When it comes to managing household finances, budgeting makes sense. However, it’s sometimes hard to accurately estimate what your outgoings will be each month. Unexpected bills and one-off costs can disrupt the best-laid plans! While there is no perfect way to ensure you live within your means, we have some suggestions that might help.

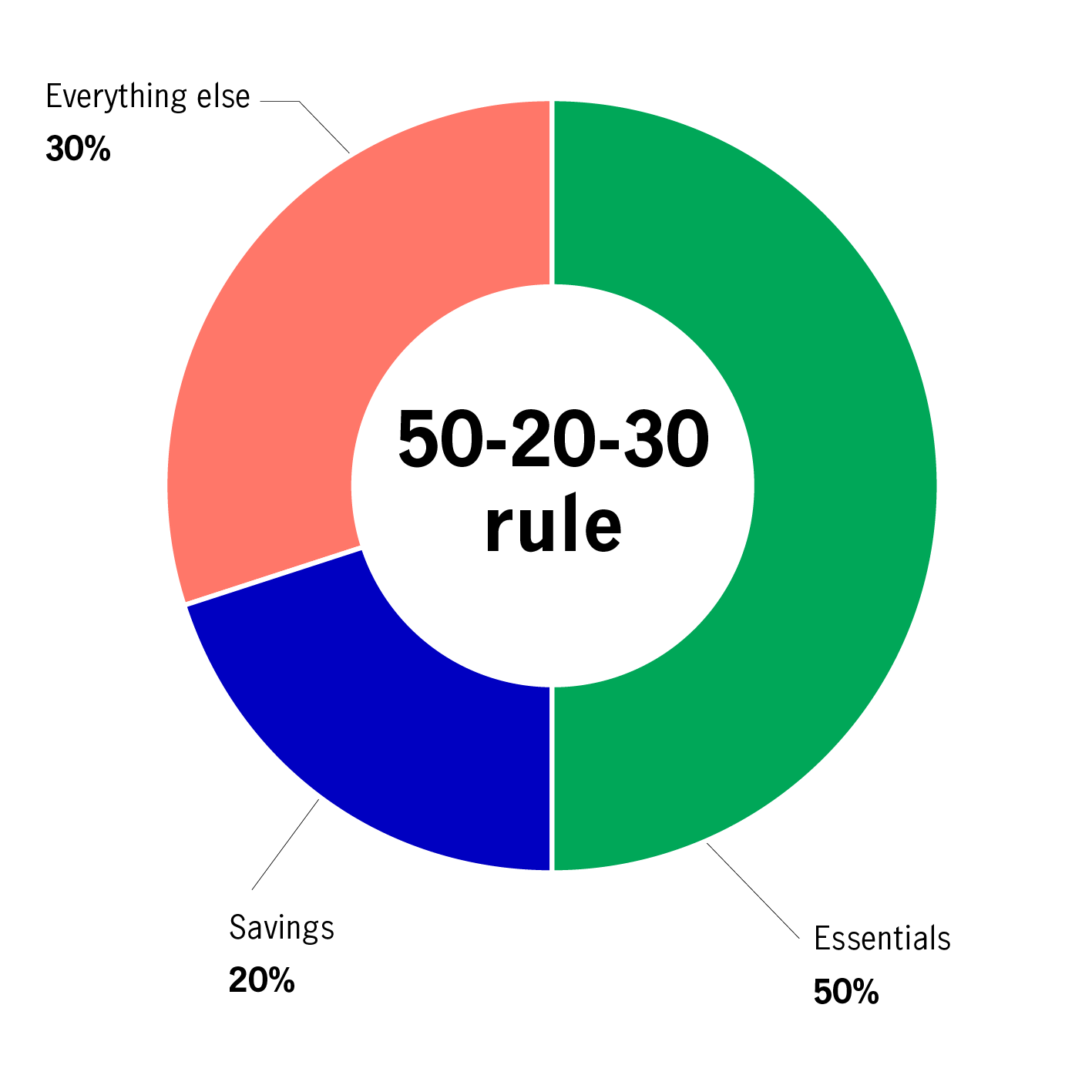

First of all, there’s the 50-20-30 rule. A wealth-management technique that divides your monthly income into three categories:

