22 November 2024

Alex Grassino, Global Head of Macroeconomic Strategy

Dominique Lapointe, CFA, Global Macro Strategist, Multi-Asset Solutions Team

The 2024 US elections delivered a trifecta for the Republican party: Not only did Donald Trump win the presidency, but Republicans also clinched crucial majorities in both the House of Representatives and the Senate. Among early market reactions to this red sweep, US equities, the dollar, and bond yields have all climbed higher in the days since 5 November (local time).

For policy watchers, economic prognosticators, and investors alike, the question now is around what to take away from the 2024 election results. From where we sit, the answers have a lot to do with time horizons. Alex Grassino, Head of Global Macro Strategy, and Dominique Lapointe, Global Macro Strategist, Multi-Asset Solutions Team, share their latest views.

President-Elect Trump won’t take office until 20 January, 2025, roughly two months from today, which can seem like an eternity in the financial markets. More to the point, once the transfer of power does occur, the incoming administration will have to contend with some well-entrenched macroeconomic dynamics exerting their influence on the US economy. We would expect the momentum of these dynamics to persist for some time before any policy changes even begin to have a meaningful impact on the economy. Consequently, in the short term (2–6 months out), we’ll remain focused on macroeconomic data over government actions as a driver of US monetary policy and global markets.

Right now, we believe the combination of a cooling labour market and inflation trending back toward the US Federal Reserve’s (Fed’s) 2% target should allow the Fed to continue easing monetary policy until at least the middle of 2025. We also believe the lagged effects of higher interest rates since 2022 could eventually have a dampening effect on the economy, perhaps leading to a soft patch in the first half of next year. While the supporting data isn’t there yet, it’s a risk worth monitoring. Nonetheless, absent an alarming deterioration in the economic backdrop, a more accommodative interest-rate environment should continue to provide a tailwind for risk assets.

With Republicans soon to regain control of both houses of Congress, the next Trump administration will likely face lower hurdles to turn some of its key campaign policy pledges into actual legislation. There is, however, a great deal of uncertainty around the timing and true impact of these proposed policies, making it difficult to accurately gauge their future effects on the markets. Broadly speaking, though, we do expect these policies to ultimately reinforce and accelerate two major global macroeconomic trends that were set in motion years ago:

