17 May 2022

ESG investing may surpass US$53 trillion in assets by 2025 on growing demand from global investors.1 In Asia, the appetite for sustainable investments soared in China (up 80% in 2021) and in Japan (rose 34% in 2018-2020).2 Demand for responsible investing has also grown among pre-retirees who wish to align their personal values to their retirement goals (U.S. public pensions applied ESG factors to at least $3 trillion in assets in 2018)3.

ESG investing is becoming the new investment strategy that offers diverse benefits to investors of any kind.4 What can be gained from adopting a sustainable investment approach? We list the five key benefits of ESG investing.

Outperformance is measured in terms of relative performance. It could mean more gain and less loss when compared with a benchmark fund or standard index. Investee companies that integrate ESG more thoroughly are generally considered better-run from a governance perspective, which helps financial performance. Here’s why.

ESG-focused companies have sustainability strategies and tend to have better operational efficiency, cost savings, lower employee turnover, innovation, retained talent, reduced compliance costs, and risk management — all of which may help to increase shareholder value.5

As for funds that carry ESG labels, we found that they have tended to outperform over the medium to longer term.6 According to Morningstar, over the 10-year period through 2019, more than 58.8% of sustainable funds outperformed (delivered higher returns than) their average traditional peers.7 Furthermore, over 77% of these funds still exist today, while more than half (53%) of traditional funds have dissolved.8 Indeed, research shows that funds considering ESG factors were able to outlast and outperform their conventional, non-ESG counterparts.

