23 January 2025

Murray Collis, Chief Investment Officer, Fixed Income (Asia ex-Japan)

Chris Lam, Portfolio Manager, Asia Fixed Income

Billy Wu, Portfolio Manager, Asia Fixed Income

As rate paths shift and deposit rates head lower, investors who were once comfortable locking up their capital in risk-adverse options at attractive returns will find it increasingly difficult to repeat this strategy. With market volatility expected to increase across global rates, credit, and currency markets, Murray Collis, Chief Investment Officer of Fixed Income (Asia ex-Japan), and the Pan-Asian Fixed Income team explain why the sub-asset classes within the Asian Fixed-Income space (Asia High Yield, Asia Investment Grade, and Asia Local Currency) could provide shelter with opportunities and play a more significant role in investors' portfolios this year.

A new phase of the cycle has begun following the US Federal Reserve’s (the Fed’s) long-awaited rate cut in September 2024, helping Asian fixed bonds return to favour. Investors who were once comfortable locking up their capital in attractively yielding fixed deposits face rising reinvestment risks as rates drop. Within the span of six months, 3-month US dollar (USD) deposit rates1 have fallen by around 100 basis points, from around 5.5% to 4.5%, and the average return on deposits after accounting for reinvestment has become less competitive when compared with other Fixed Income options in the market.

Having been accustomed to the high deposit rate environment for the past two-and-a-half years, many investors have naturally built up a level of risk aversion over time, as they have benefited from attractive returns while taking on relatively little market risk. This behaviour was evident ahead of the first Fed rate cut in 2024, where data flows2 indicated a surge in demand for high-quality assets that offered decent yields, such as US Investment-Grade bonds. As global central banks continue to cut interest rates gradually and as macro uncertainties persist, we believe that further diversification within investment portfolios may be required to meet longer-term return objectives.

For investors, maximising not only total returns but risk-adjusted returns should be a key focus for 2025, as we expect to see more market volatility across the global rates, credit, and currency markets, given the more hawkish stance on trade and tariffs from the incoming US government. This could lead to a regime with potential downside risks to global growth and inflation reignition.

