12 March 2024

Steven Slaughter, Lead Portfolio Manager

CJ Sylvester, Portfolio Manager

Steven Slaughter, Lead Portfolio Manager, and CJ Sylvester, Portfolio Manager from the Global Healthcare Team, maintain a sense of considerable optimism for the performance of healthcare equities and the underlying key subsector themes in 2024.

Suffice it to say that 2023 was a tumultuous year for equity markets and the healthcare sector in particular. At the outset of the year, post-pandemic global markets were poised for continued monetary tightening in response to ongoing global inflationary pressures. Many (if not most) investors anticipated that this environment would precipitate economic slowing and a possible recession.

Despite these early pressures, global equity markets performed well in the fourth quarter of 2023, as the worries that had weighed on sentiment earlier in the year rapidly dissipated. In November, The U.S. Federal Reserve (Fed) indicated it was likely on track to begin cutting rates in 2024, given rapidly decelerating inflation. Other central banks were expected to follow suit, removing a headwind that had pressured investor sentiment for almost two years.

Accordingly, the broader global markets successfully scaled this multi-faceted “wall of worry” by the year’s end, posting strong absolute returns (the MSCI World Index advanced 23.8%, the S&P 500 Index returned 25.7%, and the Nasdaq100 surged 53.8% in 20231). U.S. large/mega-cap technology names primarily drove this narrow market leadership amid Wall Street’s newly found enthusiasm for artificial intelligence (A.I).

Specific to healthcare, the MSCI World Health Care Index generated relatively modest returns in 2023 of 3.8%2. The sector’s underperformance is a substantial departure from the exceptional relative outperformance seen in 2022 when the healthcare subsector outperformed the broader MSCI benchmark by nearly 1500 basis points. That said, as a defensive sector with substantial growth potential, healthcare stocks have typically held up better in down markets or in falling interest rate environments. Of note, on a 10-year basis, healthcare equities continued to outperform the broader market.

Entering 2024, we maintain a sense of considerable optimism for the performance of healthcare equities going forward. This is being driven by multiple considerations:

