26 January 2024

Susan A. Curry, Senior Portfolio Manager, Capital Appreciation

Ryan P. Lentell, CFA, Portfolio Manager, Capital Appreciation

With interest rates appearing to have peaked and lenders’ deposit costs easing, 2024 could turn out to be a far more hospitable year for U.S. regional banks than 2023.

For U.S. regional banks, 2023 was a tumultuous year. The failures in March and April of Silicon Valley Bank, Signature Bank, and First Republic Bank weighed on regional banks’ stock prices through the spring and into the summer. These failures focused customers' attention on their deposits at other institutions that were financially sound, which led to accelerated upward deposit re-pricing activity. This deposit repricing weighed on banks’ bottom lines, leading investors to fret about the durability of bank deposit bases and the magnitude of further deposit repricing in an environment of elevated interest rates.

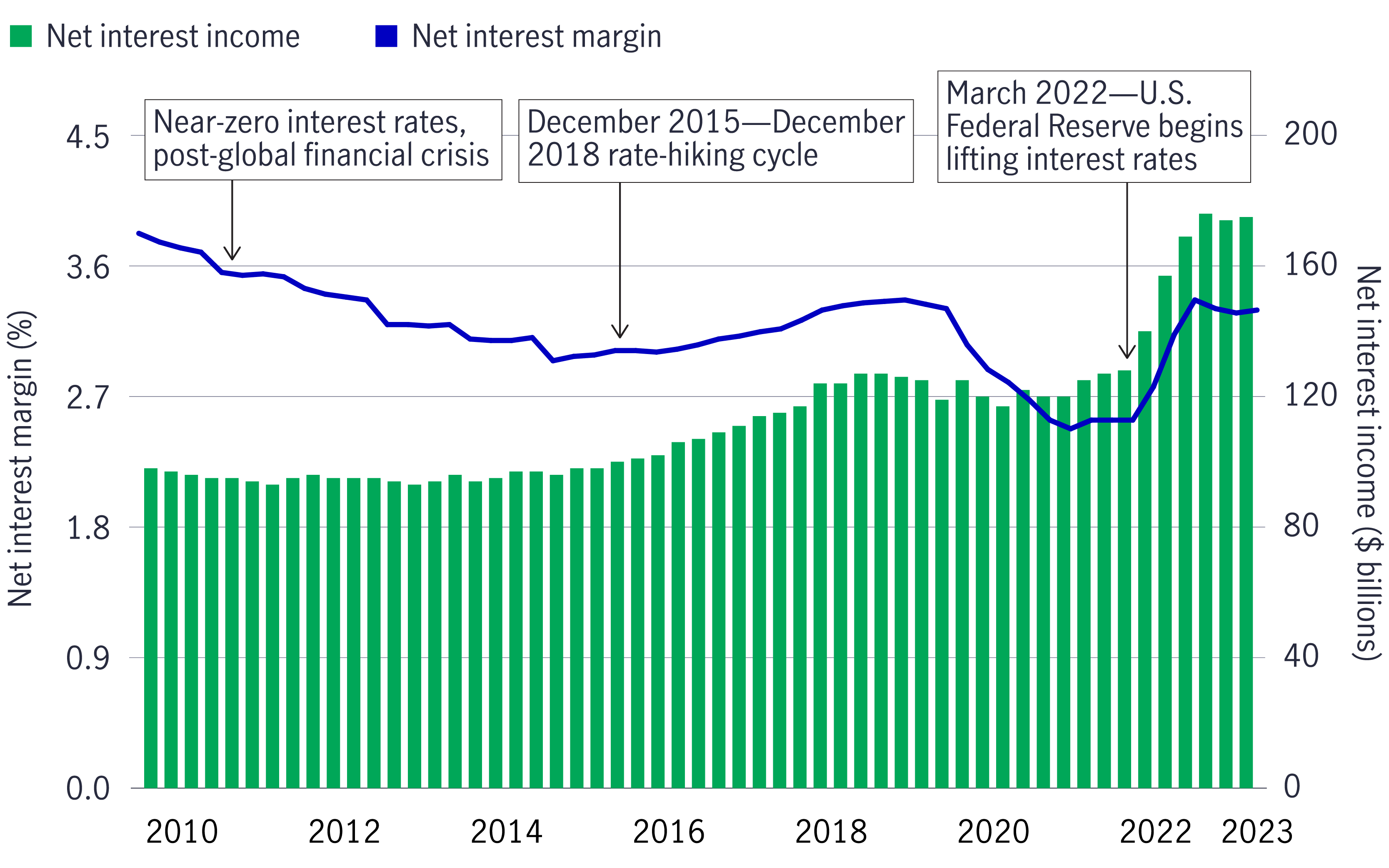

But now that 2023 is behind us, we’re starting to see greater clarity on deposit costs. This has improved investor sentiment for U.S. regional bank stocks as a whole and sets the stage for net interest revenue to trend higher in 2024 and beyond, in our view.