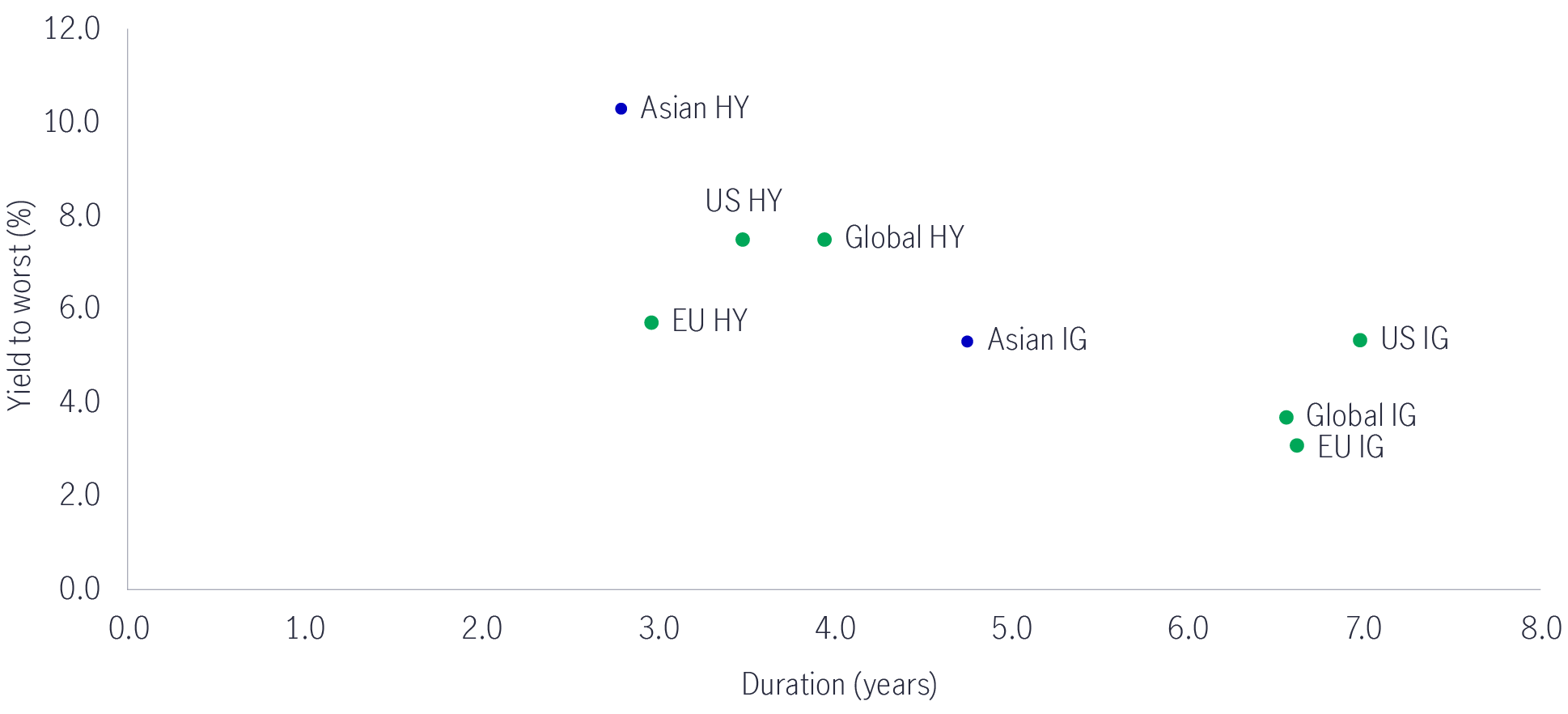

As such, we believe that Asian Fixed Income will play a more significant role in investors’ portfolios this year. Asian Fixed Income, whether Investment Grade or High Yield, provides attractive carry and all-in yields compared with global peers, which can serve as a buffer to protect investor returns against adverse mark-to-market movements and lower interest rates. Risk-averse investors, who have held onto high-quality assets and who are looking to pick up additional yield given the rate cut environment, would naturally look to extend the maturity of their holdings or diversify towards assets that could potentially generate the most incremental returns while taking on the least amount of incremental risk in their investment portfolios.

Chart 1: Asian Fixed Income provides attractive yields with shorter duration compare with global peers

Source: Manulife Investment Management , JP Morgan Asia Credit Non-Investment Grade Index, Bloomberg US Corporate High Yield Index and Bloomberg Pan European High Yield Index, as of 31 December 2024.

Additionally, active management will be key in navigating the upcoming year's uncertain market environment. Besides delivering on performance targets in line with a strategy’s objectives and guidelines, active management can also ensure that the asset classes continue to deliver on the key features and benefits that have made them attractive historically, with the support from in-depth analysis of macro, fundamentals, valuations, and technicals in the region.