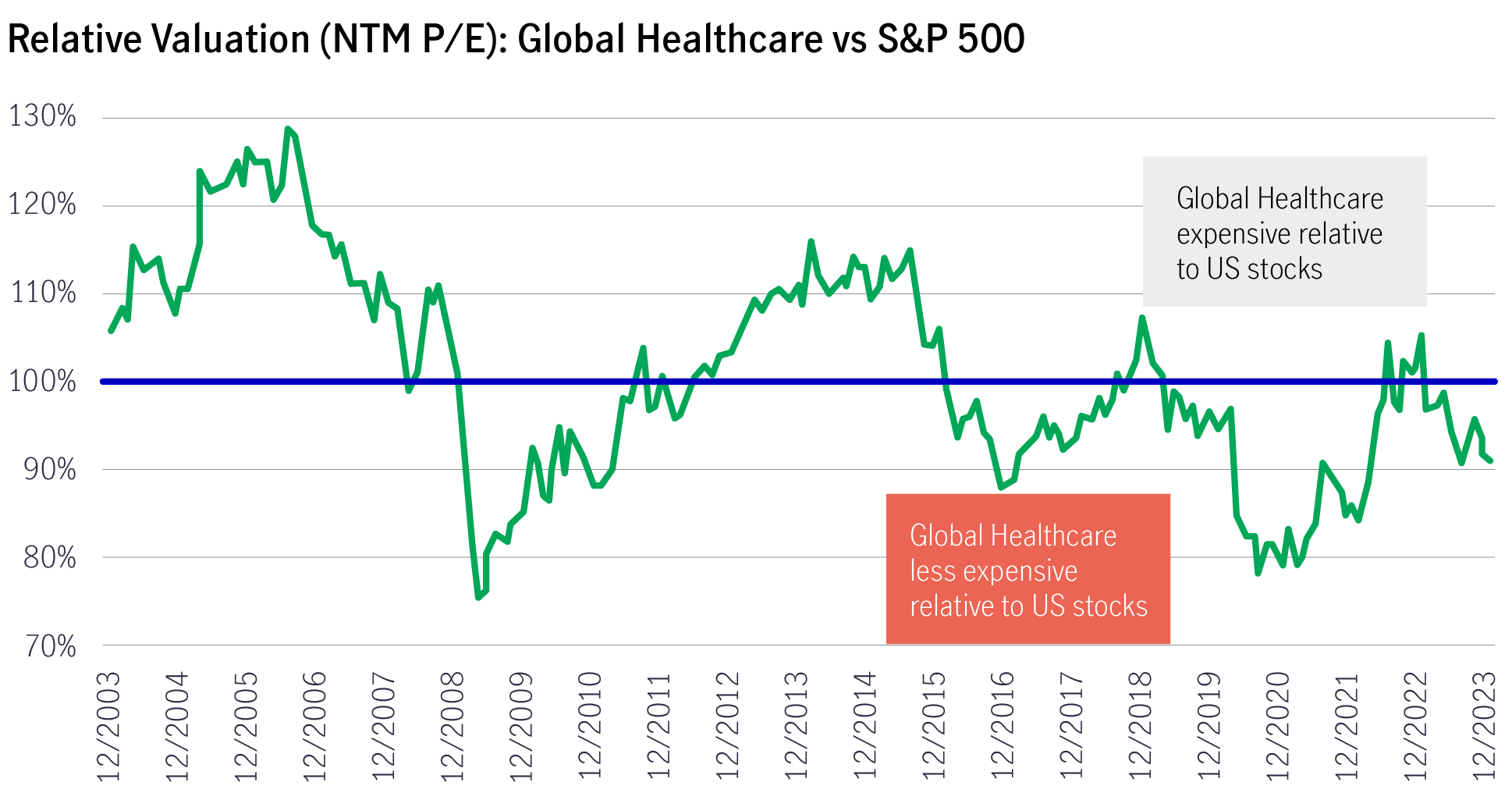

Chart 1: Global healthcare equities’ relative valuation versus the broader market in various cycles

Source: Factset, as of December 2023.

We continue to emphasise a bottom-up fundamental research process informed by our assessment of emerging scientific and medical trends, coupled with a thorough intrinsic valuation analysis. This approach should ensure that our capital allocation focuses on companies tackling important unmet medical needs, pursuing underappreciated market opportunities, and/or demonstrating an ability to bend the healthcare cost curve.

![]()

Biopharmaceuticals

Constituting roughly two-thirds of our investable healthcare universe, we remain focused on biopharma companies with best-in-class product portfolios serving patients in disease states with inelastic demand. Our previous work related to structural changes in a “post pandemic” world supports the continued urgency to effectively manage other pre-existing disease states (cancer, metabolic syndrome, central nervous system and immunologic disorders), which our research suggests predispose these comorbid patients to higher morbidity and mortality post-Covid. Accordingly, this has led us to maintain our optimism towards companies focusing on treating hematologic cancers, cardiovascular disease, asthma, Alzheimer’s disease, and diabetes/obesity.

A final biopharma comment: It is worth noting that many of these important biopharma advances in recent years have accrued to a rather concentrated subset of the overall investment universe (for example, the two leading GLP-1 competitors command roughly 98% of the current market). Simply put, we’ve seen a fairly substantial bifurcation between the “haves” and “have nots”.

The “haves” continue to allocate their incremental capital towards emerging research platform technologies in diseases of unmet medical need, precipitating diverse and seemingly de-risked pipelines, funding needed capital investments, and pursuing targeted mergers and acquisitions (M&A) with their excess cash flow for the benefit of their shareholders.

The “have nots” continue to chase well-established therapeutic categories with undifferentiated pipeline assets. They struggle with disproportionate exposure to “patent cliffs” given their lack of breadth of therapeutic category participation and frequently overpay for “bulk” and/or late-stage M&A targets (or their own shares via ill-advised share repurchases), all to the detriment of their shareholders.

Moving into 2024, with a healthy deference to our intrinsic valuation methodology, we remain convinced of the continued and attractive investment opportunities among the “haves”.

![]()

Medical technology and life science tools

Fundamentals within select areas of the global healthcare equipment/supplies and life science tools/services industries remain attractive. Additionally, we believe select companies will continue to reap the benefits of the excess revenues generated pre pandemic, with more measured incremental cash flows in the now endemic state of Covid-19. We expect several of these companies will generate above-market returns as the incremental research, capital expenditure and pipeline investments they have implemented reach fruition in the coming quarters and years.

For example, a diversified med-tech company that generated some US$25 billion of incremental revenue during the three-plus years of Covid-19 testing has deployed this excess cash flow into a multi-year “pull forward” of selected med-tech pipeline projects, which are now attaining requisite regulatory approvals. These new products include a first-in-class “dual analyte” continuous glucose monitor, a new leadless pacemaker, a “first-in-class” bioresorbable peripheral vascular stent, and two leading “clip” devices for mitral/tricuspid valve regurgitation. These innovative advances should drive above-market growth for the company’s diabetes and cardiovascular device businesses for years to come.

