31 July 2023

As the saying goes, “What goes up must come down”. Given that the US Federal Reserve (Fed) has raised interest rates to their highest level since 2007, investors will now look to “when” borrowing costs (or deposit rates) will start to fall. It’s not only the US considering a halt to interest-rate hikes, other central banks are thinking of doing the same.

Though it seems apparent that rates are likely set to fall after aggressive hikes, the task of predicting downward rate movements is made trickier by persistently high inflation and market volatility. Therefore, in an uncertain, higher-for-longer interest-rate environment, some people may be tempted to opt for security by continuing to migrate their assets from bonds or equities into a bank deposit account. After all, “cash is king”.

Or is it?

A fixed deposit is a saving instrument that involves depositing a monetary lump sum over a specified period to earn a fixed interest rate. Fixed deposits typically offer a higher rate than saving deposits, and the principal amount is guaranteed, regardless of market fluctuations.

Fixed deposits also offer two different means of payment throughout their tenures – these can be either cumulative or non-cumulative. If the fixed deposit is cumulative, the interest and principal amount will be paid on its maturity date; However, if the fixed deposit is non-cumulative, then the interest and principal will be paid out in specified increments.

Fixed income is a broad definition encompassing various investment securities that pay investors fixed interest (or coupon payments) until their maturity dates. Fixed-income investments are generally considered low risk (for example, versus equities) because an issuer promises to repay investors the principal amount with fixed returns unless a credit event occurs (e.g., a coupon payment default). Some examples of fixed-income securities include government or corporate bonds.

The interest on fixed-income securities is generally paid twice a year, with the principal amount repaid on the bond’s maturity date. However, some fixed-income providers may pay interest monthly, quarterly, or annually.

Comparing fixed deposit and fixed income

|

Fixed deposits |

Fixed income |

Issuer |

Banks |

Government, corporations |

Regular income |

Yes |

Yes |

Credit rating |

None (backed by banks) |

Assigned by credit rating agencies |

Risk |

Low |

Moderate |

Return |

Relatively lower |

Potentially higher |

Options of tenure/maturity |

Yes |

Yes |

Liquidity |

Not applicable |

Relatively higher |

Premature withdrawal penalty |

Yes |

No |

Diversification benefits |

No |

Yes |

Inflation protection |

No |

Possible |

Fixed deposits are generally considered a good saving option when interest rates rise. This is because fixed deposit rates move in tandem with interest rates. As interest rates rise, so do fixed deposit rates. Fixed deposits are also attractive during market fluctuations because of their reliability. Fixed deposits will always deliver the principal amount, despite market fluctuations, which can be attractive when markets are unpredictable.

Since April 2023, there’s been a downward revision of some fixed deposit rates1 among regional retail banks and a slower migration to higher-yielding fixed deposit/term deposits. In other words, lenders (and some investors) believe that the prospect of a slowdown in the US, coupled with lower inflation, will see interest rates start to fall and are positioning themselves accordingly.

If this happens, cash investors potentially face the risk of lower yields when their fixed deposits mature. On the flip side, declining deposit rates can help boost the allure of asset classes, such as fixed income.

While fixed-income returns have varied from year to year, they’ve compounded over the longer term to reach levels that potentially beat inflation and are higher than the current nominal rates for time deposits. Closer to home, Asian bonds (sovereign and corporate) have traditionally enjoyed higher yields than their US counterparts.

