Important Notes:

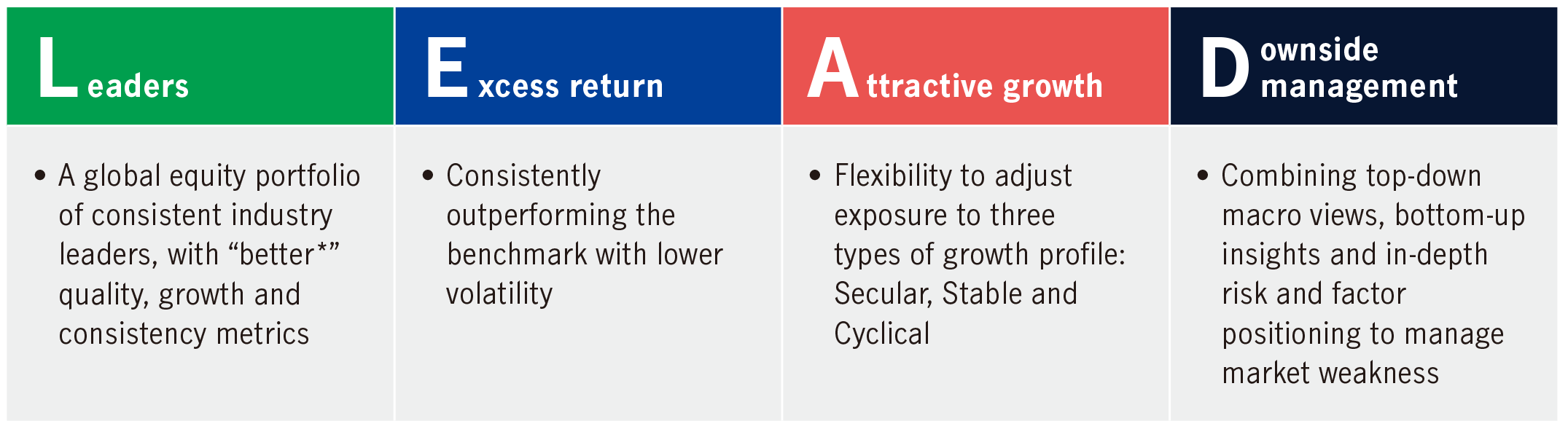

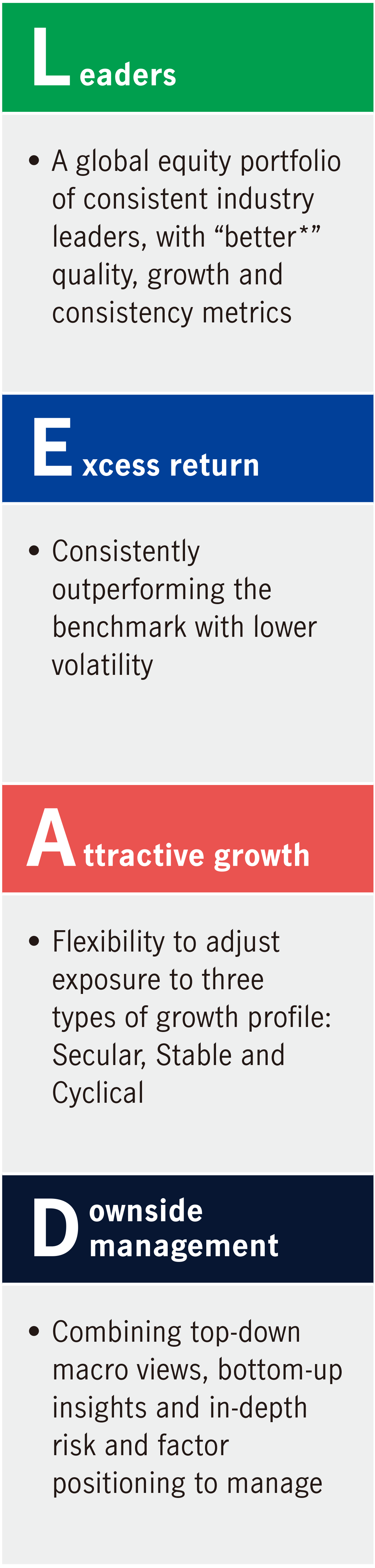

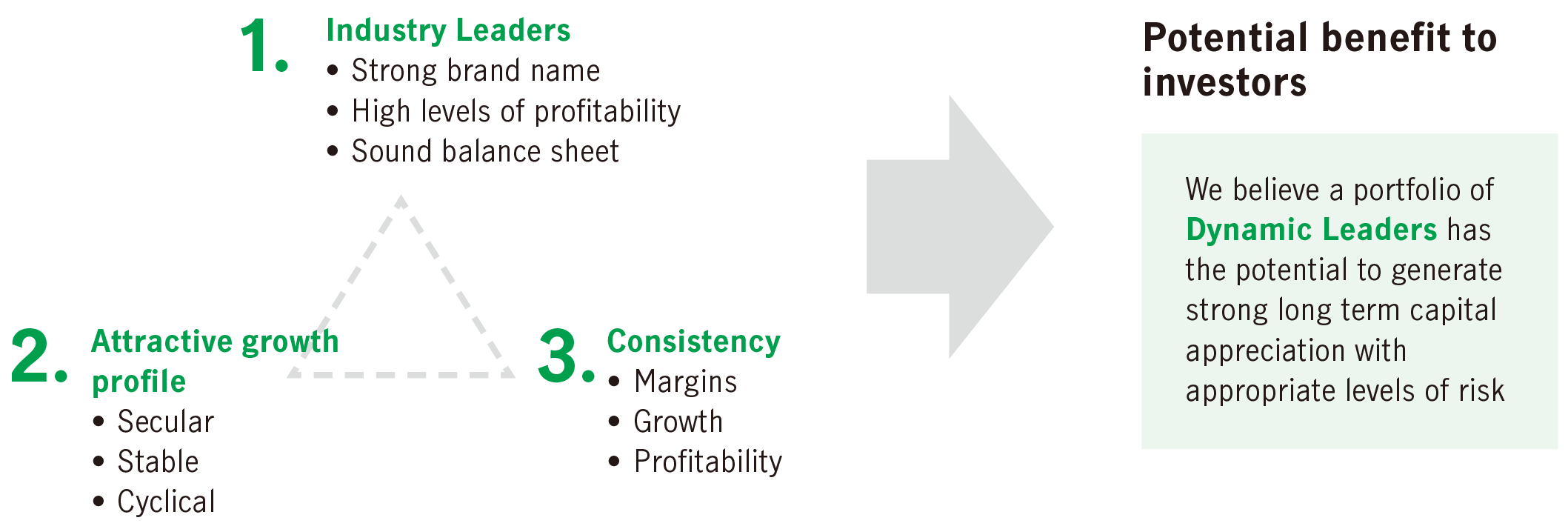