Aside from diabetes and cardiovascular disease, additional med-tech markets showing solid growth prospects as we enter 2024 include electrophysiology (EP), robotic surgery, large joint replacement, spinal orthopaedic and contact lens markets. Underlying demand in these EP, surgical and vision subsegments appear to be driven by persistent product innovation, pent-up post-pandemic demand, strong geographic expansion in emerging markets, as well as the continued, unremitting ageing of citizens in developed markets. We expect that these tailwinds will persist well beyond 2024.

Conversely, several previously “high growth” medical technology markets appear to be experiencing considerable headwinds at present. These include insulin pumps and obstructive sleep apnea devices, which are experiencing initial pressures from GLP-1 therapeutics that may accelerate over time. Additional headwinds are emerging in the transcatheter aortic valve replacement market (TAVR), which is slowing due to pricing pressures and new market entrants. The clear aligner/dental implant markets are also slowing due to global pricing pressures, competitive entrants, and disposable income constraints.

Various life science tools companies also accrued substantial excess cash flows during the pandemic, both from antigen/antibody testing and vaccine/therapeutics bioprocessing revenues. While several have redeployed these excess cash reserves into targeted capital expansion and M&A activities (i.e. building out manufacturing/fill & finish capacity, acquiring new competencies in emerging technologies), the short-term returns on these investments have proven more mixed. The contract manufacturing organizations, in particular, experienced a large “air pocket” of excess capacity in sterile syringe fill/finish, as Covid-19 vaccine demand dropped precipitously in 2023.

Similarly, many global bioprocessing companies experienced a substantial “pull forward” of excess product sales (e.g. filters, pipette tips, culture media) in the teeth of the pandemic, given supply-chain disruptions and excessive lead times in the 2021-2022 period. These same companies experienced a substantial shortfall in product demand throughout most of 2023, an “air pocket” that now appears to show initial signs of receding as excess inventories begin to burn off.

Accordingly, many of the tools companies that meaningfully underperformed both the healthcare and broader market indices in 2023 (some down upwards of 40-60% on the year) appear poised for improved performance in 2024 as excess supply/capacity wanes, driven by inventory normalisation and increasing demand for new products (oncology biologics, cell therapies, GLP-1’s etc.).

We remain favourably predisposed to the higher “recurring revenue” tools companies vis-à-vis those with more “big ticket” capital equipment exposure. In particular, the capital-heavy businesses have experienced pockets of weakening demand in core product markets (e.g. mass spectrometry, flow cytometry, etc.), particularly in the key mainland China market in recent quarters, a weakness that may be expected to persist absent the re-emergence of government stimulus spending.

In sum, stock selection will be paramount in the medical technology and tools/services subsectors in 2024. We maintain strong conviction in our current positioning in this regard, and with deference to their historically stretched valuations, we look forward to differentiated performance going forward.

![]()

Healthcare providers and services/healthcare technology

Within the healthcare providers & services industry, we continue to see solid value in select supply-chain companies, specifically pharmaceutical wholesalers. We expect these companies will improve their margins from accelerating drug inflation and continued recovery in prescription volumes. These companies have consistently demonstrated solid capital allocation competency, investing their excess cash flows in higher-margin services businesses (e.g. oncology practice management, speciality pharmaceutical distribution, prescription technology/services, etc.), thereby improving their consolidated operating margin profiles to the considerable benefit of their shareholders over time. Given their rational valuations and solid earnings growth/return on invested capital (ROIC) profiles, we consider these positions to be core holdings going forward.

We have also maintained our positioning in select healthcare insurers commensurate with recently improved growth profiles despite the recent and expected reversion of a pandemic-induced reduction in office visits and surgeries in the Medicare population. We maintain a somewhat “out of consensus” perspective on the long-term attractiveness of the largest Medicare Advantage (MA) insurers, in particular, despite the recent contraction in the 2024 fiscal year per capita reimbursement levels implemented by the U.S. Centres for Medicaid and Medicare Services (CMMS) late last year.