50% for essentials: rent and other housing costs, such as groceries, electricity or transport

20% for savings: savings accounts, retirement contributions, loans, or credit card payments

30% for everything else: non-essential expenses, such as clothing, eating out, monthly streaming subscriptions, or gym memberships

While you might not have a problem remembering the numbers 50-20-30, the rule itself isn’t always easy to live by. When it comes to expenses, one size doesn’t fit all and lifestyles will vary depending on, for example, where you live. City living can be more expensive and people may spend a large part of their income on rent, which can cause problems if your income is irregular. Housing costs can also be particularly tough for those in low-paid jobs.

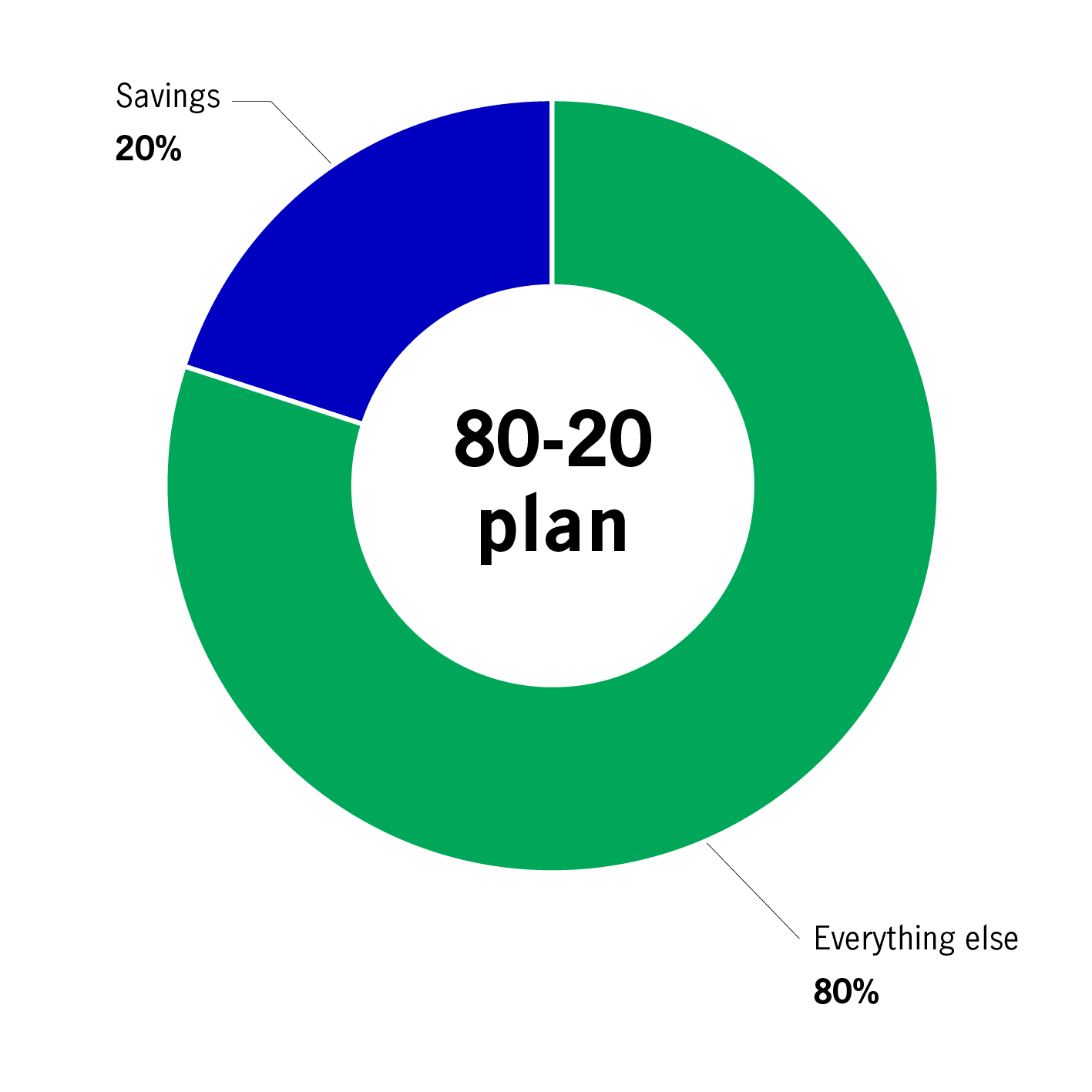

Even simpler than the 50-20-30 rule is the 80-20 plan. Instead of separating every expense into what’s essential and what’s not, you take 20% of your monthly income and deposit it directly into a savings account. What’s left over is available to spend however you want.

A good tip here: create an automatic transfer that sets aside 20% as soon your monthly salary is paid. By immediately placing the cash in a separate savings account, it’s like you never had it in the first place!

Everyone’s budgeting needs are different. That’s why it’s sometimes better to create your own method. Start by calculating all your monthly expenses. Check your bank statements to make sure you’re noting everything down. Mortgage or rent costs are easy to remember, but subscriptions, such as streaming services or phone contracts, may slip through unnoticed. And remember to account for payments that come off less regularly, such as annual fees.

Once you know how much you spend, a quick calculation will tell you what’s left each month. This is easy when you have a regular salary but could be a little harder to determine if you have a freelance job or get extra funds from other work, rental income, or interest payments.

Quick Budgeting Checklist:

Once you’ve counted up all these numbers, you can decide where your money will go each month and how much disposable cash remains.

Remember, it’s important to monitor your expenses on an ongoing basis. Save all your receipts and cross check them against your card statements at the end of the month. See if you’re overspending in certain areas or if you can save a little more.

