27 March 2025

Steven Slaughter, Lead Portfolio Manager

CJ Sylvester, Portfolio Manager

Despite recent political shifts, Steven Slaughter, Lead Portfolio Manager, and CJ Sylvester, Portfolio Manager from the Global Healthcare Team, maintain a sense of measured optimism for the performance of healthcare equities, given the underlying strength of key subsectors in 2025.

Suffice it to say the healthcare sector provided investors with something of a case of whiplash in 2024.

Following strong performance through the first eight months of 2024 (+18%), market fears about the potential implications of a second Trump presidency reared their heads in the period leading up to and following the US presidential election, with the MSCI World Health Index giving back nearly all its gains for the year.

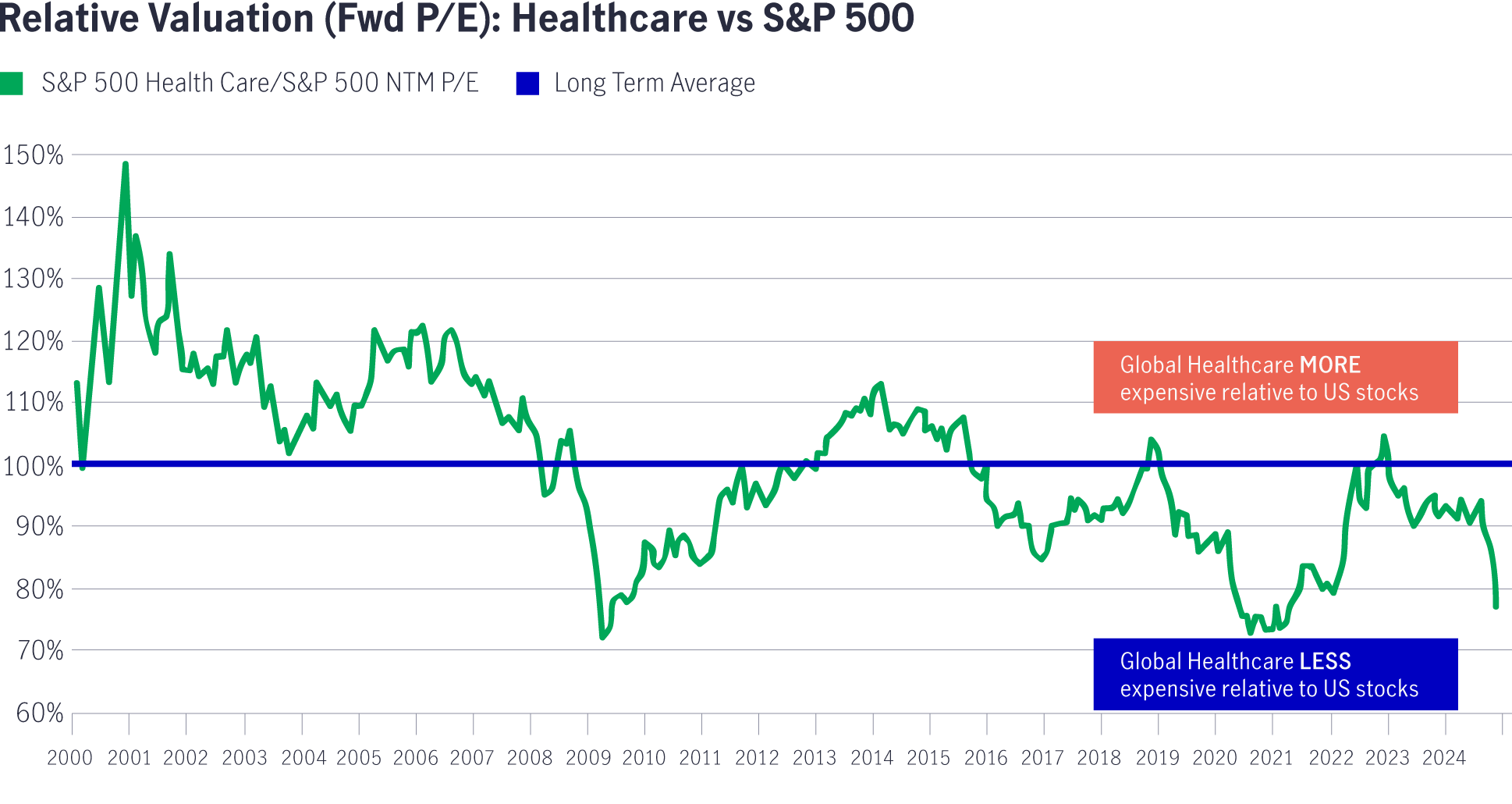

With a rather anaemic 1.6% return in 2024, the MSCI World Healthcare Index markedly underperformed the broader MSCI World Index by approximately 17.6 percentage points, marking the second consecutive year this historical stalwart failed to keep up with the broader markets.

