17 May 2024

Traditionally, many Asian investors prefer the perceived safety of the money market and bank deposits, allocating an average of 40% of their assets to cash to achieve their financial goals.1 However, in the close-to-zero interest-rate environment that followed the global financial crisis, investors began to seek different products that offered a higher income.

Even though interest rates are now higher, achieving a regular income remains a priority for Asian investors. Through income investing, Asian investors not only capture a potentially higher income than cash but may also earn capital gains from their investments.

Note that income products are not risk-free and carry no guarantees. Thus, we believe moving towards a “Better Income” approach that balances risk, growth, and income to reflect investors’ needs is important.

The “Better Income” approach is designed to understand an investor’s objectives and the underlying risks associated with certain levels of income generation. Income brings with it varying levels of risk commensurate with the amount of income an investor seeks.

For example, a younger investor with a long-term horizon may be ready to sacrifice some short-term income in pursuit of wealth accumulation, whereas a retiree may want to preserve their capital and seek a regular income level just above cash rates.

Remember, “income” is not “interest”, and it is not “risk-free”. That’s why investors should understand how their portfolios can be built around the level of risk they are willing to take. What’s more, “Better” does not necessarily mean the highest income level but rather the stability and consistency of reasonably higher yields generated throughout various market cycles.

We believe that investors should thoroughly understand a particular source of income and its investment risk profile to achieve a stable income while making their capital last as long as possible.

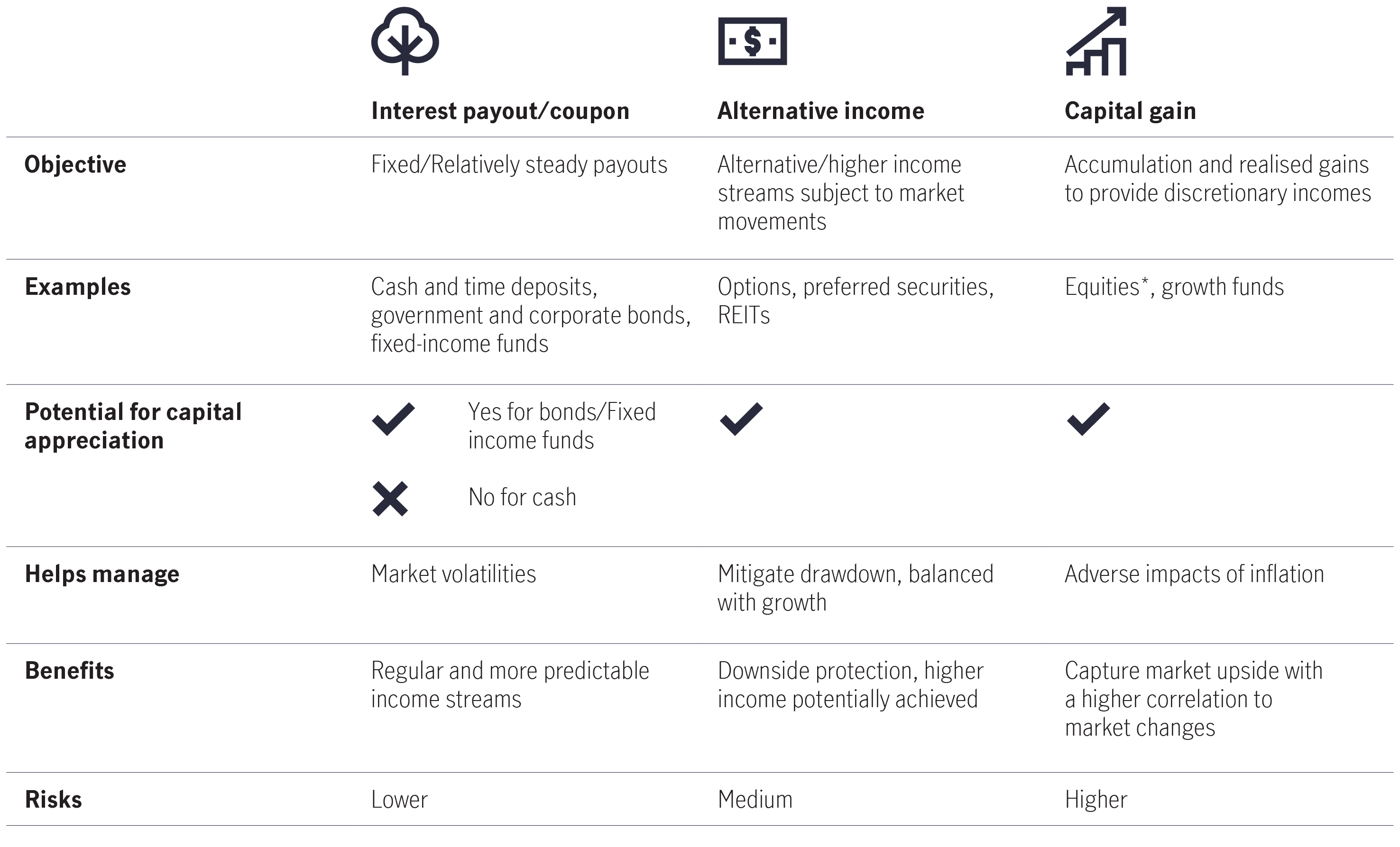

Different sources of income

*Investors may directly receive an income (in the form of dividends) if they hold equities. Alternatively, they may indirectly receive an income (in the form of distributions) if they own mutual funds, exchange-traded funds (ETFs), or other pooled vehicles that hold equities.

Distribution of incomes, the frequency of distribution and the amount/rate of incomes are not guaranteed. Positive distribution yield does not imply positive return.

1 Manulife Investment Management commissioned NielsenIQ to conduct an online survey of 2,000 people from Hong Kong, Taiwan, Indonesia, and Malaysia – 500 people from each market – who are aged 20 to 60 between 25 August and 6 September 2022. The research aims to assess people’s retirement readiness and aspirations, including savings and investments, and lifestyles and family issues they consider when planning for retirement.

Better income – Aim for higher, not the highest

If we focus too much on chasing the highest yield and upfront yield generation, we could suffer from early capital depletion and miss the total return opportunity towards the later stages of the investment journey.

Cash is king?

Amid volatile market conditions and higher interest rates, seeking security by burying your savings in a deposit account is tempting. As the saying goes, “cash is king”. Or is it?

Dollar cost averaging and its benefits

If investors wish to reduce volatility and benefit from long-term growth when the markets move up and down, the passive strategy of dollar cost averaging may be a feasible choice.

Better income – Preferred securities

Over the past three years, preferred securities showed slightly higher volatility than US Treasuries, but less volatile than other rate-sensitive assets like US mortgage-backed securities (MBS) and US investment-grade bonds. Preferreds also demonstrated a relatively better return than US Treasuries, MBS and investment-grade bonds.

Hong Kong/Mainland China market update

Mainland China’s Third Plenum 2024 concluded with structural reforms in key areas, and the government introduced some concrete measures. The Greater China Equities Team believes that mainland China is focusing not only on long-term structural reform but also on short-term economic targets. The series of fiscal and monetary announcements, along with greater subsidies and infrastructure spending, should support a faster recovery in domestic demand.

Better income – Aim for higher, not the highest

If we focus too much on chasing the highest yield and upfront yield generation, we could suffer from early capital depletion and miss the total return opportunity towards the later stages of the investment journey.