Keeping an eye on income and spending is not easy. However, working to a budget can simplify matters. Once you have established a reliable system that tracks your money, the process becomes less tricky, and you’ll find it easier to take control of your finances.

Source: John Hancock

How much do I need to save?

Find out more by using our target savings calculator!

Better income – Preferred securities

Over the past three years, preferred securities showed slightly higher volatility than US Treasuries, but less volatile than other rate-sensitive assets like US mortgage-backed securities (MBS) and US investment-grade bonds. Preferreds also demonstrated a relatively better return than US Treasuries, MBS and investment-grade bonds.

Hong Kong/Mainland China market update

Mainland China’s Third Plenum 2024 concluded with structural reforms in key areas, and the government introduced some concrete measures. The Greater China Equities Team believes that mainland China is focusing not only on long-term structural reform but also on short-term economic targets. The series of fiscal and monetary announcements, along with greater subsidies and infrastructure spending, should support a faster recovery in domestic demand.

Better income: Global multi-asset diversified income

The Global Multi-Asset Diversified Income approach remains focused on generating higher, sustainable natural yields from a range of assets with lower correlations and expected relatively lower volatilities.

How much do you know about rates?

Recognise the different terms related to interest rates and understand how much yield global government bonds can offer.

Four essential keywords related to interest rates

Central banks in some emerging and Asian markets have started to hike rates, but deposit rates may not necessarily move in tandem. This would gradually erode depositors’ purchasing power in an inflationary environment. To achieve potential returns that beat inflation, deposit-focused investors should base any investment decisions on their risk tolerance levels and wealth management objectives.

Why demographic change requires a new set of cards

Many Asian governments are considering incentives to encourage larger families. These evolving policies will be vitally important, as the region looks to sustain a fast-greying population.