Since last summer, bank management teams have consistently tried to convey the message that deposit repricing had been decelerating. That said, the market didn’t seem to believe this was the case, based on the continued struggle of many bank stocks to regain ground lost months earlier amid what turned out to be a brief and quickly contained surge in bank failures. However, this negative sentiment recently shifted as it became more apparent that the aggressive rate-hiking cycle begun by the U.S. Federal Reserve (Fed) in March 2022 had peaked and probably ended. The Fed’s so-called pivot came at its December 2023 meeting, when slowing inflation led Chair Jerome Powell to emphasize the growing likelihood of rate cuts in 2024. As we’ve noted, bank stocks have historically outperformed in the 12 months following the last Fed rate hike.1

The plateauing of deposit costs is very powerful for banks, in our view. Deposits are effectively a bank’s costs of goods sold—an accounting term defined as the total amount a business pays to sell a product or service. As banks’ costs of goods sold peak in a normalized interest-rate environment, many institutions still have an opportunity to continue to raise the price of the “goods”—in the case of banks, the increased rates that institutions can charge on loans and the higher income that banks may earn from investment portfolios.

We believe that this ability to generate more income in a normalized rate environment relative to a low-rate regime creates a favorable dynamic for bank revenue as we move through 2024 and beyond.

When the Fed raised rates beginning in early 2022, banks benefited in the short term, as loans tied to industry benchmark lending rates such as the Secured Overnight Financing Rate repriced to pay banks higher rates almost immediately.2 At the same time, the eventual rise in banks’ deposit costs lagged; however, this situation reversed in early 2023 as deposit repricing exceeded loan repricing across the banking sector. Now that the Fed appears to have reached peak rate levels, we expect that loan and security repricing is likely to recapture the lead from deposit repricing at many banks in 2024.

Banking industry’s quarterly net interest margin (left axis) and net interest income (right axis), January 2010–October 2023 (%)

Source: Federal Deposit Insurance Corporation, 2023. Net interest income is the revenue a bank earns from its interest-bearing assets minus expenses from paying interest to depositors. A bank’s net interest margin is an indicator of a bank’s profitability potential over the long term, calculated by dividing net interest income from average earning assets. Past performance does not guarantee future results.

According to the CME FedWatch Tool as of January 12, 2024, there was a 81.2% probability of a rate cut in March and a 99.6% probability of a rate cut in May, as implied by 30-day Fed funds futures pricing data.3 These probabilities fluctuate day to day with changing market conditions; for example, as recently as December 15, 2023, the probability of a March cut was 69.5%; for a May cut, the probability was 94.7%. In our view, the timing of a rate cut is less important than the fact that the Fed is unlikely to return to a near-zero rate policy again in the near term. This marks a fundamental change from the period that followed the 2007–2009 global financial crisis, and we believe this shift will benefit banks over the long term. As we look past 2024, banks will still hold fixed-rate loans and securities that were originated and purchased during the near-zero rate environment. These holdings will reprice in the higher/normalized rate environment—a continued “goods” repricing that we believe is likely to provide a long-term tailwind to bank revenue. Bank management teams have only recently begun to discuss this longer-term tailwind, and we believe it’s underappreciated by bank investors. We believe that most banks are likely to produce record net interest income in 2025 as “goods” continue to reprice higher.

In addition to the failures of a few institutions, persistent credit fears also weighed on bank stocks in 2023. Specifically, the market worried about regional banks’ perceived exposure to commercial real estate (CRE), including premier downtown properties struggling with a postpandemic rise in vacancies owing in part to increased remote work arrangements; however, these fears failed to recognize that the majority of regional banks’ CRE exposure is within the multifamily, suburban office, industrial, hospitality, medical, and retail categories, based on our proprietary research.

