16 May 2024

James Robertson, Senior Portfolio Manager, Head of Asset Allocation–Canada, Global Head of Tactical Asset Allocation, Multi-Asset Solutions Team

Investors are navigating an environment characterized by significant global economic resilience, but with crosscurrents. We review some of the themes driving our latest asset allocation outlook.

As we near the midpoint of 2024, the monetary policy landscape is some distance from what markets anticipated at the start of the year. A holding pattern persists, and uncertainty remains around how hard or soft the landing will be when it comes. In our view, several key themes are poised to shape financial markets in the coming months.

Broad equity markets continue to demonstrate strong performance, a trend bolstered by the robust American consumer and stable job market. These factors have helped global economies avoid significant downturns, suggesting a continuation of this positive trajectory; however, increasing desynchronization among developed economies introduces complexities that investors need to manage.

In the United States, economic resilience stands in stark contrast to the situation in the United Kingdom and Japan, where economies have either flirted with or entered recessionary periods—defined as two consecutive quarters of negative growth. Other G7 nations appear to be on a comparable path. In contrast, Asian markets broadly offer diverse investment opportunities, with South Korea and Japan emphasizing their manufacturing strengths, and India benefiting from vigorous domestic activity.

The previously expected easing in the federal funds rate starting mid-2024 has been scaled back to potentially one cut, with debate about whether the U.S. Federal Reserve (Fed) might hold rates steady for the remainder of the year. This recalibration in expectations is likely to keep fixed-income volatility high and maintain upward pressure on rates across the yield curve. While the global rate-hiking cycle may have concluded, navigating the evolving landscape requires caution.

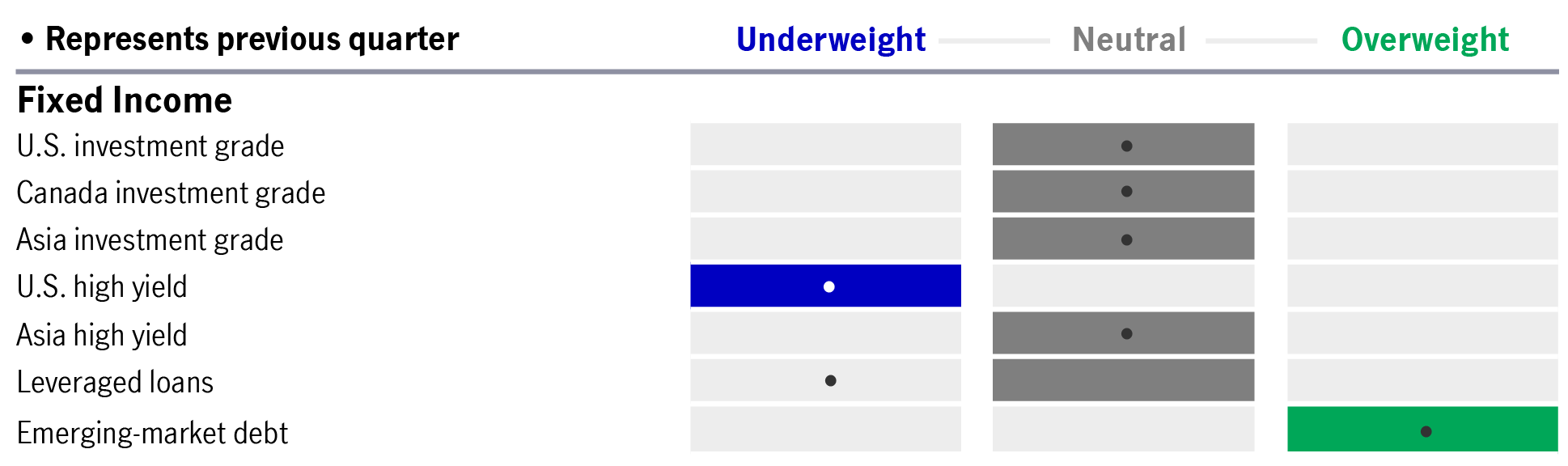

Fixed-income overview

Source: Multi-Asset Solutions Team, Manulife Investment Management, 30 April, 2024.

Market consensus suggests that the European Central Bank and the Bank of England may adjust their policies ahead of the Fed. Switzerland became the first major economy to cut interest rates after a surprise 0.25% cut in March to take its main interest rate to 1.50%. Also in March, Mexico cut its interest rate by 0.25%, taking its overnight interest rate to 11%, while Brazil lowered its interest rate to 10.75%, cutting by 0.50%.

