Important Notes:

An unconstrained income driven approach across global asset classes can become an attractive strategy in order to capture a sustainable high-income payout within a challenged growth outlook.

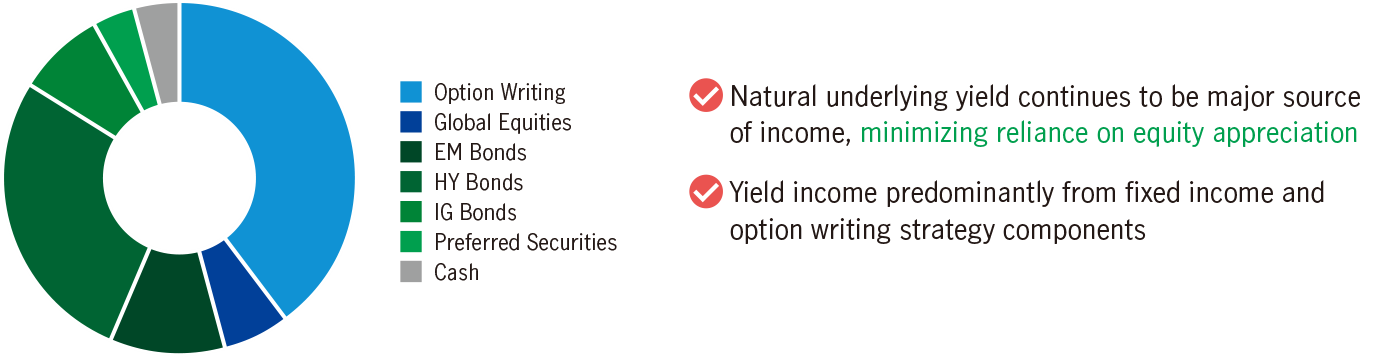

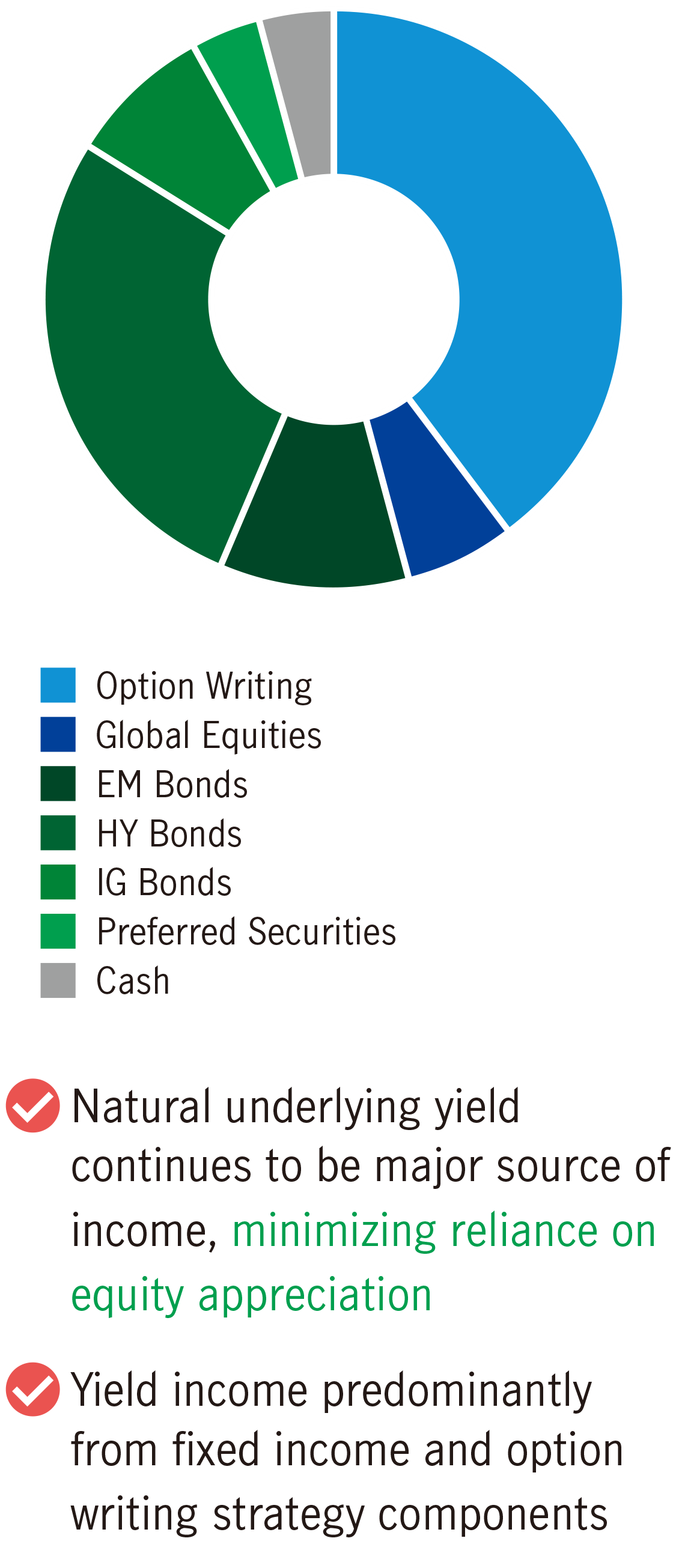

To strive for a sustainable long-term income distribution, our strategy adopts a differentiated approach of achieving yield, minimizing reliance on equity appreciation by focusing on maximizing yield from income generating assets.