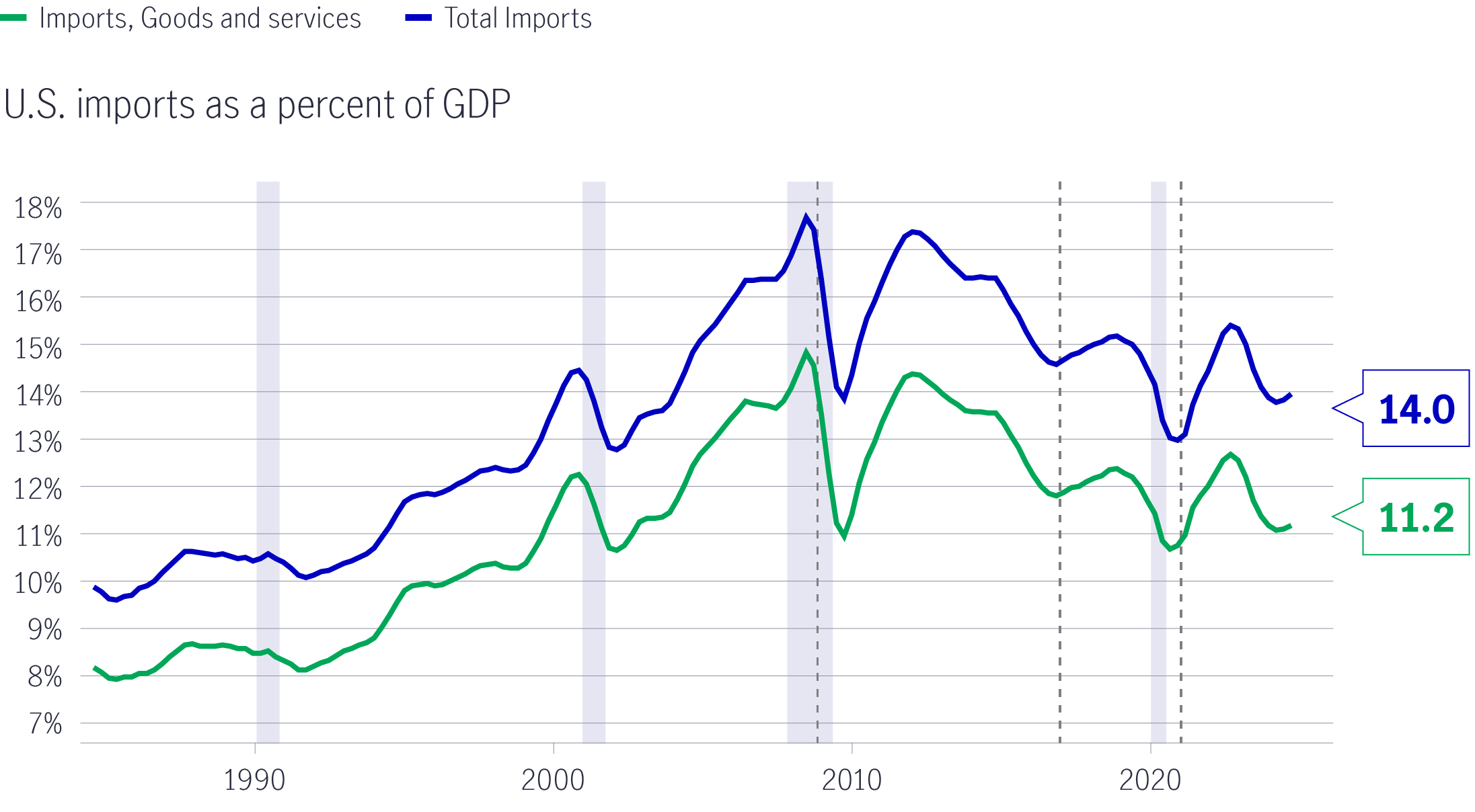

1) Deglobalisation — President-Elect Trump has vowed to impose import tariffs on China and other global trading partners, which would accelerate the deglobalisation trend that began some 15+ years ago. To be clear, deglobalisation would probably have proceeded apace regardless of the 2024 election outcome, as illustrated by the fact that US trade openness (based on the country’s imports as a share of its GDP) has been steadily declining across all US administrations over the past couple of decades. Additional tariffs and trade restrictions would be consistent with the tendency to substitute globally sourced goods and services for domestically produced equivalents.

Chart 1: US International trade peaked in 2008 and has been declining ever since

Source: BEA, Macrobond, Manulife Investment Management, as of 7 November 2024. Grey areas represent recession periods.