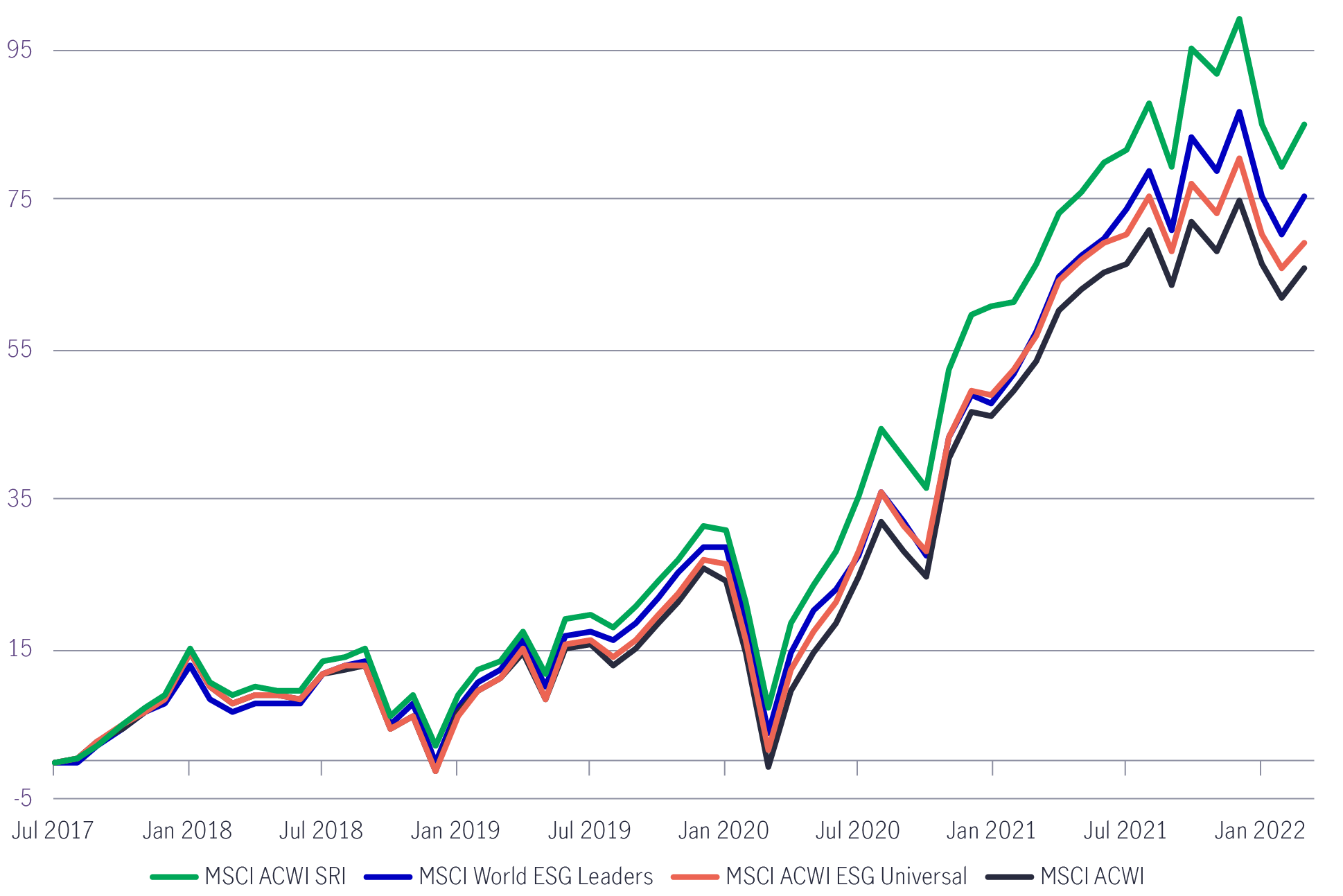

What’s more, ESG funds have also shown resilience during periods of heightened market volatility. An MSCI study compared three global ESG indexes with the parent gauge, MSCI All Country World Index ACWI, during the first quarter of 2020 (the onset of the COVID-19 sell-off) and found that the ESG measures outperformed the traditional benchmark (MSCI ACWI) over the same period and onwards (See Chart 1).

Chart 1: Index performance of select MSCI ESG Indexes and MSCI All Country World Index

Source: Bloomberg data for 31 July 2017 – 31 March 2022. Cumulative total return (gross dividends) of indexes. MSCI All Country World (ACWI) index tracks broad global equity-market performance. MSCI ESG Universal Index represents an ESG weight-tilt approach, MSCI ESG Leaders a 50% best-in-class sector approach and MSCI Socially Responsible Investing (SRI) a 25% best-in-class sector approach. It is not possible to invest in an index.

In the past few decades, human activities have contributed to climate change, biodiversity loss and the erosion of the world’s wildlife, plants, and marine environments. Overall, public pressure is rising for corporates and governments to play more active roles on sustainability.