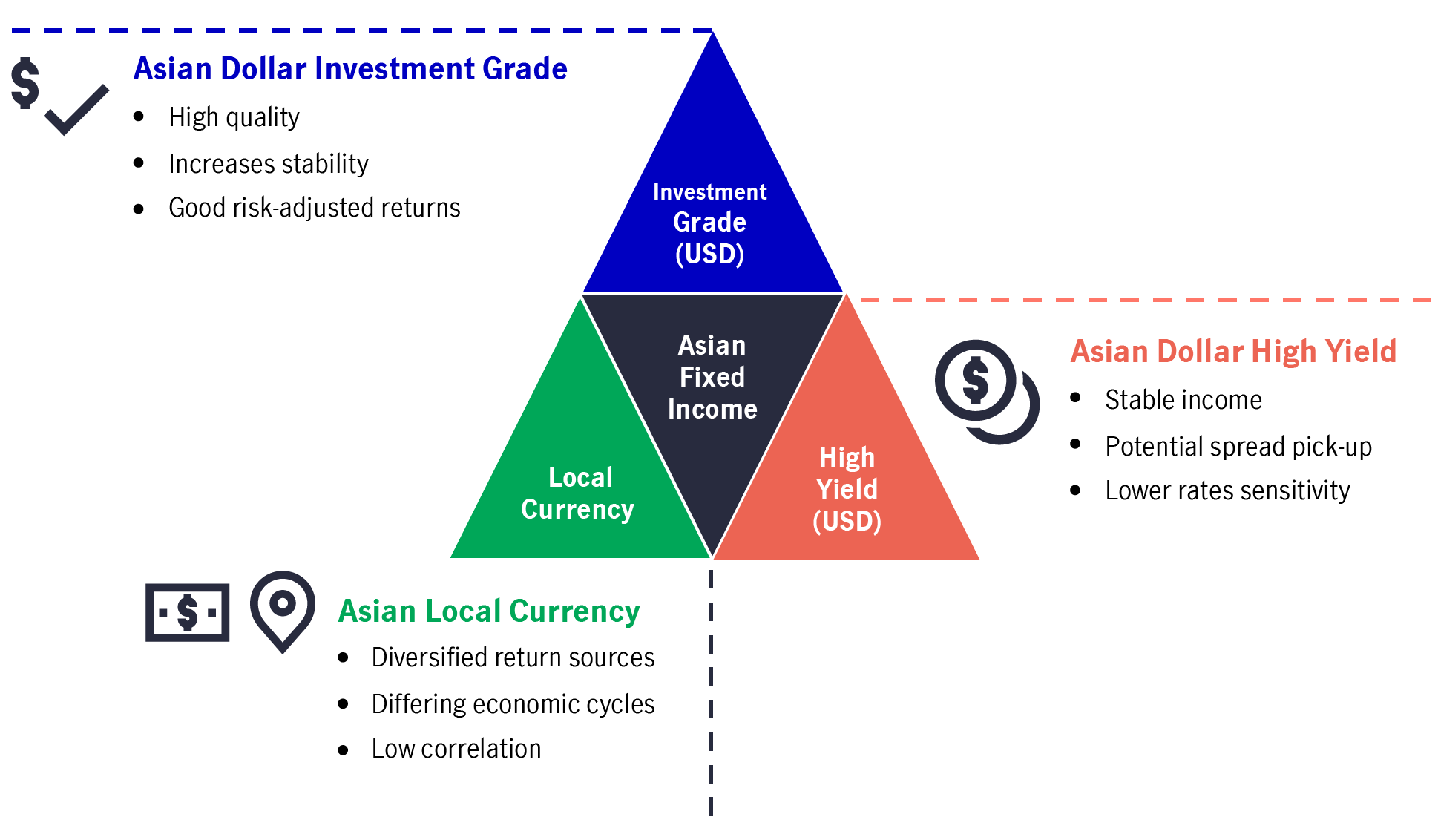

Asian Fixed Income sub-classes have historically delivered distinct benefits to investors’ portfolios – High Yield has provided attractive income with relatively lower interest-rate sensitivity; Investment Grade has provided compelling risk-adjusted returns with relatively lower performance volatility; and Local Currency has supplied diversified sources of return with relatively lower correlations to the other major asset classes.

Chart 2: Distinct benefits of the Asian Fixed Income sub-classes

Source: Manulife Investment Management, 2025.

We believe that investors should consider allocating to Asian Fixed Income amid likely market volatility in the coming year. The three themes highlighted in our 2024 mid-year outlook remain valid and help support the value propositions of the sub-classes. In particular:

