Important Notes:

As the globalised world is changing, there is renewed opportunity for emerging economies by capitalising on trends like China+1 and friend shoring. We believe that emerging economies such as India are at the cusp of scalable and sustainable growth as it has carried out structural reforms over last 10 years to benefit from these trends.

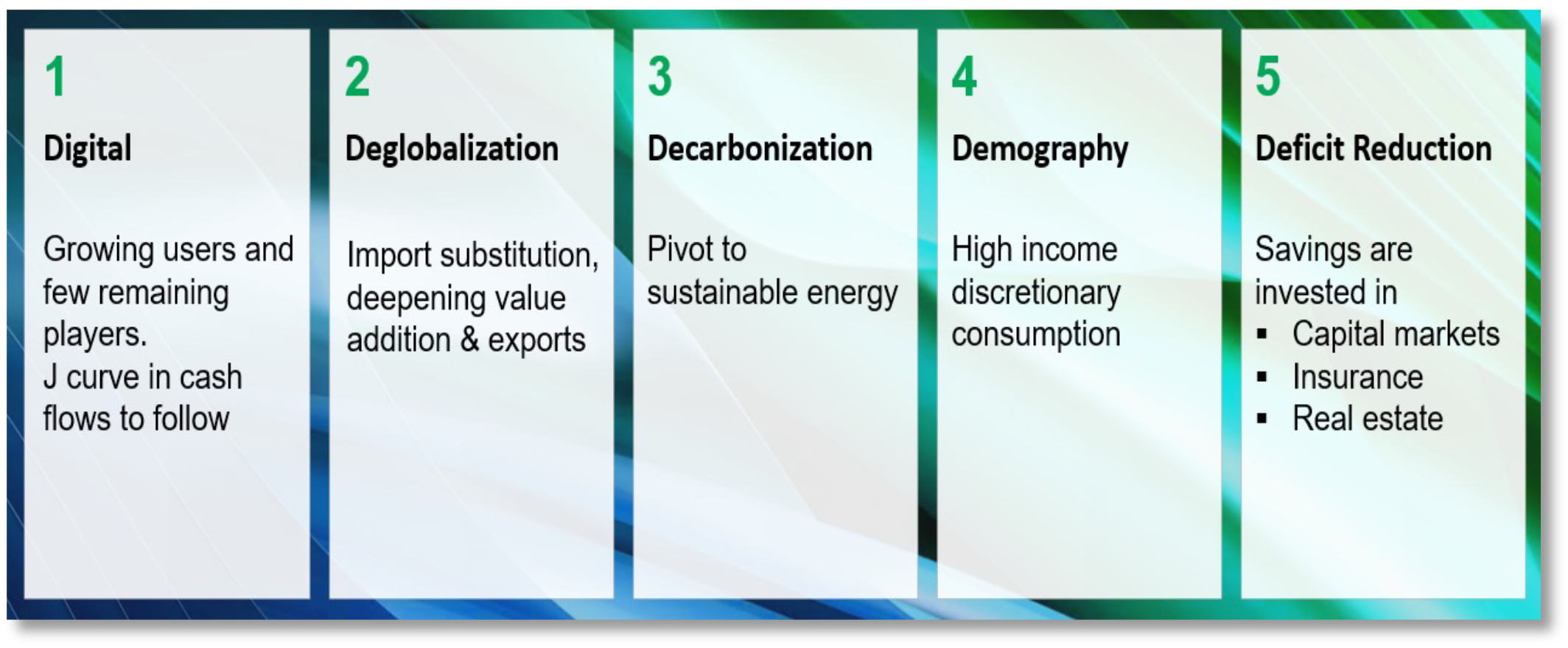

Themes expected to drive long term growth

India is going through a metamorphosis. Novel business models are emerging, and incumbents are getting challenged. We have a 5D classification framework, which help capture the areas we like.

Source: Manulife Investment Management. For illustrative purposes.

Digital

As the digital economy grew, certain platforms in areas like consumer and financial services have gained scale.