To be fair, this dichotomy continued to be driven by US large/mega-cap technology names, whose narrow market leadership amid Wall Street’s continued enthusiasm for artificial intelligence (AI) finally showed signs of abating in the early weeks of 2025.

Accordingly, we believe this recent stretch of relative underperformance for the healthcare sector should end in 2025. On what do we base our measured sense of optimism this year?

Overall, the initial month of this second term has served to underscore President Trump’s top policy priorities, which were elucidated during the recent presidential campaign. These overarching priorities remain tax policy, international tariff impositions, border security, energy independence and rooting out government waste, fraud and abuse (through the newly formed Department of Government Efficiency (DOGE)).

We think the controversy surrounding Donald Trump’s proposed healthcare policies in late 2024 was reactionary and relatively manageable vis-à-vis other sectors of the economy.

First, we believe concerns about the new US Secretary of Health and Human Services (HHS), Robert F. Kennedy Jr., should be placed in context, as this cabinet appointee made it abundantly clear during his Senate confirmation hearings that he will serve as a conduit for President Trump’s healthcare agenda and priorities.

Further down on this list of President Trump’s initial priorities for healthcare appear to be food safety (ingredient reviews, school lunch programmes, agricultural reallocations), the reprioritisation of National Institute of Health (NIH) research/funding, and HHS government efficiency initiatives1.

Although Secretary Kennedy’s priority list may include changes to vaccine policies vis-a-vis informed consent (e.g. changing the composition of the Advisory Committee on Immunization Practices advisory committee on immunisation practices) and possibly some focus on Food and Drug Administration (FDA) funding mechanisms (i.e. the elimination of so-called "user fee" laws, that require companies to fund their FDA regulatory reviews)2, we continue to believe that President Trump’s priorities will supersede those of his HHS Secretary.

Of note, to date, we have seen no substantive comments from either President Trump or Secretary Kennedy on overt drug pricing initiatives, but in our research process, we will continue to monitor any such developments closely.

Chart 1: Global healthcare equities’ relative valuation versus the broader market in various cycles

Source: FactSet, as of 31 December 2024.

In summary, President Trump’s key policy initiatives may skirt most of our key investment opportunities, at least to date, returning the healthcare sector to its historical position as a relative bastion of safety and an outperformer in the broader economy. This should set us up well for disciplined stock selection.

We continue to emphasise a bottom-up fundamental research process informed by our assessment of emerging scientific and medical trends and a thorough intrinsic valuation analysis. This approach should ensure that our capital allocation focuses on companies tackling important unmet medical needs, pursuing underappreciated market opportunities, and/or demonstrating an ability to bend the healthcare cost curve.

![]()

Biopharmaceuticals

Constituting roughly two-thirds of our investable healthcare universe, we remain focused on biopharma companies with best-in-class product portfolios serving patients in disease states with inelastic demand.

Our previous work related to structural changes in a post-pandemic world supports the continued urgency to effectively manage other pre-existing disease states (cancer, metabolic syndrome, central nervous system, and immunologic disorders), which our research suggests pre-dispose these comorbid patients to higher morbidity and mortality post-Covid.

Accordingly, this has led us to maintain our optimism towards companies focusing on treating hematologic cancers, cardiovascular disease, asthma, Alzheimer’s disease, and diabetes/obesity.

Indeed, changes to the Medicare drug benefit (pursuant to the 2022 Inflation Reduction Act) profoundly impacted demand for more advanced, oral therapeutic options that had previously proven out of reach for many Americans due to uncapped co-pay obligations.

These design changes led to meaningful elevations in calendar 2024 utilization of advanced (and high priced) treatments in diseases like prostate cancer, heart failure, breast cancer, and diabetes. We expect even further elevations in patient demand to appear here in 2025, as the individual retirement account (IRA) changes now cap patient “out of pocket” co-pays to $2000 per year for all Medicare beneficiaries’ medications (down from $3800 per year in 2024).