I. Asian High Yield – the case for stable income and relative value

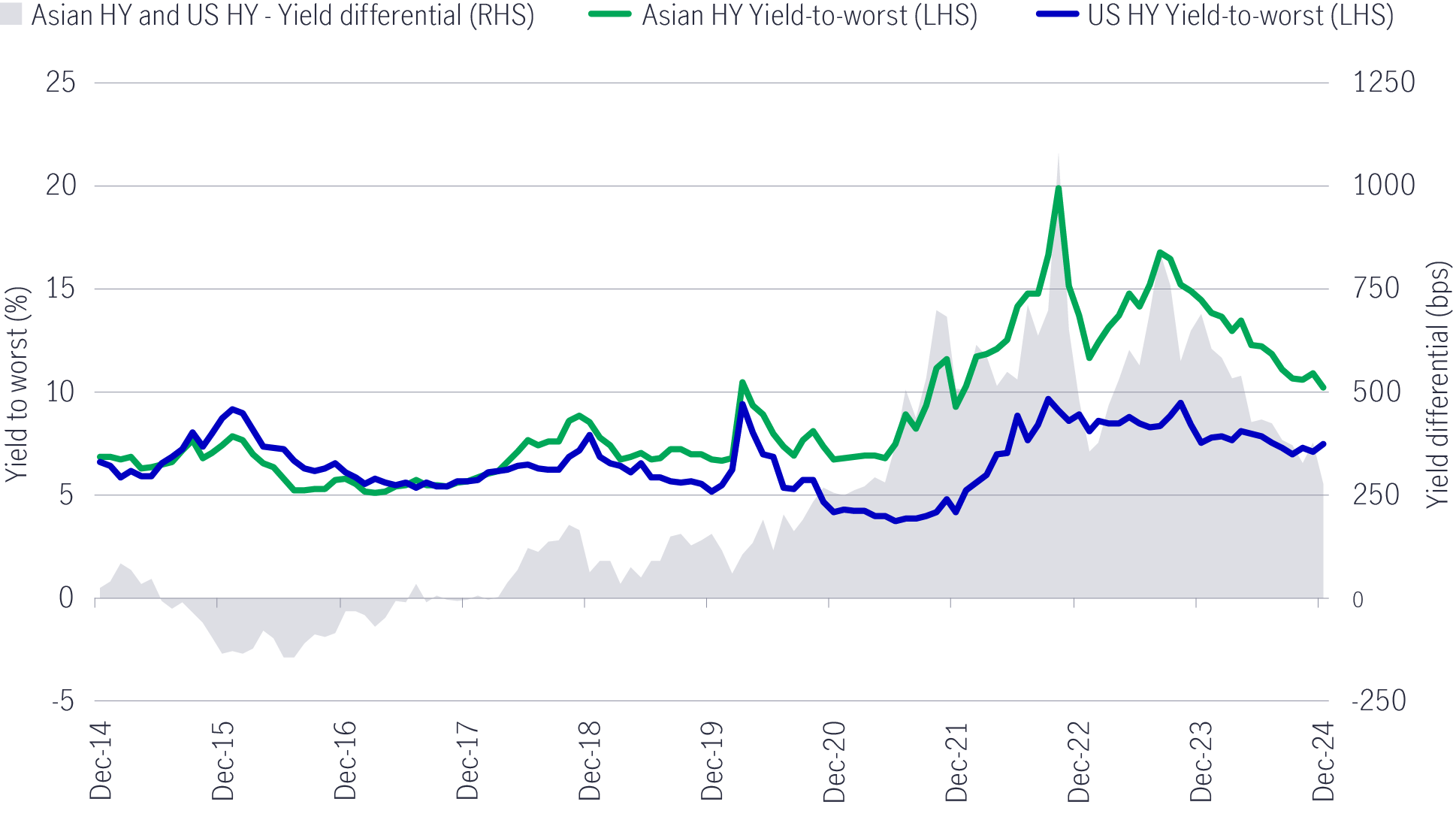

Asian High Yield had a remarkable year with a total return of 15.2% in 2024 and was one of the best performing Fixed Income sub-classes globally. In 2025, we think the focus should shift away from purely total returns, given the change in the market environment. However, we believe that Asian High Yield remains an attractive sub-class, especially after challenging performance between 2020 and 2023. This has resulted in a significant reset in valuations and structural changes driving the opportunities available in the market today.