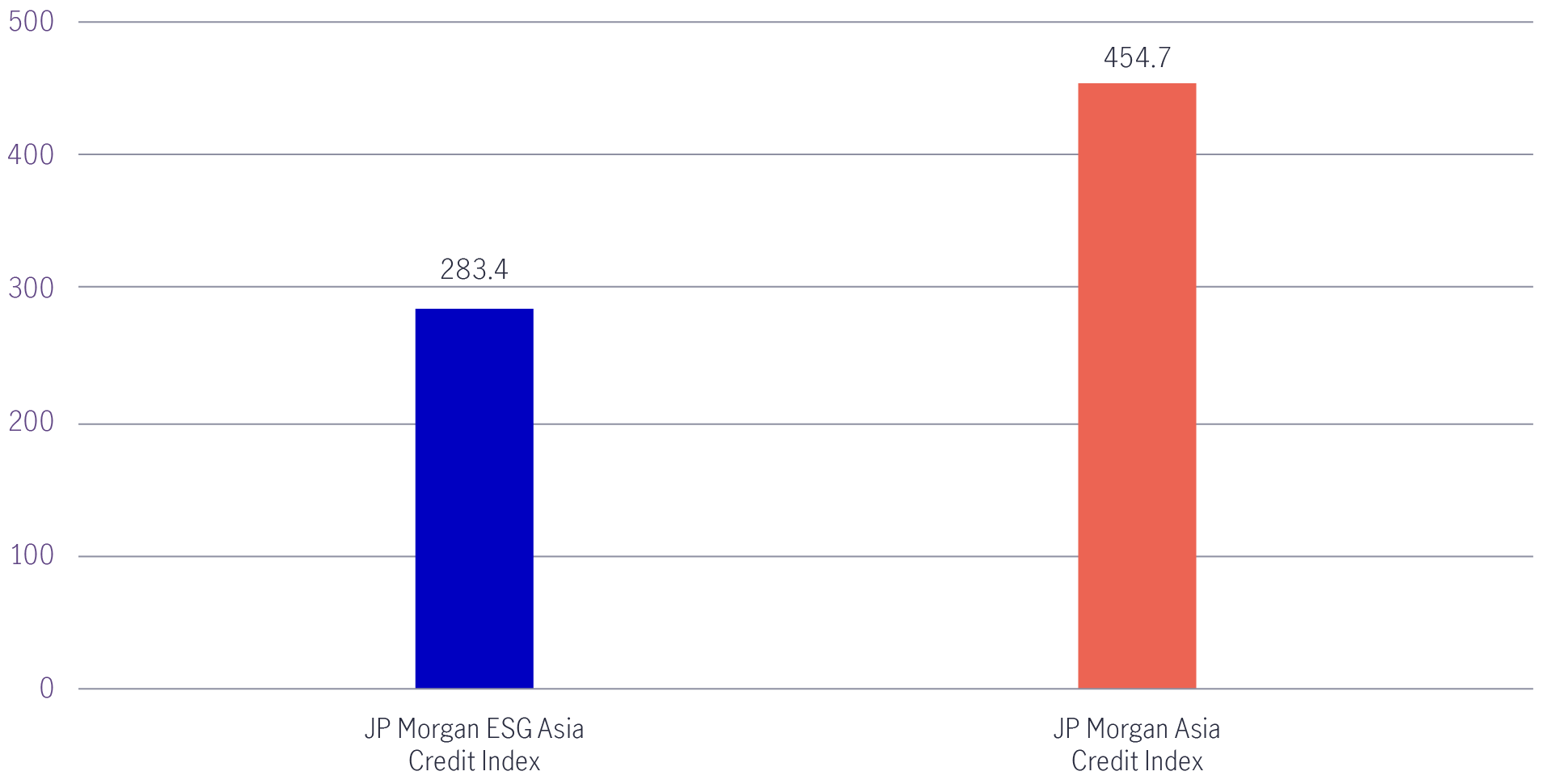

Investing in ESG-oriented companies can potentially help the environment and mitigate climate change. Green bonds, for example, are focused on environmental objectives, including reducing carbon emissions to improve air quality. As data from J.P. Morgan ESG Asia Credit Index (JESG JACI) vs. J.P. Morgan Asia Credit Index (JACI) demonstrate, the JESG JACI emitted less carbon dioxide (CO2) for every US$1 million of revenue generated, implying a milder environmental impact (See Chart 2). Another example is investing in a rail network company. Transport by rail can result in 75% less greenhouse gas (GHG) emissions than trucking, creating an opportunity to gain customers, comply with environmental regulatory changes, and reduce GHG footprints.

Chart 2: Carbon Intensity (Tons CO2e / $M revenues)

Source: Bloomberg, 31 December 2021. Figures shown are in gross USD terms. Carbon intensity data sourced via Trucost ESG Analysis and Manulife Investment Management. Carbon intensity refers to Scope 1- & 2-tons CO2 equivalent emissions per million USD revenues. It is not possible to invest in an index.

It may not be obvious, but the economy, businesses, and nature are all intertwined. The environment plays an integral part in the global supply chain. More than half of the world’s total GDP (almost US$44 trillion economic value generated) is broadly dependent on nature, particularly in sectors like construction, agriculture, and forestry. Investors may be better positioned to enhance portfolio resilience by understanding the hidden risks of biodiversity and nature loss and its impact on the economy and investments.

Investing in ESG-oriented companies may reduce overall investment risk, given those companies’ stronger relative governance practices and better business ethics. A growing number of initiatives like the United Nations Principles for Responsible Investment (UNPRI) are requiring members to exercise the fiduciary duty of incorporating ESG factors in their investment decisions. Meanwhile, more stock exchanges are requiring ESG disclosures; exchanges in Hong Kong (HKEX) and Singapore (SGX), for instance, require listed companies to file annual ESG reports. (See Chart 3)

Chart 3: ESG disclosures by Asia-Pacific stock exchanges

Source: CFA Institute, 2019. Note: There is no guidance on biodiversity disclosure for Hong Kong and Japan, and on health and safety for India. Singapore discloses on climate change adaptations in lieu of GHG emissions.