We highlighted in last year’s outlook piece the biopharmaceutical “haves”: Research-based companies that allocate their incremental capital towards emerging research platform technologies in diseases of unmet medical need, precipitating diverse and seemingly de-risked pipelines, funding needed capital investments, and pursuing targeted mergers and acquisitions (M&A) with their excess cash flow for the benefit of their shareholders.

These “haves” remained highly productive in 2024:

It is worth noting that many of these “haves” are now finding considerable success in China, redeploying their capital by in-licensing stunning new therapeutic options emanating from Chinese research labs and private companies.

Important new treatments for lung cancer and metabolic disease (just to name two) constituted groundbreaking licensing deals for major multinational pharmaceutical companies in 2024. We have highlighted this impressive Chinese research competency for several years now and expect this research competency to proliferate further in the years ahead.

At the outset of 2025, we continue to find attractive investment opportunities among the “haves”, once again with a healthy deference to our intrinsic valuation methodology.

![]()

MedTech and life science tools

Fundamentals within select areas of the global healthcare equipment/supplies and life science tools/services industries remain reasonably attractive.

Select companies continue to reap the benefits of the excess revenues generated from pandemic-era Covid-19 testing and vaccine production, with more measured incremental cash flows in the now-endemic state of Covid-19. Many of these companies are now generating above-market returns as the incremental research, capital expenditure, and pipeline investments they have implemented have reached fruition in recent quarters and years, addressing important persistent unmet medical needs.

For example, a diversified MedTech company generated incremental cash flows from its sale of ventilators during the pandemic, some of which it chose to redeploy in funding clinical trials for a catheter-based approach for the treatment of resistant hypertension (aka high blood pressure).