Chart 3: Spread difference of Asian and US high yield

Source: Manulife Investment Management, Bloomberg and JP Morgan indices. as of 31 December 2024. Indices used: JPMorgan Asian investment grade index, JPMorgan Asian non-investment grade index, JPMorgan Asian non-investment grade corporate index, and Bloomberg US Corporate High Yield Index. Past performance is not indicative of future results.

With Asian High Yield becoming a less concentrated and more resilient investment universe and with China High Yield property now a minor part of the market, we believe that the proposition of stable income has been restored since late 2023, and this income buffer can serve as a valuable defensive mechanism for investment portfolios when faced with potential market volatility.

Asian High Yield also stands out in terms of relative value, offering one of the highest all-in yields across all Fixed Income assets, with a pick-up of 279/458 basis points compared to its US/EU High-Yield peers (which have similar average credit rating profiles) and with a lower duration/spread duration profile to reduce the impact of interest rate/spread volatility. Although investors have preferred higher-quality assets in recent years due to the higher base rate environment, we see more value in Asian High Yield over Investment Grade, given improved fundamentals and attractive valuations from both relative and historical perspectives. We are selective on Asian High-Yield credits and believe that returns will be generated mainly from idiosyncratic opportunities.

Within Asian High Yield, there are two specific areas we want to highlight this coming year that can potentially add value from either a return or risk perspective: China and the frontier markets.

China. As highlighted in our views post the US elections, Chinese policymakers have proactively launched a series of pro-growth policies during the fourth quarter of 2024, which included cutting several key interest rates, rolling out a 10-trillion yuan debt swap programme to ease local government refinancing pressures, and providing financial support for the property sector. In addition, the “Two Sessions” meeting in March 2025 will be a closely monitored catalyst, where authorities are expected to provide more colour on the economic growth target and fiscal budget forecast for the year.

We believe that the government has demonstrated a willingness to support the economy through its recent measures and that combating deflation is becoming a priority that supports growth in China and the broader Asia region. This “policy put” should also create opportunities in selected China High-Yield credits from a capital appreciation perspective, particularly in some distressed names with the potential for equity-like returns.

Frontier markets. Markets such as Sri Lanka and Pakistan have performed well in 2024 on the back of International Monetary Fund (IMF) programme support, progress on debt restructuring, and normalisation of distressed valuations. We continue to see attractive value-added opportunities in the frontier markets for 2025 but must be mindful of the risks that remain given their fragile economic and political situations.