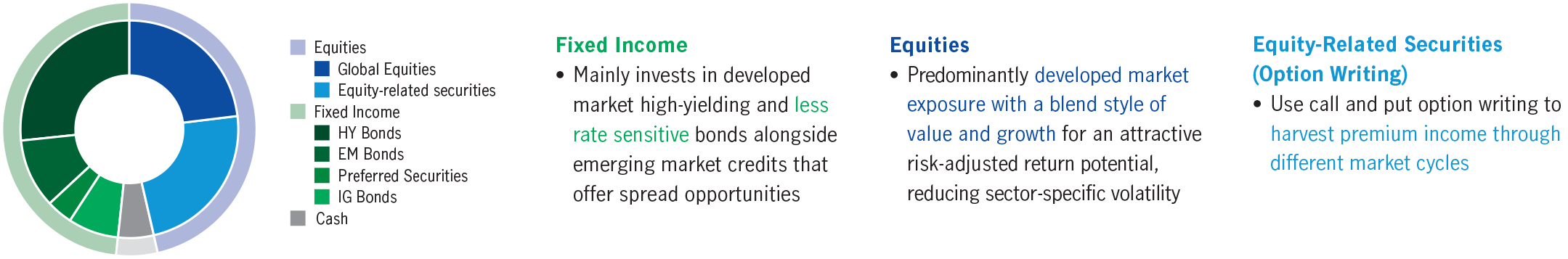

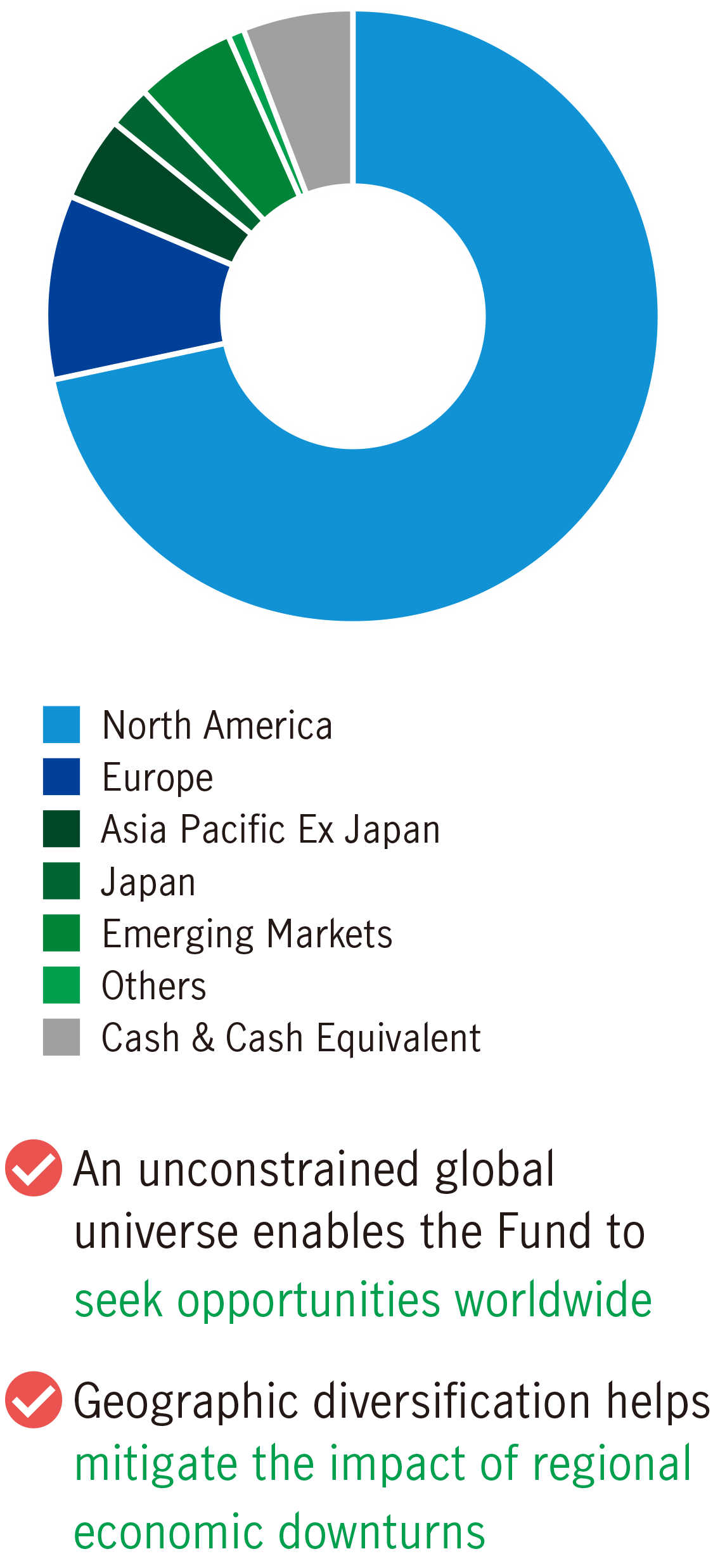

The typical globally diversified asset allocation of the portfolio has a relatively low volatility profile, dominated by fixed income credits, developed market equities and an option writing (income generating) structure.

Typical asset allocation (%)1

Average yield breakdown by asset class (%)1

Typical geographical breakdown

One of the key factors for achieving long-term performance is effectively managing downside risk through a lower volatility construction.

Apart from competitive income distribution, the Fund also aims to achieve an optimal risk-reward profile with a low volatility, minimal style bias portfolio.

