29 July, 2020

Steven Slaughter, Lead Portfolio Manager, Global Healthcare Strategy

Amid the pandemic and volatile global markets, the healthcare sector has emerged as one of the best-performing areas of the market this year1. We look at the sector’s resilience in difficult market and economic conditions and provide compelling insights for developments in the sector.

The COVID-19 pandemic has upended everyday life and financial markets. As the human toll measurably increases, this pandemic has galvanised scientists and investors alike to search for a potential cure. While the spread of COVID-19 may be unique in its compressed time frame, the healthcare sector is well versed in addressing similar clinical challenges with profound health implications daily, including pursuing treatments and cures for cancers, diabetes and Alzheimer’s disease, to name a few. Indeed, it is these unmet needs, and their potential economic payoff, that shape the sector’s bright outlook which can offer unique opportunities.

The healthcare sector has come to the forefront against the backdrop of recent unprecedented volatility. During the first quarter of 2020, COVID-19's worldwide advance sent global share prices into bear-market territory2.

Healthcare then emerged as the best performing sector following the sharp selloff in March, and in April, when the market rebounded swiftly on the prospect of potential peaking coronavirus cases. In May and June, the sector’s returns moderated somewhat as share prices normalised, despite important medical advances emerging in the diagnostic, therapeutic and vaccine landscape for COVID-19.

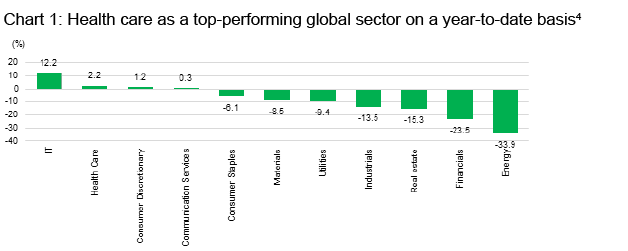

Overall, healthcare moved higher by roughly 2.2% through the first half of 2020 compared to a roughly 5.5% loss for the broader global equities index (see Chart 1)3, outperforming many sectors.

Q&A: The role of Asia-Pacific bonds in an investor’s portfolio

We look at Asian dollar bonds from a broader perspective and their role in downside protection.

Understanding the preferred securities market

Preferred securities occupy a unique niche in financial markets, blending elements of both debt and equity. In this Q&A, we explore the different types of preferred securities and delve into why their versatile nature makes them an attractive option across a wide range of market environments.

Beyond the hyperbole: three macro takeaways from the 2024 US elections

What investors and policy watchers should take away from the 2024 election results depends, in part, on time horizon.

Although some of the volatility has subsided, mainly due to unprecedented fiscal and monetary stimulus, markets may still face a tough climb given the challenging economic conditions. That said, we believe that the secular drivers of the healthcare industry position it well in the current environment and beyond.

Three factors underpin the case for healthcare: the sector’s defensive characteristics, its strong organic growth prospects, and relatively attractive historical valuation levels.

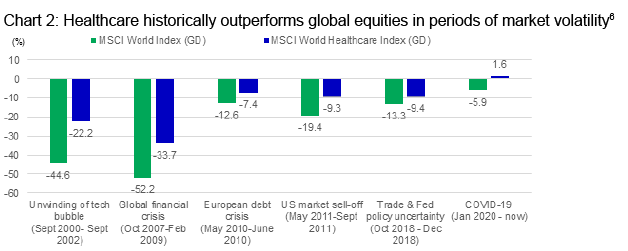

Healthcare has historically delivered strong performance, particularly during economic downturns. Over the past 25 years (1995–2020), global healthcare equities have, on average, outperformed global equities5. These excess returns have been more pronounced during periods of heightened market volatility or economic distress. (see Chart 2).