II. Asian Investment Grade – the choice for low historical volatility and attractive risk-reward

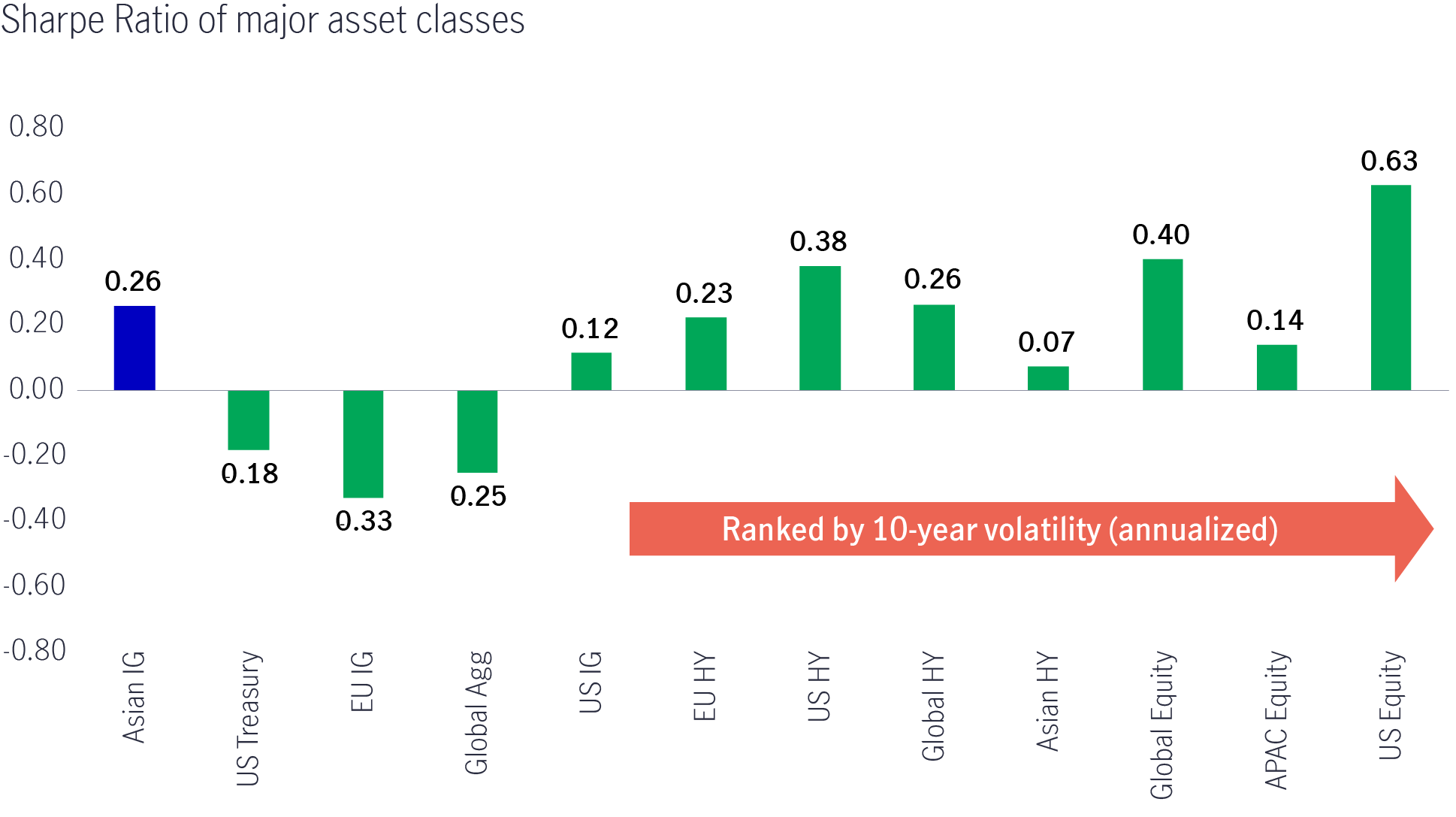

Asian Investment Grade deserved more attention in 2024. It delivered a relatively strong performance with a total return of 4.2% for the year, outperforming its global Investment-Grade peers. As one of the lowest volatility sub-classes, Asian Investment Grade continues to provide stable returns and competitive all-in yields, with an average duration that is around two years shorter than its global Investment-Grade peers (thus relatively less sensitive to interest-rate movements). From a risk-reward perspective, Asian Investment Grade’s Sharpe Ratio also stands out from most major Fixed-Income asset classes and other asset classes like Asia Pacific Equity.

Chart 4: Sharpe ratio of major asset classes

Source: Manulife Investment Management, Bloomberg as of 31 December 2024.

The improving fundamentals of the Asian Investment-Grade sub-class also support the stable return thesis. Credit metrics, whether net leverage or debt servicing ratios3, have improved in recent years, and the number of credit-rating upgrades has outpaced that of downgrades, reinforcing the high-quality nature of the sub-class. Furthermore, the government-linked background of selective Asian Investment-Grade credits also helps underpin their stable credit profiles. Over the past two years, these improvements have constantly been reflected in the valuations of the sub-class, where credit spreads have continued to tighten towards the lowest levels since before the 2008 Global Financial Crisis. In other words, investors are willing to pay more for assets of higher quality that offer more stable returns.

III. Asian Local Currency – capturing the growth drivers and diversified return sources

Asian Local Currency will continue to provide diversification benefits and return opportunities for investors in 2025 under various market conditions, given the diverse economies and differing economic cycles of the countries within the region. China, for example, has been on a different monetary cycle than the US and other major developed market economies. In contrast, markets such as Singapore and South Korea – although they closely follow the monetary cycle of the US – have relatively less volatile local rates markets. In addition, the interest-rate differentials across the region will continue to offer opportunities in the local-currency markets as well.