Historically, institutions and the wealthiest members of society have been the largest donors to philanthropic causes. These days, ESG investing offers more options for investors of any kind who are interested in making a positive social impact.

Investing in ESG-focused companies goes beyond financial returns, and places high priority on social benefits, such as protecting employee welfare and fostering relationships between businesses, shareholders, and communities.

From an employee’s standpoint, studies show that encouraging staff to act in a “prosocial” way correlates with higher job satisfaction and productivity (factors that play into mental health)9.

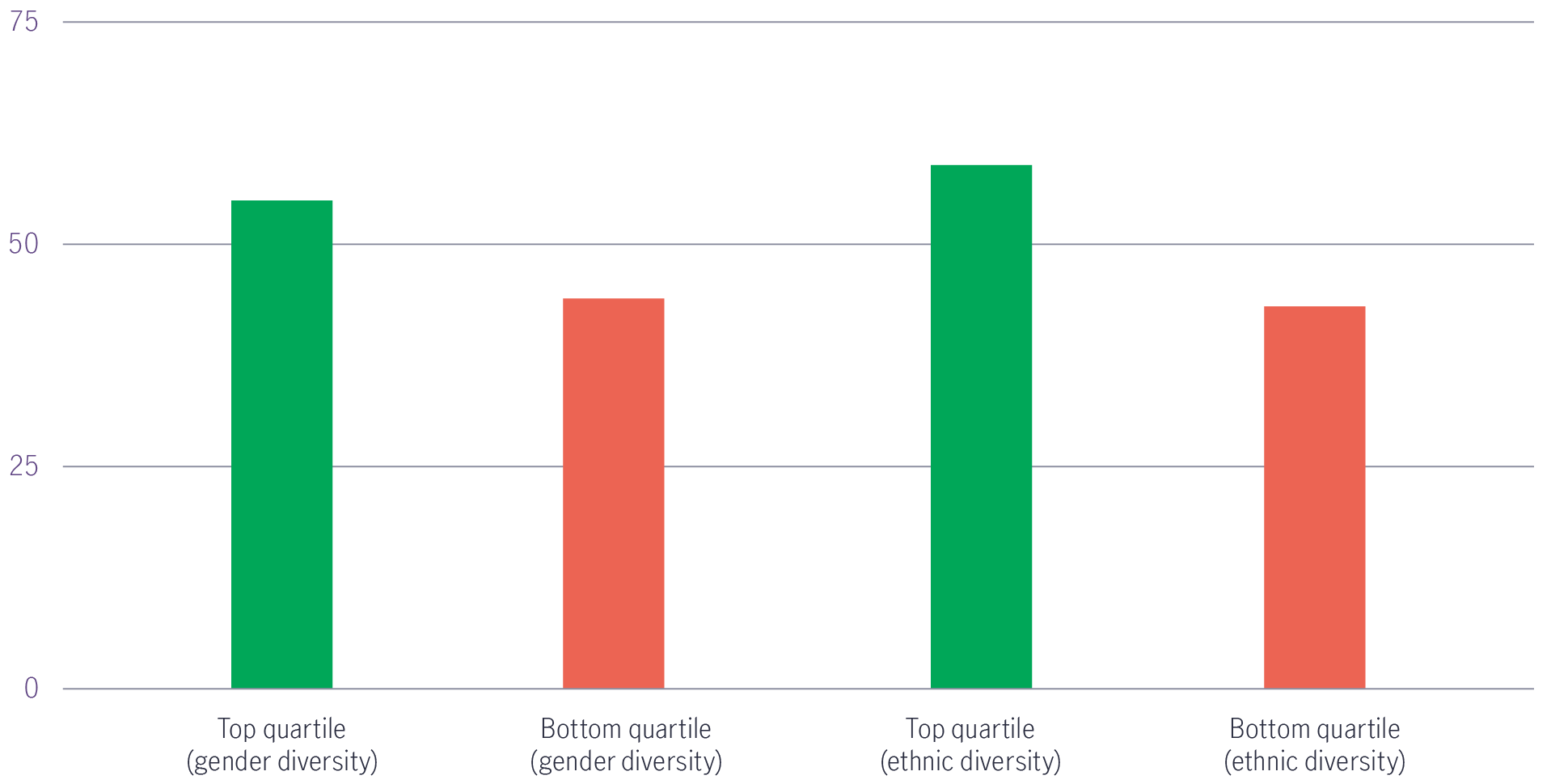

From a shareholder’s standpoint, a 2019 McKinsey study found that companies in the top quartile for diversity in gender or ethnicity on executive teams were 25 percent more likely to have above-average profitability than companies that had less diverse representation.10 (See Chart 4)

Chart 4: Likelihood of financial outperformance (%) by diversity of executive team

Source: McKinsey, 2019.