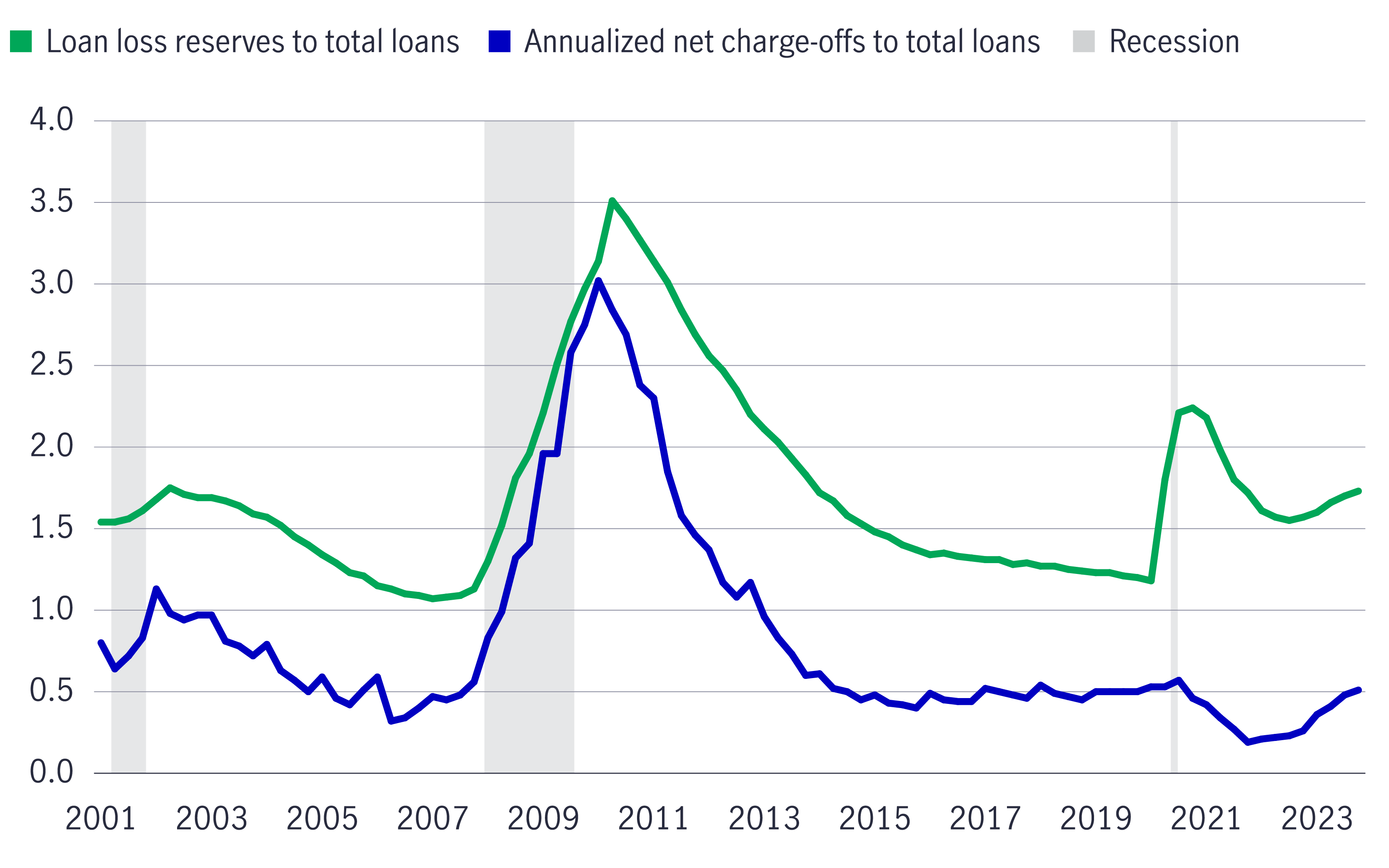

We continue to believe this concern is excessive, as underwriting standards have vastly improved since the global financial crisis. While we do expect some losses attributable to commercial real estate, banks’ exposure to the most troubled office towers in central business districts is limited. In addition, banks have been actively monitoring these property portfolios and have built specific loan loss reserves against this loan category. We regularly talk to bank management teams about their office exposure and they appear to us to remain comfortable with underwriting standards, levels of exposure, and loan loss reserves. Moreover, most banks have increased disclosure regarding their office loans to alleviate investor concern. For example, a regional bank with a $5.5 billion market capitalization recently disclosed that the weighted average loan to value on its portfolio was 58% and the average office loan was $2.7 million. From our experience, this is typical of regional banks, where most office exposure is to smaller buildings versus central business district office towers. While some one-off losses are likely to arise, we believe this isn’t a systemic issue.

As for banks’ overall ability to absorb credit losses of all types, loss levels have recently normalized from multi-year lows reached during the pandemic; however, we haven’t seen a deterioration in credit that would cause concern. In addition, the industrywide ratio of bank loan loss reserves to loans has recently increased, which provides protection against potential future loan losses.