Rates – the need to be nimble and tactical. Several central banks around the region, including Indonesia, Philippines, South Korea and Thailand, have already embarked on their rate-cutting cycles in 2024 and are in good positions to continue their easing trajectory given the benign inflationary environment. However, the pace and magnitude of the Fed’s rate cuts may limit the amount of easing in the region, given the central banks’ desire to maintain currency stability; hence, a tactical approach to managing rates is required for 2025.

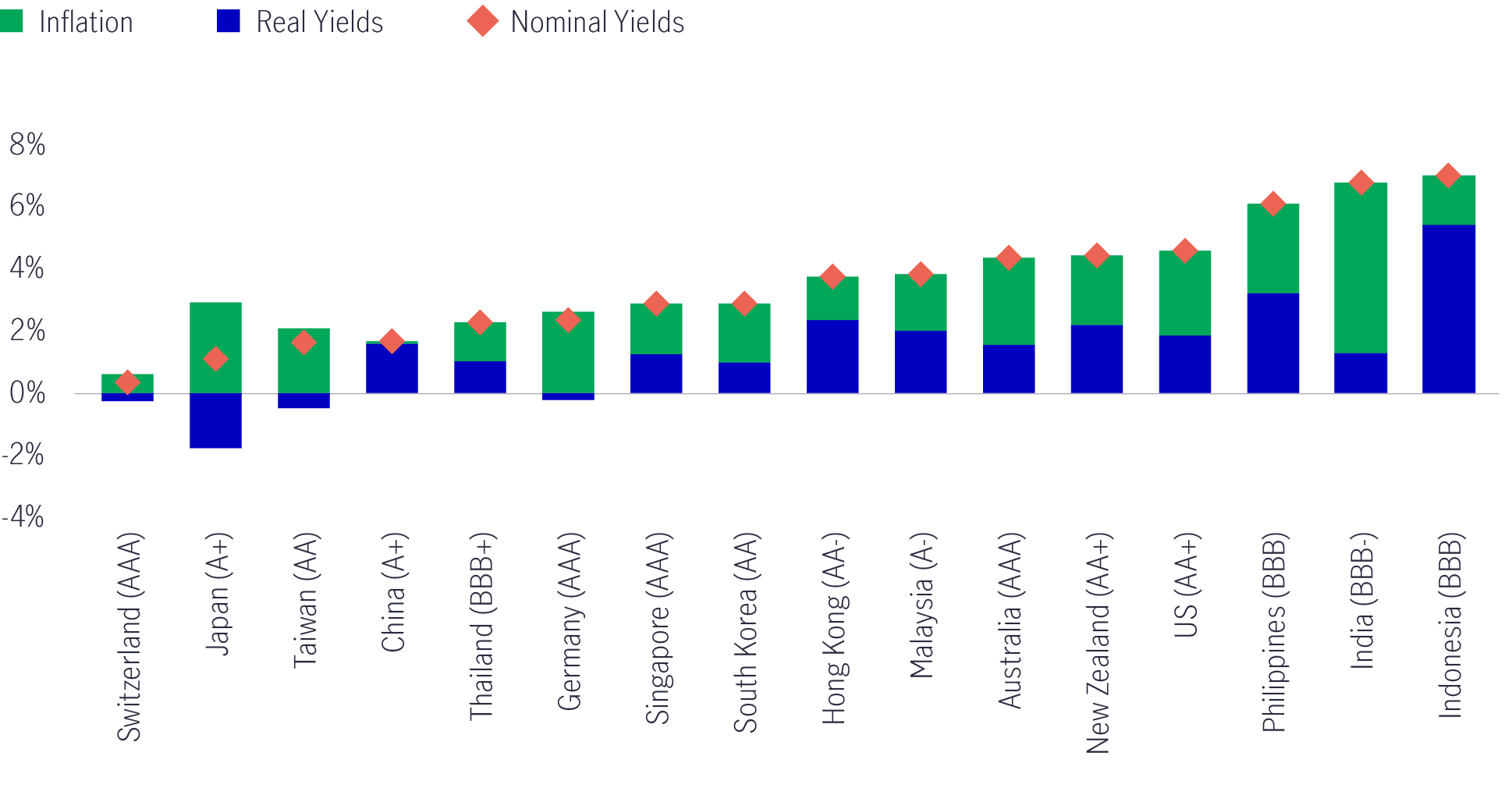

Chart 5: Nominal and real yields

Source: Manulife Investment Management, Bloomberg as of 31 December 2024.