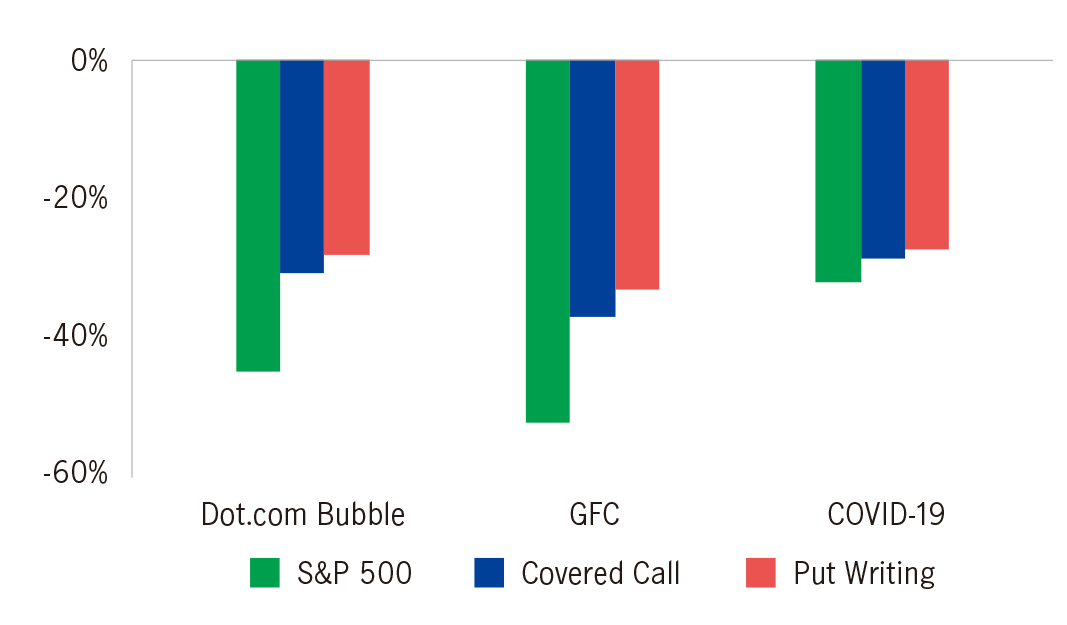

Option writing saw better downside performance2

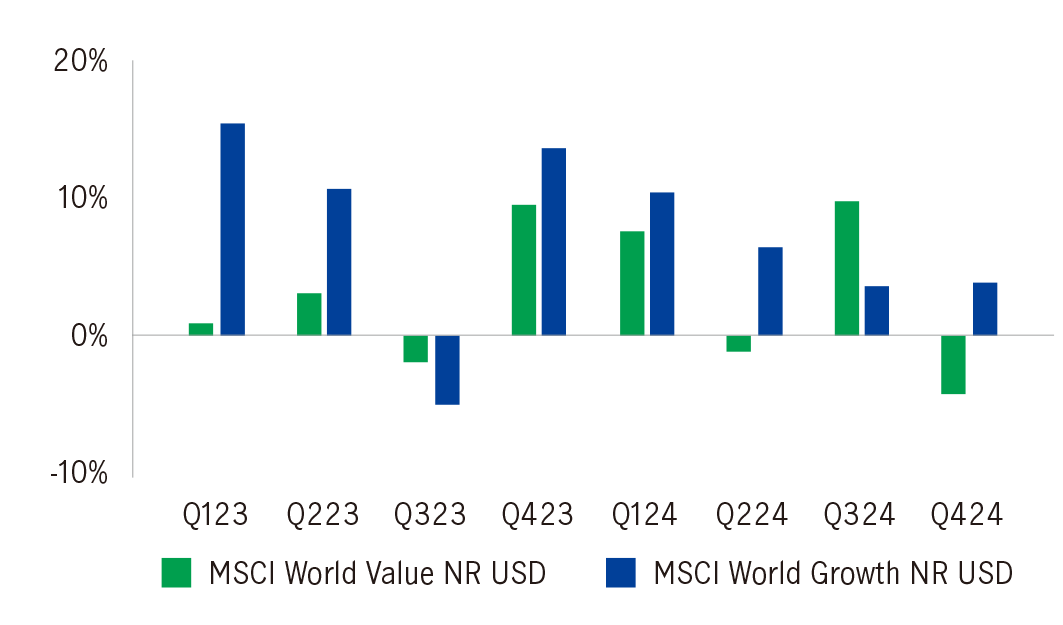

Value vs Growth: Style rotation with volatility3

Aims to generate high, stable income through multiple traditional and non-traditional income sources.

(The distribution yield is not guaranteed. Distribution may be paid out of capital. Refer to Important Note 2.)

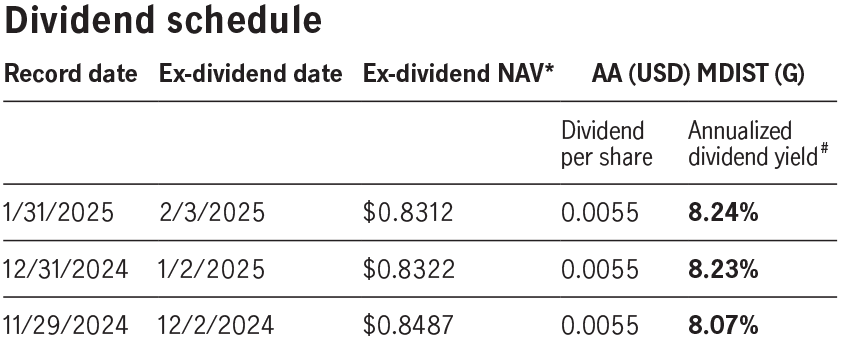

Source: Manulife Investment Management, as of June 30, 2025. For illustrative purposes only. Dividend is not guaranteed.

*Applicable to AA (USD) MDIST (G) Share class. A positive distribution yield does not imply a positive return.

Manulife Investment Management's Global Multi-Asset Diversified Income Fund (GMADI) celebrates its 5th anniversary with outstanding performance. This year, it won the Lipper Fund Hong Kong Award for the Best Fund over 3 Years, Mixed Asset USD Flex – Global.

We are the global wealth and asset management segment of Manulife Financial Corporation, we draw on more than 150 years of financial stewardship to partner our clients globally.

25+ years

average investment experience of management team

700+

investment experts across asset classes4

USD 147.8 billion

AUM of multi-asset solutions5

Pursuing a regular and achieving a higher income from investment products is still a top priority for many investors in Asia. Geoffrey Kelley, and John F. Addeo, the portfolio managers, are sharing with us the investment philosophy of our multi-asset income strategy, and how they manage volatility in achieving a relative high- and stable-income payout across market cycles.

# Dividend rate is not guaranteed. Dividends may be paid out of capital. Refer to important note 2. Please note that a positive distribution yield does not imply a positive return. Investors should not make any investment decision solely based on information contained in the table above. You should read the relevant offering document (including the keyfacts statement) of the fund for further details including the risk factors. Past performance is not indicative of future performance. Annualized yield = [(1+distribution per unit/exdividend NAV)^distribution frequency]–1, the annualized dividend yield is calculated based on the latest relevant dividend distribution with dividend reinvested, and may be higher or lower than the actual annual dividend yield.

4687301