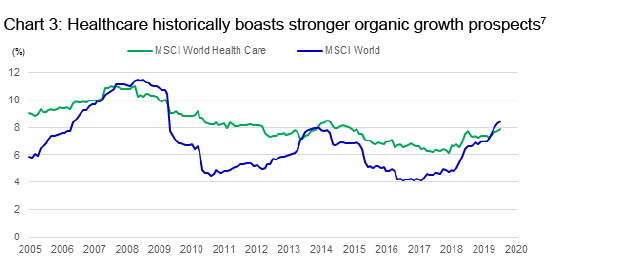

The sector’s defensiveness stems from the supply-and-demand dynamic of healthcare products and services. While cyclical industries usually experience a sizable reduction in demand during economic downturns, healthcare demand generally remains resilient, with consumers having an inelastic appetite for medical goods and services. We also believe that the sector is poised for strong organic growth. With an economic recession looming (or having landed) in several markets, it is worth noting that healthcare has traditionally shown higher long-term sales per share (SPS) growth compared to the broader market (see Chart 3).

And despite the sector’s recent outperformance and positive growth outlook, valuations are still reasonable. Healthcare equities, both in the US and globally, maintain reasonable valuations based on forward P/E multiples (price-to-earnings per share) versus the broader market indices.

Based on these industry drivers, we believe that stock selection remains a critical factor in facilitating outperformance. Accordingly, we think that several industry segments have potential and are constructive on the following areas:

Our view on healthcare insurers remains constructive as dislocation in medical procedures and surgeries may prove a strong profit tailwind in the short and intermediate term. Conversely, we expect to see pandemic-induced pressures on healthcare providers and select services companies going forward.

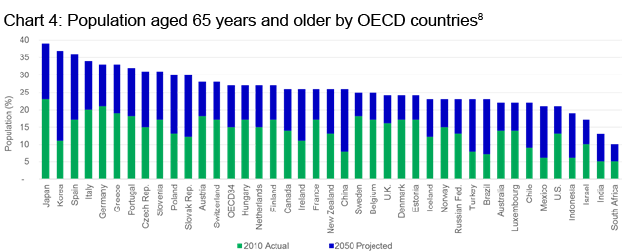

It should be said that the case for healthcare is not limited to favourable cyclical drivers associated with the COVID-19 pandemic. There are also several long-term secular trends creating opportunities in the sector:

Healthcare companies continue to pursue unmet medical needs beyond COVID-19. These include central nervous system disorders (CNS), metabolic syndrome/obesity, and rare/orphan disorders.

The current pandemic presents unprecedented challenges for global leaders and the medical community. However, in a brief period, medical research has produced new diagnostics, therapeutics, and prospective vaccines, enabling the identification/treatment/prevention of COVID-19 infections. The cases for healthcare are compelling, given the advances being made in the treatment of diseases now and potential developments that may emerge in the future.

1 Source: FactSet, as of 30 June 2020. MSCI Healthcare was the second-best performing global equities sector with a total return of 2.19% year-to-date after Information Technology (returning 12.21% year-to-date).

2 Source: Bloomberg. On 23 March, the MSCI World index was mired in a bear market, down 34% from its February peak.

3 Source: Bloomberg, as of 30 June 2020. The MSCI World Health Care Index gained 2.19% (total return) through 30 June 2020, while the MSCI World Index fell by 5.5% over the same time period.

4 Source: Bloomberg, as of 30 June 2020.

5 Source: MSCI World Health Care Index posted 11.02% annualised returns versus 7.25% for MSCI World from 12/31/1994 to 04/30/2020.

6 Source: Morningstar Direct as of 30 June 2020.

7 Source: Bloomberg as of 30 June 2020.

8 OECD Historical Population Data and Projections Database, 2013

Q&A: The role of Asia-Pacific bonds in an investor’s portfolio

We look at Asian dollar bonds from a broader perspective and their role in downside protection.

Understanding the preferred securities market

Preferred securities occupy a unique niche in financial markets, blending elements of both debt and equity. In this Q&A, we explore the different types of preferred securities and delve into why their versatile nature makes them an attractive option across a wide range of market environments.

Beyond the hyperbole: three macro takeaways from the 2024 US elections

What investors and policy watchers should take away from the 2024 election results depends, in part, on time horizon.