Despite this headwind, the rise in yields following the US elections also helps Asian local yields offer better value as we start the new year, and we see attractive opportunities in markets with relatively high nominal yields which offer decent carry compared to other global bonds.

Currencies – expect volatility amid a strong US dollar.

In our view, the strength of the US dollar will likely persist in 2025, given the potential impact of the incoming US administration’s trade tariffs and the possibility of increased trade tensions, which would introduce greater uncertainty to the region’s economic growth and volatility for local currency movements against the US dollar.

India is a market with attractive opportunities in both rates and currency. The country’s strong growth prospects, attractive nominal yields, and strong technicals from index inclusion provide a healthy backdrop that should allow the bonds to deliver relatively stable returns for investors. Our constructive view on India is built around:

We believe that 2025 will be a year where Asian Fixed Income will add greater value to investment portfolios through a combination of both yield enhancement, compared to fixed deposits after recent rate cuts, and downside protection, given the policy uncertainties of the new US government. Investments such as securitised assets, which have offered attractive income to investors in recent years, may be exposed to headwinds and downside risks if economic growth worsens due to aggressive tariffs and trade policies, which could impact the loan repayment ability of consumers with respect to mortgages, auto loans, and credit card loans.

Furthermore, with an elevated terminal rate of around 4.0% and with pandemic savings fully depleted4, any signs of weakness in consumption, which accounts for around 70% of US GDP, would translate to downside risks to US economic growth.

In the Year of the Snake, as the name suggests, an even more active, nimble and flexible approach towards portfolio management will be warranted.

1 Bloomberg Ticker: USDRC Curncy.

2 JPM EM weekly flows report.

3 Source: JPM 2025 Asia Credit Outlook.

4 Pandemic Savings Are Gone: What’s Next for U.S. Consumers? - San Francisco Fed

Asian Fixed Income: Are we at a turning point?

This outlook analyses the near-term tailwinds propelling returns in Asian fixed income, as well as the structural fundamentals and shifting geopolitical trends that could support the asset class over the long-term.

Midyear 2025 global macro outlook: what’s changed and what hasn’t

More forceful-than-expected government policy decisions, particularly by the United States, have swiftly overtaken some of our early 2025 views. Global trade issues and deglobalization have indeed come to the fore, with knock-on effects for many trade-sensitive emerging markets. Elsewhere, capital markets the world over are contending with a big wave of government debt supply, which is driving global bond yields higher.

Greater China Equities: 2H 2025 Outlook

The latest Greater China Equities Outlook highlights how our investment team navigates global uncertainties and invests through the lens of our investment framework via the “4A” positioning: Acceleration, Abroad, Advancement, and Automation.

Asian Fixed Income: Are we at a turning point?

This outlook analyses the near-term tailwinds propelling returns in Asian fixed income, as well as the structural fundamentals and shifting geopolitical trends that could support the asset class over the long-term.

Midyear 2025 global macro outlook: what’s changed and what hasn’t

More forceful-than-expected government policy decisions, particularly by the United States, have swiftly overtaken some of our early 2025 views. Global trade issues and deglobalization have indeed come to the fore, with knock-on effects for many trade-sensitive emerging markets. Elsewhere, capital markets the world over are contending with a big wave of government debt supply, which is driving global bond yields higher.

Greater China Equities: 2H 2025 Outlook

The latest Greater China Equities Outlook highlights how our investment team navigates global uncertainties and invests through the lens of our investment framework via the “4A” positioning: Acceleration, Abroad, Advancement, and Automation.