Last but not least, from a customer’s standpoint, corporate social responsibility (CSR) can also help companies build customer loyalty. Numerous studies indicate U.S. millennials are more likely to buy brands that support social issues they care about. And for the younger generation under the age of 40, instead of donating money directly to social causes, they would prefer to give back through the places they shop.11

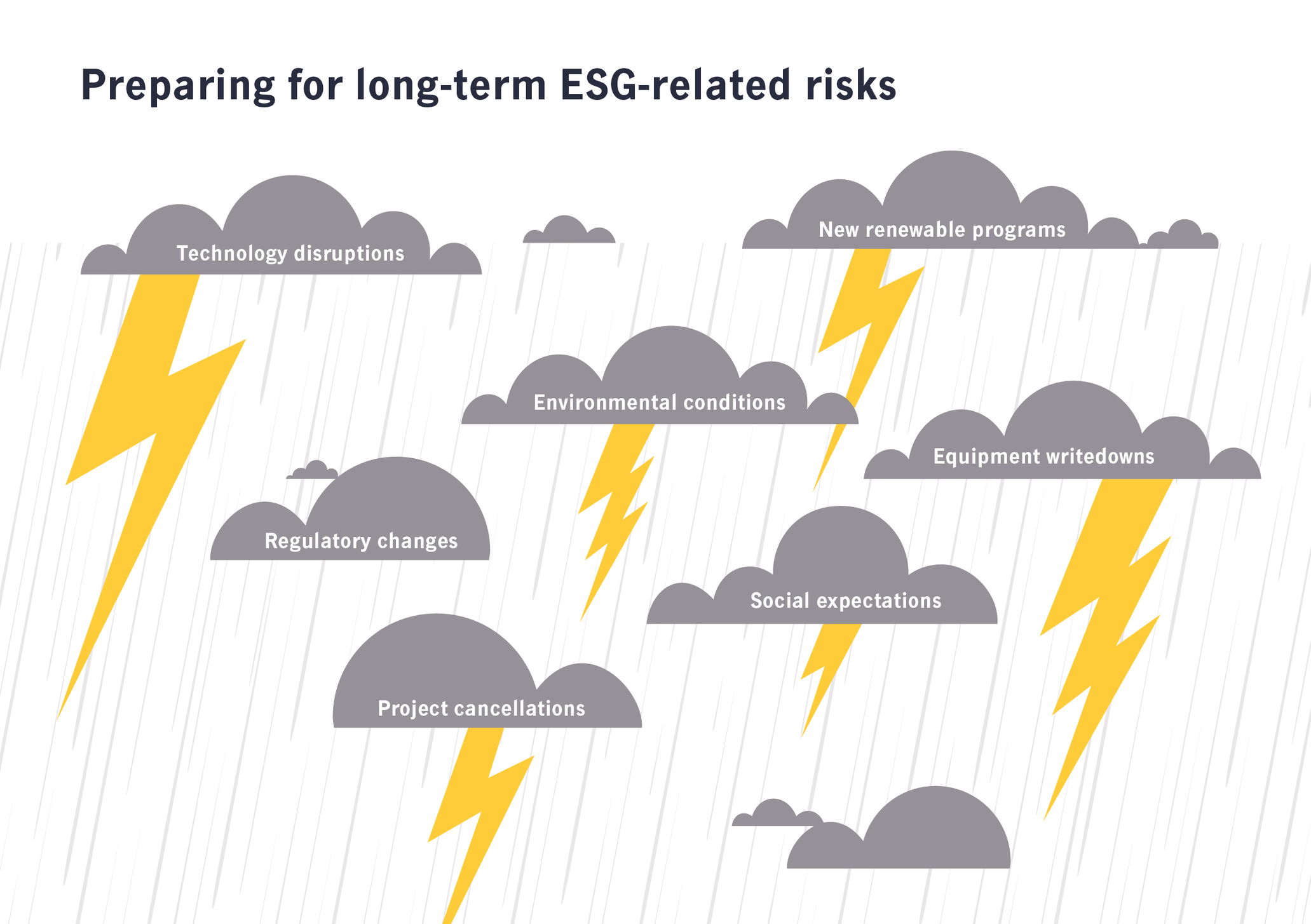

The benefits of ESG investing are more likely to be realised over a longer-term investment horizon. Equally, ESG risks and the negative impacts of unsustainable practices on financial returns are more likely to emerge over longer timeframes.

In general, companies are exposed to assets that depreciate over time due to changes in regulation, social expectations, disruptive technology, or environmental conditions.12 In this regard, companies with sustainability plans may be better prepared to anticipate and adapt to ESG-related changes. For example, a fossil-fuel company may need to decommission and write-down assets, cancel projects and replace them with renewable programs. A beverage manufacturer may be liable for a city’s water scarcity, face consequential legal risks, reputational and punitive damages, and loss of public trust if it has inadequate CSR policies.

From new retail investors to experienced professionals to pre-retirees, people around the world are beginning to recognise the benefits of ESG investing. ESG is fast becoming a mainstream long-term investment strategy, which can help investors align their financial goals with their personal values, as well as build a better and sustainable world.

To learn more about ESG investing, explore our sustainability insights.

1 Bloomberg, ESG assets may hit $53 trillion by 2025, a third of global AUM, 23 February 2021

2 Asia Asset Management, China sustainable fund assets soar to record high, 26 January 2022. Global Sustainable Investment Alliance, Global Sustainable Investment Review 2020

3 Center for Retirement Research at Boston College, ESG Investing and Public Pensions: An Update, October 2020

4 MSCI, Swipe to invest: the story behind millennials and ESG investing, March 2020