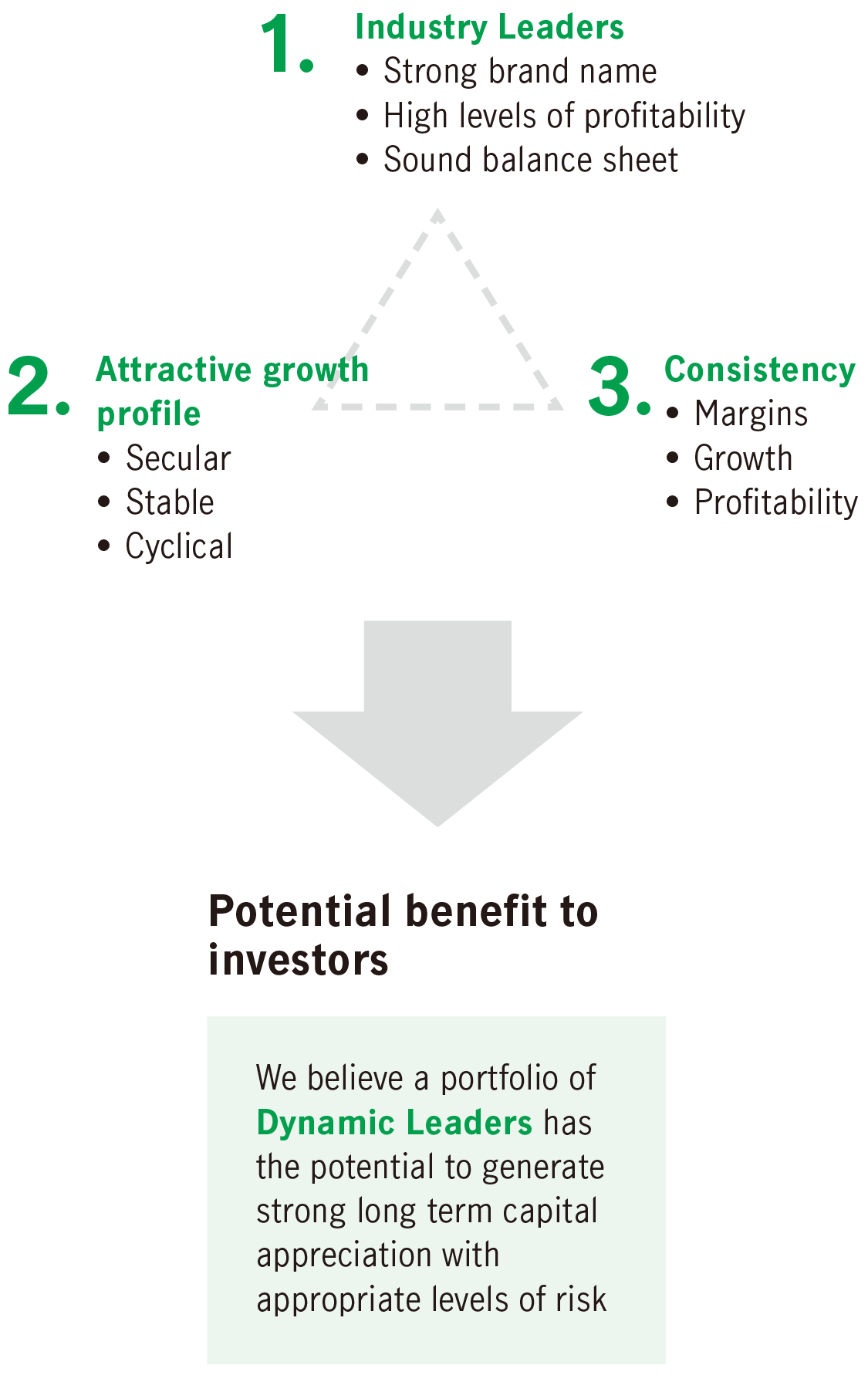

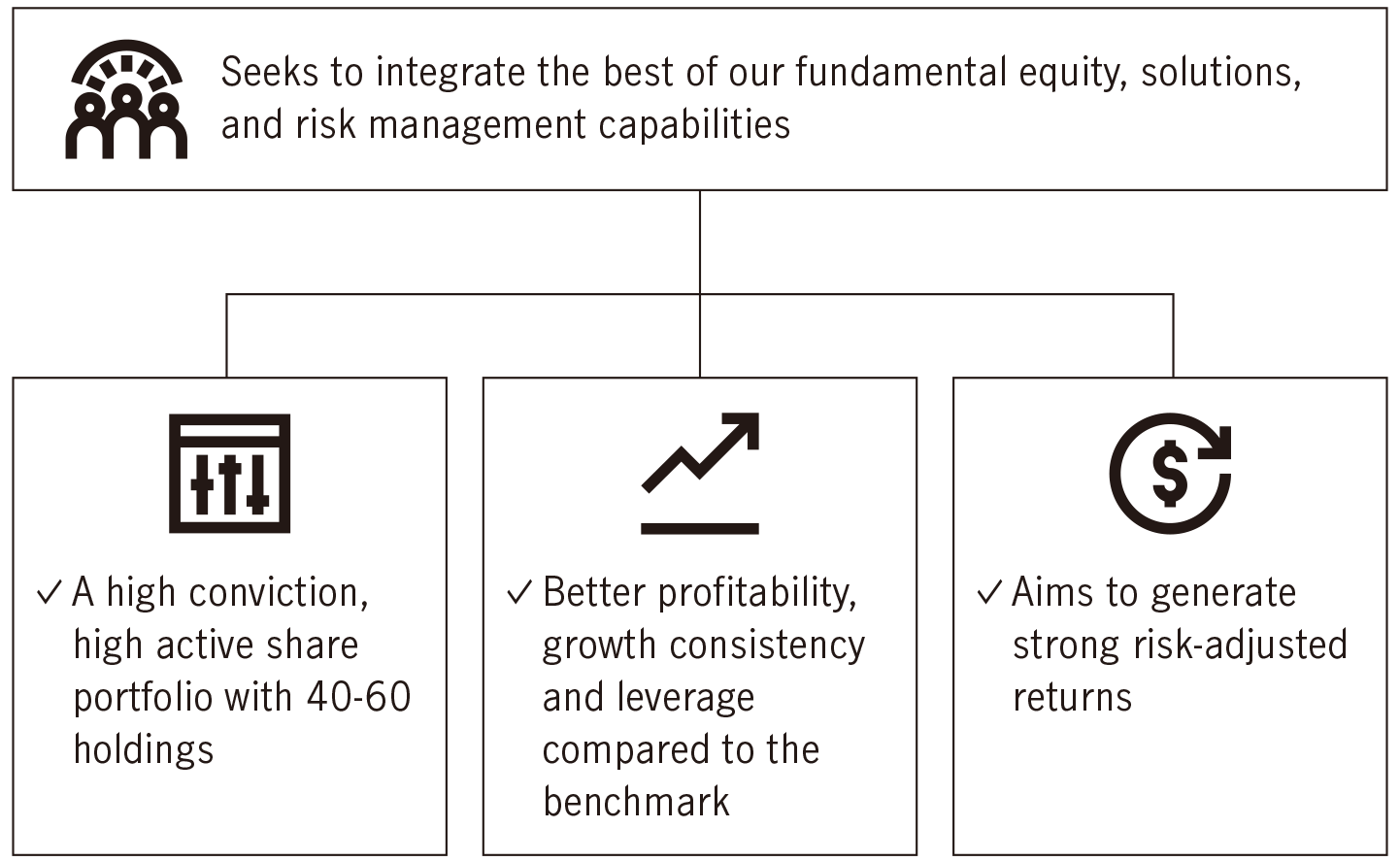

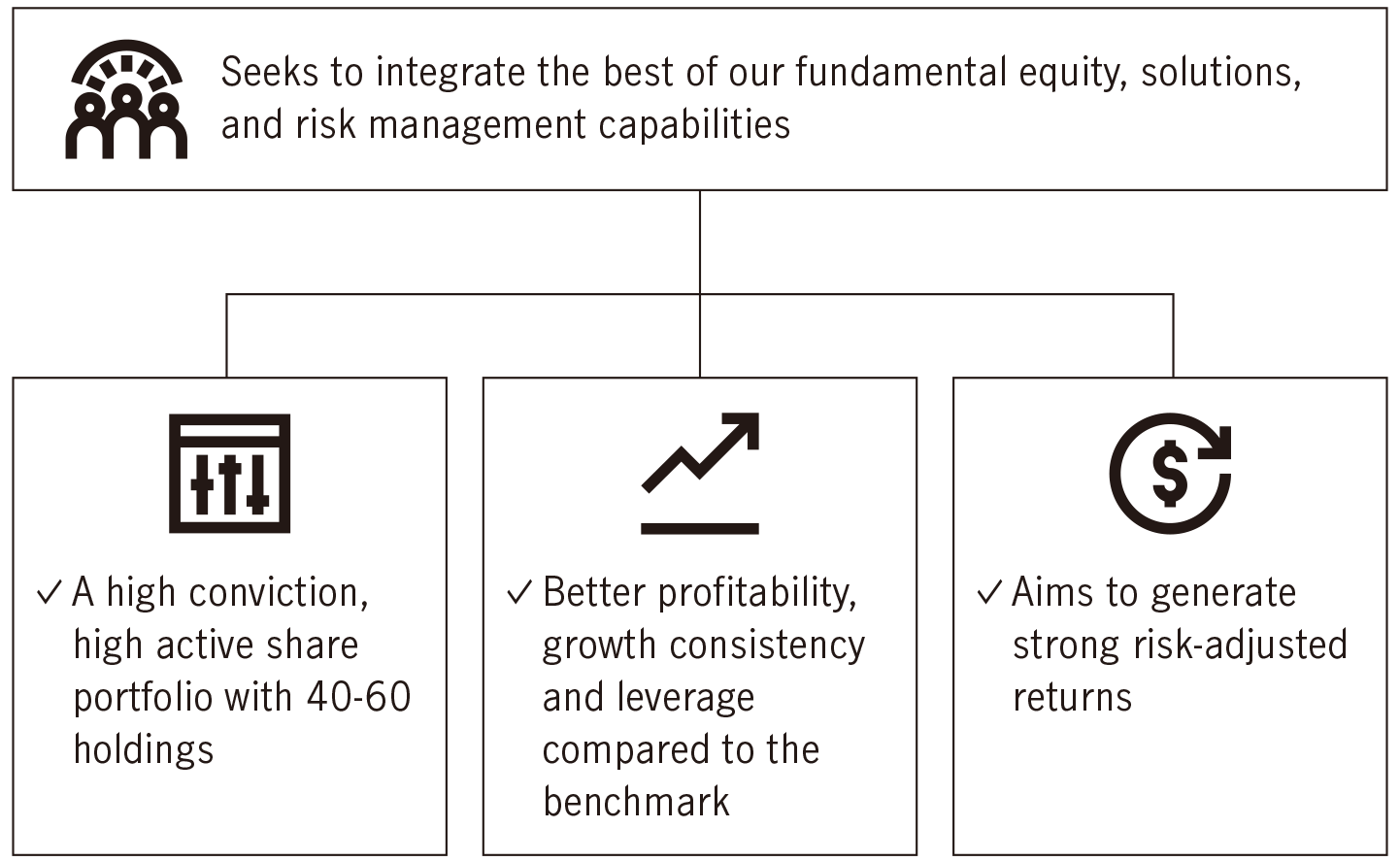

In today’s dynamic investment world, investors are seeking an investment strategy to participate in the potential equity market upside, while mitigating the downside risk. Manulife Dynamic Leaders Fund seeks to fulfill your financial goal by investing in a global equity portfolio of consistent industry leaders that has the potential to generate strong risk-adjusted returns.