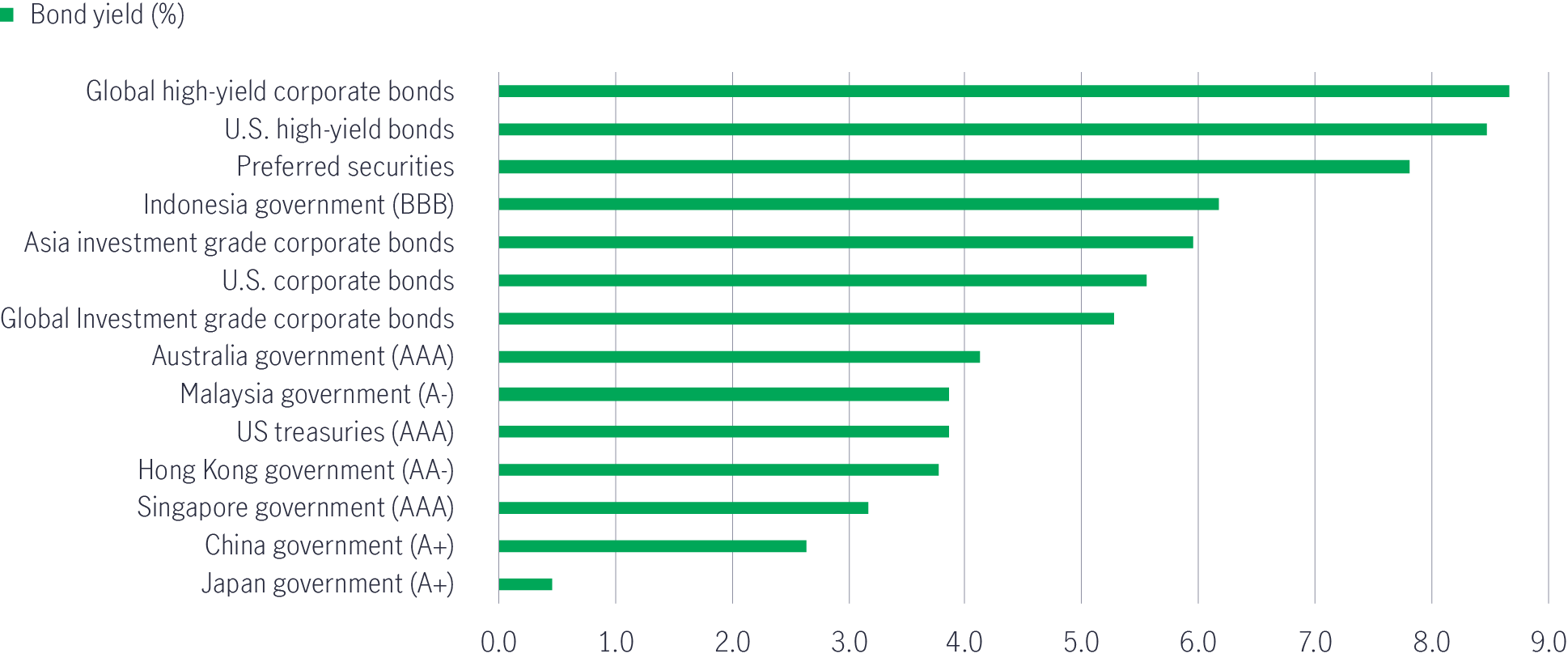

Bond yields have reached attractive levels2

Generally, when we approach the peak of a rate-hiking cycle, most bond yields will reach relatively attractive (high) levels, meaning further yield increases are limited. Hence, investors who consider entering the bond markets can take advantage of the re-priced bond prices (prices are lower due to yield surge) while clipping the higher yield return. As a result,bond holders could enjoy price appreciation once bond prices rebound alongside the rate-cutting cycle – generating total returns via higher yields and price increases and hence maximising total returns.

If you opt to remain invested in bonds or consider an allocation to this asset class, a few tips could prove helpful.

Spreading Risk

Should you invest in a single bond or a fixed-income fund? Placing all your eggs in one basket may not be prudent, especially if you're a retail investor. The typical amount invested in an Asian US-dollar (USD) bond is USD200,000, a significant sum that could represent your entire life savings. This money would be at risk if the bond defaults.

Conversely, investing in fixed income via a mutual fund can offer diversification benefits, as a typical vehicle may have 100+ bond holdings, with some containing up to 150 to 200. That’s spreading your eggs over many baskets.

Rebalancing your portfolio with age

Then there’s the question of how much of your overall investment pot you should expose to fixed income. The general rule of thumb is that an investor’s bond holdings should equal their age. For example, if you're 30 years old, you should have around 30% of your portfolio invested in fixed income and 70% in equities. The allocation to fixed income should grow in tandem with your age.

We have just mentioned equities, and a point to note is that investors should not expect equity-like returns from fixed income.

Capital protection

What can fixed-income hedge against? Besides income generation and the compounding effects mentioned above, another potential benefit of fixed-income investing is that bonds can preserve capital and protect against economic downturns. Bonds are typically less volatile than stocks and offer a source of diversification that can help reduce volatility and overall portfolio risk.

Gathering momentum over time

Lastly, let time be your friend! The earlier you put your money to work, the more time it has to accumulate. For example, some fixed-income funds pay a more regular income than deposits due to their distribution schedule, e.g., monthly or quarterly. This could even boost your income as more interest is compounded over time.

1 欢迎光临中国工商银行新加坡网站 (icbc.com.cn), as of 1 March 2023, the 3-month time deposit rate for SGD was 3.7%, as of 21 July 2023 it decreases to 3.5%.

2 Source: Manulife Investment Management, Bloomberg, ICE Data Indices, LLC as of 12 July 2023. Sovereign ratings based on the median rating between S&P, Moody’s and Fitch, as of 31 March 2023. Government bond data based on the respective 10-year government bond yield, except that Hong Kong government bond based on Hong Kong Government Bond Programme. Corporate bond data based on yield-to-maturity (conventional). Global high yield represented by ICE BofA Global High Yield Index, US High Yield represented by ICE BofA US High Yield Index, Preferred Securities represented by ICE BofAML US All Capital Securities Index, Asian investment grade represented by ICE BofA Asian Dollar Investment Grade Corporate Index, US corporate represented by ICE BofA US Corporate Index, Global investment grade represented by ICE BofA Global Corporate Index.

Risk Diversification

There is no free lunch. But Risk Diversification comes close in investing. A diversified portfolio was shown to optimize returns with lower volatility in the long run.

Better income – Aim for higher, not the highest

If we focus too much on chasing the highest yield and upfront yield generation, we could suffer from early capital depletion and miss the total return opportunity towards the later stages of the investment journey.

Cash is king?

Amid volatile market conditions and higher interest rates, seeking security by burying your savings in a deposit account is tempting. As the saying goes, “cash is king”. Or is it?

Risk Diversification

There is no free lunch. But Risk Diversification comes close in investing. A diversified portfolio was shown to optimize returns with lower volatility in the long run.

Better income – Aim for higher, not the highest

If we focus too much on chasing the highest yield and upfront yield generation, we could suffer from early capital depletion and miss the total return opportunity towards the later stages of the investment journey.

Cash is king?

Amid volatile market conditions and higher interest rates, seeking security by burying your savings in a deposit account is tempting. As the saying goes, “cash is king”. Or is it?