Today, the correlation is almost 0.8 and is approaching a 50-year high.4 That’s been a bitter pill to swallow for investors who held fixed income to offset equity risk, particularly given last year’s decline of more than 18% for the S&P 500, as broad-based bond exposures also produced double-digit losses.5

Looking ahead, however, we believe correlations are likely to be more in line with their historical norms. While inflation may remain elevated for some time, we believe the initial shock has been priced into markets and that a slowdown in global growth will soon be the next major event for markets to metabolize. As risk appetites diminish, we anticipate the correlation of stocks and bonds to begin to fall. And a slowdown at this stage feels increasingly likely: The IMF recently pegged its outlook for global growth over the next five years at just 3.0 percent––the lowest five-year forecast it’s ever published.6

For all of these reasons and more, it seems likely that we’re on the cusp of a great reawakening for bond investors, as their collective appetite for higher-quality, intermediate-duration fixed-income securities—those more garden-variety holdings that were so unappealing for so long from an income perspective—returns in force.

Rolling 1-year correlations are abnormally high

Source: FactSet, as of 30 April 2023. It is not possible to invest directly in an index.

It’s likely no surprise that our belief about the most prudent way to navigate the coming transition is fundamentally no different than our baseline philosophy: that a broadly diversified, actively managed approach allows investors to proactively respond to fluctuating risks in the markets. We see several attractive opportunities worth highlighting further.

Interest rate positioning: As we’ve illustrated, since investors are now being compensated appropriately (in the form of yield) for the risk of any additional rate hikes, we think now is the time to begin embracing interest rate risk: The higher income base investors earn would act as an offset to price losses should yields move materially higher from here. We also see a benefit to emphasizing global diversification when it comes to duration exposure. We believe as we move further into a late-cycle environment, there could also be benefits in allocating to countries where local economies may be more sensitive—or vulnerable—to higher interest rates. We’d expect those countries to begin cutting policy rates before the Fed is ready to move.

Credit positioning: Within corporate bonds, we hold a positive outlook for investment-grade and select higher-quality high-yield bonds that operate in sectors poised to benefit from the broader economic reopening, including travel, leisure, and food services. We also believe that commodity producers and more defensive industries such as healthcare, utilities, and non-cyclical consumer segments can perform well in the current environment. Select securitized assets are also attractive as they can diversify a portfolio away from traditional corporate credit risk. Within that space, we’re finding attractive offerings in commercial mortgage-backed securities tied to life sciences, traditional agency mortgage-backed securities, and also unique asset-backed securities.

Currency positioning: Our analysis suggests the USD likely peaked in late 2022 and, looking out over the medium term, we believe a less hawkish (or possibly easing) Fed policy, coupled with the potential for a shallow U.S. recession, could result in the dollar falling further. A weaker dollar would benefit international fixed-income markets; subsequently, we believe non-North American currencies have become more attractive, particularly in places like the Eurozone where interest rates have normalized. Select local emerging-market currencies from jurisdictions where central banks have preemptively raised interest rates also look attractive from both a carry and total return perspective. We would caution, however, that within emerging markets, country selection can prove of paramount importance given elevated geopolitical, political, and liquidity risks experienced in the sector. We prefer higher quality, liquid emerging markets with strong fiscal positions, independent central banks, and floating exchange rates (rather than pegged). Targeted exposures in Latin America (LATAM), where investors can pick up double-digit yields on short-term bonds, and Asia, which should benefit from peaking inflation and better growth prospects on the back of China’s economic reopening, both look appealing.

1 U.S. Department of the Treasury, as of 30 April 2023.

2 Bureau of Labor Statistics, as of 30 April 2023.

3 Federal Reserve Bank of St. Louis, as of 30 April 2023.

4 Bloomberg, as of 30 April 30, 2023.

5 Standard & Poor’s, as of 30 April 2023.

6 International Monetary Fund, World Economic Outlook, April 2023.

Solutions for navigating market volatility amid U.S. tariff changes

Recent changes in U.S. tariffs have introduced new dynamics to the global market landscape, presenting both challenges and opportunities for investors. Understanding these developments is essential for making informed investment decisions. Marc Franklin, our Deputy Head of Multi-Asset Solutions, Asia, and Senior Portfolio Manager provided his view.

Quick thoughts on US reciprocal tariffs

The US President Donald Trump announced reciprocal tariff details on 2 April, 2025, which has introduced volatility to the financial markets. Alex Grassino, Global Chief Economist, along with the Multi-Asset Solutions Team (MAST), Macroeconomic Strategy Team, share their latest views.

Takeaways from China’s NPC Meeting & upcoming drivers for Greater China equity market

In addition to the recent breakthroughs in AI and humanoid robot development, we observe other positive catalysts that further support the region’s market.

Solutions for navigating market volatility amid U.S. tariff changes

Recent changes in U.S. tariffs have introduced new dynamics to the global market landscape, presenting both challenges and opportunities for investors. Understanding these developments is essential for making informed investment decisions. Marc Franklin, our Deputy Head of Multi-Asset Solutions, Asia, and Senior Portfolio Manager provided his view.

Quick thoughts on US reciprocal tariffs

The US President Donald Trump announced reciprocal tariff details on 2 April, 2025, which has introduced volatility to the financial markets. Alex Grassino, Global Chief Economist, along with the Multi-Asset Solutions Team (MAST), Macroeconomic Strategy Team, share their latest views.

Takeaways from China’s NPC Meeting & upcoming drivers for Greater China equity market

In addition to the recent breakthroughs in AI and humanoid robot development, we observe other positive catalysts that further support the region’s market.