* Seeking “Better” than MSCI ACWI Index

* Seeking “Better” than MSCI ACWI Index

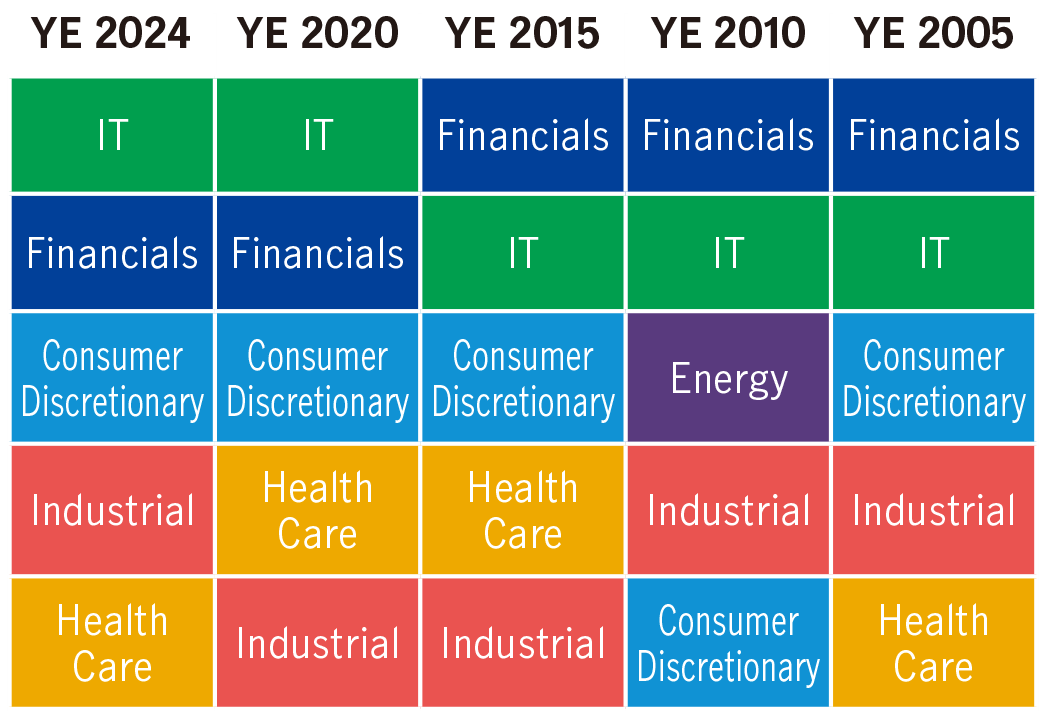

MSCI ACWI top 5 sectors by market weight1

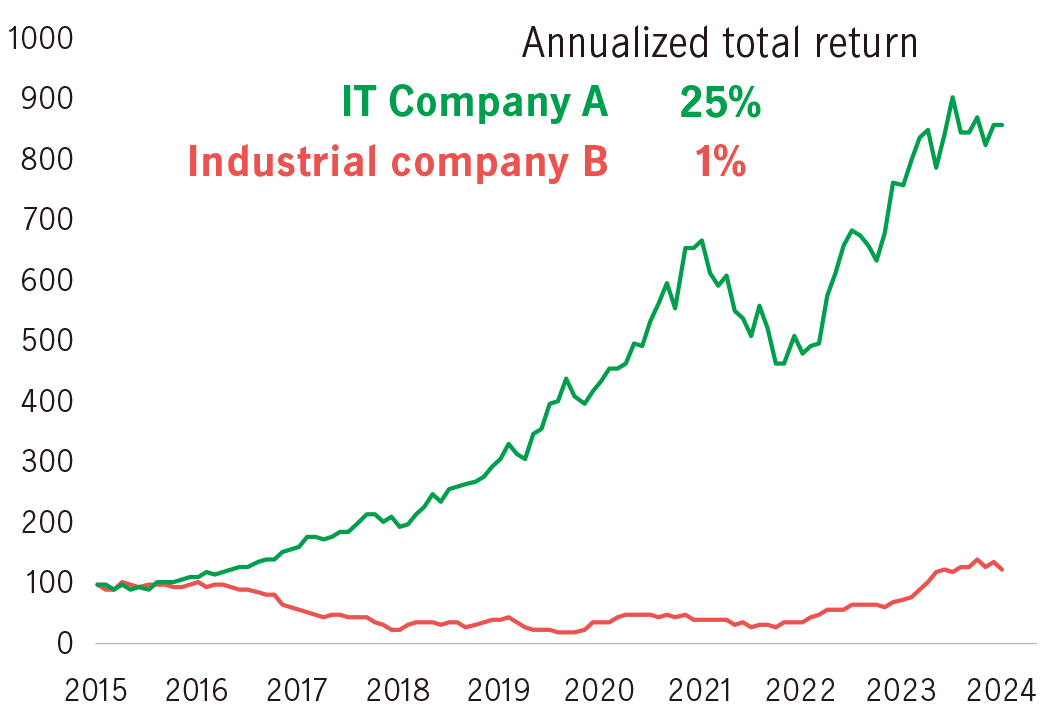

Performance of two top 10 market cap companies as of December 20152

| Fund name | Manulife Global Fund – Dynamic Leaders Fund |

| Investment objective | Dynamic Leaders Fund aims to achieve capital growth from investing at least 80% of its net assets in a concentrated portfolio of equity and equity related securities of large capitalisation companies (i.e. companies with a minimum market capitalization of US$10 billion) listed globally (including in emerging markets from time to time), including, but not limited to, common stocks and depositary receipts. |

| Inception date | December 4, 2024 |

| Base currency | USD |

| Available share classes |

|

| Initial subscription fee4 | Currently up to 5% of the NAV per Share |

| Management fee4 | Currently 1.50% p.a. |

| Specific Risk Factors |

|

29+ years

average investment experience of portfolio managers of the Fund

160+

investment professionals in equities5

USD 116.4 billion

AUM in equity assets5

Unless otherwise stated, all information sources are from Manulife Investment Management, as of November 30, 2024. Projections or other forward-looking statements regarding future events, targets, management discipline or other explanations are only current as of the data indicated. There is no assurance that such events will occur, and if they were to occur, the result may be significantly different than that shown here. Investment involves risk. Investors should not make investment decisions based on this material alone and should read the offering document for details, including the risk factors, charges and features of the product. This material has not been reviewed by the Securities and Futures Commission. Issued by Manulife Investment Management (Hong Kong) Limited.

4077474