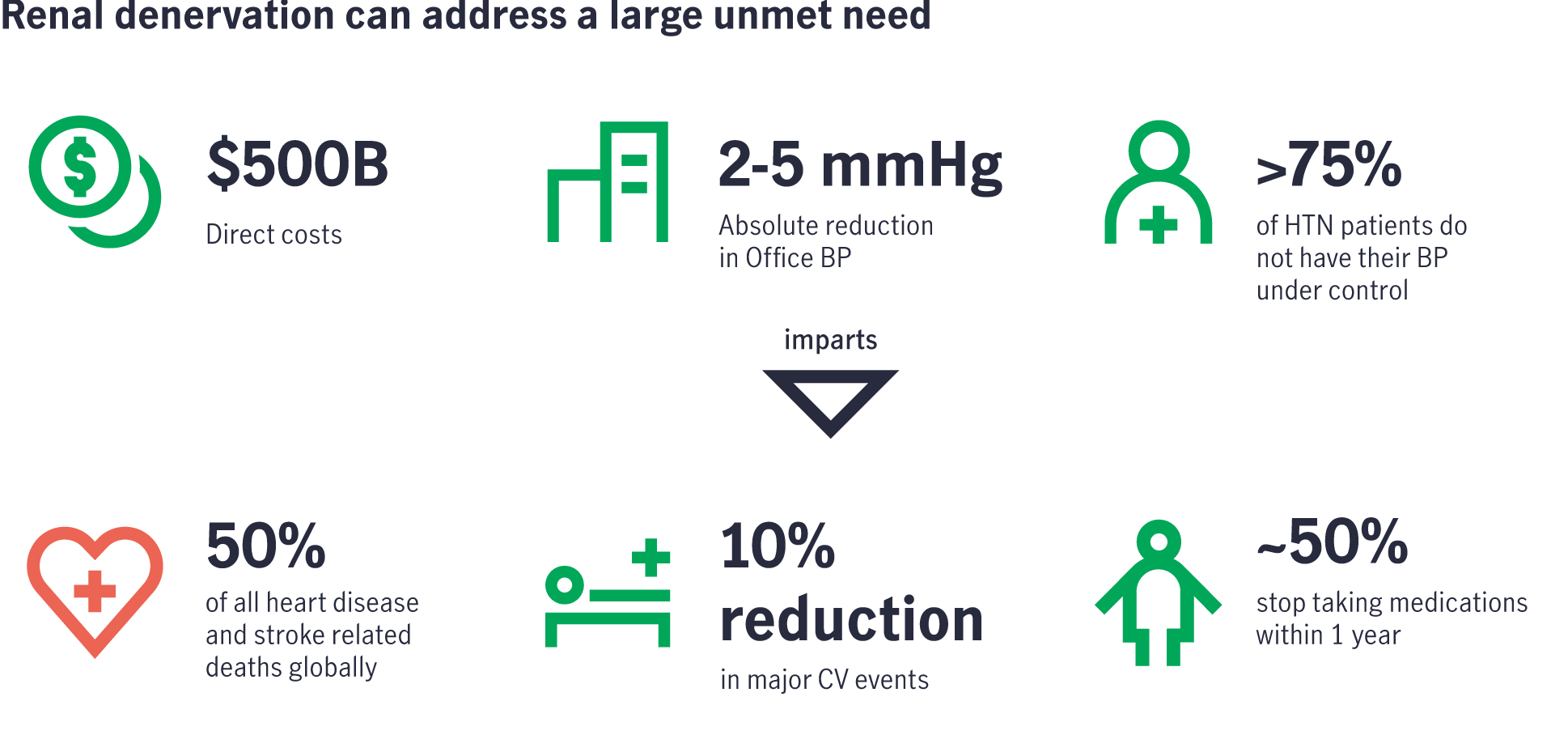

Hypertension remains the most persistent and prevalent risk factor in all of cardiovascular medicine, with some 26% of adults in the world suffering from high blood pressure (roughly 1.2 billion people), of which approximately one in six (200 million) are considered “treatment resistant” (i.e. remain refractory or intolerant of at least three drug treatments from the six classes of drugs used to manage the disease).

Chart 2: Renal denervation targets unmet medical needs4

This diversified MedTech company presented two-year data on its renal denervation (RDN) catheter for treatment-resistant hypertension at an important cardiovascular medical meeting in September 2024 (the data that led the US FDA to approve the device earlier that summer). The results were astounding.

This RDN catheter lowered systolic blood pressure by a full 12 mm Hg in a continuous measurement setting and by eye-popping 17 mm Hg intermittently (i.e. when tested by a healthcare professional in an office setting). The treatment has demonstrated no appreciable side effects (relative to a sham or placebo control arm), takes a mere 45 minutes to perform by an interventional cardiologist, and can be performed on an outpatient basis.

Most remarkably, the blood pressure lowering efficacy of this RDN treatment appears to grow over time (i.e. the blood pressure lowering efficacy actually improves with every six months of follow-up patient monitoring).

Chart 3: Efficacy of RDN treatment5

Medical literature suggests that hypertensive patients accrue a roughly 10% reduction in the risk of heart attacks and strokes for every 5 mm Hg reduction in their blood pressure6. Thus, this breakthrough treatment could be expected to lower the risk of heart attacks and strokes (still the leading causes of death in the developed world today) by roughly 30% in two years.

Two companies have now received approval from the US FDA and the European Medicines Agency for RDN catheter devices. These companies are now awaiting final Medicare reimbursement in the United States (roughly 60% of treatment-resistant hypertensives reside in the over-65 Medicare population). A positive national reimbursement coverage decision is expected in the US in October 2025.

This RDN opportunity reminds us of the GLP-1 (incretin) opportunity which our intrinsic valuation research process uncovered in 2019: Compelling efficacy/safety data addressing an indisputable unmet medical need, a wholly underappreciated market opportunity (as Wall Street estimates for RDN revenues/profits remain “place holders” at present) and a legitimate cost-curve-bending economic argument to preclude more expensive (to say nothing of life-threatening) adverse cardiac events down the road.

Accordingly, investors should assume that we’ve positioned our portfolio appropriately to capitalise on this emerging opportunity.

Aside from this RDN cardiovascular disease opportunity, additional MedTech markets showing solid growth prospects as we enter 2025 remain electrophysiology (EP), robotic surgery, large joint replacement, spinal orthopaedic, and contact lens markets.

Underlying demand in these EP, surgical and vision subsegments appear to be driven by persistent product innovation, pent-up post-pandemic demand, strong geographic expansion in emerging markets, as well as the continued, unremitting ageing of citizens in developed markets. We expect that these tailwinds will persist well beyond 2025.