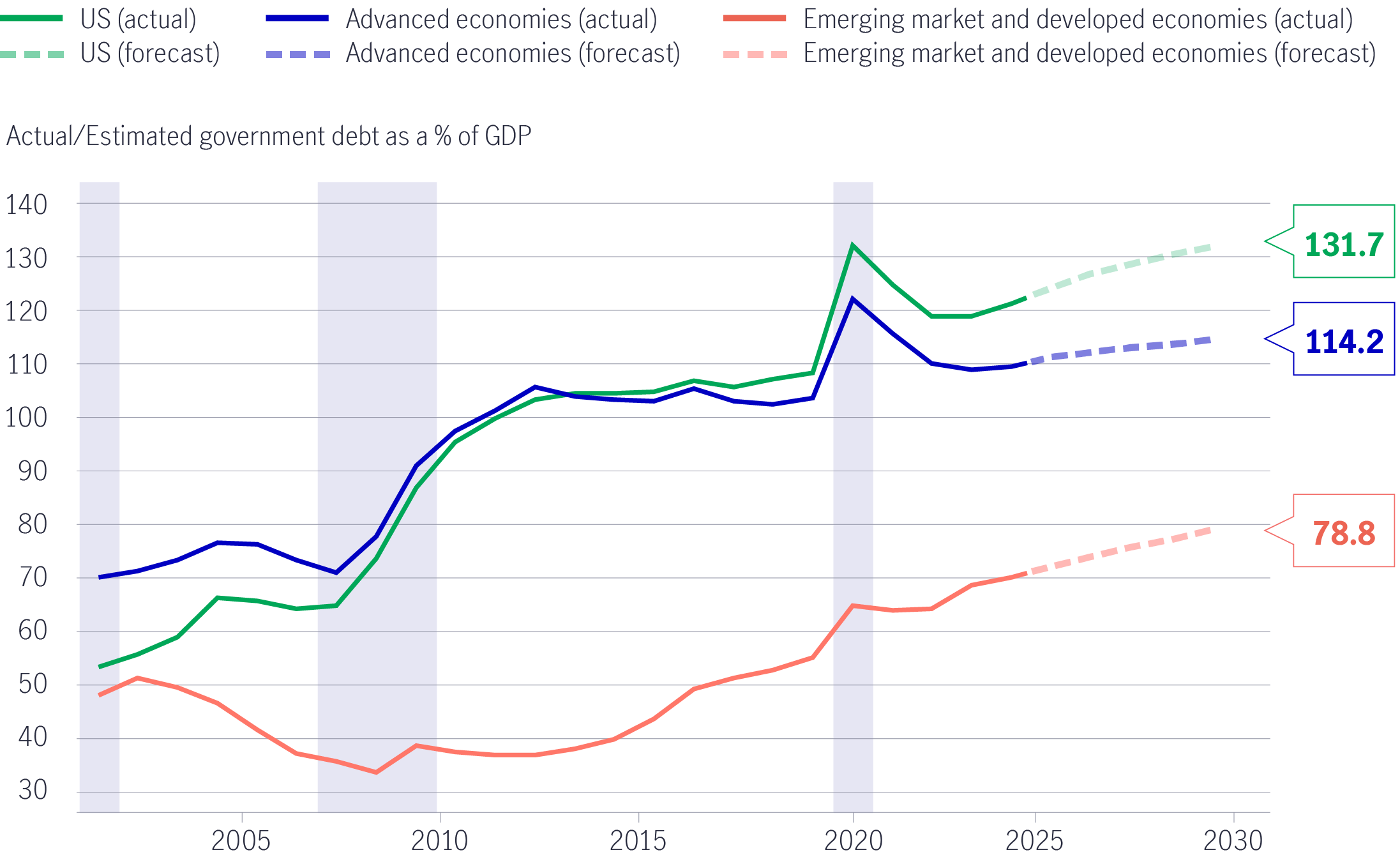

2) Rising public debt — Across most countries and regions, levels of national government debt are higher now than they were before the COVID-19 pandemic, and we believe there’s little public appetite for reversing the upward trajectory of that debt. Notably, President-Elect Trump’s stated intention to extend the 2017 personal income-tax cuts passed during his first administration—and to consider lowering corporate income taxes even more—would further increase the already large US federal budget deficit. Without offsetting revenue measures, the need for and supply of US government debt would likely also rise, potentially putting upward pressure on global interest rates.

Chart 2: Government debt has been on the rise virtually everywhere globally

Source: IMF, Macrobond, Manulife Investment Management, as of 7 November 2024 with estimated figures for future dates. Based on gross debt of general governments. Grey areas represent recession periods.

We believe that a likely one-two punch of looser fiscal policy and stiffer tariffs under President-Elect Trump 2.0 would, all else equal, lead to moderately higher global inflation in the period ahead. However, the overall, multi-year economic impact of any policies the new administration might enact remains to be seen because, without further details and/or an unimpeded runway to efficient execution, each of these policies could affect different sectors of the economy in distinct ways over time

For instance, while President-Elect Trump’s campaign platform called for a drastic reduction in immigration into the United States, how implementable this would be in practice is a big unknown. Whether or not the economy would experience a net benefit from less immigration is also unclear. On one hand, a decreased labour force could eventually raise wages as the pool of labour available to businesses shrinks. Conversely, slower population growth could blunt aggregate demand for housing and related goods, as well as for consumer staples, which might ultimately prove disinflationary

With all that in mind, initial outsize market moves in response to the US elections are apt to fade. This would likely minimize portfolio effects for all but the most short-term, tactical investors. In that vein, we more or less agree with Fed Chair Jerome Powell’s “stay vigilant but don’t overreact” approach to how the Fed will be inclined to analyse any upcoming government policy changes: understand their potential economic implications, map out possible scenarios without factoring them into the base case, and be prepared to act judiciously as paths forward solidify. We suggest that most long-term investors do the same.

The case for liquid real assets in a shifting inflation regime

For over a decade, global investors operated under the assumption that inflation would remain subdued, anchored below 2% - a belief reinforced by central bank credibility and structural disinflationary forces like globalisation and technological deflation. However, the post-pandemic world has ushered in a new regime of structurally higher inflation risks, with evolving policy responses that make liquid real assets increasingly attractive.

Greater China Equities: Perspective for Q4 2025

Heading into the final quarter of the year, we remain constructive, supported by the US Federal Reserve interest rate cutting cycle, Mainland’s demand-side stimulus, strategic priorities outlined in the 15th Five-Year Plan, continued recovery in corporate earnings and robust fund inflows.

Q&A: Potential market impact of a US government shutdown

The US Senate failed to pass a last-minute funding deal, triggering the first federal government shutdown in nearly seven years starting from 1 October. Our Multi-Asset Solutions Team shares insights on how markets have responded during past shutdowns, and how investors can position themselves amid the uncertainty.

The case for liquid real assets in a shifting inflation regime

For over a decade, global investors operated under the assumption that inflation would remain subdued, anchored below 2% - a belief reinforced by central bank credibility and structural disinflationary forces like globalisation and technological deflation. However, the post-pandemic world has ushered in a new regime of structurally higher inflation risks, with evolving policy responses that make liquid real assets increasingly attractive.

Greater China Equities: Perspective for Q4 2025

Heading into the final quarter of the year, we remain constructive, supported by the US Federal Reserve interest rate cutting cycle, Mainland’s demand-side stimulus, strategic priorities outlined in the 15th Five-Year Plan, continued recovery in corporate earnings and robust fund inflows.

Q&A: Potential market impact of a US government shutdown

The US Senate failed to pass a last-minute funding deal, triggering the first federal government shutdown in nearly seven years starting from 1 October. Our Multi-Asset Solutions Team shares insights on how markets have responded during past shutdowns, and how investors can position themselves amid the uncertainty.