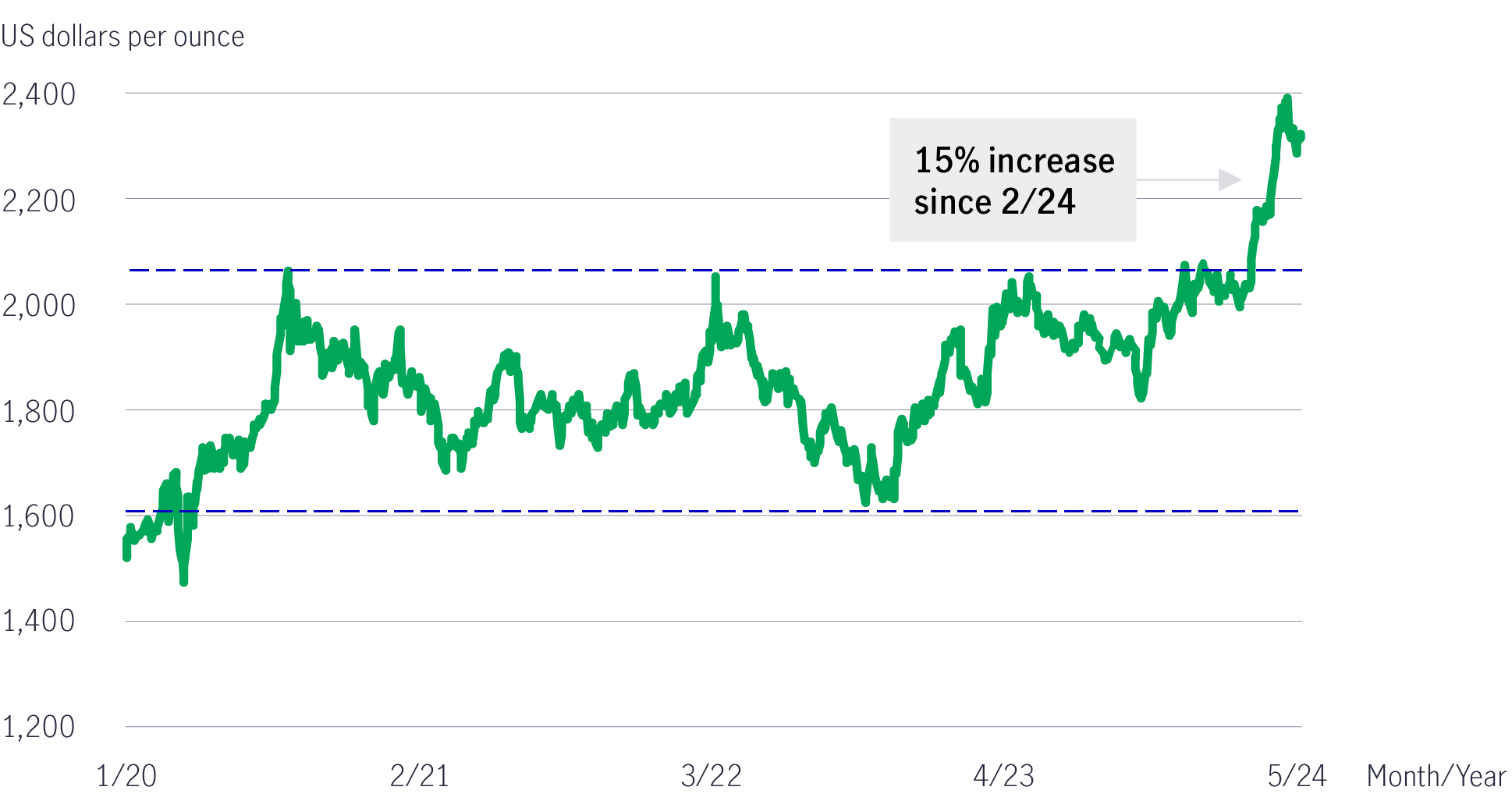

Despite higher interest rates and a stronger U.S. dollar, gold has surged 15% since early February. We believe that it could have further to go as recent strength is underpinned by several distinct factors, namely:

As well as increasing by 15% since early February, the metal has also broken through its price pattern, potentially suggesting a higher price range going forward.

Gold prices trending upward due to demand

Source: Bloomberg, May 2024. Spot gold prices are denominated in U.S. dollars.

We believe that gold combined with a broader mix of commodities may offer attractive potential upside for investors, especially as higher inflation and interest-rate volatility dilute the effectiveness of long duration bonds as a diversifier to equities.

Looking ahead, the enduring narrative of higher-for-longer interest rates presents some challenges for asset classes that would benefit from more accommodating monetary policy, such as U.S. small caps, which typically gain momentum in an easing cycle. Elevated valuations in the United States introduce risks related to corporate earnings, such as the possibility that the market's response to earnings reports may introduce volatility. Understanding these dynamics and some of the crosscurrents at play, while remaining adaptable, will be essential for navigating the anticipated complexities of global financial markets.

2025 Outlook Series: Global Healthcare Equities

The Global Healthcare team maintains a sense of measured optimism for the performance of healthcare equities given the underlying key subsector strength in 2025.

2025 Outlook Series: Global Semiconductors

From an investment perspective, we believe a diverse, global portfolio of high conviction, quality companies in these target industries offers an attractive, long-term risk-return profile underpinned by robust fundamentals, significant tailwinds, structural demand growth and earnings visibility.

2025 Outlook Series: Asia Fixed Income

As rate paths shift and market volatility is expected to increase across global rates, credit, and currency markets, we explain why the sub-asset classes within the Asian fixed income space (Asia high yield, Asia investment grade, and Asia local currency) could provide shelter with opportunities.

2025 Outlook Series: Global Healthcare Equities

The Global Healthcare team maintains a sense of measured optimism for the performance of healthcare equities given the underlying key subsector strength in 2025.

2025 Outlook Series: Global Semiconductors

From an investment perspective, we believe a diverse, global portfolio of high conviction, quality companies in these target industries offers an attractive, long-term risk-return profile underpinned by robust fundamentals, significant tailwinds, structural demand growth and earnings visibility.

2025 Outlook Series: Asia Fixed Income

As rate paths shift and market volatility is expected to increase across global rates, credit, and currency markets, we explain why the sub-asset classes within the Asian fixed income space (Asia high yield, Asia investment grade, and Asia local currency) could provide shelter with opportunities.