U.S. banks' quarterly ratios of total loan loss reserves to total loans and annualized net charge-offs to total loans, January 2001–October 2023 (%)

Source: Federal Deposit Insurance Corporation, 2023. Recession periods indicated are as defined by the National Bureau of Economic Research. Past performance does not guarantee future results.

As 2024 unfolds, we believe that regional bank shareholders are likely to finally realize some benefits from banks’ most valuable assets—their low-cost core deposit bases. During the period of near-zero rate policies, banks lacked a significant funding cost advantage versus nonbank competitors such as nonbank mortgage lenders, commercial lenders, and consumer finance companies. With the Fed moving away from the zero-rate floor, banks’ funding cost advantage has returned. We believe that this competitive advantage had become hidden to bank investors as deposit rates climbed faster than loan yields in early 2023; however, with the Fed seemingly at or near its peak-rate level, deposit costs have recently begun to plateau. We expect that this will drive most banks’ net interest revenue higher through 2024, bolstering investor sentiment.

Despite recent improvement in bank stocks, we believe that a significant disconnect remains between the fundamental performance of banks today and valuations in the market. As of December 29, 2023, the S&P Composite 1500 Banks Index was trading at a price-to-earnings multiple of 10.6x based on what we view as conservative consensus earnings estimates.4 This figure was significantly below its historical discount relative to the S&P 500 Index dating to the mid-1990s.5 On a price-to-book basis, banks were trading at 1.07x—also well below the index’s historical discount.3,4 While we expect there is likely to be some continued volatility, historically, periods like these have been an attractive entry point for investors, in our view.

1 Source: Morningstar Direct. Following the ending dates of the past four U.S. Federal Reserve rate-hiking cycles on 2/1/95, 5/16/00, 6/29/06, and 12/19/18, the average total returns over the four subsequent 12-month periods were 29.97% for the S&P Composite 1500 Banks Index, 19.67% for the S&P 500 Index, and 18.38% for the Russell 2000 Index. The S&P 500 Index tracks the performance of 500 of the largest publicly traded companies in the United States. The Russell 2000 Index tracks the performance of 2,000 small-cap companies in the United States. It is not possible to invest directly in an index. Past performance does not guarantee future results.

2 Secured Overnight Financing Rate (SOFR) is a secured overnight interest rate. SOFR is a reference rate; a rate used by parties in commercial contracts that is outside their direct control. SOFR uses actual costs of transactions in the overnight repo market, calculated by the New York Federal Reserve with U.S. government bonds serving as collateral for borrowing.

3 CME FedWatch Tool, as of 1/2/24.

4 FactSet, as of 12/29/23. The S&P Composite 1500 Index tracks the performance of 1,500 publicly traded large-, mid-, and small-cap companies in the United States. It is not possible to invest directly in an index.

5 FactSet, as of 12/29/23, for the S&P 500 Index relative to its average dating to 12/31/94.

2025 Outlook Series: Global Healthcare Equities

The Global Healthcare team maintains a sense of measured optimism for the performance of healthcare equities given the underlying key subsector strength in 2025.

2025 Outlook Series: Global Semiconductors

From an investment perspective, we believe a diverse, global portfolio of high conviction, quality companies in these target industries offers an attractive, long-term risk-return profile underpinned by robust fundamentals, significant tailwinds, structural demand growth and earnings visibility.

2025 Outlook Series: Asia Fixed Income

As rate paths shift and market volatility is expected to increase across global rates, credit, and currency markets, we explain why the sub-asset classes within the Asian fixed income space (Asia high yield, Asia investment grade, and Asia local currency) could provide shelter with opportunities.

Solutions for navigating market volatility amid U.S. tariff changes

Recent changes in U.S. tariffs have introduced new dynamics to the global market landscape, presenting both challenges and opportunities for investors. Understanding these developments is essential for making informed investment decisions. Marc Franklin, our Deputy Head of Multi-Asset Solutions, Asia, and Senior Portfolio Manager provided his view.

Quick thoughts on US reciprocal tariffs

The US President Donald Trump announced reciprocal tariff details on 2 April, 2025, which has introduced volatility to the financial markets. Alex Grassino, Global Chief Economist, along with the Multi-Asset Solutions Team (MAST), Macroeconomic Strategy Team, share their latest views.

2025 Outlook Series: Global Healthcare Equities

The Global Healthcare team maintains a sense of measured optimism for the performance of healthcare equities given the underlying key subsector strength in 2025.