Deglobalization

This refers to the manufacturing opportunities created by import substitution, value addition and exports.

Decarbonization

To make its economic growth truly sustainable, the government has pivoted to adding significant capacities in renewable power.

Demography

As GDP per capita has inflected above US$2,500 in 2023, we see demand for discretionary and premium goods rising at a much faster pace.

Deficit reduction

As India overall reduces deficit and increases savings, we see investment opportunities in real estate companies as well as in savings institutions and capital market linked businesses like wealth and asset management.

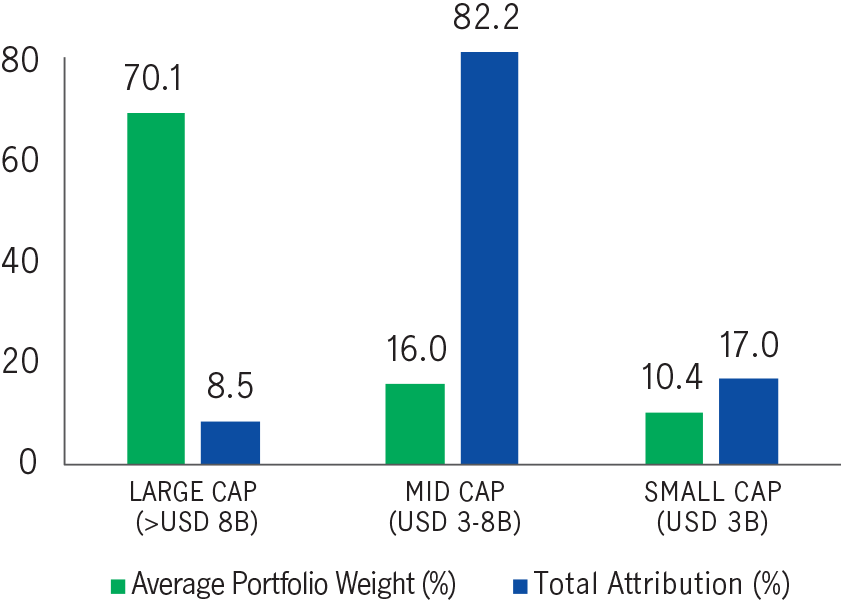

Manulife India Equity Fund adopts a balanced approach across large and small/ mid cap stocks, and sustainable and scalable growth opportunities with a good balance between growth and cashflow.

Market capitalization allocation and attribution (%)2

(March 2019 to March 2024)

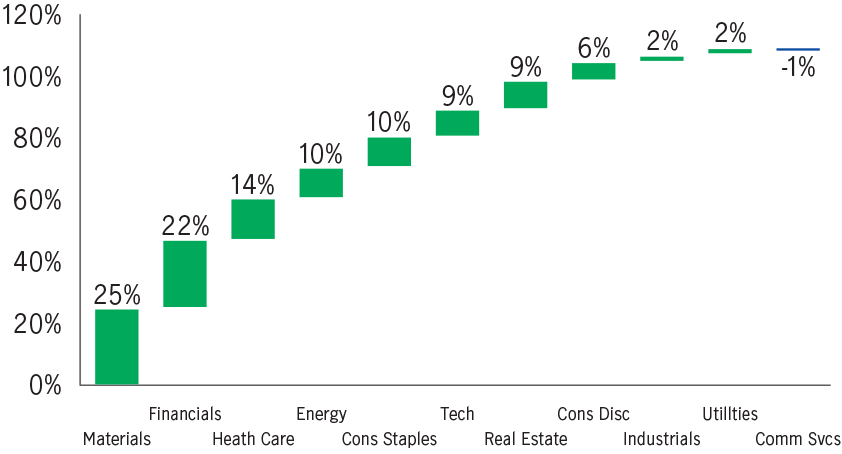

Sector attribution over the past five years (%)2

(March 2019 to March 2024)

120+ years

investment management experience in Asia

USD 147 billion

assets under management and administration in Asia3

200+

investment professionals based in Asia4

3670331