Enrolment leadership in MA portends a structural cost advantage in this, the highest organic growth (i.e. +6-8% per annum) subsegment of the U.S. health insurance ecosystem. We believe that long-term demographics (i.e. more than 10,000 citizens per day reach age 65 in the U.S., thus potential customers for MA plans) underpin the solid long-term prospects for this market, particularly in the current U.S. election year (as seniors generally love their MA plan benefits, and generally show up at the polls). Relative to Medicaid and the Affordable Care Act (also known as “Obamacare”) Exchange beneficiary pools, we see less economic and political risk for dramatic changes to reimbursement going forward with Medicare Advantage, particularly if the Republicans retake the Senate and Presidency.

All eyes are on the Inflation Reduction Act

As the largest biopharmaceutical market in the world, with the second highest aggregate pricing globally, the U.S. biopharma market has commanded considerable research efforts from our team over the past 18 months following passage of the Inflation Reduction Act (IRA). Our research suggests that the IRA U.S. drug pricing “Negotiations” (and corresponding changes to the Medicare Part D benefit restructuring) hold the potential for meaningful changes to the economics of pharmaceutical benefits. In sum, we anticipate potential economic headwinds for biopharma companies going forward (given shorter effective market exclusivities, higher payment responsibilities, probable changes to formulary structures, etc.).

The government-dictated truncation of established U.S. pricing for “late in life” Rx products4 will dramatically truncate the economic returns associated with dozens of major pharmaceutical products and has already begun to impact capital allocation decisions on the part of industry participants (in anticipation that this law may be fully implemented as written).

In addition, the Prescription Benefit Manager (PBM) entities (primarily subsidiaries of diversified insurers) may see their Medicare Part D margins constrained beginning in 2025, given their higher burden of coverage (60%, up from a previous 15%) in the “catastrophic” stage of beneficiaries’ plans.

Presumably somewhat non-consensus once again, our recent diligence efforts vis-à-vis pharma’s ongoing litigation challenging the provisions and implementation of the IRA lead us to believe that one or more of the nine current federal lawsuits may prove successful in restricting initial implementation of the law in 2024 (by means of a preliminary injunction). Should one or more of these lawsuits attain an industry-favourable District Court decision, we would anticipate eventual elevation to the Supreme Court of the United States (SCOTUS), with a SCOTUS final ruling likely in 2025 (i.e. before the final implementation of drug “negotiation” in 2026).

Notwithstanding these potential risks, we believe the unprecedented innovation and medical advancements among select companies today should provide a fertile opportunity set for market beating growth. As such, we continue to view this as an opportune time to be investing in the sector given its historically defensive characteristics, strong organic growth and persistent demand for products and services over various economic cycles.

Overall, we believe investors may benefit by combining fundamental research with an assessment of emerging scientific and medical trends within healthcare, coupled with a thorough intrinsic valuation analysis.

1 eVestment, as of 31 December 2023

2 Factset, as of December 2023

3 Fed expects to make three rate cuts this year, says Jay Powell (ft.com)

4 Rx Product means a pharmaceutical product for use in humans that has been approved by the FDA for sale to customers and/or patients in the Territory with a prescription written by a Professional.

3428149

2025 Outlook Series: Global Healthcare Equities

The Global Healthcare team maintains a sense of measured optimism for the performance of healthcare equities given the underlying key subsector strength in 2025.

2025 Outlook Series: Global Semiconductors

From an investment perspective, we believe a diverse, global portfolio of high conviction, quality companies in these target industries offers an attractive, long-term risk-return profile underpinned by robust fundamentals, significant tailwinds, structural demand growth and earnings visibility.

2025 Outlook Series: Asia Fixed Income

As rate paths shift and market volatility is expected to increase across global rates, credit, and currency markets, we explain why the sub-asset classes within the Asian fixed income space (Asia high yield, Asia investment grade, and Asia local currency) could provide shelter with opportunities.

2025 Outlook Series: Global Healthcare Equities

The Global Healthcare team maintains a sense of measured optimism for the performance of healthcare equities given the underlying key subsector strength in 2025.

2025 Outlook Series: Global Semiconductors

From an investment perspective, we believe a diverse, global portfolio of high conviction, quality companies in these target industries offers an attractive, long-term risk-return profile underpinned by robust fundamentals, significant tailwinds, structural demand growth and earnings visibility.

2025 Outlook Series: Asia Fixed Income

As rate paths shift and market volatility is expected to increase across global rates, credit, and currency markets, we explain why the sub-asset classes within the Asian fixed income space (Asia high yield, Asia investment grade, and Asia local currency) could provide shelter with opportunities.