6 Note: We consider that the integration of sustainability risks in the decision-making process is an important element in determining long-term performance outcomes and is an effective risk mitigation technique. Our approach to sustainability provides a flexible framework that supports implementation across different asset classes and investment teams. While we believe that sustainable investing will lead to better long-term investment outcomes, there is no guarantee that sustainable investing will ensure better returns in the longer term. In particular, by limiting the range of investable assets through the exclusionary framework, positive screening and thematic investment, we may forego the opportunity to invest in an investment which we otherwise believe likely to outperform over time.

7 Morningstar analysis across seven categories: global large cap blend equity, global large cap growth market equity, global emerging markets equity, US large cap blend equity, Europe large cap blend equity, Eurozone large cap equity, EUR corporate bond.

8 Morningstar, Do Sustainable Funds Beat their Rivals?, 16 June 2020

9 Occupational & Environmental Medicine Journal, Manchester Business School paper: The relationship between job satisfaction and health: a meta-analysis, 2005

10 McKinsey, How diversity, equity, and inclusion (DE&I) matter, 2019

11 Forbes, Why Giving Back Increases Brand Loyalty, 10 June 2019

12 Ernst & Young, Tomorrow’s Investment Rules 2.0, 2015

Dollar cost averaging: An easier way to withstand volatile markets

If investors wish to reduce volatility and benefit from long-term growth when the markets move up and down, the passive strategy of dollar cost averaging may be a feasible choice.

Risk Diversification

There is no free lunch. But Risk Diversification comes close in investing. A diversified portfolio was shown to optimize returns with lower volatility in the long run.

Better income – Aim for higher, not the highest

If we focus too much on chasing the highest yield and upfront yield generation, we could suffer from early capital depletion and miss the total return opportunity towards the later stages of the investment journey.

Dollar cost averaging: An easier way to withstand volatile markets

If investors wish to reduce volatility and benefit from long-term growth when the markets move up and down, the passive strategy of dollar cost averaging may be a feasible choice.

Risk Diversification

There is no free lunch. But Risk Diversification comes close in investing. A diversified portfolio was shown to optimize returns with lower volatility in the long run.

Better income – Aim for higher, not the highest

If we focus too much on chasing the highest yield and upfront yield generation, we could suffer from early capital depletion and miss the total return opportunity towards the later stages of the investment journey.