Important Notes:

Issued by corporates, preferred securities rank between traditional bonds and common stocks in the capital structure of a corporate. In the event of corporate financial distress or a bankruptcy, a company's preferred securities are senior to common stock but subordinated to traditional bond.

The preferred securities issuers are usually large and highly regulated institutions and/or companies with stable cash flows such as banks, utilities, and real-estate investment trusts (REITs).

Banks, insurance companies and financial services

Bank of America Corporation, HSBC Holdings, Morgan Stanley, MetLife Inc.

Utilities

Dominion Energy Inc., DTE Energy Company, NextEra Energy Capital Holdings Inc.

Others

Vodafone Group Inc., Ford Motor Company, Brunswick Corporation

With an average investment-grade rating, preferred securities offer yields that are comparable to high yield bonds, meaning investors could enjoy relatively high yields with lower credit risks.

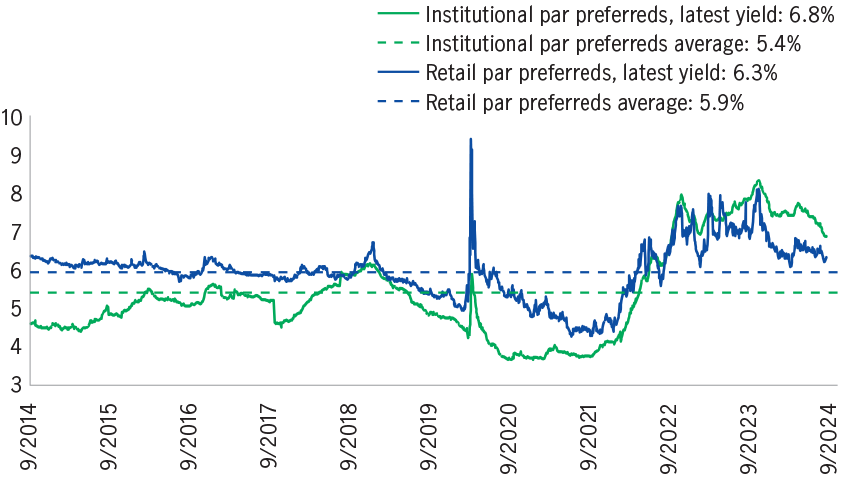

Preferred securities are offering yields higher than 10-year average2

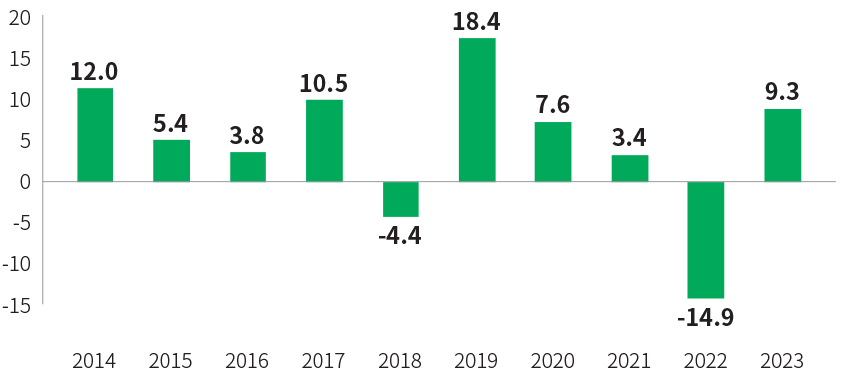

Preferreds only saw two negative calendar year return in the past decade, with strong rebound on the following year. In 2019, preferred securities registered a 18.4% return as the Fed started cutting interest rates.

Preferred market calendar year return (%, in USD)3

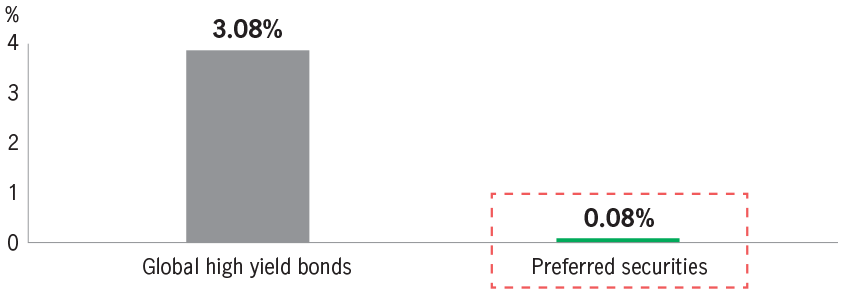

Preferred securities are well positioned to help buffer economic slowdown as near 90% of preferred issuers are rated as investment grade and are generally well-established, high-quality companies with solid balance sheets. Historically, the default rate of preferred securities was much lower than global high yield bonds.

10-year average default rate4

Manulife Preferred Securities Income Fund aims to offer monthly distributions with potential capital growth. Compared to broad preferred market, the Fund is more diversified, with focus on utilities, energy and financials sectors, which are better-positioned in a high inflation and low growth environment.

The Fund adopts dynamic strategies to respond to the changing macroeconomic environment by flexibly allocating into various types of preferred securities, e.g., institutional/retail, fixed-to-floating/fixed and convertible/nonconvertible. The Fund also actively manages portfolio duration in accordance with the interest rate cycle.

(The distribution yield is not guaranteed. Distribution may be paid out of capital. Refer to Important Note 2.)

30+ years

investment experience by US-based lead manager

150+

global fixed income investment experts7

USD 5.6 billion

AUM in preferred securities, one of the key players in the market8

4961015