Various life science tools companies also accrued substantial excess cash flows during the pandemic, both from Covid-19 testing and vaccine/therapeutics bioprocessing revenues. While several have redeployed these excess cash reserves into targeted capital expansion and M&A activities (i.e. building out manufacturing/fill and finish capacity, acquiring new competencies in emerging technologies such as cell and gene therapies), the recent economic returns on these investments have proven more mixed. The contract manufacturing organisations, in particular, experienced a large “air pocket” of excess capacity in sterile syringe fill/finish, as Covid-19 vaccine demand dropped precipitously in 2023 and persisted through much of 2024.

Importantly, many of these diversified tools companies have also struggled in recent quarters from the purchasing inertia associated with pipeline reprioritization activities of the “have-nots” in the global biopharmaceutical customer universe. In addition, many of these life science tools companies over-indexed to the Chinese research/development buildout of the last ten years. They saw retrenchment in this key geographic market as China’s government stimulus programmes and organic GDP growth have been more measured in recent quarters.

Accordingly, many life science tools companies underperformed both the healthcare and broader market indices again in 2024 (after substantial relative underperformance in calendar 2023). Hopes for improved life science tools performance in 2025 appear to hinge on the normalisation of biopharmaceutical and government spending, improvement in the underlying Chinese economy, and increasing demand for new products (oncology biologics, cell therapies, GLP-1’s, etc.). Early indicators here in 2025 on these key variables remain mixed at best.

Accordingly, we have been underweight tool companies these past two years and remain cautious on this subsector, and our overall weightings reflect that sense of caution.

In sum, stock selection will be paramount in the MedTech and life science tools/services subsectors in 2025. We maintain strong conviction in our current positioning in this regard, and with deference to their historically stretched valuations, we look forward to differentiated performance going forward.

![]()

Healthcare providers and services/healthcare technology

Within the healthcare providers and services industry, we continue to see solid value in select supply-chain companies, specifically pharmaceutical wholesalers.

We expect these companies will improve their margins from persistent drug inflation and continued acceleration of underlying prescription demand pursuant to the aforementioned changes to the Medicare Drug Benefit patient obligations.

These companies have consistently demonstrated solid capital allocation competency, investing their excess cash flows in higher-margin services businesses (e.g. oncology and ophthalmology practice management, speciality pharmaceutical distribution, prescription technology/services, etc.), thereby improving their consolidated operating margin profiles to the considerable benefit of their shareholders over time. Given their rational valuations and solid earnings growth/return on invested capital profiles, we consider these positions core holdings going forward.

In contrast, we elected to recast our positioning in select healthcare insurers early in 2024, commensurate with deteriorating profit profiles, reflecting pandemic-induced and persistently elevated utilisation, most notably impacting the Medicare and Medicaid populations.

While elevated spending trends have been ubiquitous throughout US insurance markets these past two years, simply put, the commercial insurance carriers appear better equipped to reflect those trends through more fulsome market rate adjustments (vis-à-vis the Medicare and Medicaid populations, where government mandates serve to impede required rate adjustments).

In particular, we remain concerned with the recent (and we believe persistent) elevated drug cost trends that may continue to suppress MA and Medicare Part D margins given these plans’ higher burden of prescription drug coverage (60%, up from a previous 15%) in the “catastrophic” stage of beneficiaries’ plans, post the final redesign implementation of the IRA Part D redesign here in early 2025.

As previously noted, potential US legislative spending cuts to government-sponsored health insurance remain an “unknown unknown” in the current budgetary flux in Washington, DC.

Medicaid and ACA plans look to be the most probable sources of savings given current Republican trial balloons and the ruling party’s disposition to focus on these programmes (over Medicare), all else equal. Accordingly, our portfolios are well positioned, once again, to mitigate those exposures.

That said, we remain vigilant that potentially aggressive IRA US drug pricing “negotiations” (which we’d highlighted in last year’s outlook piece) presumably remain “on the menu” should CMS seek to find additional cuts beyond these traditional entitlement programmes.

One final thought on our biopharmaceutical universe.

Should the new HHS Secretary attempt to make substantive changes to US vaccine policy based on misguided “scientific theory”, we expect a complete and unwavering rejection from the global scientific and medical community of any harmful alterations that may be proposed.

It's worth noting that there is currently an outbreak of measles in the United States7. Scientific literature suggests that measles kills roughly 1/1000 afflicted children. In addition, there is an H5N1 Influenza (also known as “bird flu”) outbreak in the United States right now, which has infected millions of chickens and dairy cattle to date (along with scores of agricultural workers) and has claimed at least one human life8. H5N1 is clearly evolving and could potentially mutate into a highly transmissible variant.

In our portfolio, we have been and remain materially under-indexed to global vaccine market participants. This underweighting is derived from our bottom-up, fundamental research process, as our proprietary financial models reflect the relatively unattractive economic nature of the vaccines business (i.e. low intrinsic margins, difficult demand forecasting, high capital expenditures, etc.).

Notwithstanding these potential risks, we believe the unprecedented innovation and medical advancements among select companies should provide a fertile opportunity set for market-beating growth.

The first two months of 2025 reinforced our conviction in this regard, as the MSCI World Health Index rose by 7.7%, outpacing the broader market by roughly 4.8 percentage points. This is an encouraging start, which might be expected to continue should air continue to seep from the AI/tech bubble.

Given its historically defensive characteristics, strong organic growth, and persistent demand for products and services over various economic cycles, we continue to view this as an opportune time to invest in the sector.

Overall, we believe investors may benefit by combining fundamental research with an assessment of emerging scientific and medical trends within healthcare, coupled with a thorough intrinsic valuation analysis.

2 Source: https://www.ajmc.com/view/5-health-policy-stances-of-robert-f-kennedy-jr.

3 Source: HHS.government data. https://www.hhs.gov/careers/working-hhs/agencies#:~:text=Is%20made%20up%20of%20a,through%20HHS%20programs%20and%20policies.

4 Source: Medtronic 2025 JP Morgan Healthcare Conference, January 2025.

5 Source: Long-term Safety and Efficacy of Radiofrequency Renal Denervation in the Presence of Antihypertensive Drugs: 24-Month Results From the SPYRAL HTN-ON MED Randomized Trial

6 Source: Lancet, Blood pressure lowering for prevention of cardiovascular disease and death: a systematic review and meta-analysis - PubMed.

7 Source: https://www.cdc.gov/measles/data-research/index.html.

8 Source: https://www.cdc.gov/bird-flu/situation-summary/index.html.

Overweight utilities – stability meets growth in a rate-cutting cycle

Heading into 2026, preferred securities remain an attractive asset class supported by strong fundamentals and favourable macro trends. In particular, utilities preferreds stand out as a core allocation, benefiting from structural growth drivers, such as artificial intelligence (AI)-driven energy demand, easing monetary policy, and their defensive characteristics amid potential market uncertainties.

2026 Outlook Series: Greater China Equities

Greater China equity markets registered a strong equity rally in 2025 to date, driven by technology breakthroughs, demand for localisation, go-global demand, and upward earnings growth revisions. We reiterate a positive view on Greater China equity markets going into 2026 as we believe Mainland and Taiwan are well-positioned to drive high-quality growth to the next level.

2026 Asia Equities ex-Japan Outlook: Positive catalysts drive continued momentum

Asia equities ex-Japan delivered strong performance in 2025. Looking ahead to 2026, June Chua, Head of Asia Equities, outlines in this investment note why she believes the outlook for the asset class remains constructive, underpinned by numerous positive catalysts: a softer US dollar, the US Federal Reserve’s rate-cut trajectory, supportive earnings and valuations, and differentiated growth drivers across geographies.

Overweight utilities – stability meets growth in a rate-cutting cycle

Heading into 2026, preferred securities remain an attractive asset class supported by strong fundamentals and favourable macro trends. In particular, utilities preferreds stand out as a core allocation, benefiting from structural growth drivers, such as artificial intelligence (AI)-driven energy demand, easing monetary policy, and their defensive characteristics amid potential market uncertainties.

2026 Outlook Series: Greater China Equities

Greater China equity markets registered a strong equity rally in 2025 to date, driven by technology breakthroughs, demand for localisation, go-global demand, and upward earnings growth revisions. We reiterate a positive view on Greater China equity markets going into 2026 as we believe Mainland and Taiwan are well-positioned to drive high-quality growth to the next level.

2026 Asia Equities ex-Japan Outlook: Positive catalysts drive continued momentum

Asia equities ex-Japan delivered strong performance in 2025. Looking ahead to 2026, June Chua, Head of Asia Equities, outlines in this investment note why she believes the outlook for the asset class remains constructive, underpinned by numerous positive catalysts: a softer US dollar, the US Federal Reserve’s rate-cut trajectory, supportive earnings and valuations, and differentiated growth drivers across geographies.